Colliers’ Townsville Market Snapshot property report examines region’s mixed results

A new report has taken a deep dive into mixed performance of Townsville’s property market over the past year and looked towards a bright future in 2025. Read the highlights.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

North Queensland’s commercial property market is in a holding pattern, with not enough availability to meet investor demand according to analysis in a newly released report.

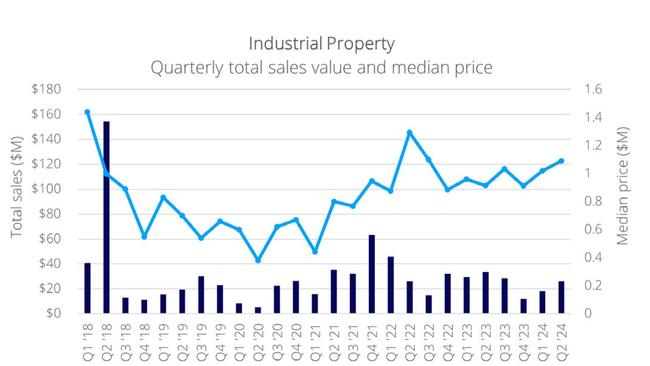

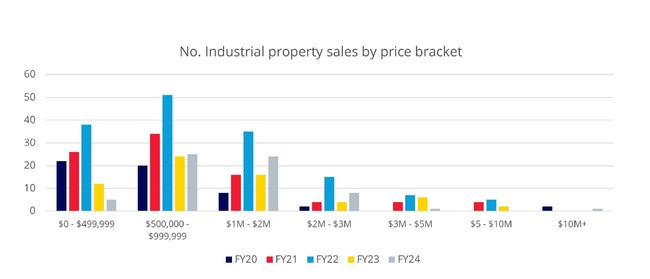

Compiled on behalf of Colliers Townsville by Townsville economist Callum Kippin, the Townsville Market Snapshot 2024 Financial Year in Review recorded a decline in volume of sales over the financial year, yet prices continued to rise due to there being an insufficient number of listings to meet demand.

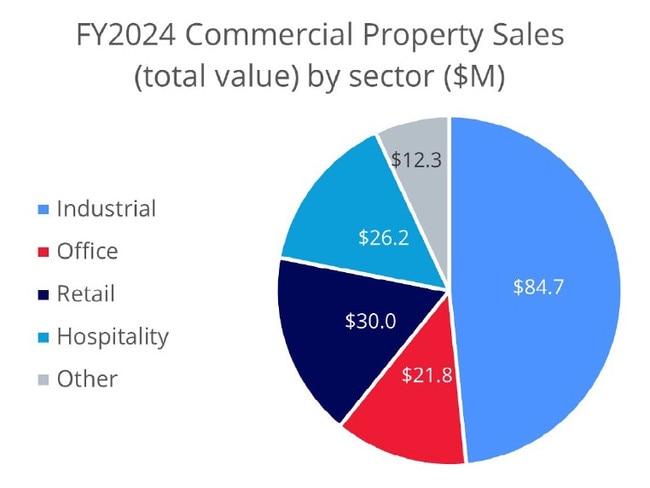

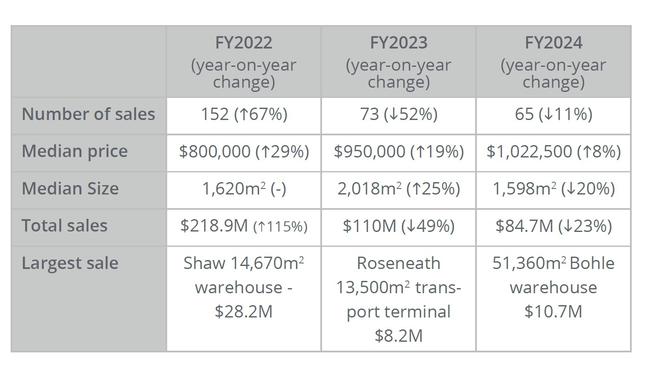

Highlights over the last financial year included an 8 per cent lift in the median price for industrial properties to $1.02 million, the median price for retail property rising 37 per cent to $1.2 million, and healthy hospitality sales totalling $23 million.

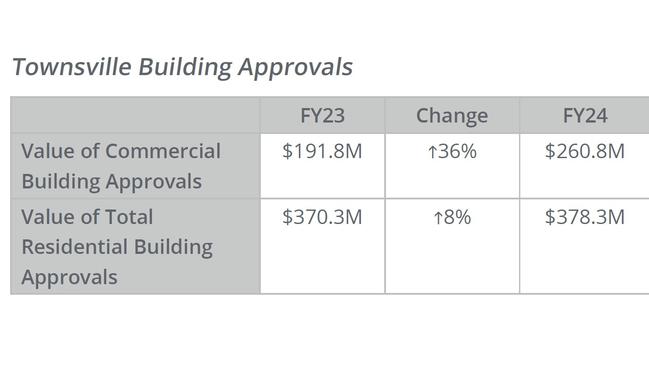

While availability and cost of construction has limited the amount of new properties able to come to the market, there was a promising 36 per cent increase in the value of commercial building approvals to $260.8 million, and an 8 per cent upswing in the value of total residential building approvals to $378.3 million.

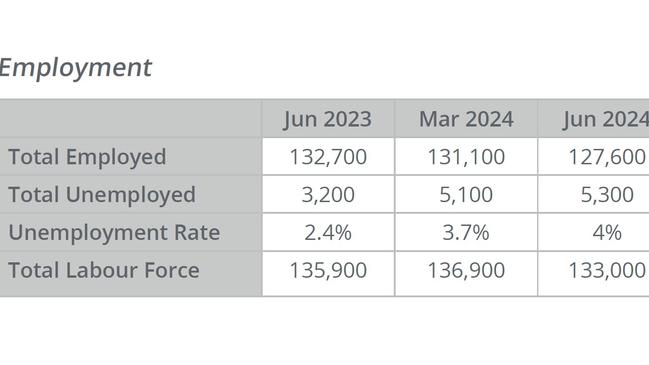

The report took into account the local impact of national economic challenges, with local unemployment increasing and business confidence cautiously optimistic in the face of high interest rates, “persistent” inflation creating uncertainty and hurting consumer spending, and the ongoing housing crisis.

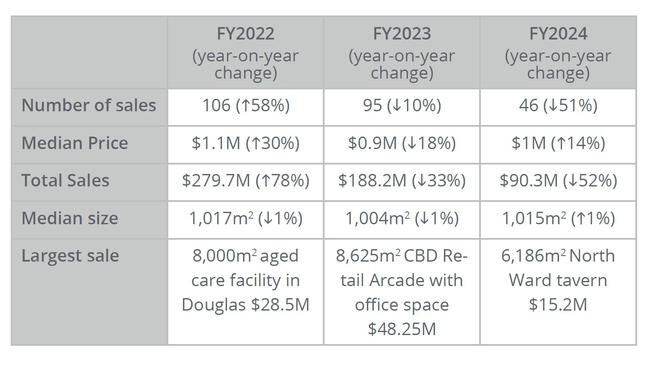

These economic conditions introduced “elements of patchiness”, with some market segments starting to struggle, most acutely seen among leasing activity in the discretionary retail sector, which was highly exposed to declines in household spending.

Retail had the biggest drop in commercial property transactions, with less than a third of 2023’s sales and volume down 75 per cent.

Despite the challenges, a promising local outlook was keeping investors looking north, particularly towards the “standout” industrial sector, where the largest sale was a 51000 sqm Bohle warehouse which sold for $10.7 million.

The strength of industrial property was on the back of an enviable $36 billion pipeline of major projects, led by the $5 billion Copperstring transmission line, and significant industry developments in the northwest Minerals Province, “which will stimulate a population growth and support the economy in the medium and longer term”.

“This activity will drive the long-term prospects for the commercial property industry,” the report said.

“Continuing tight supply led to the quietest year of non-industrial commercial property activity since 2019.

“The long-awaited commencement of an interest rate easing cycle, hoped to begin in 2025, should sustain demand in the local market.”

Given the lack of available properties, Colliers Managing Director Peter Wheeler said it wasn’t surprising to see that overall sales in the market are down.

“But rising prices and some high profile transactions are a great sign of the demand that is out there,” Mr Wheeler said.

“Now that construction is underway on Copperstring, the first step has been taken in rolling out a major project pipeline that will invigorate our economy. We’re expecting to see big growth in North Queensland, and investors are too.”

Major Projects Update

• Copperstring – $5 billion – Construction commenced on the first worker accommodation site, located in Hughenden.

• Great Barrier Reef Aquarium Redevelopment – $180 million – Partial funding reallocated to project by Townsville City Council. Awaiting Australian Government confirmation.

• North Railyards Housing Project – Fringe-CBD site transferred into company ownership for Townsville City Council led housing project. $35 million Queensland Government commitment for site preparation.

• Townsville Eastern Access Rail Corridor – Queensland Government funding commitment to revisit business case.

• Gawara Baya Wind Farm – $1.4 billion – Australian Government approval granted to Windlab for 69-turbine facility in the Burdekin region. Construction expected to commence 2024.

More Coverage

Originally published as Colliers’ Townsville Market Snapshot property report examines region’s mixed results