Qld’s credit rating faces downgrade for first time in 15 years

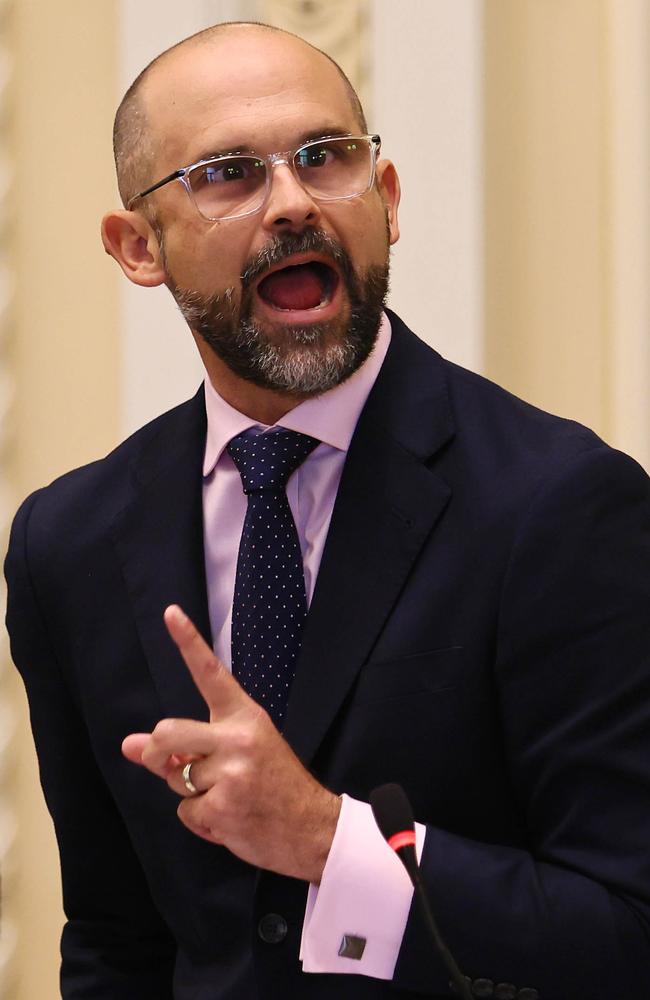

David Janetzki, in his first major speech as Treasurer, will say the LNP has likely inherited a credit rating downgrade after a decade of Labor rule.

QLD News

Don't miss out on the headlines from QLD News. Followed categories will be added to My News.

Queensland is facing its first credit rating downgrade in 15 years, Treasurer David Janetzki has warned – a financial slap that would make the state’s spiralling debt burden more expensive.

Billions of dollars in project blowouts across transport, energy and health alongside an end to the coal royalties rivers of gold have weakened Queensland’s finances.

Mr Janetzki, in his first major speech since becoming Treasurer, will say the LNP has likely inherited a credit rating downgrade after a decade of Labor rule.

“Before I started in my ministerial role, I was clear about the challenge. I wanted to stabilise our fiscal position and ensure our current rating was secure,” he said.

“I even said that I didn’t want to be a Treasurer who has a ratings downgrade on my watch.

“However, knowing what we know now, I am in an unenviable position where that could well be the case. This is the unfortunate reality that I have learned in the month since becoming Treasurer.”

A credit rating downgrade would make it harder and more expensive for Queensland to borrow money for its enormous infrastructure pipeline ahead of the 2032 Olympic and Paralympic Games.

Mr Janetzki revealed Queensland Treasury, in his incoming brief, had warned the state was at “heightened risk of credit rating downgrades” and was suffering a “concerning increase in the interest burden likely to exceed critical thresholds”.

He also revealed rating agency S&P Global, in his first official meeting as Treasurer, had warned existing settings would “increase pressure on key credit rating metrics” with deeper deficits to add to growing debt. Queensland’s latest budget, handed down by Labor in June, had the total debt hitting nearly $172bn in 2027-28, with interest repayments of $7.733bn.

It is expected those figures have significantly worsened, with Mr Janetzki promising a “warts-and-all update” on the state’s fiscal position in late January as part of a delayed mid-year budget update.

Queensland’s credit ratings fate will likely be known in the immediate aftermath of the update.

“The public deserves to know the true state of the books, something that has been hidden for almost a decade,” Mr Janetzki said.

Queensland has not been hit with a credit ratings downgrade since it was stripped of its AAA rating by S&P Global amid falling revenues and a growing deficit in a global financial downturn.

Labor’s freewheeling election promises to add extra $9bn to Queensland’s debt bill in order to fund free school lunches and state-owned petrol stations among other populist policies prompted S&P Global to warn the AA+ rating could come under pressure.

The newly LNP government will blame the former Labor administration for making the state a fiscal basket-case through “flagrant spending and debt settings”.

But Mr Janetzki has also promised a safe and secure plan to get debt under control and to restore fiscal discipline – though how this will be achieved and how quickly is not known.

Mr Janetzki, who is also the energy minister, will underline the need to “carve out a path to net zero with guard rails on energy reliability and economic security for Queenslanders”.

The LNP has also ruled out any new and increased taxes.

Faced with a significant $6.4bn blowout across the health budget and a powerline project increasing to $9bn from the original $5bn among other hikes, the LNP has promised to build the projects to the full promised scope.

Mr Janetzki, in a bid to ward off a job cut scare campaign, will explicitly rule out cuts to the public service.

“We have also ruled out cuts to the public service, and, will always guarantee essential services,” he said.

The warnings from Mr Janetzki come after Tasmania and NSW had their credit rating outlooks dropped to negative in the last fortnight.

In setting the scene for a credit rating downgrade, Mr Janetzki pointed to falling short-term revenue amid a dip in global coal prices and a looming GST shortfall.

The shortfall was expected after Queensland reaped $26bn in coal royalties in just two years after former Treasurer Cameron Dick’s controversial decision to impose a super profits tax.

Mr Dick, now the deputy opposition leader, had during the election campaign dismissed claims Labor’s election expenditure would affect the state’s credit rating.

In the weeks leading up to the June budget he had laid the groundwork for Labor to be unapologetically big spending in the name of cost of living relief, regardless of the impact on credit ratings.

“These are deliberate choices that all political parties must make: whether to prioritise people or numbers on a balance sheet; to decide who comes first, ratings agencies or Queensland families,” Mr Dick said.

More Coverage

Originally published as Qld’s credit rating faces downgrade for first time in 15 years