‘Fear and panic’ welcomed by AFIC

Australian Foundation Investment Co boss Mark Freeman has made three big bets on the current, volatile market. See which stocks the market picker has bought.

Australian Foundation Investment Co boss Mark Freeman has made three big bets on the current, volatile market. See which stocks the market picker has bought.

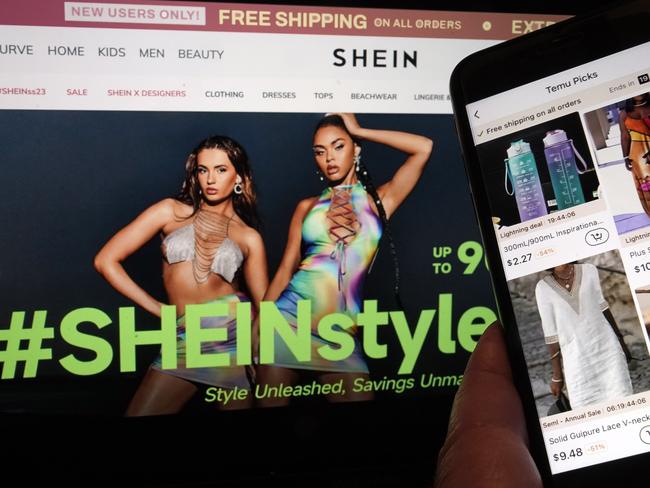

Donald Trump’s tariffs are stripping trillions from global share markets. Not only are ultra-cheap shipments to the US under $US800 no longer tariff-free, they now incur duties of 90 per cent.

The sharemarket has lost trillions of dollars, trade wars are raging and a global recession is feared, but Guzman y Gomez’s boss is placing his faith in people’s appetite.

Nothing unites fund managers like a market storm and the worst sell-off since 2020 has the bulls running to the history books.

Australian wines shipped to the US will face a 10 per cent tariff, but major competitors in France and Italy will be slugged double that, which could benefit domestic winemakers in the long run.

Australia’s global healthcare companies and its network of biotechnology companies will likely avoid the worst. Not so surgical gloves maker Ansell.

Kitchen appliances maker Breville slumped more than 10 per cent, while the beef tariff could trigger a price war that will advantage burger menus and hurt fried chicken operators like KFC.

The boss of Metcash has savaged the Albanese government for its latest attack on supermarkets and says the accusation of profit gouging is inflammatory language designed to win votes.

Fred Harrison has been working in supermarkets for 50 years, and comments from the election trail have left him fuming. Meanwhile, former ACCC chair Allan Fels says profit gouging is hard to prove.

Some auto brands are refusing to supply Bunnings for fear of upsetting chains like Supercheap Auto and Autobarn, but the hardware chain’s boss has given them a blunt warning.

Original URL: https://www.theaustralian.com.au/author/eli-greenblat/page/7