Hillsong staffer’s $50k pool tax deduction revealed in documents tabled in Federal Parliament

Christian megachurch Hillsong told staff how to claim housing expenses as deductions to minimise tax, leaked documents show. See what they claimed and listen to the podcast.

Faith On Trial

Don't miss out on the headlines from Faith On Trial. Followed categories will be added to My News.

Christian megachurch Hillsong told staff how to claim housing expenses, including a $50,000 pool, as deductions to minimise tax, leaked documents show.

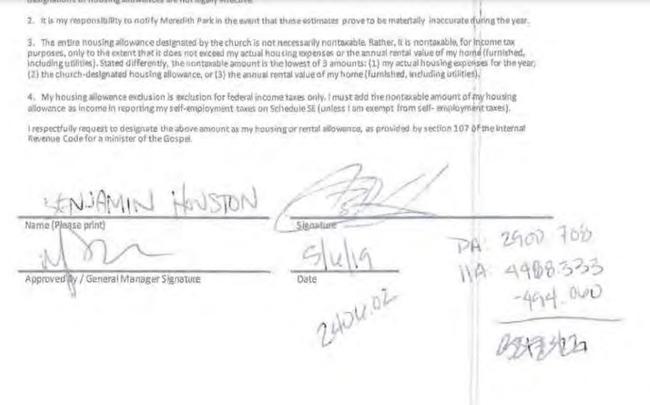

Emails and internal forms from the scandal-plagued church, tabled in federal parliament, reveal Hillsong’s “unwritten rules” when it comes to paying tax.

The details have emerged as the church has been hit with claims in parliament of financial impropriety.

The Australian Charities and Not-for-profits Commission, which has the power to strip Hillsong of its tax-free status, has also confirmed it’s investigating the church.

Separate to that investigation, Ben and Joel Houston, the sons of Hillsong founders Brian and Bobbie Houston, music star Brooke Ligertwood and pastor Darren Kitto were named in documents detailing the US tax scheme. There is no evidence that their actions were illegal.

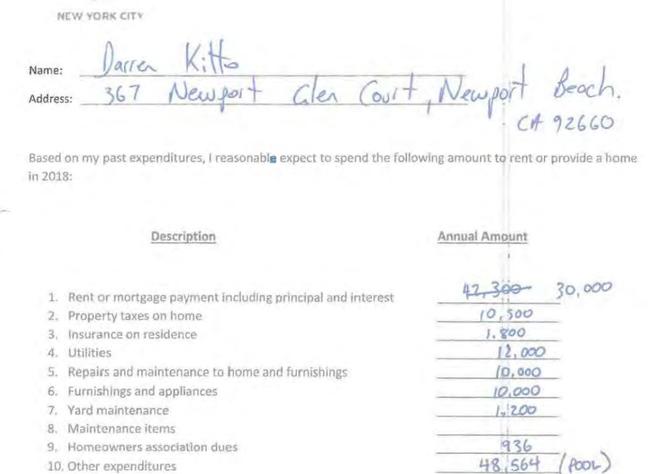

According to the documents, Mr Kitto claimed $48,564 for a pool as part of his $125,000 housing allowance, which reduced his taxable income.

The four-bedroom, four bathroom home in Newport Beach, California, listed in the documents is valued at $4.7 million (AUD).

Mr Kitto also claimed $10,000 in “repairs and maintenance”, another $10,000 on “appliances” and $1200 on “yard maintenance”.

The details of the housing allowance scheme in the United States were set out in emails after inquiries about payments to Hillsong’s Grammy award-winning artist Brooke Ligertwood.

“There is an “unwritten” rule that a minister needs to have at least some income – maybe $400 or $500 minimum,” an email with the subject line “Payroll Q’s” states.

“Again, you will not find this in writing but with zero taxable income, it gives the impression there is noncompliance. And no-one wants that.

“Ultimately, the housing allowance should be less than the salary.”

LISTEN TO THE FAITH ON TRIAL: HILLSONG PODCAST BELOW

The advice warns that the “bottom line is that the housing has to be a reasonable amount”.

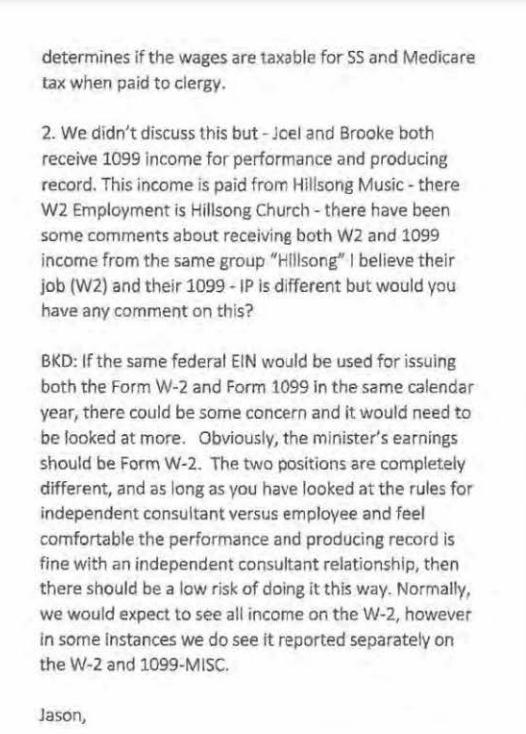

Hillsong was also asked whether the royalties income that Joel Houston and Ms Ligertwood received from the church’s record label had tax implications.

Joel Houston and Ms Ligertwood were paid as employees for work as pastors and contractors for the music royalties on songs they produced under Hillsong’s label.

The church was advised that it was “low risk” to pay the musicians as employees as well as an “independent consultant”.

Brian Houston, who had been offered a $350,000 per year retirement package, quit the church in 2022 but his sons remain key members of the church.

Phil Dooley, Mr Houston’s replacement, told church members at an extraordinary meeting on March 30 that the church was not just making “improvements” but making “changes” to its financial practices.

Mr Dooley said the church had legal advice that it had not acted “unlawfully”.

Send your story tips to crimeinvestigations@news.com.au or stephen.drill@news.com.au

More Coverage

Originally published as Hillsong staffer’s $50k pool tax deduction revealed in documents tabled in Federal Parliament