Cairns rental crisis victim calls for change to 30 per cent income test

A family of three on an above-median household income is being pushed towards social housing, despite willing to pay “anything” for a private rental. They want the 30 per cent rule changed.

A Cairns mother who would “pay anything it takes” for a roof over her head is calling for a major change to rental practices with days to find accommodation as a pending eviction notice looms.

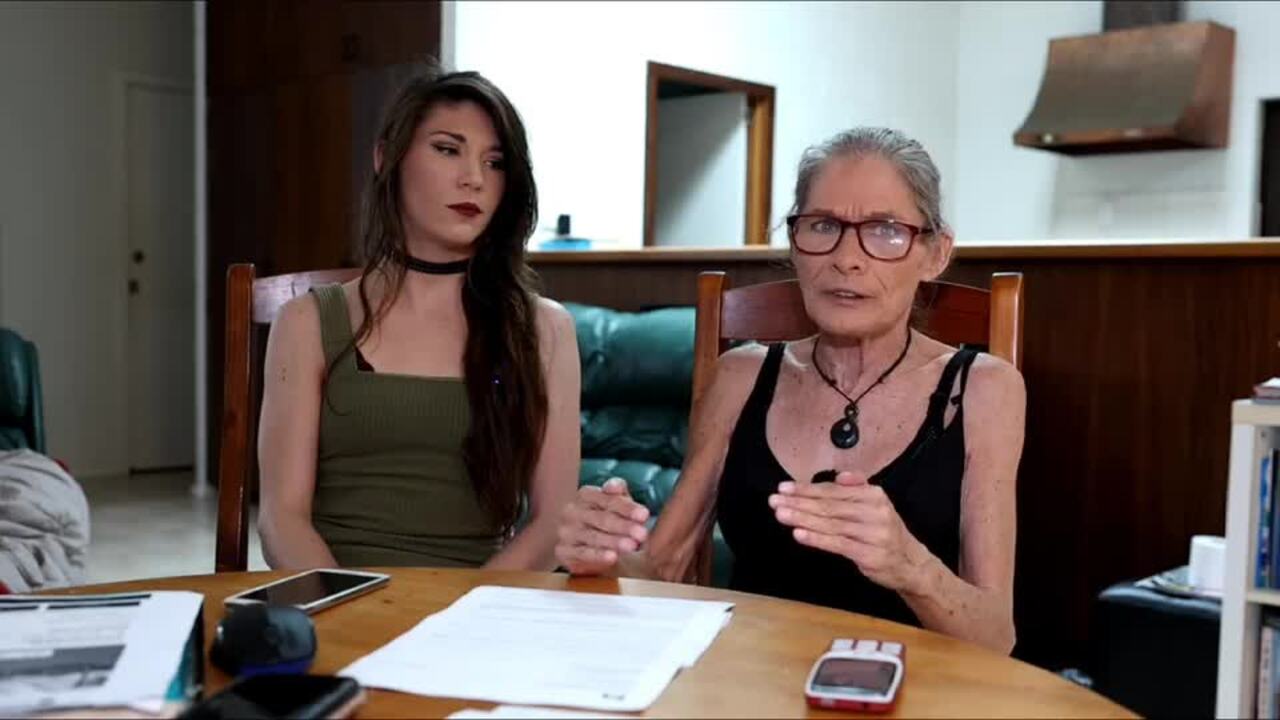

Tracie Carvin lives with her two daughters – Cami Coughey, her younger sister Shayla Carvin, 11 at Freshwater.

Between Ms Carvin’s centrelink allowance and Ms Coughey’s full-time job at The Red Beret, the household earns $1700 a week, above the Cairns median, with $650 of that paying their rent.

But as is the story with many Far Northerners, their residence was sold, and now the family is desperately hunting for a new rental, while also preparing for a QCAT hearing on Friday to extend their stay which they concede will likely be unsuccessful.

Applying for rentals “every spare minute” of every day, Ms Carvin said real estate agents were knocking back her application or refusing to consider it because the asking rent of properties exceeded the “30 per cent of income” threshold.

In theory, the 30 per cent rule helps property managers determine whether an applicant can afford rent.

“I’ve had a perfect tenant history for 12 years, I have a great credit rating, why does it matter if we want to spend more than 30 per cent to put a roof over our heads,” Ms Carvin said as she flicked through the pages of her rental ledger at her home in Freshwater.

“I understand real estate agents can get in trouble if they let a tenant in and it doesn’t work out,” she said.

“So why can’t the government change this, why do there have to be penalties for someone who’s always paid their rent and their bills?

“What right does the government or someone else have, to tell me how I can spend my money and how much I can spend on housing – a basic human right.

“I’ve been a responsible financial adult, if I want, I should be allowed to spend 80 per cent.”

While the 30 per cent rule is not ingrained in state legislation, it’s understood real estate agent’s can be found to be practicing in neglilence, if they approve a tenant who defaults. Further, insurance companies may refuse landlords any payouts if the lease does not meet an ethical renting criteria.

The family of three admit being selective about suburbs and properties, but feel they had good reason to remain in the Freshwater area.

Ms Coughey said she had worked up to a supervisor role at the Redlynch pub with aspirations of becoming manager.

“People say, why don’t you move to Manoora or Manunda – well I’d lose the security of my job, I don’t drive and sometimes I’m going home at 3am (after work),” Ms Coughey said.

Ms Carvin said when seeking assistance, she was directed towards “social housing lists”.

“That was soul-destroying. How would someone who is genuinely on the list feel, knowing someone like us willing to pay $650 a week is also on the list.

“My question is ‘who can actually afford these rents?’

“How many people are out there, who can actually find something within their 30 per cent.

“It’s an affordability problem, not just a supply or availability problem.”

A search for available rentals on realestate.com.au for Freshwater yielded 88 results, with the lowest rent $500 per week. Median rent in Cairns has increased by a whopping 31.3 per cent since March 2020, according to CoreLogic.

Aside from dropping the 30 per cent rule, Ms Carvin said she would like to see an increase of the tax-free threshold which was at $18,200.

“In the ’70s the governments privatised everything and we were told it would be good, now the government makes no money and we’re left paying all this tax while the price of everything goes up.”

STATE’S RENT ASSISTANCE

The state government has rolled out an additional 42 RentConnect officers in a bid to assist struggling tenants amid an escalatingrental and housing crisis.

Cairns MP Michael Healy said of the 42, two officers had been deployed to Cairns who would continue the roll of assistingtenants with administrative challenges including applications, history, references and also financial support to help payfor rent increases, arrears and bonds.

He said about 530 households in Cairns had already sought assistance through the $160m Rent Relief package.

Mr Healy denied suggestions the scheme which gave renters a “fee-free option to pay rent” was a bandaid solution to an affordabilitycrisis.

“There’s not one solution to this,” Mr Healy said while referring to Tuesday’s announcement of 53,500 social homes acrossthe state by 2046.

He said there was a strict criteria for those would receive rent relief to ensure “the money is getting to those most needyin our community.”

However, when asked if splashing additional cash for struggling tenants would only further incentivise landlords to increaserents, Mr Healy said there were avenues part of the RentConnect proccess to report unjust advances in lease values.

Mr Healy also ruled out rent freezes and price caps, stating it would spook investors.

More Coverage

Originally published as Cairns rental crisis victim calls for change to 30 per cent income test