Still rising: The QLD regions where prices are still going up

Prices in 11 QLD housing markets are still rising as demand for property continues to outstrip supply. And recent natural disasters have done nothing to help the housing crisis.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

PRICES in 11 Queensland housing markets are still rising, or at their peak, as demand for property continues to outstrip supply in the Sunshine State.

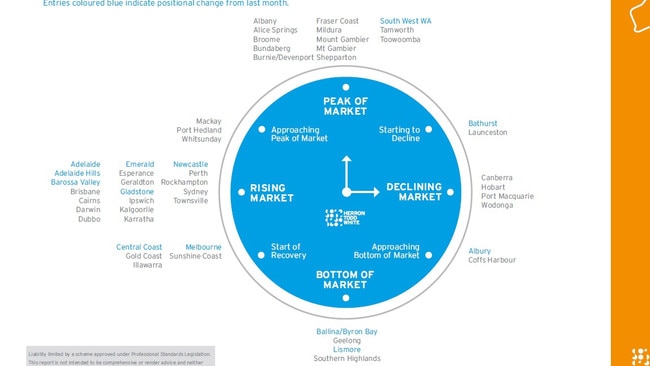

Low vacancy rates, high buyer and renter demand and damage to properties as a result of recent natural disasters have combined to create a perfect storm of pressure on the Queensland property market, according to the latest Herron Todd White (HTW) Month-in-Review report.

No housing or unit markets were considered to be “declining markets”.

Incredibly, Brisbane, the Gold Coast and Sunshine Coast are still at the “start of recovery” after the short-lived downturn in 2022 and monthly price rises since then, according to the report.

PropTrack recently reported that Brisbane home values rose another 0.17 per cent in January to reach a new peak of $794,000, just $5000 less than Melbourne.

Home values in the River City are now 57.8 per cent higher than they were at the start of the pandemic in early 2020, according to PropTrack.

HTW Brisbane director David Notley said they believed that the market momentum established late last year would continue - a plus for those already holding property.

“This trend of demand outstripping supply is well established, and it’s not going away anytime

soon,” he said.

“Our population is booming with a swathe of interstate arrivals coming to resettle here.

“We already enjoy disproportionate rates of population growth compared to other states and

territories, but throw in the record numbers of overseas immigrants and returning expats coming to Australia, and you can see that things won’t slow down.”

Mr Notley said he would not be surprised to see price and sale volume records tumble in Brisbane this year.

Lack of supply and high demand is also driving price growth across the Gold Coast, but affordability would be a key factor this year, according to HTW Gold Coast associate director Jerusha King.

It is a similar story on the Sunshine Coast, where supply and affordability will be the big issues going forward.

“Sunshine Coast property was cheaper than our southern capital city cousins of Sydney and

Melbourne… and by some way,” HTW Sunshine Coast director Stuart Greensill said.

“This is no longer the case as we run near price parity with Melbourne, and the gap has narrowed to Sydney.”

Rising Queensland markets include Gladstone, Rockhampton and Townsville, while Cairns, Mackay and Whitsunday are “approaching peak of market”.

Bundaberg, Fraser Coast and Toowoomba are “peak of market” while Ipswich is currently “bottom of market”, according to the report.

Meanwhile, Gold Coast and Sunshine Coast units are “start of recovery”, Brisbane, Cairns, Gladstone, Ipswich, Rockhampton and Townsville are “rising markets”, Mackay and Whitsunday units are “approaching peak of market” and Bundaberg, Fraser Coast and Toowoomba are “peak of market”.

Ongoing pressure on the construction sector and soaring detached dwelling values are expected to see unit prices continue to rise this year.

MORE NEWS: 14 bidders! Qld’s ‘most rank’ house sold at auction

Waterfront showstopper snatches record from fitness star

Revealed: The 20 words that could sell your home

SuburbTrends recently revealed that rents could rise by more than $300 a week by the end of the year, and rival that of houses in some Queensland suburbs.

SuburbTrends founder Kent Lardner said the meteoric predicted rise in unit rents was being driven by affordability.

That in turn is luring investors into the market.

Up north, HTW Townsville valuer Hayden Lynam said their market entered the year on the back of strong demand, increasingly from the investor sector.

“The investor market has been aggressive recently in the marketplace and a lot of stock which was typically limited to local owner-occupier buyers has been purchased by investors,” he said.

“Our record low vacancy rates and all-time high rents have seen Townsville become a more

attractive option to non-local investors.”

But the Cairns market is “off to a rocky start” after Cyclone Jasper delivered record flooding in December.

HTW Cairns director Danny Glasson said the inundation of properties had “severely affected” market activity in some areas, particularly Machans Beach, Holloways Beach, Yorkeys Knob, Lake Placid and Caravonica.

“With over 1000 homes in the region impacted, it is expected to place further strain on the already tight rental market as affected residents seek alternative accommodation in the short term,” he said.

He noted that a flood-affected resident from the Northern Beaches recently leased a Manunda house for $600 a week, a premium of around 10 per cent of the achievable market rent before the cyclone.

More Coverage

Originally published as Still rising: The QLD regions where prices are still going up