Madoff: The Monster of Wall Street review details accountant’s attempted to bring down Bernie Madoff

This story involves a Harry, but this one used his powers for good. Instead of trying to bring down a monarchy, he attempted to bring down a ‘monster’.

‘The family just shattered. It was as if you’d smashed it with a hammer.”

No, this is not another quote from a prince unloading on air or within his 407-page freshly printed memoir.

This story involves a Harry, but this one used his powers for good. Instead of trying to bring down a monarchy, he attempted to bring down a “monster”.

This is a tale, ultimately, about accounting. Madoff: The Monster of Wall Street is about dodgy books rather than ghostwritten ones.

Rather than my fingers being over my eyes and in my ears, like they were for the Prince Harry TV interviews we endured this week, I watched this four-part series using my hands to muffle gasps of horror.

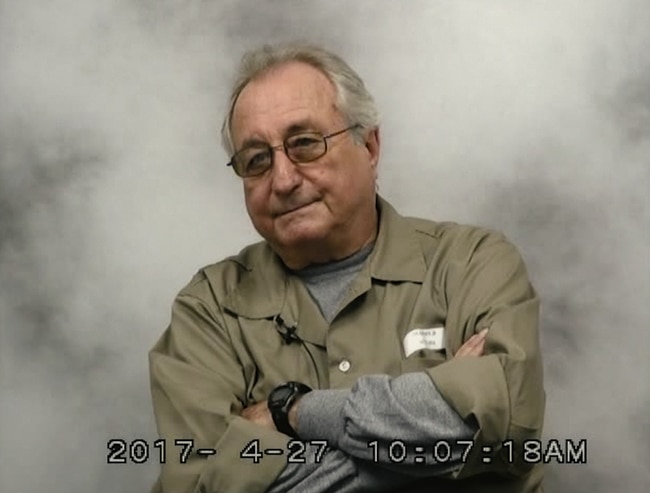

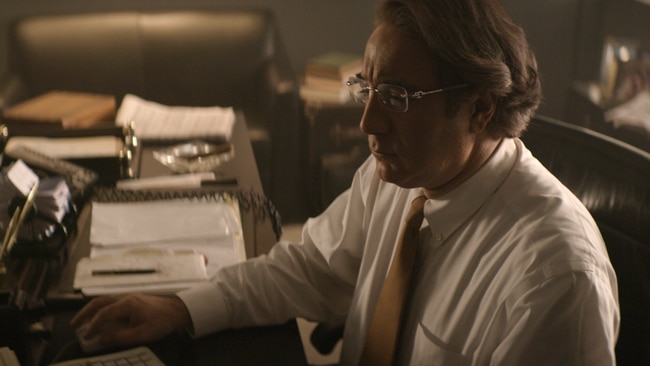

The series is shot with re-enactments akin to Australia’s Most Wanted (just with a Hollywood budget) alongside testimony and evidence from people who followed, were fascinated by and were the first to cop on to Bernie Madoff — the most crooked financier of modern times. The man who would rather lie and steal from strangers than disappoint his family.

This production is a chartered accountant’s charcuterie board and the hero — the cabanossi among the wilted pickles and crusty French onion dip — is Harry Markopolos.

Don’t be put off by the intimation that the star of the show is an accountant. Madoff is fascinating viewing even for those who don’t work with balance sheets or have only a faint understanding of what Bernie — the face of the 2008 global financial crisis — did, or more aptly, managed to get away with.

A highlight is Markopolos’s infamous and blistering testimony to the US Congress in 2009 where the former securities industry executive tells lawmakers it took him five minutes to spot the giant investment fraud the regulators couldn’t detect.

It’s a spray that is as compelling as Watergate with a dash of spice not seen or heard in public since Earl Spencer’s eulogy for his sister.

Markopolos and journalists tried for years, from 1999 until December 2008, to get to the truth but were stonewalled, ignored and laughed at until the jig was up and Madoff’s wealth-management business was found to be nothing more than a Ponzi scheme.

“What’s a Ponzi scheme,” Madoff’s wife, Ruth, reportedly asked her husband when he told his family everything was a lie.

Ruth is just one remaining piece of this puzzle, and her meticulously organised desk drawer being discovered by the FBI raises more questions than answers.

“This woman was a bookkeeper,” one of the agents says.

The four episodes are an indictment on those who enabled and reportedly bankrolled Madoff but it’s also a searing account of the US Government and its financial services regulators.

Madoff messed up as early as the 1960s; he needed to be bailed out by his father-in-law.

By the 1990s, alarm bells should have started ringing in the hapless Securities and Exchange Commission. So close was Madoff to the top brass that when quizzed about possible nefarious schemes he just swatted them away with platitudes. There were even rumours he would be installed as the commission’s new chief.

It was an organisation that, if it did its job correctly, could have thwarted his fraud, saved millions of people losing billions, including celebrities, bankers and, more importantly hard working “mum and dad” investors — widows, small business owners, people from the tight-knit Jewish communities in Palm Beach and beyond — who trusted Madoff with their life savings.

One family went from thinking they had a nest egg of $30 million to nothing. Another couple was told to divorce in case Madoff’s trustee came knocking to recoup more losses from them — money they didn’t have after an initial $900,000 investment. Meanwhile just like another disgraced financier Jeffrey Epstein, no one — other than Bernie and a handful of associates — has ever been held to account for these malicious actions.

The total damage bill by the time Madoff was arrested after being dobbed on by his two sons in 2008 was about $50bn. For context, the new AUKUS nuclear submarine deal will cost Australian taxpayers $70bn.

But it’s the humanity, or lack thereof, that steals the show. Once Madoff is sentenced to 150 years in jail, Ruth is kicked out of her $7m penthouse and lives in a banged up Honda. Both Madoff sons are dead, one from suicide, another of cancer, and Bernie’s ashes are now sitting in a box in a lawyer’s office. No one wants him.

-

Speaking of wasting money, things no one wanted, raging greed and narcissism ... #WagathaChristie is back.

The social media storm of 2019, which became a tabloid dream before clogging up Britain’s judicial system in 2022, is coming to the small screen.

If we learned anything from the Johnny Depp v Amber Heard case, we are suckers for celebrities thrashing it out and airing their expensive laundry in public.

Vardy v Rooney: A Courtroom Drama focuses on the shocking moments from the defamation case between the wives of two famous soccer stars that ended up in London’s Royal Courts of Justice.

Allow me to translate, Mum. #VardyVRooney#WagathaChristiepic.twitter.com/l2suYTP1ID

— Channel 4 (@Channel4) December 28, 2022

The 90-minute movie re-creates the courtroom drama of the defamation claim brought on by Rebekah Vardy — a former I’m A Celebrity UK star married to soccer player Jamie Vardy — after she was outed on Twitter for allegedly leaking stories about Coleen Rooney, the wife of former English football captain Wayne Rooney.

The viral post took off when Rooney admitted she posted “fake” stories to her Instagram account, tales that then emerged in The Sun — a Bible for WAGs wanting attention.

Rooney changed the settings on her account so only one user could see the posts and felt confident to declare to her millions of followers: “it’s … Rebekah Vardy’s account.”

Vardy denied it and sued. The High Court judge dismissed the case, stating Vardy’s evidence was “evasive or implausible” and “manifestly inconsistent”.

Both Vardy and Rooney engaged two of the best legal minds in Britain. One of them is played by Micheal Sheen while the other, in reality, represented King Charles. They charged like wounded bulls by the hour to build cases around Instagram stories, WhatsApp messages, tabloid stories about Peter Andre’s lovemaking ability and the fact one key player “accidentally” dropped her phone into the North Sea before she had a chance to extract evidence.

Vardy v Rooney: A Courtroom Drama serves up more salacious drama than any Aaron Spelling series. If Ruth Madoff was cast as a swan of Fifth Avenue, these two, who subjected themselves to excruciating, humiliating and unnecessary cross-examination, are the bin chickens of Britain.

The premise of the show is pathetic but as a made-for-TV melodrama it is absolutely perfect — even down to Vardy’s faint eyebrow piercing scar, the fake nails, the pinched faces and pouts. It’s hard to tell if Sheen’s apathy as an eminent KC is acting or an exaggerated eye roll at the hijinks of his real life celebrity counterparts.

Either way it’s worth the watch just to laugh at well-manicured morons who have nothing better to do than waste the judicial system’s time and, at the most recent count, $3m in legal fees.

Madoff: The Monster of Wall Street is streaming on Netflix Vardy v Rooney: A Courtroom Drama premieres on Foxtel Arena on Sunday, January 15 at 8.40pm

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout