Resources Top 5: Buxton plans drilling in quest to conquer Centurion IOCG project

Buxton Resources is reinforcing the quest to conquer the Centurion iron-oxide copper-gold project in Western Australia with planning in hand for its maiden drilling.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Plans are in hand for Buxton Resources’ maiden drilling at the Centurion IOCG project

Adriatic Metals is in the sights of TSX-listed precious metals giant Dundee Precious Metals

Broad high-grade copper hits continue to roll in for White Cliff Minerals at the Rae project in Canada

Your standout resources stocks for Wednesday, May 21, 2025

Buxton Resources (ASX:BUX)

Buxton Resources is taking steps to conquer the Centurion iron-oxide copper-gold project in Western Australia with planning in hand for its maiden drilling.

Investors have welcomed the initiative with shares 22.9% higher to 4.3c.

An important step on the path to drilling has been the awarding of contracts for earthworks and drilling services to JB Contracting and DDH1 Drilling respectively.

The program at Centurion in the underexplored West Arunta region will test a large-scale geophysical anomaly defined by coincident magnetic and gravity anomalies – a characteristic often associated with major IOCG systems like Olympic Dam and Carrapateena in South Australia.

An initial 1000m hole will test this anomaly with provisions for immediate follow-up ‘daughter’ holes to assess the gravity and magnetic features from the ‘parent’ hole.

This approach optimises the initial exploration phase and allows for rapid evaluation of the target.

Drilling costs will be partially offset by a Western Australia Government EIS co-funding grant of up to $220,000.

Earthworks are expected to start in June 2025 with drilling to start shortly after, subject to conducive weather.

JB Contracting and DDH1 Drilling have existing operations in the West Arunta region, offering additional cost benefits and operational synergies.

"The imminent maiden Centurion drilling program represents a significant step in unlocking the potential of this substantial IOCG target,” chief executive officer Marty Moloney said.

“We are therefore delighted to partner with highly reputable and experienced contractors, JB Contracting and DDH1 Drilling, for this pivotal campaign.

“Their established presence and operational experience in the West Arunta region provide cost efficiencies and the invaluable leverage of their local knowledge."

IOCG deposits are large, simple-to-process concentrations of copper, gold and other economic minerals.

They have the potential to be company makers thanks to their enormous sizes with Olympic Dam in South Australia being the third largest copper equivalent deposit and third largest gold deposit in the world.

Adriatic Metals (ASX:ADT)

The ASX’s largest pure play silver exposure, Adriatic Metals, was up big in early trade courtesy of news that TSX-listed precious metals giant Dundee Precious Metals wants to swallow up the emerging European miner via a takeover.

Banking sources told Sky News over in the UK the deal could clock in at £700 million, around $1.46bn Aussie, with its market cap now in the order of $956m.

Adriatic confirmed early stage talks this morning. It owns the Vares mine in Bosnia, expected to produce 12-13Moz of silver equivalent metal this year.

It’s delivered 2.2Moz AgEq this year, which includes licks of zinc, lead, copper and gold, up from 1.3Moz across full year 2024 when the mine was opened.

The deal could take another miner off the unloved London exchange, the focus of scrutiny from large investors who say capital and, by proxy, value is abandoning Paternoster Square.

But more broadly the promise of a cash deal from a major player is exciting market watchers.

There’s the premium implied for Adriatic shareholders themselves, clearly behind today’s ~24% rise, which would enable them to realise value for a project that fell prey to the ramp-up curse last year as ADT was forced into an equity raise and saw old boss Paul Cronin step aside for current MD and former BHP CTO Laura Tyler.

Then there are the broader implications, Lion Selection Group recently updated its mining clock to 5 O’Clock, a time when cash takeovers become common as cashed up producers feed on unloved juniors to fuel their growth when prices turn.

We’re not there yet, but 6 O’Clock is when bust starts to give way to boom.

It’s not the only bottom-of-the-cycle deal we’ve seen in recent times. Rio Tinto (ASX:RIO) paid $10bn cash for lithium producer Allkem in the summer and just announced a deal with Codelco to study its Maricunga lithium assets in Chile.

Xanadu Mines (ASX:XAM) is the subject of an agreed 8c per share cash offer from a consortium of Singapore-based Boroo (owner of the formerly Barrick stewarded Lagunas Norte gold mine in Peru) and Xanadu director Ganbayar Lkhagvasuren.

XAM owns the Kharmagtai copper project in Mongolia, with the $160m cash offer (at a 57% premium to XAM’s pre-bid price) a potential fishhook for long-time admirer Zijin to stump up and make it a competitive process.

White Cliff Minerals (ASX:WCN)

The broad high-grade copper hits continue to roll in for White Cliff Minerals at the Rae project in Nunavut, Canada, with the Danvers prospect delivering 90m at 4% copper from surface and shares reached 3.4c, a 9.7% increase on the previous close.

Within the 90m in Hole DAN25005 was 18m at 6.5% copper and 11.4g/t silver from 26m, a high-grade core zone of 1.52m at 19.45% Cu and 34.1g/t Ag from 30m, and a further 14m at 7.7% Cu and 16.2g/t Ag from 61m.

The hole was drilled towards the southeast and perpendicular to the strike of the copper-rich breccias, with the aim of testing the thickness of the mineralisation.

White Cliff Minerals (ASX:WCN) notes the latest assays confirm the continuation of high-grade mineralisation observed in hole DAN25003/004 to the southwest and DAN25001/002 to the northeast.

“Danvers continues to just get better and better with each assay we receive,” WCN managing director Troy Whittaker said.

“Not only are these high-grade results, once again, from surface but we have now dialled in on high-grade zones.”

Whittaker said the company was confident of a material maiden exploration target being delivered at Danvers following completion of the next round of drilling.

“We now know, as we had hoped, that Danvers has what appears to be an extensive high-grade core which should add tremendously to overall economics,” he explained.

“This hole, like Hole 8, carries huge significance. Hole 8 was designed to test the depth of mineralisation with the last metre ending in 4% copper and Hole 5 designed to test the width.

“These two holes alone confirm significant continuity and grade across a large copper-rich breccia vein that at a 3-4% average starts to put real substance into not just Danvers but all other vein hoisted breccias on our ground.”

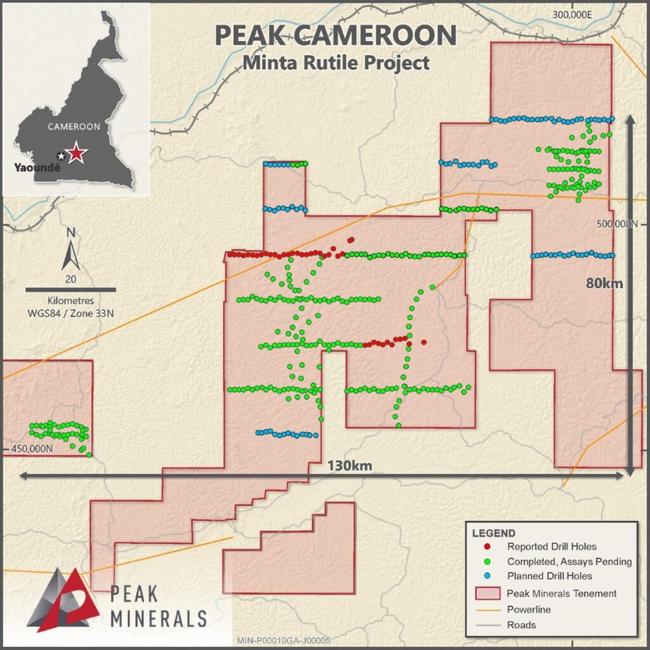

Peak Minerals (ASX:PUA)

A four-year high of 2.1c was reached by Peak Minerals, an increase of 31.3% on the previous close, after heavy minerals (HM) were intersected across a strike length of 28km at the Minta rutile project in Cameroon.

The results of up to 3.1m at 8.4% HM, 6.8m at 2.8%, 3.5m at 5.0% and 6.3m at 2.4% from an additional 29 holes of reconnaissance exploration auger drilling confirm the project’s significant scale.

All holes hit HM mineralisation from surface with an average depth of 3.9m and ending in mineralisation at auger refusal.

The initial intercepts are adjacent to the discovery hole of 4m at 1.57% HM which included 4m at 1.05% rutile.

“This second batch of results from the drilling program at the Minta Rutile Project in Cameroon continues to confirm the extensive scale and consistency of heavy mineral mineralisation across the project area,” Peak Minerals CEO Casper Adson said.

“These latest results, covering 29 holes adjacent to the discovery holes, 28km across strike and up to 35km from the first reported drilling result location, indicate significant heavy mineral intersections in every hole.

“With the Minta Project spanning over 7,000km2 and this initial drilling phase covering approximately 50% of the total project area, these findings underscore the substantial potential of this emerging rutile province.

“These results reinforce the scale of the Minta Project, underscoring its potential as a significant new source of rutile and potentially a globally significant rutile province, we look forward to reporting further results as they become available.”

Oceana Lithium (ASX:OCN)

Firm commitments have been received by Oceana Lithium for a placement to raise $667,000, before costs, with shares hitting a new 12-month high of 5.7c, a lift of 72.8%.

Strong bids were received for the placement at $0.023 per share, with support from new and existing institutional and sophisticated shareholders.

The price was a ~30% discount to the company’s last closing price of $0.033 and a ~21% discount to the 15-day VWAP.

OCN has welcomed a number of new Australian high net worth/family office investors to the register.

Proceeds will be used to progress the company’s projects in Australia and Brazil, for working capital and to identify and assess new complementary project opportunities.

Non-executive chairman Martin Helean agreed to participate for $10,800 in the placement on the same terms as other participants but subject to shareholder approval.

“Securing additional funds ensures Oceana is well placed to progress the company’s existing assets in Brazil and Australia, as well as continue to assess new project opportunities," Helean said.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions.

While White Cliff Minerals and Buxton Resources are Stockhead advertisers, they did not sponsor this article.

Originally published as Resources Top 5: Buxton plans drilling in quest to conquer Centurion IOCG project