The real message CBA is sending about the Australian economy

Despite CBA’s profit engine shifting down a gear, a decision to send billions of dollars back to investors speaks volumes.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

In the face of a slowing economy; painfully high inflation; rising bad debts and a gnawing uncertainty over what’s coming, the nation’s biggest bank has sent $1bn back to shareholders on top of a hefty dividend increase.

Intuitively, this is the time that banks should be piling any extra cash onto their balance sheets to reinforce themselves while the economic storm passes.

But a surprise decision to send more funds to investors says more about the Commonwealth Bank chief executive Matt Comyn and his bank’s calculations of where the economy is heading.

And despite looming financial heartburn, CBA is telling us it believes broader disruption will be minimal and Australia’s soft landing likely short-lived.

Comyn acknowledges he sits on the more “optimistic” side of most forecasts, but there is an underlying message of confidence about the Australian economy. As the nation’s biggest bank, CBA has an unrivalled view into the health of more than a third of Australia’s households, as well as a large chunk of Australia’s small business and corporate customers.

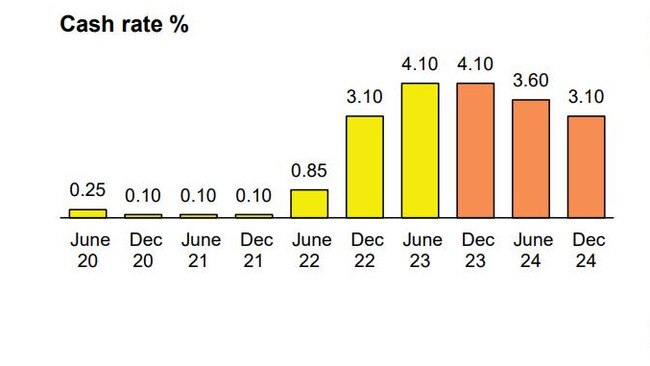

The bank boss still expects growth to continue to slow over the course of this calendar year, but Australia will avoid slipping into a recession, he says. Critically, CBA is tipping we are very near the end of further interest rate rises while the jobs market will remain robust. Immigration too continues to provide a cushion for growth.

Comyn was speaking as CBA posted a better-than-expected 6 per cent increase in full-year cash profit to a record $10.16bn. The emphasis from the CBA team was around strength in the face of uncertainty and having the capacity to support customers. CBA’s final dividend was up 14 per cent to $2.40 a share. Comyn too shared in some of the surge, taking home $10.4m over the year as his long-term bonus payments from 2019 finally arrived.

However, the earnings numbers also reveal CBA’s profit engine has shifted down a gear. The June half profit fell 3 per cent as costs tracked closer to broader inflation and interest margins have started to come under pressure. Indeed, the bank suffered a double-digit squeeze in interest margins during the second half. At the same time, CBA was forced to put aside an additional $1.2bn to cover potential lending losses. A decision to pull off cashbacks on mortgages is starting to hurt lending growth.

‘Uneven impact’

Comyn is quick to point out with multiple cash rate rises it remains a tough environment for most households and many are dipping into their savings buffers. He expects the next six months to be the most challenging, with the lag effect of rate rises still to come.

“Overall, we are very conscious that many Australians are feeling under pressure as a function of inflation and higher interest rates and increases in the number of household expenses,” Comyn tells The Australian.

Interestingly, it’s CBA’s customers in the 25-34 year age group that are feeling the squeeze of higher mortgage or rental costs the most, and these are the ones who have sharply pulled back on spending.

However, the savings-rich customers of 55 years old and above have increased their average spending in recent months. This is a stark example of the generational divide of higher cash rates in action.

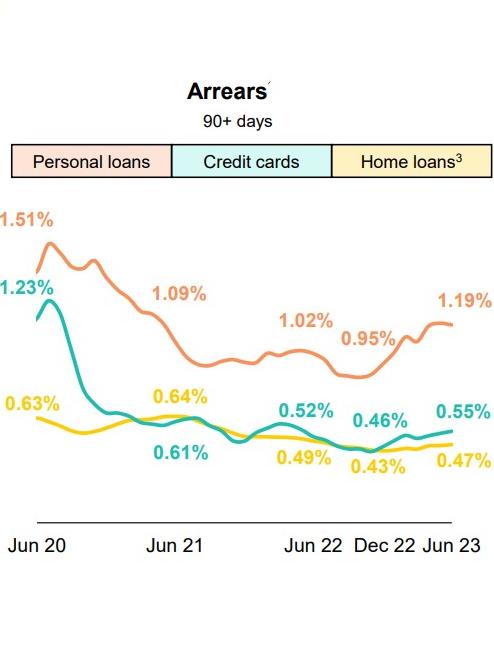

As the bank’s full-year accounts show, the actual number of customers that are falling behind on their mortgage payments is “very small” and still near historic lows, Comyn says. Among business customers, lending losses are being led by construction, where labour shortages and rising material costs are biting.

One area to watch is the so-called mortgage cliff that is still working through the system. That is customers moving from ultra-low Covid era fixed rates to higher market-priced variable rates.

“At this stage, we would say that only about two-thirds of cash rate changes have been borne by households. That is another third to go.”

He says the bank has also been reaching out to every customer coming off a fixed-rate mortgage to let them know of financial assistance options in the face of higher mortgage costs. This is an exercise designed to head off possible losses before they arise.

Deposit fight

One area that looms as a battle for all banks is a fight for deposits, which in many ways will overtake the mortgage fight seen over the past 18 months. This is in part as a result of the Term Funding Facility put in place by the Reserve Bank during the Covid pandemic that gave bank access to ultra-cheap term loans. This was then lent out to borrowers in the form of low rate mortgages. The funds have now matured and need to be repaid. This means that all banks will be looking to refinance hundreds of billions of dollars at once, and in many cases deposits are going to be a cheaper option than wholesale markets.

Comyn, who needs to tap funding markets for more than $60bn this coming year, is expecting intense competition on the deposit front.

“Obviously, we’re going to continue to compete in those markets. We’re not prepared just to see cheer for the sake of, but we’re very focused on sustainability over the medium term,” he says.

Regional lender Suncorp, also delivering earnings numbers on Wednesday, called out “increased competition on deposits” as a feature for the coming year.

CBA’s house economic forecasts are more bullish than others, including the Reserve Bank. CBA is tipping economic growth of 1 per cent in 2024, which sees Australia avoid a recession. It has inflation coming down to 3.1 per cent next year. Significantly, the bank is betting on an end to the rate hike cycle and official cash rate cuts from early next year. This could see the cash rate fall to a dovish 3.6 per cent by June from 4.1 per cent currently.

Of course, there is a risk the bank has it wrong and inflation becomes sticky, which means higher rates for longer. That is the recipe for Australia to slip into a grinding recession.

CBA will have $2bn in excess provisioning over its so-called central scenario. A sudden and sharp turn in the outlook would require it to set aside even more funds to cover potential lending losses.

Other market economists are forecasting the cash rate will move only modestly higher from here, with most having baked in just one more hike before cuts begin from very late next year. The Reserve Bank too expects inflation to get back into its target 2-3 per cent band by 2025.

“We’ll continue to watch the economy very closely. But fortunately, we come into this year with a very strong position and will obviously be doing everything we can to support our customers,” Comyn says.

Suncorp surge

There was a lot more going on under the surface for insurer and regional bank Suncorp as it rocketed to an 86 per cent surge in full-year cash profit to $1.25bn. It was the revaluation of Suncorp’s vast insurance investment portfolio given the changing outlook for interest rates that drove the top line.

But Suncorp has been in the headlines for different reasons in recent days, with the insurer hungry to sell its banking arm to ANZ for $4.9bn. However, competition regulator the ACCC last Friday comprehensively rejected the deal, arguing it would be bad for banking competition in Australia. The ACCC would rather Suncorp pursue a sale with smaller lender Bendigo and Adelaide Bank – something which Suncorp boss Steve Johnston insists is not in the best interest of his shareholders. Suncorp plans to appeal the decision in the competition tribunal.

Speaking publicly for the first time about the knock-back, Johnston says almost three years of analysis was put to the competition regulator in its submission. And over this period the view of selling his bank to a small regional changed dramatically. That’s why he’s been pursing a cash sale with a big four bank.

“The analysis that we’ve done – which is informed by work that we’ve done on a more contemporary basis – and also the engagement that we’ve had with the Queensland government, puts me in a position to say that I don’t believe there’s a commercial likelihood of a regional merger being achieved,” Johnston tells The Australian.

He says his view is not only formed through the prism of shareholder accountability, but also as an executive who is legally accountable for the longer term performance of Suncorp’s bank.

“I’ve got to make decisions that are in the best interest of the bank,” Johnston says.

The Suncorp chief says he is disappointed with the ACCC decision, but says he went into the process knowing there was always the potential for ending up in an appeal.

“And so that’s where we are, and they will look at all the evidence with a fresh pair of eyes, and we will then be guided by the outcome.”

Suncorp’s full-year dividend jumped 50 per cent to 60 cents a share. Suncorp held back some of the dividend, which was at the very bottom of its targeted payout range, to keep the bank strong in the slowing environment. It also believes it is safer to sit on excess funds while it is going through the uncertainty of the appeals process. Johnston is still hopeful of a sale by mid-2024.

johnstone@theaustralian.com.au

Originally published as The real message CBA is sending about the Australian economy