ASX clocks best close since February

The ASX eked out a modest gain on Tuesday but hit its highest close since late February, as the energy sector surged on a higher oil price.

The ASX eked out a modest gain on Tuesday but hit its highest close since late February, as the energy sector surged on a higher oil price.

The bank has joined the forecasters with a less gloomy take on the impact of the coronavirus crisis.

Two powerful proxy advisers have recommended Village Roadshow shareholders vote for a takeover proposal from private equity house BGH Capital.

Top picks of 2019’s SOHN Investment Conference have put the broader market to shame, with one hot stock returning more than 500 per cent.

Shopping mall giant Vicinity has been hit by a hefty vote against the re-election of a key director with a long history at billionaire John Gandel’s private group.

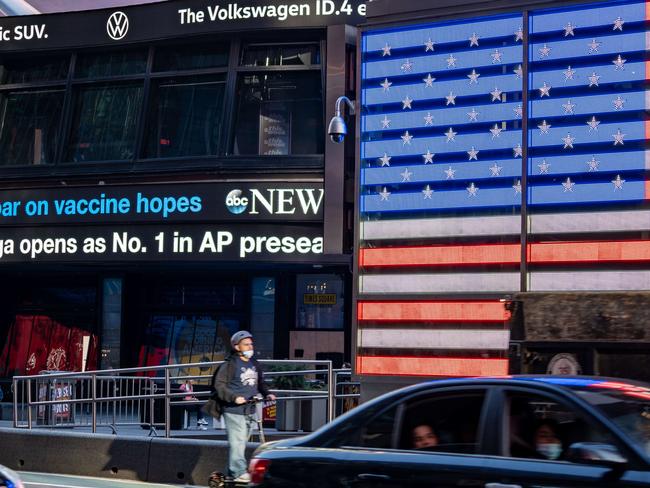

Commercial property developers and landlords are stepping up activity as confidence flows into the sector in the wake of coronavirus vaccine advances.

ASX closed at an 8-month high as Pfizer’s vaccine trial continued to cheer global investors, and as Nasdaq futures turned up after taking a hit from an EU antitrust probe of Amazon.

Financial services firm Evans Dixon was hit by a first strike against its remuneration report.

Once synonymous with upmarket tropical holidays in Australia, Dunk Island has been quietly put on the market.

Profit-taking sharply pushed down shares that have benefited from the pandemic.

Original URL: https://www.theaustralian.com.au/author/ben-wilmot/page/190