AFSA’s Inspector General of Bankruptcy to probe personal insolvency of lawyer Beau Hartnett

A Federal investigation has been launched into how a Gold Coast lawyer was able to strike a deal to pay a fraction of a six-figure debt to an elderly man. Find out why

Gold Coast

Don't miss out on the headlines from Gold Coast. Followed categories will be added to My News.

A Federal investigation has been launched into how a Gold Coast lawyer was able to strike a deal to pay a fraction of a six-figure debt to an elderly man.

Beau Timothy John Hartnett, 58, “exorbitantly” charged an elderly client $288,000 to enforce a $30,000 mortgage and then spent almost a decade in court trying to avoid repaying the money.

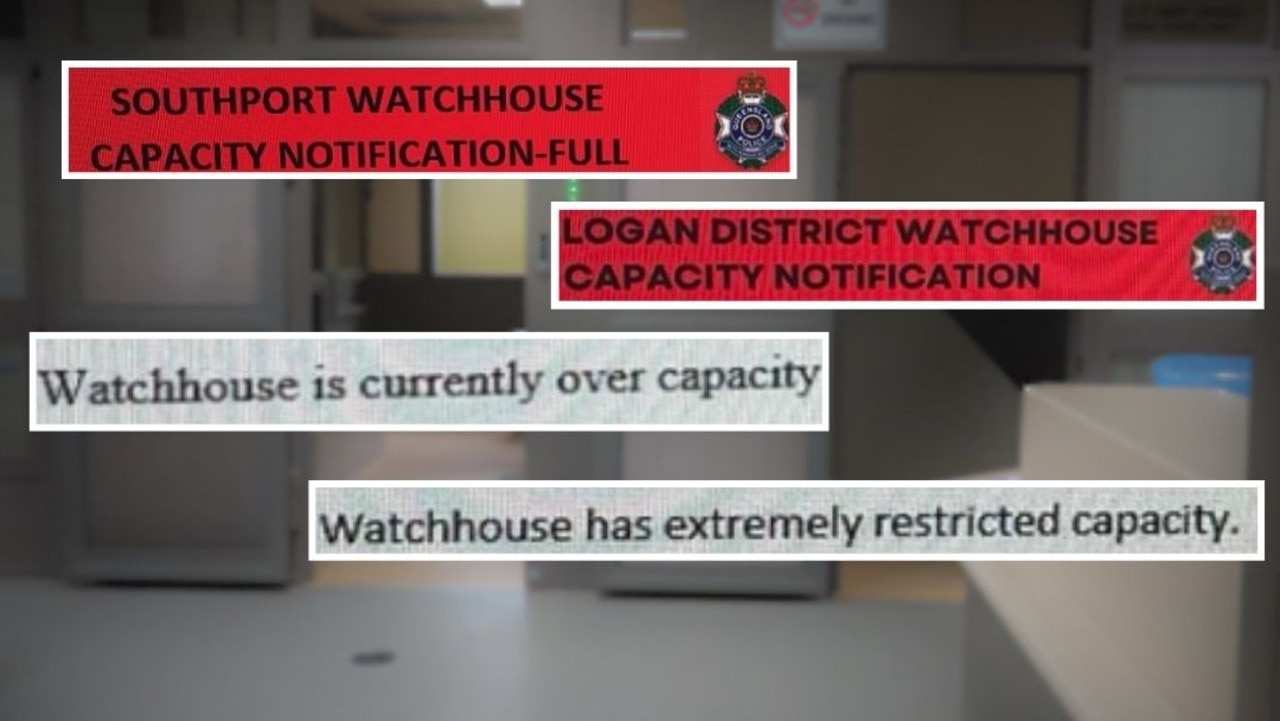

When he’d exhausted his appeals, he claimed he was broke and couldn’t pay, entering a personal insolvency agreement but avoiding bankruptcy.

Insolvency documents obtained by the Gold Coast Bulletin last week show Anthony Robert Bell, who was owed $584,589 by Mr Hartnett, would see less than three cents for every dollar despite the latter living in a $3.25m mansion with $9.5m in declared interests in trusts.

Responding to questions from the Bulletin, the Australian Financial Security Authority (AFSA) said Inspector-General in Bankruptcy Timothy Beresford would investigate the “circumstances surrounding the personal insolvency” of Mr Hartnett.

“AFSA has acted after becoming aware of concerns regarding Mr Hartnett’s conduct and actions taken in relation to his personal insolvency,” the authority said in a statement.

“AFSA takes a firm but fair approach to regulatory action. This includes investigating potential offences against the Bankruptcy Act 1966.

“This investigation is ongoing and further details will be provided at an appropriate time.”

The deal to pay creditors 2.64 cents in the dollar was struck after a company directed by Mr Hartnett and his wife claimed it was owed more than $3.7m, making it his largest creditor and giving it the power to vote up the proposal.

Mr Hartnett’s trustees, Anne Meagher and Adam Kersey of SV Partners, had not received proof of the debt when they wrote their report to creditors so it was not publicly available.

They have not responded to multiple requests for comment.

The Bulletin has contacted Mr Hartnett for comment.

Meanwhile, Mr Hartnett, whose conduct a judge said had “debased the reputation of the legal profession” has retained his legal practising certificate and his company directorships.

The lawyer was found by the courts to have “exorbitantly” charged an elderly client $288,000 and continued to invoice her after she died. He then went after her children for money.

The “exorbitant” fees were taken from the settlement of a property inherited by Mr Bell, who was forced to take on the court actions in an attempt to get it back.

Despite the court findings, and Mr Bell’s direct complaints to the Queensland Law Society since at least 2017, Mr Hartnett this week remained registered as an unrestricted principal.

QLS President Rebecca Fogerty said QLS “co-regulates the legal profession with the Legal Services Commission”.

“The LSC receives and investigates complaints about solicitor’s conduct,” she said.

“QLS issues practising certificates. A practitioner who becomes bankrupt is placed in a show cause position where they must make submissions to satisfy QLS they remain fit and proper to hold a practising certificate.

“While that process is ongoing it is not appropriate to make comment about any particular matter.”

The society would not say whether a show cause process was under way for Mr Hartnett.

According to the Society, the definitions of a ‘show cause event’ are “broad and extend beyond bankruptcy, for example it includes being served with a creditor’s petition and making certain arrangements with creditors”.

A statement from the Legal Services Commission said the “issue, renewal and regulation of practising certificates, including whether a person is a ‘fit and proper person’ to practise law, does not fall with the Commission’s functions or jurisdiction”.

The statement said the Commission could not comment specifically on Mr Hartnett’s case.

“The Commissioner also does not comment on, including confirming or denying the existence, or any aspect, of any alleged complaint, investigation or referral.”

AFSA encouraged anyone who suspects wrongdoing, criminal misconduct, dishonesty, or fraud in a personal insolvency matter, to report it immediately. Tip-offs can be made anonymously here.

More Coverage

Originally published as AFSA’s Inspector General of Bankruptcy to probe personal insolvency of lawyer Beau Hartnett