How to get a better interest rate on your home loan

ONLY one per cent of home loan customers are bothering to demand a better interest rate from their bank. Here’s how to do it so you can save thousands of dollars.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

AN ASTOUNDING one per cent of mortgage customers are bothering to contact their financial institution to get a better interest rate, banking sources have revealed.

Borrowers are copping rate hikes on the chin after new figures from some of the nation’s largest lenders found very few people are demanding a rate discount.

MORE: THE EASIEST WAY TO GET A HOME LOAN DISCOUNT

MORE: SAVE YOURSELF $1600 A YEAR

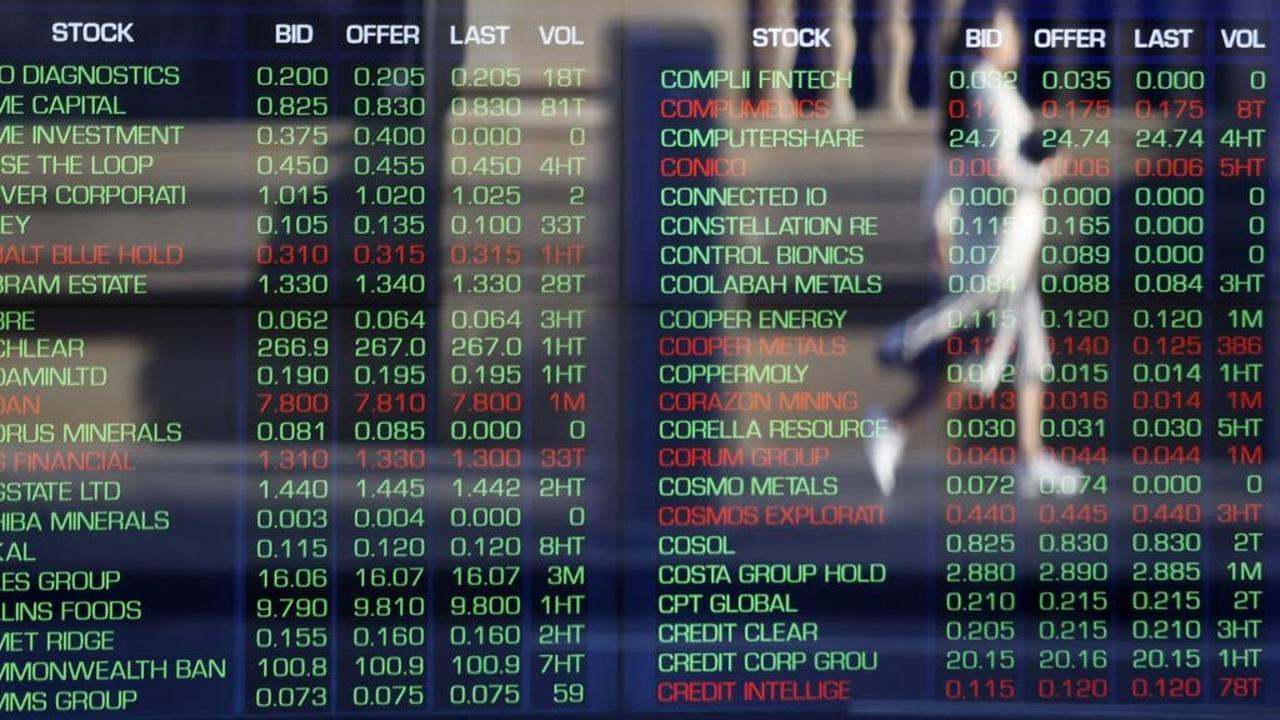

In the past fortnight three of the Big Four banks — Westpac, ANZ and Commonwealth Bank — have all hiked their variable rate deals for both owner occupiers and investors.

But sources from within the banks said hardly any customers take the time to phone up their bank’s retention team and ask to give them a cheaper rate or threaten to leave.

Home Loan Experts managing director Otto Dargan said borrowers should be taking action in the coming weeks, phoning up their lender and asking for a discount.

“It’s best for borrowers to wait a month for all lenders to make their changes and then negotiate with their lender,” he said.

“The customers most at risk are people who have been with their bank for over ten years.

“They rarely compare with the rest of the market and as a result their loyalty usually means they end up paying more.”

Financial comparison website RateCity’s database shows the lowest variable rate for borrowers with a $300,000 30-year home is offered by Reduce Home Loans at just 3.44 per cent.

Data from the site found of 1000 borrowers 77 per cent are worried about rising rates.

And one in seven people said they would immediately default in the first month if rates increased.

Mortgage online bidding service Loan Dolphin’s chief executive officer Ranin Mendis said it’s “unfortunate” so many mortgage customers “have a set and forget mentality” when it comes to their finances.

“No bank is also proactively going to call you and say here’s 20 basis points off your mortgage,” he said.

“Even if the call to your lender gets you 20 basis points off your current rate this will result in saving you $7000 over the life of your loan.”

Mr Mendis said some new customers get up to a 1.5 percentage points discount off a lender’s standard variable rate but existing customers are missing out on such large price cuts.

But financial comparison website iSelect’s spokeswoman Jessie Csaplar said it can be as simple as just asking for a discount to get one.

“Some lenders may be more likely than you think to offer you a discounted rate on your home loan so it doesn’t hurt to at least ask the question,” she said.

“Before you speak to your lender do your research so that you are confident and firm with your request.”

TIPS TO GET A BETTER DEAL

1. Know what deal you are on.

2. Compare deals online.

3. Pick up the phone and ask for your bank’s retention team.

4. Talk tough and tell them you want a better rate.

5. If they won’t budge tell them you’re leaving.

Originally published as How to get a better interest rate on your home loan