Australians want to use fingers, cars to make cash payments

Australians want to make cash payments using finger-embedded microchips and even their cars, and the technology could be here sooner than you think.

Technology

Don't miss out on the headlines from Technology. Followed categories will be added to My News.

Australians could be splashing cash with the touch of a finger by the end of the decade and using their car to make payments even sooner, a new report predicts.

The report by financial software company FIS found that 17 per cent of Australians were interested in having a chip implanted in their digits to make cash transactions easier.

The global survey, which included more than 1000 Australian respondents, also found that 30 per cent of those polled locally were interested in using their car to make payments, such as when at the petrol pump or when going through a drive-through.

FIS General Manager for Global eCommere in the Asia-Pacific, finger-tap payment technology, Phil Pomford, said the interest in finger-tap payment technology would help spur it’s development, but some hurdles would need to be cleared first.

“When the youth start to adopt technology, things move a lot faster,” Mr Pomford said, adding that interest in microchip implants were higher among Gen Z and Gen Y at 25 per cent and 24 per cent respectively.

“But given this technology is invasive, there will be some resistance and fear. So I think when you add in things like potential regulation and understanding as to how it would work, it’s probably something that might eventuate in the medium to long term”.

Mr Pomford added that the technology would likely be rolled out “before the end of the decade”.

Meow-Ludo Meow-Meow — co-founder of open-access molecular biology laboratory, BioFoundry — said he was not surprised to hear the idea of finger-embedded microchips were popular among younger generations.

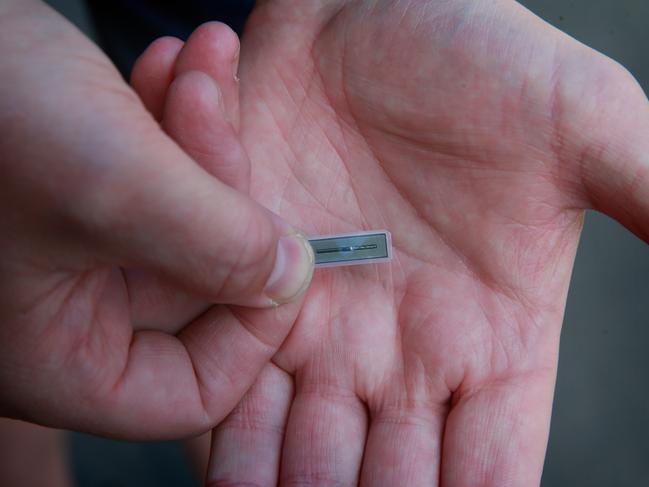

The biohacker, who was once fined for implanting a chip from NSW public transport card, Opal, into his hand before his conviction was overturned, believed adoption payment technology would eventuate around 2024-2025.

“By the end of the decade, I’d be very surprised if a more advanced version of microchip technology was being released,” Mr Meow-Meow said.

“I think simple binary interactions like unlocking a house, switching on a microwave, on/off-type things is where you’ll see wide-scale adoption.”

Since his Opal ordeal, he had installed a couple of other microchips in his hands that could store small amounts of information for simple tasks, such as transferring Wi-Fi log-in details to a device that was placed near the chip.

He also hoped to get a payment chip installed next year if someone would “sponsor” him.

Meantime, paying with your car was “much closer to reality”, Mr Pomford said.

He said, for example, a card reader attached to a petrol pump could connect to another device attached to the vehicle to make payment.

“You only need to look at some of the cashier-less stores at the moment. The technology already exists,” he said.

“I think that’s something we’re likely to see in the very near future.”

The FIS research also found overall, Australian respondents were more likely to use Buy Now, Pay Later (BNPL) services for smaller purchases (under $375) than they were larger for larger ones (above $1500).

But Millennials and Gen Z were more open to being more indulgent in their BNPL spending, with more than a third saying they would be likely to use a payment-deferring program for a purchase of more than $1500.

Eleven per cent of Baby Boomers, 17 per cent of Beyond Boomers (those aged 74 and over), and 29 per cent of Gen X-ers said they would do the same.

Cash was also found to be the most prevalent method of payment among Australians across the past 12 months at 70 per cent, followed by direct debit (51 per cent), credit card in store (45 per cent), debit card in store (41 per cent) and credit card online (40 per cent).

Almost half of Australians said that COVID-19 had no impact on how they chose to pay.

MORE NEWS:

Private health insurers’ $900m windfall from pandemic

Grant Denyer’s plea as Aussies gear up for road trips

Tokyo 2021: Coronavirus cops ban Olympic cheers

Originally published as Australians want to use fingers, cars to make cash payments