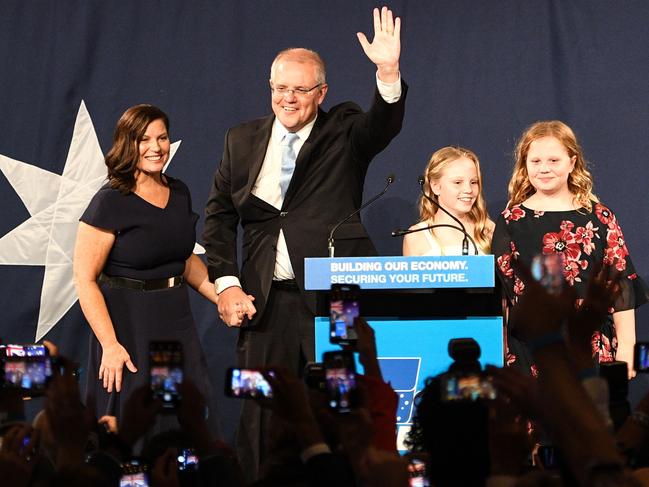

Scott Morrison could let down 10 million taxpayers over tax cuts

He’s only just been re-elected but the Prime Minister may have to break his first election promise already, disappointing millions of Aussies.

Federal Election

Don't miss out on the headlines from Federal Election. Followed categories will be added to My News.

It threatens to be Scott Morrison’s first broken election promise.

The Prime Minister told low and middle-income earners they would have just over $1000 extra in their 2018-19 tax returns if the Coalition was re-elected to Government.

But he now faces the prospect of having to let down those 10 million taxpayers.

While he got his re-election wish, Mr Morrison is running out of time because of matters he has no control over.

He is unlikely to be able to recall parliament before the end of the financial year to pass legislation for the promised tax cuts.

He is now asking senior public servants how he can deliver the cuts without them first becoming law.

This could involve the Australian Taxation Office (ATO) in the 2029-20 financial year backdating the cuts for the 2018-19 returns.

The Prime Minister’s first problem is he won’t have a parliament for some time yet. He has to wait for formalities to be completed.

“We obviously have to wait for the writs to be returned and there is a formal process for that,” Mr Morrison told Sky News last night.

“At the moment, it is not looking like until the back end of June.

“So that really does make very narrow that opportunity to do it before June 30, and I think that is very unlikely with the advice I have received.”

The Australian Electoral Commission won’t even declare the vote is complete until May 31 at the earliest.

The good news for Mr Morrison is that the cuts are likely to be passed, with the help of Labor, once they are put in legislation. However, the Greens will continue to oppose them.

The bad news is that the ATO has previously made clear it needs a law change to change tax returns, although it could get ready for that in advance.

RELATED: Tony Abbott’s eye-watering pay rise

RELATED: Today host exposes leadership problem

RELATED: How One Nation royally screwed Labor

“If the law for these tax cuts passes after June, we could also retrospectively amend assessments to provide the tax cut once the law is passed,” the ATO said in April.

Liberal frontbencher Simon Birmingham said the tax cut timeline was tightening.

“Now of course exactly when will depend upon the return of the writs and so we will take advice from the Electoral Commissioner in that regard,” Senator Birmingham told ABC radio.

“But we have of course our plans for lower taxes that we want to see legislated.

“We equally want to get on with delivery of our legislation around social media controls to protect particularly young Australians better in the future, but all Australians from some of the misadventures that can occur on social media.”

But while Labor is likely to back the tax bonus, it will argue that the real reason for Mr Morrison’s delay is that he knows the Budget cannot afford it.

And the Liberal explanation is being challenged by recent history.

In past elections — 2010, 2004, 1998, 1980 — the gap between polling day and the return of parliament was 38 days.

If applied to this election, parliament would be back by June 25, giving time for tax legislation to be submitted before the end of the financial year on June 30.

And a Labor source has pointed out that the old Senate would still be sitting. It doesn’t turn over until July.

Originally published as Scott Morrison could let down 10 million taxpayers over tax cuts