Young mum of two reveals how she paid off $60k of debt, $5 at a time

Facing debts of more than the $50,000, a 29-year-old Brisbane woman has now almost saved enough for a house deposit.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

In an era of buy-now-pay-later, payday loans and easy credit, the number of Australians finding themselves drowning in debt is on the rise.

Personal debt skyrocketed to nearly $3 billion last year and, according to payment data from the Reserve Bank of Australia, $205m of new debt was added to credit card balances just in December.

But one group of money savvy Australians is turning their back on debt and are using social media to share their financial success stories and inspire others to clear debt.

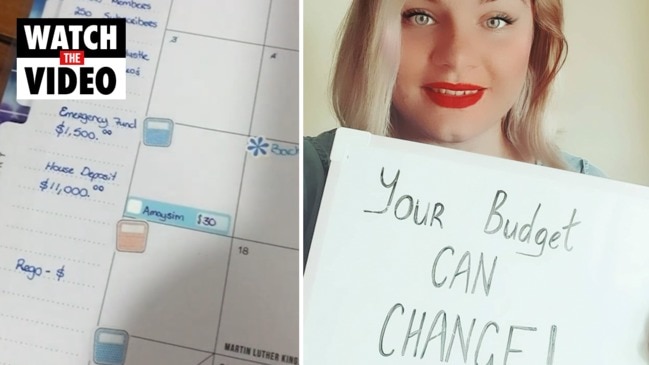

One of those making a name for herself in this thriving online community is a Brisbane-based mum of two, who paid off $60,000 of debt, built an emergency fund and saved the bulk of a house deposit in four years. All on an income of less than $50,000.

FACING UP TO THE PROBLEM

The 29-year-old influencer – or ‘fin-fluencer’ – who goes by the handle @aussiedebtfreegirl on Instagram and YouTube started her mission to become debt free when she was expecting her second child.

“I’ve always hated debt and been a huge advocate of being frugal,” she shares. “My partner and I met in December 2015, we had a baby on the way and we were trying to start a life together.

“We had a conversation about what we both wanted in life and how we could never have that while carrying all this debt.”

The conversation motivated the Brisbanite to take over the couple’s finances with a goal to pay off everything they owed, including utility bills, personal loans, phone bills and car accident debt.

“We scrimped and saved and threw every extra dollar we could at the debt. Paying them off and knocking them down one at a time. We made so many random payments of $5 just to chip away at it.”

As well as taking on extra work, she cut down on household bills by shopping around for everything, from reviewing energy providers every few months, to making the most of loyalty and rewards schemes.

The mum of two also used money management app WeMoney, which helped her see all of her bills in one place, so she could work out a monthly budget and goals from there.

FRUGAL FUN

Even though the couple scrimped, they still managed to have some fun, although they always made sure it was on the cheap.

Date nights consisted of discounted sushi, where every plate was less than $4, a romantic walk and cuddling up on the couch, while family fun was about grabbing takeaway and hitting the park for a picnic and a play with the children, now aged four and seven.

“Some of our favourite things to do cost next to nothing. Our only rule is, if we’re going to do something, we have to love it.”

SHOPPING AROUND AND SIDE-HUSTLING HARD

As well as focusing on paying down their debt, the couple found new ways to boost their income. Starting out on a modest $20,000 combined income, the pair slowly increased their earnings each year before finally ending on $50,000.

“We side-hustled hard. In between jobs my partner did landscaping and was a handyman while I did cleaning and refurbished furniture, flipping items to sell online.”

“I would’ve paid off the debt sooner if we hadn’t had a few emergencies,” she says. “It took me four years due to a low single income and life, job losses, and the emergencies that cropped up as we went.”

Those crises, namely her partner’s car – essential for his work as a tradie – breaking down, inspired her to focus on building an emergency fund in conjunction with conquering their debt because “there’s no point in paying off debt if the next emergency is just going to undo all that hard work.”

RELATED: Weird electricity habits that cost thousands

A MUCH-NEEDED EMERGENCY FUND

Once debt free and equipped with an emergency fund, Emily turned her focus to saving for a house deposit and had part of it saved when another emergency hit. Her son became sick and, in the months it took for him to get a diagnosis, their cash reserves were drained through specialist appointments, medications, hospital parking, carers leave and childcare for her daughter.

However, she remains philosophical about it. “I’m not going to lie, I was gutted when I saw those five figures go down to zero, but that’s real life, that’s personal finance, things will happen that you need to spend money on,’ she says.

“You’re not always going to hit those big audacious goals, you can’t be too rigid or upset about it, life happens. I just reset and think ‘I can do it again’.”

RELATED: How to choose family health insurance

FINDING FINANCIAL FREEDOM

Emily believes anyone can clear their debt, no matter how large, if they’re just willing to tackle it head on.

“If you’re in debt, don’t hide from it. List out what debts you have, what the interest rates and fees are on them, then pick just one to focus on and smash it,” she advises.

“I recommend starting with the smallest because not only does it prove that you can do it, then you can roll over that minimum payment on the next debt and it just snowballs from there.”

Now back to concentrating on that house deposit so they can get a mortgage, a debt Emily believes is “a part of life”, she’s more dedicated than ever to being thrifty.

“It’s a lifestyle choice for us, even if we had more money coming in, I’d still be frugal. At the end of the day, we don’t want to work forever, so we have to stick to a budget as much as we can.”

RELATED: 3 crucial dates Aussies need to know

Originally published as Young mum of two reveals how she paid off $60k of debt, $5 at a time