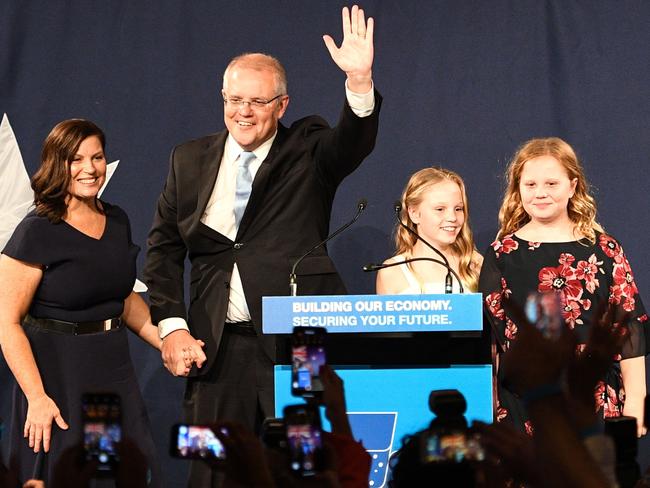

How Scott Morrison’s ‘miracle’ federal election win affects property, superannuation and tax

The Coalition win could lessen the fall in property prices but it would stabilise superannuation policy. SEE HOW IT WILL AFFECT YOUR HIP POCKET

Federal Election

Don't miss out on the headlines from Federal Election. Followed categories will be added to My News.

Exclusive: The Coalition’s shock election win could lessen the fall in property prices by as much as eight per cent, experts say.

Scott Morrison’s self-described “miracle” should also bring stability to the superannuation system, insiders believe.

That said, there are predictions the Prime Minister may look to act on negative gearing concessions and franking credit refunds — albeit it in a far more limited, and palatable, way than Labor planned.

Such changes could find support on the new-look Senate crossbench, where there is concern about whether the extra $158 billion of personal income tax cuts proposed in the Budget can be delivered without a reduction in government services.

From a hip-pocket perspective, that’s the Reader’s Digest version of what you need to know about how things could play out from here.

Now for the detail …

EFFECT ON THE PROPERTY MARKET

“The big negative around Labor winning and changing the tax arrangements for property has now gone,” said AMP Capital’s highly respected head of investment strategy Shane Oliver.

The likely impact of Labor’s negative gearing and capital gains reforms would have been to deepen the drop by 8 per cent to nearly 30 per cent in Sydney and 20 per cent in Melbourne, Dr Oliver, who is also AMP’s chief economist, said.

Now Sydney’s decline looked like being limited to about 20 per cent, while Melbourne could bottom out 15 per cent below the 2017 peak.

Sydney has already fallen 15 per cent and Melbourne by 11 per cent.

He expected the low points to now come sooner.

Aussie Home Loans founder John Symond said people were “rightly” concerned the value of their own home would fall further under Labor’s changes.

“It really scared the hell out of the community,” Mr Symond said.

What the Coalition victory means for you

Why Queensland turned its back on Labor

“It was a huge positive for Australia that the Coalition got up,” he said. “Confidence is everything and it’s been lacking badly.”

Auction clearance rates were what to watch for signs of improving confidence, he said.

He didn’t expect markets would go “gangbusters” again and that was a good thing.

Mr Symond said reforming negative gearing “should be done” — just not how Labor planned.

He favours a cap on what can be claimed, rather than axing the concession.

“It shouldn’t be there for wealthy people, me included, to really try to milk the cow dry.”

Mr Symond said he attempted to discuss negative gearing with Chris Bowen six weeks ago but the shadow treasurer “wasn’t interested”.

Mr Symond said he had spoken with others who had met with Labor and they reported an “arrogance”.

“They acted like they were already in government”.

SUPERANNUATION AND FRANKING CREDITS

One of the nation’s leading experts on super, Rice Warner founder Michael Rice, said a “period of stability” was now likely but that didn’t mean there would be a “vacuum where we can all relax”.

Mr Rice said “you could still modify the system” to target the people Labor meant to “but did a very bad job of”. For example, there was a strong case for restricting franking credit refunds for self-managed super funds containing more than $5 million.

“If you want to do things that are unpopular they usually say it’s best to do it in the first year of your term,” Mr Rice said.

The significant change coming to super would be the forced closure of up to 28 underperforming funds, Mr Rice said. Members of those funds would be put into better products, he said.

TAX CHANGES UNDER SCOTT MORRISON

In April’s budget, Treasurer Josh Frydenberg unveiled a plan to deepen already legislated tax cuts set for 2022-23 and 2024-25.

Labor opposed the new relief and vowed to repeal the cuts that passed the Upper House last year.

Those cuts went through with the support of crossbench senators including several who weren’t re-elected on Saturday — Derryn Hinch and Fraser Anning among them.

The bill to deepen the cuts will likely require the backing of South Australia’s Centre Alliance, which was the Nick Xenophon team until he left to unsuccessfully pursue a spot in SA’s parliament.

Stirling Griff — one of Centre Alliance’s two senators — said it wanted a Treasury briefing on whether forgoing the tax revenue would reduce government services.

“We are not there to be wreckers and we are not putting up a roadblock,” Senator Griff said.

“Provided we get an update from Treasury and work through the numbers there’s a good chance we will not have any issues with it.”

Senator Griff also said that while Centre Alliance “certainly didn’t support” Labor’s franking credits plan, it was open to looking at changes aimed at those “abusing” the system.

And the party was willing to discuss reforms that limited the number of properties a person could negatively gear.

“There are some people that are fleecing the system that are doing so via franking credits or via negative gearing … and even tax havens,” Senator Griff said. “The focus should be on those abusing the system.”

Tasmania’s Jacqui Lambie — back after resigning in the citizenship saga — did not respond, nor did One Nation.

A spokesman for the Prime Minister said “there will be no changes” to negative gearing or franking credits.

Connect with John Rolfe on Facebook or Twitter

Originally published as How Scott Morrison’s ‘miracle’ federal election win affects property, superannuation and tax