NT government finances: Public sector wage explosion drives ‘grim’ fiscal outlook for the Territory

Ballooning public sector wage bills, the cost of hiring agency medical staff, and interest repayments on debt have combined to saddle the Territory with an increasingly bleak fiscal outlook.

Politics

Don't miss out on the headlines from Politics. Followed categories will be added to My News.

The Territory’s Auditor-General has published a damning report into government finances, with ballooning public sector wage and interest bills dragging the budget down into the doldrums, and the CLP’s payroll tax concessions set to further erode our position.

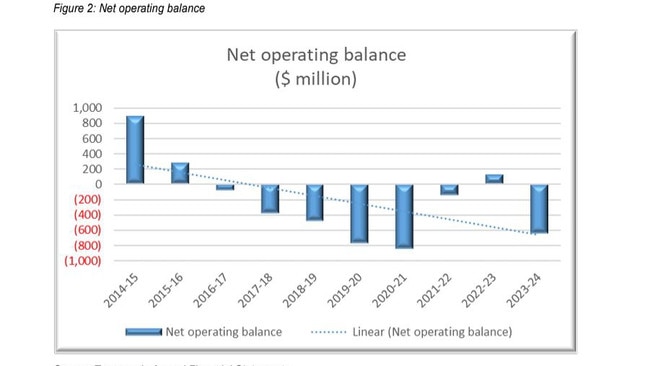

Among the most significant findings in Auditor-General Jara Dean’s latest Report to the Legislative Assembly was that in 2023–24, the NT Government operated at a net deficit of $638.4m, the seventh deficit in 10 years, with combined deficits over the decade sitting at $2bn.

Net government debt currently sits just north of $11bn, on which $403.8m interest was paid in 2023–24.

Another deficit is forecast for 2024–25.

Last financial year’s deficit, according to Mr Dean, was due “largely … to a significant increase in employee expenses, driven by back payments of pay increases under renegotiated enterprise agreements”.

There were 11 enterprise bargaining agreements that expired in the 2021 and 2022 financial years but were not renegotiated until the last financial year, with the EBAs containing back-pay provisions.

Preventing retrospective public sector wage increases was a 2019 recommendation of the Fiscal Strategy Panel but is yet to be implemented, Mr Dean noted.

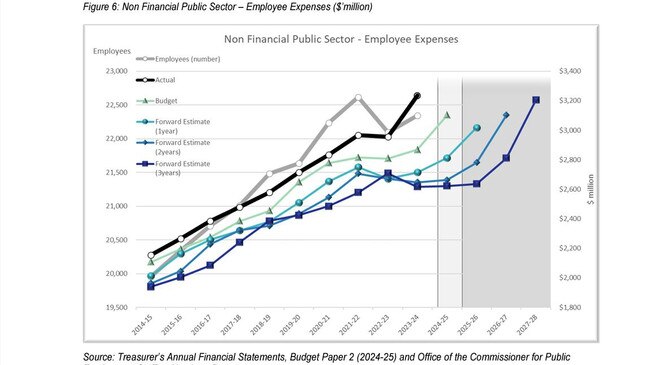

Overall public sector wages increased by $276.9m to $3.1bn, while an additional 539 full-time equivalent public servants were hired, taking the overall number to 21,455 FTEs.

In the past decade, the number of public servants has grown by 12 per cent, while the overall Territory population has grown at just 3.9 per cent.

Another prominent factor in driving the wage bill higher in the Territory was the cost incurred by the Department of Health in filling vacancies with agency staff to cover shortfalls.

“Returning the budget to surplus or at least a break-even position will require careful management of employee costs, given the government’s role as the major employer in the

Territory and that employee-related expenses have historically represented around 40 per cent of total expenses,” Mr Dean said.

To cope with the ongoing budget deficits, the NT Government borrowed an additional $1.2bn in 2023–24, taking total loans to $9bn as at June 30.

In his report, Mr Dean also expressed concern the CLP Government’s payroll tax concessions for small and medium businesses would further hurt a bottom line that is woefully dependent on commonwealth handouts, payroll tax being one of the Territory’s largest generators of own-source income.

He labelled the payroll tax concessions, and the ongoing reliance on federal cash, as presenting a “significant fiscal risk”.

Speaking on Wednesday morning after the release of Mr Dean’s report, Treasurer Bill Yan described the Territory’s debt as “Lawler’s last legacy”.

He conceded the parlous fiscal position would prompt some difficult decisions when the CLP releases its first budget next March.

“The previous government continued to say to everybody that the financial position of the Northern Territory was fine, it was in great shape, but after now coming into government, and having a close look at the books, we can see the dire financial position that the Territory faces,” Mr Yan said.

“We’re working through our budget process now for 2025–26.

“I think we’ll have a clearer picture once we finish that process in March, but it is certainly a grim picture and we’re looking at all of our spending you make sure that we’re spending Territory money wisely.”

Regarding Mr Dean’s concerns about the budgetary impact of the payroll tax concessions (raising the tax-free threshold from $1.5m to $2.5m, estimated to cost $56m over the forward estimates), Mr Yan said the government believed it would be made back via private sector investment unlocked by the policy.

Opposition leader Selena Uibo defended the former Labor government, saying it set the budget on a “good path... despite the double hit of Covid-19 and the former federal [Coalition] government ripping out $2bn [over four years] in GST”.