Qld housing summit: Renters pay more amid state’s land tax cash grab

An unprecedented Palaszczuk Government land tax slug on interstate investors has been met with overwhelming opposition. VOTE IN OUR POLL

QLD News

Don't miss out on the headlines from QLD News. Followed categories will be added to My News.

The Palaszczuk government is being urged to ditch its “unorthodox” land tax as concerns mount about its looming impact on rental prices, with Queenslanders backing the move.

A reader poll on The Courier-Mail website of nearly 1200 respondents showed an overwhelming 92 per cent thought Premier Annastacia Palaszczuk should dump the tax.

EDITOR’S VIEW: Premier must prove she cares about housing crisis

Despite the opposition to the move due to the widely shared view that the tax would result in a reduction in stock and lift in rental prices, the Australian Institute dismissed concerns, saying the tax would simply result in a redistribution of stock rather than a reduction in stock.

“Let’s say the government introduces a policy that discourages people from buying investment properties and a bunch of them decide to sell their investment properties, they’re going to have to sell them to somebody if other investors aren’t buying it,” the institute’s senior economist Matt Grudnoff said.

“The owner-occupier is buying it and those owner-occupiers would have been previous renters.

“Let’s say 1000 rental properties get sold so the supply of rental properties goes down by 1000, but because you’ll have 1000 households that are now the owner-occupiers, the demand for rental properties will also drop by 1000.”

The argument put forward by the Treasurer that the tax was closing a loophole was rejected by the Property Council Queensland chief executive Jen Williams, however.

“It is significant reform to Queensland’s previously well-understood land tax system, and it should have been consulted upon to the same extent that a reform of this magnitude would normally entail,” she said.

Ms Williams it was an “unorthodox method of calculating land tax” and was “counterintuitive” to introduce any adjustments at a time of affordability concerns.

“This tax will certainly lead to an increase in rents, as many investors will be faced with additional costs and no choice but to pass them on,” she said.

“We are also hearing reports of investors turning their back on the Queensland market and choosing to invest elsewhere. This comes at the same time we are faced with the tightest rental market in history and unprecedented demand for rental accommodation.”

Opposition treasury spokesman David Janetzki called for the tax to be reconsidered by the Palaszczuk government given the chorus of concerns about its possible impact on rental prices.

“Economists, property industry experts, lawyers and academics are raising new concerns every day,” he said.

“During the biggest housing crisis Queensland has ever seen, the last thing that vulnerable Queenslanders need is a government blind to the consequences of this unprecedented tax.”

An unprecedented Palaszczuk Government land tax slug on interstate investors is set to drive already unaffordable rental prices up right across Queensland, industry and independent property research experts have warned.

Despite Premier Annastacia Palaszczuk’s heartfelt declaration to ensure every Queenslander has a roof over their head, experts are now lining up to accuse her of not following through – with the government still committed to the introduction of its land tax hike from next year.

Industry leaders plan to use today’s roundtable with government to plead for the dumping of the tax, which was announced last year and quietly legislated with this year’s State Budget.

They say it is clear the plan to tax investors here on any property they also own interstate will further compound the housing affordability and availability crisis the government now says it is committed to addressing.

Treasurer Cameron Dick has repeatedly said the new tax was about “closing a loophole”, and last week said fears that rental prices would rise in response was a “furphy”.

“Rents are based on supply and demand,” Mr Dick said.

“That’s how the market works – that’s how rents are determined.

“We don’t anticipate this will have an impact on rents … but what we do anticipate it will have an impact on is making our tax system fairer. And that’s what I’ve always pledged to do.”

But leading data researcher Louis Christopher, the managing director of SQM Research, said he had no doubts the new tax would lead to a direct spike in the price of rentals, while also warning of significant knock-on effects to the supply of stock.

“Given the very tight rental conditions experienced by Queenslanders, landlords are actually in a prime position to pass on all costs — it is a landlord’s market at this point in time,”

Mr Christopher said.

“I would expect such additional costs will be passed on to tenants and that would happen with almost immediate effect or the moment a 12-month lease rolls over.”

He said the added burden on owning property would lead to investors abandoning the state, which would create opportunities for first home buyers but ultimately reduce the number of stock on the market.

“Which is one less rental on the market and not good from a rental crisis perspective,” he said, citing Queensland’s shrinking vacancy rate as a major contributor to the housing woes.

He said: “It will defer investment over the medium term so we can expect a drop in building approvals over the next 12 months. It hits the tenant indirectly on multiple fronts. And of course it will have an impact upon jobs, because we know the construction sector is a major contributor to the Queensland economy.”

Propertyology market analyst Simon Pressley said it was irrelevant if there “10,000 or 10 million” investors impacted, insisting the tax burden would lead to landlords either lifting their rental prices or selling their properties – contributing to the trend of rents increasing or vacancy rates shrinking.

“Those affected the most will be existing Queensland tenants,” Mr Pressley said.

The Real Estate Institute of Queensland and the state branch of the Urban Development Institute of Australia both confirmed they would be raising their concerns about the tax’s impact on rental prices at today’s roundtable hosted by the Premier ahead of her Queensland housing summit planned for October 20.

UDIA chief executive Kirsty Chessher-Brown said it was difficult to comprehend the continued support within the government for the land tax given the Premier identified the extreme pressures on the market in convening a housing summit.

She said she would be imploring the state government at the roundtable today to find ways to create more stock and abandon its multi-jurisdictional land tax which creates investment instability.

“At the moment, we just can’t afford to risk any changes to the system that could deter investors and ultimately increase rents,” Ms Chessher-Brown said.

The REIQ said it would also take the opportunity to lobby for the tax to be thrown on the scrap heap with chief executive Antonia Mercorella revealing the institute has been flooded with members declaring they would desert their investments in Queensland.

“Not only will it act as a disincentive to invest here in Queensland, it will cause a number of people to make a decision to sell their Queensland investment property and we really can’t afford any more rental properties to be diminishing,” she said.

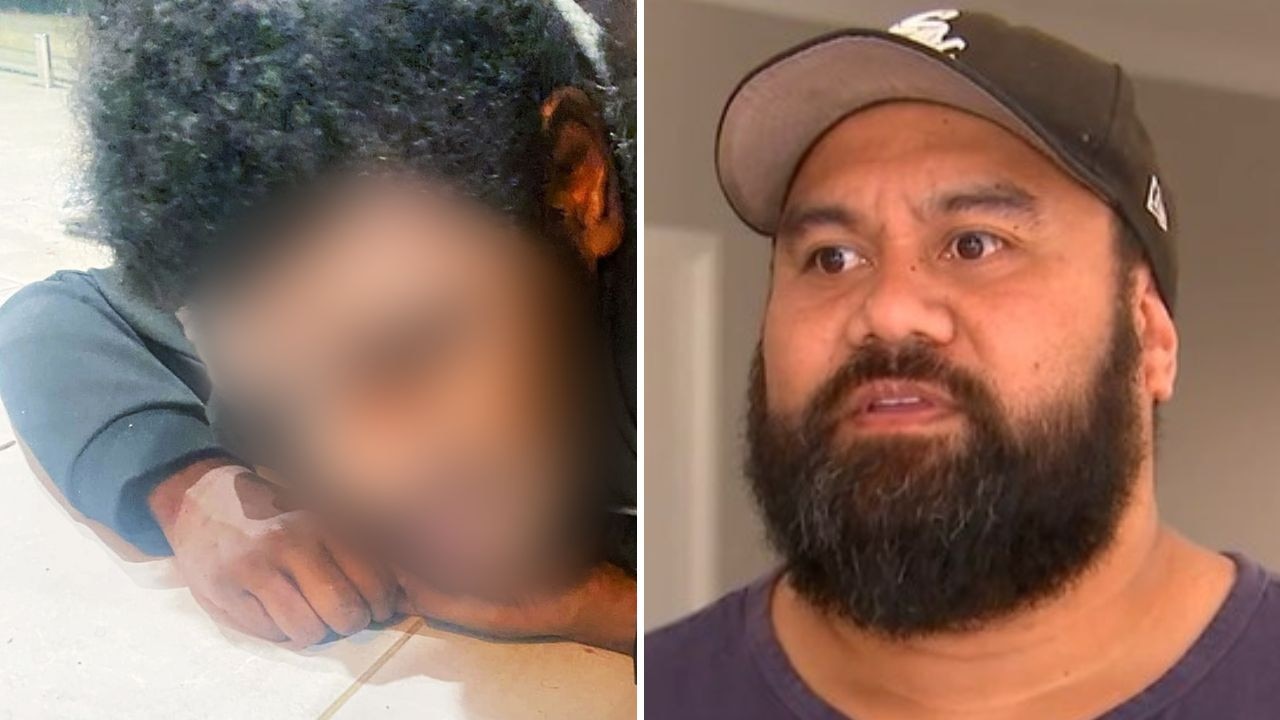

Queensland renters are already being squeezed by soaring prices and collapsing stock available on the market.

Jessica Harwood currently rents a one-bedroom apartment at Newstead in Brisbane’s inner city and said she already feels rent were too expensive.

“I’m paying $470 for an apartment you would think shouldn’t cost more than $400,” she said.

“I’m nearing the point of buying my own and really, if rent got any more expensive, I’d be looking at moving out and buying instead of renting, because it’s got to the point where paying a mortgage could actually be cheaper than renting.”

More Coverage

Originally published as Qld housing summit: Renters pay more amid state’s land tax cash grab