Lunch Wrap: WiseTech drags down ASX as execs bail, stock tanks 24pc

The ASX has begun February’s final week in the red, while WiseTech has tanked after four execs quit the company.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX starts the week slow

WiseTech hit hard after four execs quit

US markets dive as Trump tariffs weigh heavy

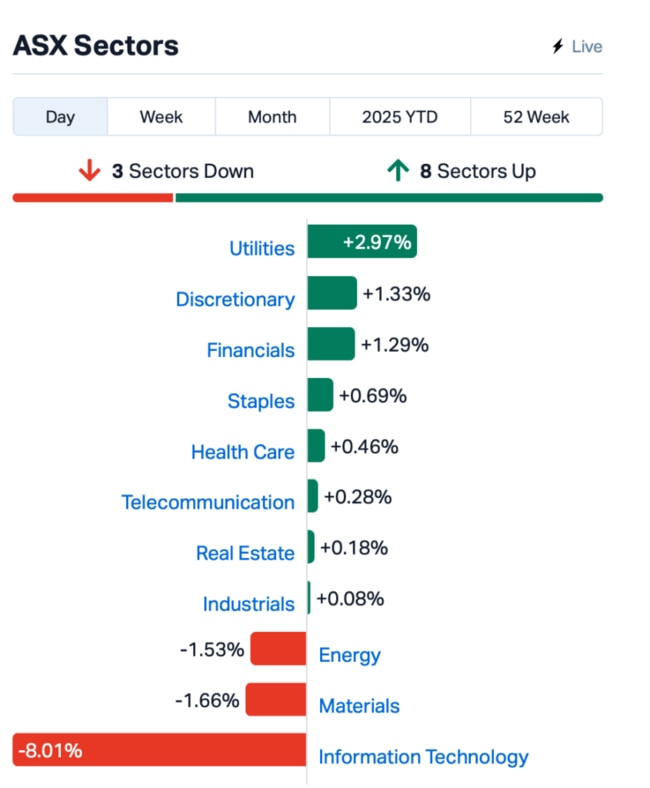

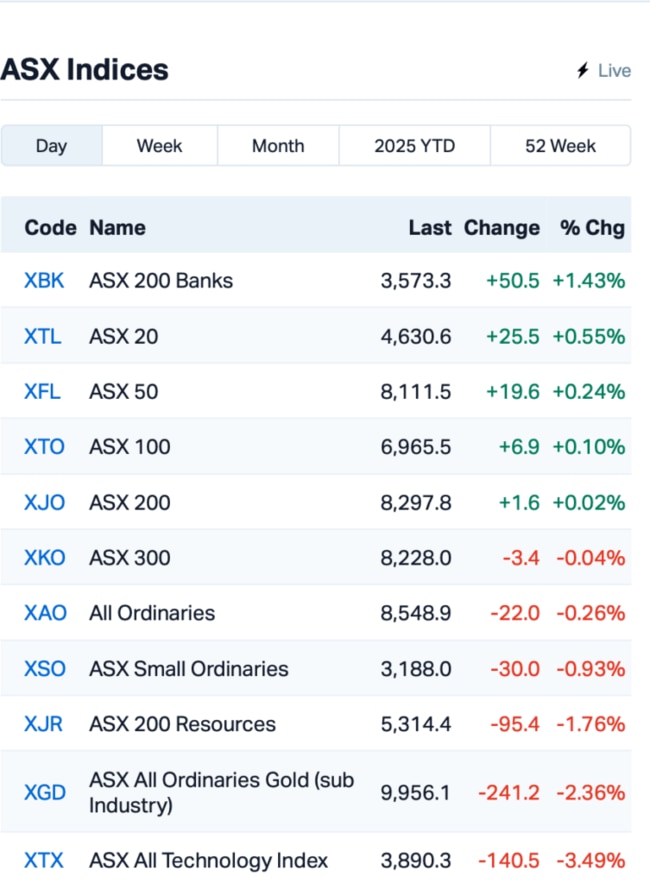

The ASX 200 index has bounced back from earlier losses this morning – where it was down by as much as 0.7% – and is now trading flat around lunchtime today.

But eight out of 11 sectors were still in the red, with a broad-based sell-off sweeping through the market.

On Friday in the US, things weren’t much better, with Wall Street closing sharply lower.

Both the Dow Jones and the S&P 500 dropped 1.7%, while Nasdaq tumbled more than 2%. Investors were feeling the heat from President Trump’s ongoing tariffs, and growing concerns about a slowing economy.

And to top it off, US consumer sentiment nosedived, falling to 64.7 in February from 71.7 in January.

But back home, on the ASX, the tech sector was smashed today, down by more than 8%, as WiseTech Global (ASX:WTC) took a battering.

The global logistics software giant just can’t catch a break as its shares plunged a staggering 24%, hitting a one-year low.

The sharp drop followed the resignation of the chairman and three independent directors.

Our understanding of what's unfolding is that the drama stems from deep disagreements within the board about former CEO Richard White’s future role with the company. Some board members had apparently disagreed on whether White should still be involved at all.

As you may recall, WiseTech announced a few months ago that White would transition to a full-time consulting role with the company after stepping down as CEO in October 2024.

In this capacity, his focus would be on product and business development, maintaining his annual salary of $1 million.

All this came amid an internal probe into White, who’s been hit with serious allegations of inappropriate behaviour from three women.

This is where things stood at around lunch time, AEDT:

WiseTech wasn’t the only large cap feeling the heat on Monday.

Perpetual (ASX:PPT) fell 4% after it pulled out of a deal with KKR. The private equity giant had been in talks to acquire Perpetual’s corporate trust and wealth units for $2.2 billion, but tax issues led to the deal being called off.

Ampol (ASX:ALD), the petrol supplier, also slipped 2% after posting a massive 68% drop in FY24’s full year net profit due to a loss at its oil refinery.

Stanmore Resources (ASX:SMR) raised its 2025 production guidance for its coal mine, but the company’s revenue took a hit, down 15% in 2024 due to a drop in coal prices. Shares surged 5%.

Meanwhile, Nickel Industries (ASX:NIC) swung to a loss in FY24 after it posted a loss of $189.8 million, a big drop from last year’s $176.2 million profit. Shares were down 2.5%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 24 :

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| CT1 | Constellation Tech | 0.002 | 100% | 264,713 | $1,474,734 |

| ECT | Env Clean Tech Ltd. | 0.004 | 33% | 651,932 | $9,515,431 |

| NES | Nelson Resources. | 0.004 | 33% | 25,000 | $6,515,783 |

| ARN | Aldoro Resources | 0.460 | 31% | 2,681,645 | $60,603,810 |

| CRR | Critical Resources | 0.005 | 25% | 116,862 | $9,856,885 |

| HCD | Hydrocarbon Dynamics | 0.003 | 25% | 829,629 | $2,156,219 |

| SLZ | Sultan Resources Ltd | 0.010 | 25% | 1,783,382 | $1,851,759 |

| ALM | Alma Metals Ltd | 0.006 | 20% | 280,000 | $7,931,727 |

| AUR | Auris Minerals Ltd | 0.006 | 20% | 181,977 | $2,383,130 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 150,014 | $12,497,745 |

| ROG | Red Sky Energy. | 0.006 | 20% | 1,004,000 | $27,111,136 |

| NRX | Noronex Limited | 0.019 | 19% | 26,175,100 | $7,994,998 |

| JGH | Jade Gas Holdings | 0.034 | 17% | 68,907 | $48,918,191 |

| VLS | Vita Life Sciences.. | 1.895 | 17% | 14,345 | $90,133,149 |

| RVT | Richmond Vanadium | 0.140 | 17% | 19,134 | $26,620,000 |

| BLU | Blue Energy Limited | 0.007 | 17% | 306,907 | $11,105,842 |

| IXR | Ionic Rare Earths | 0.007 | 17% | 4,409,529 | $31,430,570 |

| MEM | Memphasys Ltd | 0.007 | 17% | 292,857 | $10,626,089 |

| OSL | Oncosil Medical | 0.007 | 17% | 2,000 | $27,639,481 |

| RSH | Respiri Limited | 0.052 | 16% | 575,081 | $67,609,320 |

| FME | Future Metals NL | 0.015 | 15% | 66,666 | $7,475,526 |

| NHF | NIB Holdings Limited | 6.805 | 15% | 2,315,392 | $2,887,655,806 |

| C1X | Cosmosexploration | 0.120 | 14% | 1,958,310 | $10,863,993 |

| FRS | Forrestaniaresources | 0.017 | 13% | 855,105 | $3,936,817 |

| EVT | EVT Limited | 13.620 | 13% | 295,267 | $1,955,144,737 |

Noronex (ASX:NRX) said it has just hit a major copper-silver find at the Fiesta Project in Namibia, with a 500m step-out revealing solid mineralisation. Drilling results show strong intercepts, including 5m at 1.4% copper and 58g/t silver, and the mineralisation is still open, heading deeper. A diamond rig is coming in to keep testing this hot zone and see if the mineralisation keeps going. This step-out is a big win for Noronex, the company said, as it proves the potential of this system.

Vita Life Sciences (ASX:VLS)’ net assets grew by 21% to $52.3 million for the full year of FY24, with $28.6 million in cash, while operating cash flow before interest and tax hit $6.2 million. Revenue reached $79.5 million, up 8.3%, but there was a slight dip in EBITDA. VLS declared a fully franked 10 cent per share dividend, marking the 15th consecutive year of dividend payments.

Memphasys (ASX:MEM) has successfully completed the data lock for its pivotal Felix clinical trial, ensuring the accuracy and integrity of the data. The trial data is now ready for statistical analysis, with preliminary results set for release in March. The company is also preparing for a CE Mark submission in June, followed by planned market entry into Europe, Australia, and India.

Syrah Resources (ASX:SYR) has locked in a deal with Lucid, the electric car company, to supply natural graphite AAM from its Vidalia facility in the US. The three-year agreement starts in 2026, with Lucid and its battery suppliers set to buy around 7,000 tonnes of AAM. The price will float based on graphite market changes, and Syrah’s Vidalia facility is ramping up to produce up to 11,250 tonnes annually.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 24 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TX3 | Trinex Minerals Ltd | 0.001 | -33% | 9,092 | $2,817,978 |

| BYH | Bryah Resources Ltd | 0.003 | -25% | 23,044 | $2,507,203 |

| GMN | Gold Mountain Ltd | 0.002 | -25% | 3,022,454 | $9,158,446 |

| HLX | Helix Resources | 0.003 | -25% | 4,344,999 | $13,456,775 |

| OB1 | Orbminco Limited | 0.002 | -25% | 6 | $4,333,180 |

| VRC | Volt Resources Ltd | 0.003 | -25% | 176,951 | $18,117,573 |

| OZM | Ozaurum Resources | 0.084 | -24% | 10,336,496 | $21,722,456 |

| WTC | Wisetech Global Ltd | 93.280 | -23% | 2,344,040 | $40,704,950,320 |

| CDT | Castle Minerals | 0.002 | -20% | 88,465 | $4,742,035 |

| CMO | Cosmometalslimited | 0.021 | -19% | 37,500 | $3,405,815 |

| BDG | Black Dragon Gold | 0.042 | -18% | 1,822,842 | $15,489,519 |

| IRE | IRESS Limited | 7.410 | -17% | 1,395,748 | $1,677,369,477 |

| ADG | Adelong Gold Limited | 0.005 | -17% | 1,026,114 | $8,384,917 |

| ASR | Asra Minerals Ltd | 0.003 | -17% | 1,741,872 | $6,937,890 |

| EPM | Eclipse Metals | 0.005 | -17% | 111,215 | $17,158,914 |

| EVR | Ev Resources Ltd | 0.005 | -17% | 6,042,882 | $11,595,020 |

| RFA | Rare Foods Australia | 0.016 | -16% | 60,182 | $5,167,682 |

| PRN | Perenti Limited | 1.163 | -16% | 4,193,955 | $1,289,421,351 |

| BNL | Blue Star Helium Ltd | 0.006 | -14% | 3,877,809 | $18,864,197 |

| SRN | Surefire Rescs NL | 0.003 | -14% | 16,666 | $8,457,077 |

| TYX | Tyranna Res Ltd | 0.006 | -14% | 461,926 | $23,015,477 |

| REH | Reece Limited | 19.030 | -13% | 619,439 | $14,179,352,773 |

| POD | Podium Minerals | 0.033 | -13% | 1,081,042 | $25,893,603 |

| CHM | Chimeric Therapeutic | 0.007 | -13% | 2,124,287 | $12,761,199 |

Kogan (ASX:KGN) fell despite a strong half-year result, posting solid growth across the board for 1HFY25. Group gross sales hit $492.5 million, up 10.3%, while revenue reached $272.7 million, up 9.9%.

The company’s gross margin jumped 2.8 percentage points, and the company said it was in a healthy cash position with $67.7 million in the bank and no debt.

Kogan declared a 7 cent interim dividend.

IN CASE YOU MISSED IT

New World Resources (ASX:NWC) has appointed highly experienced US-based mining executive Gil Clausen as a non-executive director. Clausen brings a strong track record in project development, having previously served as President and CEO of Copper Mountain Mining Corporation, Brio Gold Inc., and Augusta Resource Corporation.

Green Critical Minerals (ASX:GCM) has appointed Chris Whiteley as head of sales and marketing to support customer engagement and revenue growth as it advances the commercialisation of its VHD Graphite technology. Whiteley brings 28 years of experience in technical sales and business development across the graphite and carbon sectors.

At Stockhead, we tell it like it is. While New World Resources and Green Critical Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: WiseTech drags down ASX as execs bail, stock tanks 24pc