Parents are outraged over new 'money grabbing' fees for their kid's bank accounts

Spriggy’s recent price hike has parents up in arms - and it’s not hard to see why.

Lifestyle

Don't miss out on the headlines from Lifestyle. Followed categories will be added to My News.

If there’s one thing all parents agree on, it’s the importance of teaching kids financial literacy, so they know the value of money from an early age.

Just how that’s done is in constant debate, however.

In recent years, the move (for better or worse) towards cashless payments means the simple act of saving a jar full of coins and depositing into a bank - or even an atm - is a thing of the past.

Want to join the family? Sign up to our Kidspot newsletter for more stories like this.

Since 2016, children aged 6-17 have had access to Spriggy, a mobile app that is linked to a prepaid Visa card.

Its slogan is that it “helps Australian parents and their kids to manage their money together and track their progress in a fun, interactive app”.

How it works is that instead of giving kids pocket money in the form of notes and coins, parents can transfer money to their kids via the app. That money is managed via the app, like a regular bank account.

Today, the app is used by “hundreds of thousands” of Australian children, and is widely used in schools for tuckshop purchases and other activities where money is required.

While there’s no denying it's a service with plenty of demand, Spriggy has come under fire online in recent weeks due to a major change in its fee structure.

Introducing our new podcast: Mum Club! Listen and subscribe wherever you get your podcasts so you never miss an episode.

Extra fees introduced to kids accounts

Parents are up in arms over the Australian company’s recent decision to raise its original yearly subscription fee of $30 to $60 for one child - a 100% increase. After one child, a family subscription is now $78 per year for up to six children. The subscription is payable after a free 30-day trial.

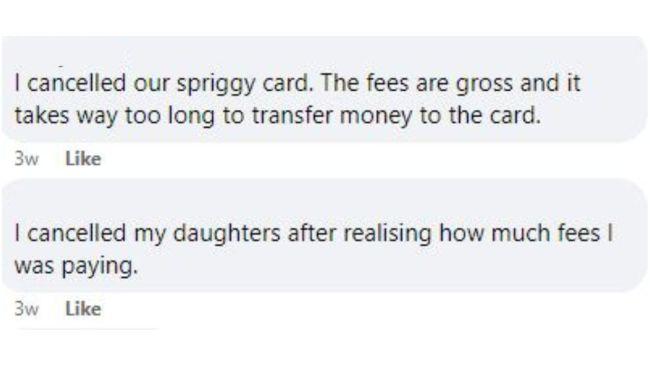

The change has led many parents to choose other options for their children’s savings.

“I cancelled our Spriggy card,” Kasey commented in the Mums Who Budget & Save Facebook group. “The fees are gross and it takes way too long to transfer money to the card.”

RELATED: Mum’s pocket money with a twist has parents in a spin

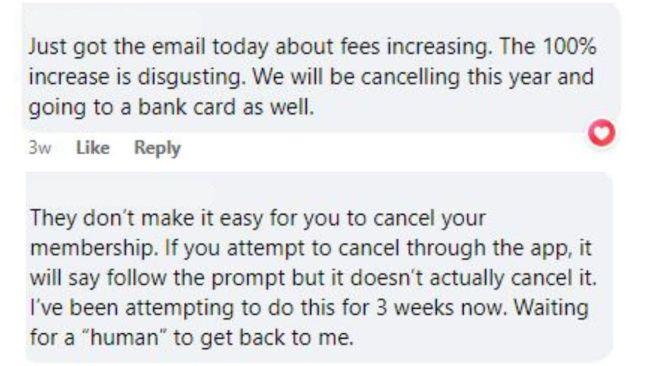

Another mum, Kayla, voiced her opinion of the increase on Spriggy’s Facebook page, just as many other disgruntled parents have done this month.

“Just got the email today about fees increasing. The 100% increase is disgusting. We will be cancelling this year and going to a bank card as well.”

Several customers also noted their attempts to cancel subscriptions was more difficult than anticipated.

“They don’t make it easy for you to cancel your membership,” Sylvia posted on Spriggy’s Facebook page. “If you attempt to cancel through the app, it will say follow the prompt but it doesn’t actually cancel it. I’ve been attempting to do this for 3 weeks now. Waiting for a ‘human’ to get back to me.”

RELATED: The national average for pocket money will shock you

Spriggy weighs in on extra fees

In response to the customer criticism of its fee increase, Kidspot contacted Spriggy, and a spokeswoman has said: “Spriggy charges a yearly subscription fee that enables us to maintain a safe and secure platform for our families while also allowing us to continue improving our products.”

“Spriggy is not a bank, and we therefore do not make money from lending or other activities, it is our annual membership fee that enables us to provide our services.”

She went on to add, “We changed our annual membership in mid-2021 for the first time since we launched in 2016. For new users, we switched from a child-based pricing model to a family-based model of $60 per family. Existing members remained on our legacy, child-based pricing for a further year and a half, before we transitioned all members onto family-based pricing in February, 2024. The move to family-based pricing was taken to simplify our pricing structures and to maintain affordability for multi-child families, in particular families with 3 or more children.”

The spokeswoman also acknowledged a portion of the company’s customer base had left.

“For lots of our families, the transition to a family-based pricing model has been more favourable and cost-effective than child-based,” she said.

“Cancellations after price changes are inevitable, however, we’ve seen an extremely small portion of our member base choose to do so.”

Those who do wish to cancel, she said, can do so “in-app or by contacting our Sydney-based Member Help team who are available for live chat through the Spriggy App”.

More Coverage

Originally published as Parents are outraged over new 'money grabbing' fees for their kid's bank accounts