Resources Top 5: Core’s Finniss could reemerge as one of the world’s most cost competitive lithium mines

Core Lithium has laid out a $200 million plan to steer its Finniss project in the Northern Territory back to production if the market turns.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Core Lithium lays out low-cost path back to production for Finniss project in NT

Highfield sells the farm (supplies) to China

Nimy starts gallium drilling at Block 3 in WA

These are your standout small cap resources stocks for Wednesday, May 14, 2025.

Core Lithium (ASX:CXO)

Core's Finniss operation was the earliest casualty of the epic collapse in lithium prices across 2023, shutting up shop in early 2024 as the small scale NT lithium mine ran into heavy lossmaking territory.

That prompted a major rethink, return to exploration and change of management.

The fruits of that labour have now been floated for the market to see, with a new study suggesting a restarted mine would be among the most cost competitive spodumene operations globally.

Finniss, then focused around the Grants open pit, was running at a unit cost of $1953/t in its last quarter of full operations (December 2023).

The new study, focused on a 20-year underground mine at the BP33 deposit, would run at just $690-785/t FOB on an SC6 (6% Li2O concentrate) basis, with mining costs down 40% and processing costs 33% lower.

Concentrate production would also rise 7% to 205,000tpa SC6, with recoveries of 78% and pre-production capex chopped 29% from $282m to $175-200m.

Morgan Stanley has been appointed as Core's corporate advisor to lead its funding strategy "with a focus on minimising dilution for shareholders", suggesting debt funding will be a key pillar of the junior's strategy.

Any FID, of course, depends on market conditions and funding. Spodumene is currently priced around multi-year lows of US$700/t, according to Fastmarkets. Core's study assumes a long-term lithium price of US$1300/t to come to its free cash flow number of $1.2bn.

Nevertheless, Core CEO Paul Brown said the restart plan focused on Finniss' strengths after a 'rigorous, bottom-up review of every aspect of the operation.'

"The Study brings together our operating experience to deliver a plan that is more robust, more efficient and built for the long term," he said.

"At BP33, we are developing a large-scale underground mine. Grants will shift to underground mining, cutting costs and doubling its mine life. Carlton will use Grants’ surface infrastructure, supporting a 20 year mine life.

"Blackbeard offers further potential to extend mine life and expand operations. Our plant upgrades will improve recovery and reduce contaminants, whilst keeping capital costs low.

"These improvements include enhanced screening, with more affordable crushing and the addition of a gravity circuit. This resets Finniss as a more resilient operation to price volatility, and will be a reliable source of high-quality, coarse-grained spodumene concentrate.

"The Study outlines a lower-cost, longer-life, and scalable operating plan that generates free cash flow of $1.2 billion, representing a six-fold return on pre-production capital."

Core shares have tumbled 94% from their 2022 highs of $1.67, but hit a near four month high of 9.6c after the release of the restart study.

A major catalyst to upscale the project could come from Blackbeard, which has an exploration target of 7-10Mt at 1.5-1.7% Li2O, well above the reserve of 10.73Mt at 1.29% Li2O in terms of grade.

Argonaut's Hayden Bairstow has a 17c price target and spec buy rating on Core, saying the study came in stronger than expected.

"Unit costs were 25% lower than we had expected, and an impressive 40% lower than the previous study," he told clients in a note.

"The exploration target for Blackbeard highlights the potential to add a second material ore source, which could push the mine life beyond 20 years, sustaining production at the ~205ktpa (SC6) capacity rate, or underpin an expansion beyond the base case."

Highfield Resources (ASX:HFR)

While the idea of competing with China has become a PR gold mine for critical minerals stocks, Chinese capital is still a major bonus for a small cap if you can get it.

And Owen Hegarty-backed Highfield Resources is certainly in that camp, surging on Wednesday after coming out of a trading halt to reveal a raising that will pump US$300 million of fresh equity capital into the $70m capped firm from Qinghai Salt Lake.

Qinghai is a subsidiary of Chinese industrial giant China Minmetals, and has signed a non-binding letter of intent to deliver the raising conditional on the completion of Highfield's acquisition of the Southey potash project in Saskatchewan, Canada, from Yankuang Energy, the main shareholder of Aussie coal producer Yancoal.

Qinghai would wind up with controlling power over Highfield if the deal goes through. The firm, which owns the Muga potash project in Spain, has long been backed by Owen Hegarty's EMR Capital and connected shareholders.

Shenzhen-listed QSL currently produces some 5Mt of potash fertiliser and 40,000t of lithium carbonate, and is the largest producer of the agricultural product in China.

The deal follows the resignation just last week of Highfield's CEO and MD Ignacio Salazar. Meanwhile, EMR will provide €1.15 million in a standby loan facility to keep the lights on as it moves to complete the deals with Yankuang and now Qinghai.

“The support from EMR reflects its commitment to Highfield and the strategic value of the Muga Project. The Company is undergoing a natural evolution as it moves closer to securing the right partnership structure for development," HFR chair Paul Harris said.

Qinghai will have exclusive rights to conduct due diligence until June 30.

Carbine Resources (ASX:CRB)

Now to some real microcap stuff, as $2m Carbine Resources, priced cheaper than a Cottesloe condo, runs 50% on the news that it has a mining lease for its Muchea West Silica Sand project.

It's not total, the newly granted mining lease covers "a portion" of the 110Mt at 99.65% SiO2 resource at Muchea West.

The balance is on a granted exploration licence called E70/4905.

There's a further catch. Having a mining lease doesn't mean Carbine can go in and mine the high grade silica sands (used for glassmaking and more) from the site, located next to the Pinjar Rifle Range.

Mining remains subject to a host of statutory approvals and consents, including environmental approvals and consents relating to the Muchea Air Weapons Range.

"The Company has been working closely with key project stakeholders, including DEMIRS and the Department of Defence, for a considerable period to progress towards securing a mining lease and will look to build on these relationships through the next approvals phase," the company said in a statement on Wednesday.

"Further updates will be provided to shareholders in due course. In order to allow the grant of M70/1433, the Company withdrew its previous mining lease application M70/1422 and exploration licence application E70/6625 which encroached on M70/1433."

CRB also owns the Down South silica sand project over 58km2 of exploration licences 10km southeast of Bunbury, where it recently secured access agreements with three landowners, paving the way for on-ground exploration to begin.

Nimy Resources (ASX:NIM)

Nimy shares are on a run, climbing close to 15% for the second straight day after announcing the start of a second round of drilling at the Block 3 project, part of its broader Mons project ~370km northeast of Perth.

Block 3 is a potentially unique Western source of gallium. Typically produced as a by-product of alumina and zinc refining, Block 3's high grades and mineralogical characteristics mean it could shape up as a rare primary source of the metal, known for its performance-enhancing properties in semi-conductor chips, solar panels, EV and wind turbine motor magnets, LCDs and more.

The metal's supply chain is also ~98% controlled by China, placing strategic importance on discoveries outside of the Middle Kingdom.

Nimy already has a partnership with M2i Global, a group which could facilitate potential sales to the US Department of Defense should the project prove economic.

The next key step is to deliver a maiden resource estimate, a potential outcome from the current and next round of drilling. Block 3 boasts an exploration target of 9.6-14.3Mt at 39-78ppm gallium.

But mineralogical assessments by the CSIRO have shown the chloritic schist rocks believed to host the highest concentration of the metal could run 400-800ppm gallium.

“The commencement of this round of drilling at the Block 3 Gallium discovery is significant as we move forward in defining a world class JORC compliant high grade gallium deposit,” Nimy managing director Luke Hampson said.

“Concurrently, Curtin University are working on metallurgical testing following CSIRO identification of high grade 400-800 g/t gallium in chlorite.

“These exploration milestones move Nimy closer to meeting the need of gallium customers who have made initial enquiries as to our progress.”

Drilling is expected to take three weeks, with results due thereafter. NIM shares have lifted 50% YTD.

Resource Mining Corporation (ASX:RMI)

(Up on no news)

Asimwe Kabunga's RMI is another very small cap, though it's slightly larger today after an 80%+ run in its shares.

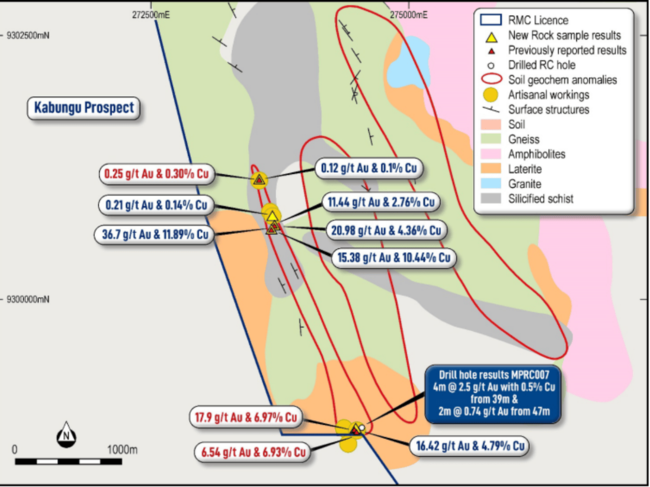

No news to speak of on market, but RMI did have some exploration updates from its Stalike and Kabungu prospects at the Mpanda copper, gold and nickel project in Tanzania to digest on Tuesday morn.

Previously announced results have included rock samples of up to 36.7g/t Au and 11.89% Cu from Kabungu and 13.58% Cu and 3.24g/t Au from Stalike.

RC drilling has also hit narrow gold intercepts in shallow locations at Kabungu.

Located close to the operation Katavi processing plant, RMI says ongoing sample analysis of auger drilling and soil samples will be combined with previous exploration results from Kabungu and Stalike to generate drilling targets.

“Ongoing exploration activities at our highly prospective Mpanda Copper-Gold Project have produced some spectacular high grade results and they are helping the Company define opportunities for exploitation of potential economic resources within our extensive tenement package," exec chair Asimwe Kabunga said on Tuesday.

"Our goal is to identify one or more significant Copper-Gold projects at Mpanda, and we have every confidence that we can achieve this. A targeted drilling programme is planned for the Stalike and Kabungu prospects following completion of this current soil and auger sample analysis work stream.

"Mpanda is clearly a richly endowed mineralised system. The extensive number of small scale operations demonstrate that systematic, modern exploration has the potential to define larger scale Copper-Gold systems.”

At Stockhead, we tell it like it is. While Nimy Resources is a Stockhead advertiser, it did not sponsor this article.

Originally published as Resources Top 5: Core’s Finniss could reemerge as one of the world’s most cost competitive lithium mines