Investors get the ‘good news two-fer’

In a sign of good news for investors, the SVB collapse has been effectively neutralised and a ‘Goldilocks’ US inflation number is pointing to a Fed rate pause next week.

Terry McCrann

Don't miss out on the headlines from Terry McCrann. Followed categories will be added to My News.

The – slightly modified – ‘Good News’ scenario has won out.

At least for now, unless and perhaps more certainly until another SVB or SBF 21st century-style woke and/or tech - or even a traditional financial - skeleton comes gambolling out of the closet.

I suggested at the start of the week, we faced two scenario extremes, from the intersection of the Silicon Valley Bank collapse Friday and the latest US inflation figures to surface near midnight Tuesday our time.

At one extreme a high inflation number could combine with the SVB disaster to create a week of numbing, highly volatile, uncertainty.

At the other, was a potential ‘Good News two-fer’: a low inflation number pointing to a rate pause from the Fed at its policy meeting next week combining with the SVB collapse being effectively neutralised.

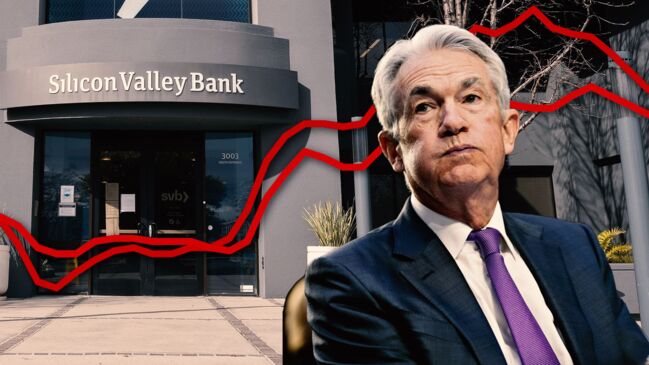

Well, it looks like the second part has been delivered by the Fed – plus the US treasury, headed by the current Fed chairman Jerome Powell’s predecessor Janet Yellen, and the bank deposit insurance entity – agreeing an immediate 100 per cent bail-out of all depositors.

That’s, of SVB, along with a smaller bank that was dragged into the financial sinkhole with and by it. Along with a clear signal that the trio would do the same for any other regional, so-called ‘non-systemically important’, bank.

Yes, this is an appalling exercise of ‘moral hazard’. Why say depositors in these banks are not insured above $250k in a collapse, when you will turn around and extend the guarantee to the bigger deposits anyway?

The depositors thereby get their cake – a higher interest rate on those supposedly ‘riskier’ deposits; and get to eat it as well, when the bank collapses and they get 100 per cent of their money back, paid for by a levy on all other bank depositors.

But that – not exactly minor point – aside, it ‘worked’.

It neutralised the SVB (and Signature) collapse; Wall St recovered the specific SBV-prompted losses of Friday.

Helped then in no small part by a ‘Goldilocks’ – not too-high, not quite low-enough – inflation number.

That’s to say, not a too-high number which would have left Powell no choice but to deliver the 50-pointer he had signalled pre-SBV. Especially, now having neutralised SBV.

But equally, not low enough, that he would have been able and indeed almost obliged to pause the rate hikes, whether or not SBV had been neutralised. But especially, obviously, if it hadn’t been.

So, it adds up to a 25-pointer.

Neutralising SVB means he could have done 50-points, if the inflation number had demanded it.

Equally, the inflation number would have allowed him to pause, if he hadn’t been able to cauterise any serious negative flow-ons from SVB.

So a neutralised SVB and the likelihood of a 25 pointer gives investors that ‘modified Good News’ scenario.

Wall St futures were trading up again Wednesday afternoon our time. If the actual session followed, Wall St would be back close to where it had been before Powell had started talking 50-pointers.

It does all leave the bigger issue lurking below the surface, utterly unresolved: the massive losses spread around the US and indeed the world financial system, on the $US30 trillion ($45tr) of US treasuries from the rise in rates.

Those losses which had formerly been ‘paper ones’ in the SVB balance sheet became all-too real when it had to sell some of its holdings.

If anyone else has to follow, they will end up in the same mess. And it’s not just US treasuries, but as much again in bonds of other countries.

As for our Reserve Bank and its next rate decision, the week has essentially been a wash. Governor Philip Lowe was heading for a pause and the SVB saga just adds cement.

Originally published as Investors get the ‘good news two-fer’