Should there be a 'cancer' allowance?

The silent struggle facing many cancer patients.

Cancer

Don't miss out on the headlines from Cancer. Followed categories will be added to My News.

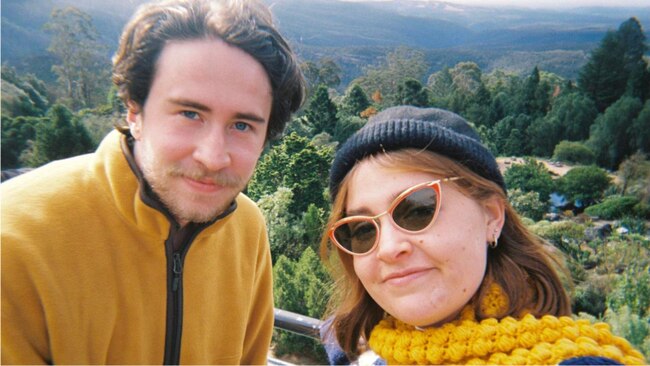

24-year-old Sydney man Lachie Keen who is undergoing treatment Hodgkin’s lymphoma opens up about the less talked about side effect of cancer treatment: Financial stress.

When 24-year-old Lachie Keen decided to press publish on a post appealing for job opportunities in his local Facebook group, he was nervous at the reaction it would receive.

Around three-and-a-half months into his treatment for Hodgkin’s lymphoma – a type of cancer that affects the immune system – Mr Keen is fortunate that his body is responding positively to treatment.

However, the Sydney man is struggling with a less talked about side effect of cancer treatment: Financial stress.

Like what you see? Sign up to our bodyandsoul.com.au newsletter for more stories like this.

“It’s not something I ever considered. Obviously the first thing you think about when you get a cancer diagnosis is, ‘Am I going to die?’” he told news.com.au.

Sharing his request to the 38,600 members of Sydney’s Mosman Living community page, he made a plea for work opportunities.

“Unfortunately, I’ve found that after I pay rent and bills I have very little money left over from my Centrelink payment,” he wrote.

“So, I thought it would be good idea to reach out to my local community and see if there were any odd jobs that people needed doing for a bit of extra cash.”

Unable to work

Previously working at a ceramics studio in Sydney’s inner west, the physical toll of chemotherapy meant he was unable to do his job.

Although he left the workplace on good terms, and hopes to return once his treatment finishes in January, everyday tasks which involved heavy lifting and even standing on his feet all day have become untenable.

“I’ve gotten back to the point where I can probably go on walks most days but my heart rate is a lot higher than what it used to be,” he said.

“Another side effect of chemo is that my forearms where I get the cannulas inserted are also always quite tender and sore. Even basic things like carrying shopping bags will hurt.”

His one-and-a-half hour commute from Mosman to Marrickville was also a risk factor due to his severely weakened immunity.

Since he’s started treatment, Mr Keen largely avoids public transport and takes precautions like RAT tests and wearing masks when seeing friends.

“My white blood cell count is well below half, so I’m quite susceptible to infection,” he said.

“There’s been times when my partner has gotten a cold and one of us has had to stay at our parents’ for a week-and-a-half.”

Livelihood slashed to $750 a fortnight

Although he admits he’s lucky he has financial help from his mum, and is still on his family’s private health insurance plan, Mr Keen now relies on Centrelink payments as his only source of income. Receiving roughly $750 a fortnight from a mix of Jobseeker and rent assistance payments, the amount barely covers the cost of the Mosman home he shares with his partner and utility bills.

“My rent takes out a massive chunk and after bills, I’m at a deficit for groceries,” he said.

“I feel like the payment sort of shows that they give you the bare essentials and not even that. You can’t pay for anything apart from rent and utilities.”

He said the process has been “really frustrating”.

“I feel limited. I’m like three-and-a-half months in treatment now and I’ve accepted a lot of the mental side of things [but the money aspect] has been difficult,” he said.

“The financial side of things only adds to the stress and the worry and the mental impact. [The welfare system] doesn’t really help. It’s not really doing its job.”

Apart from a severely reduced income, Mr Keen said he’s also faced other out-of-pocket expenses like medication costs and monthly oncologist fees which cost a few hundred dollars per appointment. While Mr Keen’s mother has helped front the majority of these costs, she estimates this has totalled an extra $3000 to $3500.

“It’s been kind of a whirlwind of figures and numbers and little finicky things to do with insurance,” he said.

“There’s just all of these little things that pile up, stuff that I don’t think Centrelink payments would cover at all.”

‘It’s not going to work’

In her job as a social worker representing Oncology Social Work Australia and New Zealand (OSWANZ), Kim Hobbs frequently sees the devastating financial impact of cancer among the people she helps.

Not only does JobSeeker struggle to cover basic living expenses, it also doesn’t factor in “indirect costs” of cancer treatment which can include expenses for hospital parking, childcare fees, and co-payments for prescription medication, or trial medication that may not be subsidised by Medicare.

Although the amount for JobSeeker needs to increase, the administrative barriers – which includes uploading a medical certificate in to Centrelink every three months – is another barrier, especially for rural patients.

“These are people who are not working through no choice of their own and their capacity to return to work is uncertain,” Ms Hobbs told news.com.au.

“Very small amounts can tip people over the edge and I know people who don’t have medications made up because that’s an additional expense.

“People have to make choices on things that are really very small out-of-pocket expenses but it is [significant] if your income is JobSeeker.”

Instead, Ms Hobbs would like to either see the return of the Sickness Allowance which ceased on September 20, 2020, or for welfare payments be increased to match the age pension. If so, the rate would increase to at least $936.80 a fortnight.

“It’s a much more liveable payment,” she said. “The problem with cancer is that it’s now a chronic condition and has multiple episodes of care.”

This means patients often face combined therapies which may include chemotherapy or radiotherapy, combined with immunotherapy. Although the treatment methods are “really great at improving outcomes,” they’re administered over a longer period of time.

Adverse side effects like immunosuppression, fatigue and drug reactions may also prolong the recovery time.

A plea for work

The idea to look to his wider community to help him with his job hunt came from a friend. Although Mr Keen said he was nervous and shy to initially make the post, the “response has been incredible”.

“Everyone’s so nice and I’ve got a couple of data entry leads and other things I can do on the computer at home,” he said.

In just hours, the post received hundreds of reactions and dozens of encouraging comments. Although Mr Keen is limited with the work he’s able to pursue, he’s now in the process of sorting through the responses.

“Physically, I’m limited to just being able to walk places but things like data entry, word processing and filing documents and things I could do at the computer at home would be ideal,” he said.

While Mr Keen has struggled to find people his age who are going through a similar experience, he said organisations like Canteen and the Cancer Council have been great at offering support.

“I haven’t managed to find a support group yet, and luckily I’m very close with my family and friends, but if people aren’t aware of the resources, those two organisations offer a lot of help.”

A costly diagnosis

With Cancer Australia estimating there will be 162,163 new cases diagnosed in 2022, the disease is a costly burden to both patients and Australia’s healthcare system.

In 2013, the Cancer Council estimated that the average cost on Australia’s health services was around $1622 for the year before diagnosis (which factors tests and consults), before that figure ballooned to $33,944 for the first year post-diagnosis and $8796 for the second year post-diagnosis.

However, the Cancer Council notes that costs are likely to have increased since 2013 due to the approval of expensive new targeted therapies and immunotherapies.

According to a 2021 study from the peer-reviewed journal BMC Cancer, the out-of-pocket costs for medical expenses increased by more than 70 per cent for patients diagnosed between 2011 to 2015.

Although the figures greatly fluctuated depending on cancers, the study found that costs for breast cancer went from $2513 to $6802, while expenses for prostate cancer increased from 1586 to $4748 for patients without private health insurance.

This story was originally published on news.com.au and is republished here with permission. You can find it here.

Originally published as Should there be a 'cancer' allowance?