Who could be the next breakout antimony star?

A supply crunch has sent antimony prices soaring, presenting a generational opportunity for a host of prospective Aussie developers.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

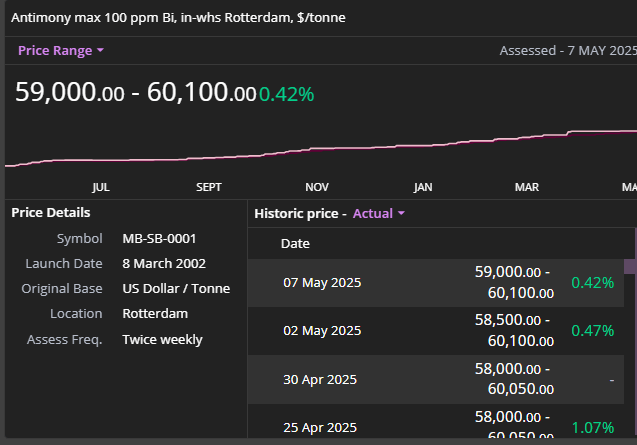

Antimony prices have surged from US$10,000 in 2023 to ~US$60,000 per tonne today

This is due to continued supply constraints exacerbated by China's export ban to the US last year

Here are a few companies that could benefit

Persistent supply constraints have pushed antimony prices to almost three times their 2023 levels, posing challenges for downstream users but opening the door for explorers whose projects may play a vital role in strengthening Western supply chains.

Prices have skyrocketed from US$10,000 in 2023 to ~US$60,000 per tonne today, with China’s export ban to the US last year fanning the flames and exacerbating the supply crunch further.

China controls the lion’s share of global refined antimony supply—and the US alone consumes around 60% of it, highlighting a critical strategic dependency.

After China, Russia and Tajikistan rank as the second and third largest antimony producers, accounting for more than 80% of global supply across the three major players.

Antimony spans many sectors, but its leading use is as antimony trioxide, primarily as a flame retardant in plastics, textiles, and other materials, which accounts for roughly half of total antimony demand.

It is also used in alloy production—particularly in combination with lead. Lead-antimony alloys are used in batteries low-friction metals, small arms, tracer bullets, cable sheathing, and other industrial products.

Fastmarkets' Jon Stibbs told Stockhead as a result of the ban, non-Chinese buyers have been forced to seek alternative suppliers of metal and trioxide from Tajikistan, Belgium, Southeast Asia and Bolivia, reconfiguring long-standing trade relationships and freight routes.

Adding to the squeeze is the fact that antimony deposits are both geologically rare and difficult to mine at scale, presenting growth opportunities for companies advancing exploration programs and working towards near-term production.

Australia’s next antimony producer?

One company doing exactly that is Larvotto Resources (ASX:LRV) who’s recent DFS for the Hillgrove antimony-gold project in NSW highlighted an impressive post-tax NPV of $694m using an 8% discount rate.

Among the compelling economics is a forecasted annual EBITDA of $251m and robust after-tax free cash flow of $128 million for 8.2 years.

Even better, the initial capital outlay is a lean $133m due to existing infrastructure like power, water, and a partially developed underground network, positioning Hillgrove as a low-risk, high-return opportunity with rapid value realisation.

With an ore reserve of 606,000oz grading 6g/t gold equivalent, and more than $150m worth of processing infrastructure in place, the company is targeting yearly output of 40,566oz of gold and 4878t of antimony.

The development timeline is also on the fast track with production forecast to start in 2026 as both gold and antimony prices ride high.

Set to lead Australia in antimony production, contributing as much as 7% to global supply, Hillgrove elevates Larvotto to the ranks of major international suppliers. But with LRV already rising to a market cap of $280m after taking the crown as 2024's top performing mining stock, we can’t help but wonder who is next.

Resolution Minerals' strong prospects

While it does not yet have a resource proved up to JORC standard, Resolution Minerals' (ASX:RML) Drake East project in NSW sits within a region well-endowed for both gold and the critical mineral antimony.

Prospect at the Hedley’s and Hensen Hills areas are believed to be part of a large antimony-gold mineral field which extends onto Legacy Minerals Holdings' (ASX:LGM) Drake project area, with early grades there showing up to 30% antimony and 85g/t gold.

Resolution’s own early sampling has returned peak values of 5.72% antimony, 60.9g/t gold and 214g/t silver from historic workings, and the company has also identified a concentration of placer gold mine workings covering around 135km2 in its Lanikai Alluvial prospect area.

The explorer says it has found close to 800 historical workings relating to both antimony and gold prospects thanks to the results of a recent LiDAR survey.

RML’s antimony exposure also extends to its Neardie project, which hosts three past producing mines and high-grade antimony mineralisation with peak values reaching as much 19.5% Sb.

In an interview with Stockhead, RML non-executive director Ari Zaetz said while the company is still in the early to mid-stages of exploration at Drake East, the company remains incredibly excited about the asset’s potential.

“The combination of historical data, high-grade potential, and market conditions makes Drake East a flagship opportunity for us,” he said.

“What excites the company most is the high-grade potential, evidenced by nearby Legacy Minerals’ rock chip samples bordering the project.

“This proximity to a known high-grade deposit suggests Drake East could be part of a larger, underexplored mineralised system,” Zaetz added.

From an antimony price perspective, he sees no reason why they wouldn’t continue rising in the short to medium term, if not longer.

“The importance of antimony in the modern world cannot be overstated,” he said.

“Antimony is probably the most important ‘war metal’ and is classed as a critical mineral with military significance.

“There is no replacement for it as an ingredient in manufacture of armor-piercing ammunition, artillery, military electronics such as night vision goggles, military-use batteries, flame retardants in military equipment, radar systems circuitry and so on."

As Zaetz is quick to point out, global geopolitics suggests military spending is on course to increase.

“Escalating war in Ukraine, Middle East, India & Pakistan, China-Taiwan tension, China-USA politics is now well into Cold War 2.0 territory, which is further exacerbated by the US-China trade war and highly concentrated supply," he said.

“Planets have all aligned so there is no way for prices to go but up, and this will continue given none of these issues have an easy, simple or short solution.”

Larvotto is not the only junior whose share price has been set alight by antimony success. It is a major component of Southern Cross Gold's (ASX:SX2) Sunday Creek discovery in Victoria, while Warriedar Resources (ASX:WA8) is up 57% over the past month after announcing what it called Australia's largest open pit antimony resource at its Ricciardo deposit in WA, clocking in at 12.2 Mt at 0.5% Sb for 60,300t of antimony.

Resolution and a number of other earlier stage antimony explorers could be on track to repeat those successes.

Nascent stage antimony explorers

Over at iTech Minerals' (ASX:ITM) Reynolds Range project in the NT, rock chip sampling results last year returned up to 22% antimony at the Sabre and Falchion prospects.

So far, the company’s work has been highly encouraging, revealing significant antimony mineralisation and a strong correlation with previously identified low sulphidation epithermal gold systems.

ITM has executed a contract with GAP Geophysics to start several induced polarisation and moving loop electromagnetic surveys over the high priority targets in May, with results to drive ongoing drill targeting and planning.

Koonenberry Gold (ASX:KNB) recently expanded its gold and antimony prospectivity with the acquisition of the Enmore project in northeastern NSW.

The project boasts historical soil sampling results of up to 91ppb gold and 663ppm antimony – the highest antimony results on the licenced area to date – as well as favourable geology and structural trends similar to that of Larvotto.

In January Sierra Nevada Gold (ASX:SNX) uncovered early evidence of antimony mineralisation at the Blackhawk epithermal project in Nevada after RC drilling returned a 4.88m intersection featuring 0.4% antimony from 87.78m.

Trigg Minerals (ASX:TMG) also has a bevy of antimony prospects across its New South Wales project portfolio with hundreds of historic gold and antimony workings to explore. Those include its flagship Wild Cattle Creek deposit, which contains a current 1.52Mt resource at 1.97% Sb.

There could be more to add to that as exploration progresses. Historical back sampling of shallow drilling from the Wild Cattle Creek dataroom revealed an average result of 4.83% antimony from areas omitted from Trigg's 2024 resource.

The assays were part of the previous resource estimate compiled by the historical owners, presenting an opportunity to improve the asset in terms of grade, scale, and overall confidence.

At Stockhead we tell it like it is. While Resolution Minerals, iTech Minerals, Koonenberry Gold, Sierra Nevada Gold and Trigg Minerals are Stockhead advertisers, they did not sponsor this article.

Originally published as Who could be the next breakout antimony star?