Espresso Moto cafes at Palm Beach, Mermaid Beach wound up by court after bitter debt stoush

A popular pair of beachside cafes has abruptly been shut down and placed into liquidation amid claims of missing cash and unpaid bills.

Gold Coast

Don't miss out on the headlines from Gold Coast. Followed categories will be added to My News.

A popular pair of beachside cafes has abruptly been shut and placed into liquidation amid a dispute between the director and a shareholder.

Espresso Moto cafes had operated at Palm Beach and Mermaid Beach for almost a decade, but companies behind them were plunged into liquidation after a court wind-up on Tuesday.

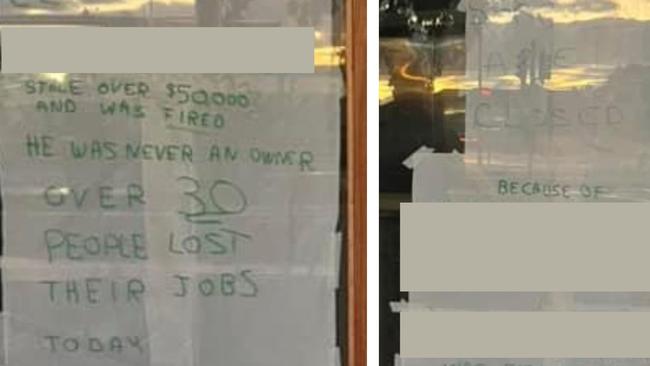

Angry and “false” signs greeted customers in the windows of the cafe on Wednesday morning, before being removed by the cafes’ former operations manager Jordan Stubbs.

The signs blamed two Gold Coast men - who the Bulletin is not naming - for the demise of the businesses, accusing one of taking “over $50,000” and accruing debts on behalf of the cafes.

As well as the signs, Espresso Moto’s Google listing was also adjusted, with the business name replaced by the word “Lies”.

Espresso Moto is directed by Shane Allan Rose, 57, with shares held 50-50 by Cairns resident Philip Stubbs and Sarose Group Holdings, also directed by Mr Rose.

Philip Stubbs, father of Jordan Stubbs, launched wind-up action against the companies in August last year with Judge James Henry ordering them into liquidation in the Supreme Court of Cairns on Tuesday.

Mr Rose said he had put the signs in the cafe window.

He said he had lost access to the business’s Google accounts and that the cafes had been subject of a “campaign” to make them fail.

Shareholder Phil Stubbs, who lives in Cairns, said the he’d seen photos of the signs before they were removed.

“I see he was blaming us for his demise, which is an interesting attack,” he said.

Mr Stubbs said Mr Rose’s past business history was a “good indicator of his character”.

Another of Mr Rose’s companies has been placed into liquidation this year – mechanical company All American Wheeling was wound up in the Brisbane Supreme Court on February 15.

Liquidator Bill Cotter reported it owed more than $400,000, mostly to unsecured creditors.

Another of his companies, Your Private Wealth, is also subject to current Supreme Court wind-up action over a debt to National Australia Bank.

The ATO is also seeking the company be wound up, with a hearing in the Federal Court scheduled for May 15.

ASIC publicly announced it had permanently banned Mr Rose from the financial services industry in March after alleging he “knowingly and dishonestly” spent investor money for purposes different from what was intended.

ASIC found Mr Rose was “not a fit and proper person to participate in the financial services industry because his dishonest actions showed serious incompetence and irresponsibility, and that he is likely to contravene financial services law in future”.

Mr Rose said he was still deciding whether or not to appeal ASIC’s banning and that ASIC had not found he’d given bad advice or left investors out of pocket.

He said All American Wheeling and his ASIC banning were not relevant or related to Espresso Moto.

Jordan Stubbs, 39, who launched the cafe and managed it for several years before leaving in September last year, told the Gold Coast Bulletin he’d removed the signs and that what had been written was completely false.

Jordan Stubbs is also no stranger to company liquidations.

Company records show an Espresso Moto company bought his previous restaurant, 8th Ave Terrace, after it went into liquidation in August 2018.

The company behind 8th Ave Terrace, Palm Beach Leisure, owed more than $980,000 to staff and suppliers when it collapsed.

Jordan Stubbs was declared bankrupt for three years from March 2019.

Mr Stubbs stayed on at the cafe as an employee under its new branding, with Mr Rose as director.

A Coolangatta Espresso Moto closed down in 2020 and was replaced by an unrelated cafe.

More Coverage

Originally published as Espresso Moto cafes at Palm Beach, Mermaid Beach wound up by court after bitter debt stoush