West Wits Mining secures ~US$50m loan facility to advance Qala Shallows gold project

The ZAR 902.5m (~US$50m) loan facility represents ~55% of the total funding West Wits Mining requires to advance development of its Qala Shallows gold project.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Special Report: West Wits Mining’s development of its Qala Shallows gold project in South Africa has taken a major step forward after signing a credit approved term sheet for a ZAR 902.5m (~US$50m) senior debt syndicated loan facility.

- West Wits signs term sheet for ZAR 902.5m (US$50m) loan facility that covers ~55% of project funding for Qala Shallows gold project

- Facility provided by leading institutions Industrial Development Corporation of South Africa and Absa Bank

- Examination continuing into range of options to procure the remaining funds required to progress development

The loan facility, which is subject to the conclusion and finalisation of definitive loan documentation and the fulfilment of conditions precedent, represents ~55% of all project funding for Qala Shallows, Phase 1 of the broader Witwatersrand Basin project.

Most of the facility (ZAR 465m) will be provided by the Industrial Development Corporation of South Africa with major South African bank Absa providing the remaining ZAR 437.5m.

West Wits Mining (ASX:WWI) plans to use equity and leverage early revenues to fund the remaining 45% of project costs.

Repayment of the facility will occur over 36 months from completion of the draw down phase, which will take ~24 months.

“Securing this facility will provide the majority of funding for this exciting project on non-dilutive, cost-effective bank loan terms,” chairman Michael Quinert said.

“It is satisfying to see we have earned the support of two of the region’s most respected lending institutions in Absa and the IDC.

“This facility provides the strongest foundation to now complete our funding requirements and move quickly to commence work on getting Qala Shallows into production.”

Attractive gold development

Under the company’s robust definitive feasibility study, Qala Shallows is expected to produce 924,000oz of gold over a 17-year mine life to deliver post-tax life-of-mine cashflow of US$522m at a conservative gold price of US$2200/oz, which is well below current prices that sit above the US$2900/oz mark.

This will deliver post-tax net present value and internal rate of return – both measures of the project’s profitability – of US$366m and 72% respectively.

Qala Shallows currently has an overall resource of 10.28Mt at 3.04g/t for just over 1Moz of contained gold. This includes an ore reserve of 351,400oz gold, or 35% of the mining inventory.

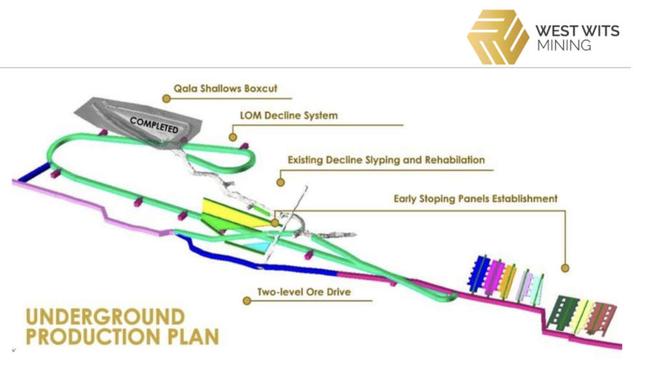

WWI will carry out underground drilling to convert resources to reserves as decline development progresses in order to maintain a minimum level of reserves.

The broader Witwatersrand Basin has a global resource of 5Moz at 4.66g/t gold that has a high level of resource confidence as 65% is contained within the indicated and measured categories.

The company is now working with IDC and Absa to quickly finalise legal documentation for execution and achieving financial close for the loan facility.

It is also continuing to examine a range of options to procure the balance of funds required to fully fund Qala Shallows.

This article was developed in collaboration with West Wits Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as West Wits Mining secures ~US$50m loan facility to advance Qala Shallows gold project