Housing crisis: Average Brisbane home now costs $800k

Brisbane’s median home price has surpassed $800,000 for the first time, hitting a fresh high after 15 straight months of gains.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Brisbane’s median home price has surpassed $800,000 for the first time in history, hitting a fresh high after 15 straight months of gains.

Dwelling values — houses and units combined — grew another 0.41 per cent in March, according to the latest PropTrack Home Price Index, with the median price now 12.9 per cent higher than it was 12 months ago, and only $1000 behind Melbourne at $802,000.

Brisbane home prices have grown by more than 63 per cent since the start of the pandemic

— almost double the growth in Sydney — and the median price of $801,000 is now just over $200,000 less than Australia’s most expensive real estate market.

The River City’s median house price is now $895,000, while the median unit price grew another 0.6 per cent last month to reach $600,000.

But the data shows the median home value in the Brisbane South market is fast gaining on Sydney’s, with the median home value now a staggering $1.038 million — not far behind Sydney’s $1.069 million.

PropTrack economist and report author Eleanor Creagh said interest rate stability had maintained confidence among buyers and sellers, resulting in higher sales volumes and price growth.

“Sales volumes are quite a bit stronger than they were throughout the first 12 weeks of last year — up 14 per cent in Brisbane compared to the March quarter of 2023,” Ms Creagh said.

“We know buyer confidence has lifted with rates on pause for a number of months now and they’re putting that improved sentiment into action given we’re seeing an uplift in sales volumes.”

Ms Creagh said sellers were also more confident, but the rise in new listings was not as apparent as in other capital cities.

“There’s not as much available on market, especially given the tight rental market there,” she said.

“Total stock on market (in Brisbane) is still 40 per cent below the prior decade average, so the tight supply environment is still there, even though there are more listing coming to market than the same time last year.

“Stronger home buyer demand is quickly absorbing those properties that are hitting the market and prices are continuing to rise at a pretty fast pace.”

Brisbane’s top regions for price growth over the past year were Ipswich (+15.47 per cent to $636,000), Brisbane South (+15.23 per cent to $1.038 million), and Logan-Beaudesert (+14.03 per cent to $687,000).

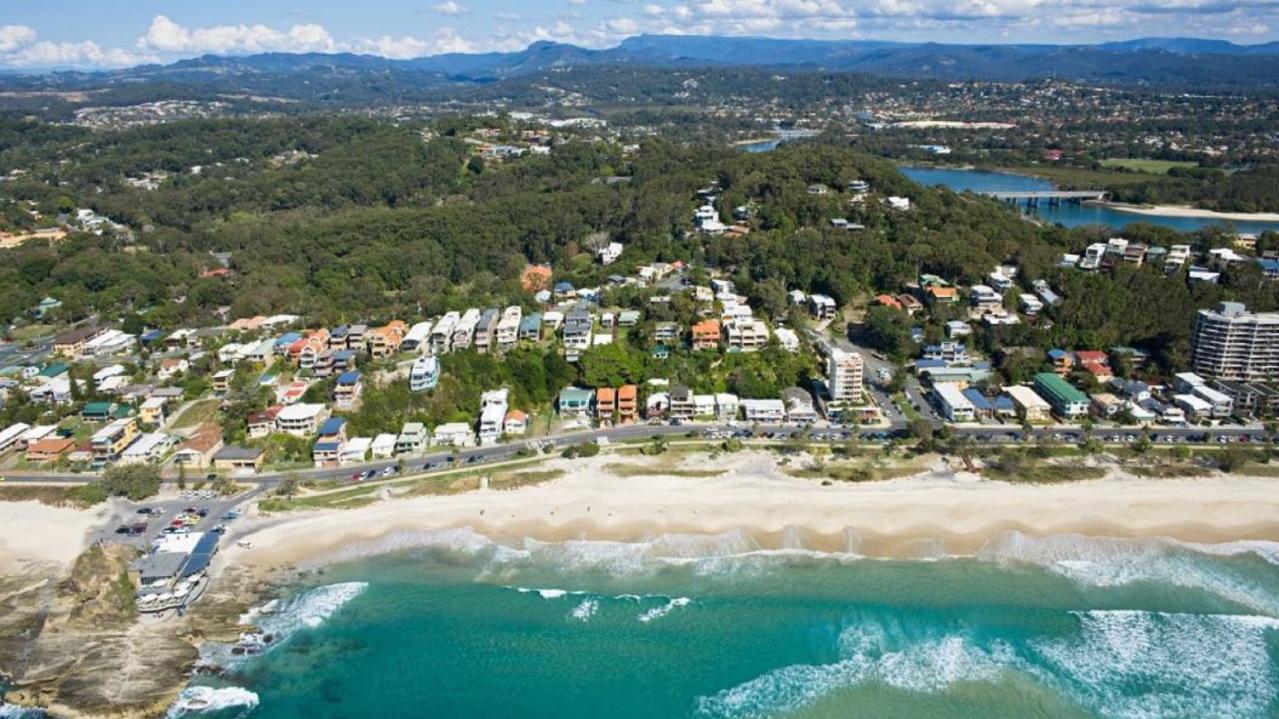

But it is not just the capital that is showing continued price growth, with the median value across regional Queensland now $645,000 – just $152,000 less than Brisbane.

Queensland’s combined regions have recorded 66.5 per cent price growth since March 2020, and 0.49 per cent in February alone, to reach a median home price of $647,000.

The PropTrack data shows Townsville led the charge with 13.3 per cent annual growth to $418,000, followed by the Gold Coast (12.14 per cent to $915,000), the Sunshine Coast (8.64 per cent to $963,000 and Cairns (8.54 per cent to $515,000).

Nationwide, home values continued to gain momentum, rising by 0.34 per cent, with home values in every capital city except Hobart lifting in March.

Herron Todd White national director of residential Ben Esau said inflation, interest rates, and unemployment figures would be the key metrics to watch going forward, with increasing immigration set to put more pressure on housing demand.

“Should interest rates start to drop towards the end of the year, a wider buyer pool with

increased buying power will add to the competition, including some purchasers who were previously forced to rent,” Mr Esau said.

But he said the lack of supply and a sluggish building sector still recovering from cost increases and margin squeezes meant the ability to bring new stock at required levels was limited, in the short term at least.

Colliers Queensland residential director Jon Rivera said southeast Queensland’s off-the-plan market was booming, with a recent surge in demand from both owner-occupiers and investors.

“Residential projects are selling out off-market before we can even release them to the general

public,” Mr Rivera said.

“This urgency in buying is fuelled by concerns of being priced out of the market in the near future and the desire to escape rapidly increasing rental costs.”

Mr Rivera said supply constraints were a huge factor in the market, with many developers grappling with fulfilling existing/sold pipeline commitments.

“Projects slated for short to mid-term release are encountering widespread cost escalations,

necessitating potential adjustments in product pricing and mix compared to current market

offerings,” he said.

“Expectations point towards pricing trends remaining firm throughout 2024, as developers confront mounting development barriers.

“Escalating costs related to site sales/acquisition, civil development expenses, and infrastructure charges pose significant challenges to feasibility and eventual pricing outcomes.”

Originally published as Housing crisis: Average Brisbane home now costs $800k