Tax tricks that rich people use, and how they can help you too

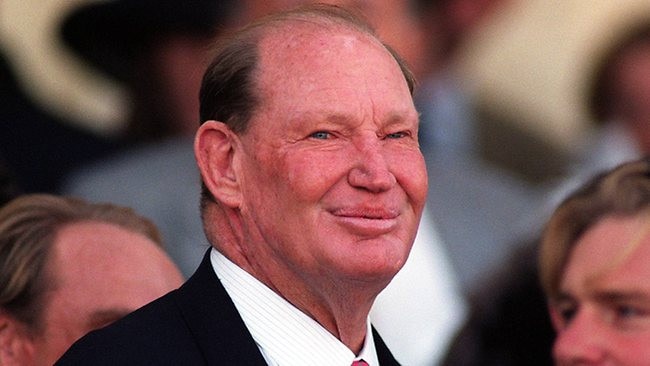

Late billionaire Kerry Packer famously spoke about minimising tax, and there are many strategies everyday Australians can use.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

While recently cleaning out a work storage cabinet full of 15 years of paperwork, piggy banks and other weird stuff, I rediscovered dozens of personal finance books.

Some of those books, such as Top Stocks 2014, were probably a little outdated, but others still pack a powerful money punch and were donated accordingly.

One of them is Tax Secrets of the Rich, by Kerry Packer’s Former Accountant. It was written by Allan Mason and published in 2022, then updated this year.

Given almost everyone wants to be rich, and that the late Kerry Packer spoke one of the most famous tax-related quotes in Australian history, I thought this book was worth a closer look.

The billionaire who was once Australia’s richest person told a parliamentary committee in 1991: “If anybody in this country doesn’t minimise their tax they want their head read”. Mr Packer added: “as a government I can tell you you’re not spending it that well that we should be paying extra”.

Mason’s book focuses heavily on business and investment strategies, and for good reason.

“To create wealth, you must be either and investor or be in business,” he writes.

Many sole traders and other small business owners can find big tax savings right under their nose. For example, Mason says a sole trader who earns $180,000 annually can potentially save $15,500 in tax – $300 a week – by switching to company structure.

“Just because you earn an income, it is not true that you will be taxed on it.”

That’s how rich people view tax, and Mason outlines the steps used to grow a $10 million asset portfolio over the long term.

He says people may argue that if it looks so easy, why doesn’t everybody do it? Lots do, he counters.

“They don’t brag and tell others, except their accountants (me) so I see it, I know.”

A key strategy is to keep growing your asset base by using the increased equity from existing assets and tax-deductible borrowed money: “the bigger the base, the larger the gains will be”.

“It doesn’t matter how much borrowing you have as long as the income covers the interest and repayments.”

Think big but don’t get talked into buying overpriced assets. “Don’t rush, but don’t sit on the fence either … timing and holding onto assets for a long period will always be your friend.”

Other tips that apply for millions of Australians include:

• Understanding your biggest tax haven – your own home, which is exempt from capital gains tax (CGT).

• Making the most of rental property tax concessions, including the 50 per cent CGT discount when you sell.

• Timing the sale of assets, as you only pay tax when you sell and a gain is realised.

• Understanding the rules around capital gains tax discounts, retirement exemptions and profits rolled into superannuation on the sale of a business.

• Using small business tax concessions such as asset write-offs, debt write-offs and prepayments.

• Making the most of superannuation’s zero tax rate when your nest egg switches to pension mode.

Importantly, do not try to cheat the Australian Taxation Office.

“You must keep on the right side of tax law,” Mason writes. The ATO’s data matching capabilities are improving every year and check your return against data from all financial institutions, government agencies, land titles offices, ride-sharing platforms, motor vehicle registries, cryptocurrency exchanges and much more.

Mason says lodge your tax return on time, because there are laws that limit how far back the ATO can go to amend it – typically two or four years.

More Coverage

Originally published as Tax tricks that rich people use, and how they can help you too