Lunch Wrap: ASX left scrambling again after Trump’s new threats; NAB misses earnings

The ASX has dipped on Trump’s tariff threat, while NAB’s earnings miss sent its stock tumbling.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX dips on Trump tariff threat, markets stay uneasy

NAB misses earnings, stock tanks

Santos profits fall, Vicinity shines

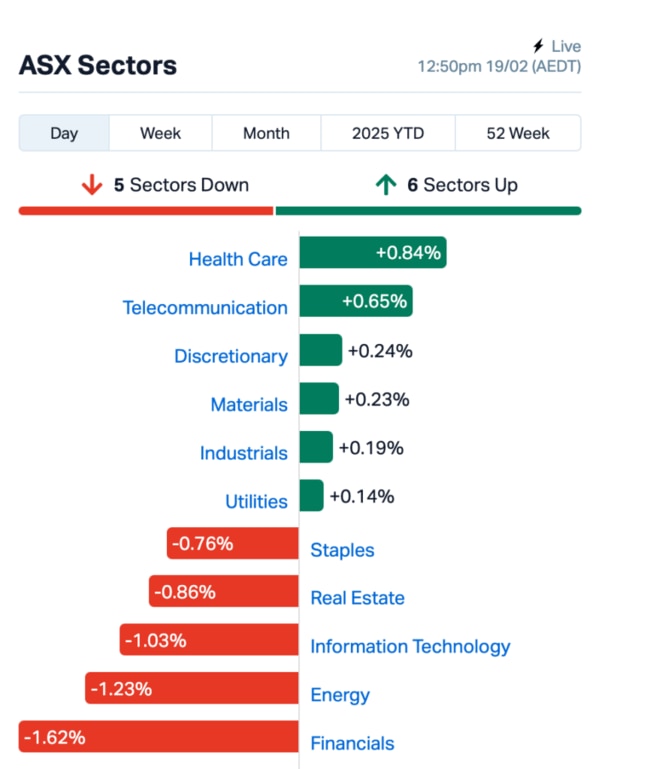

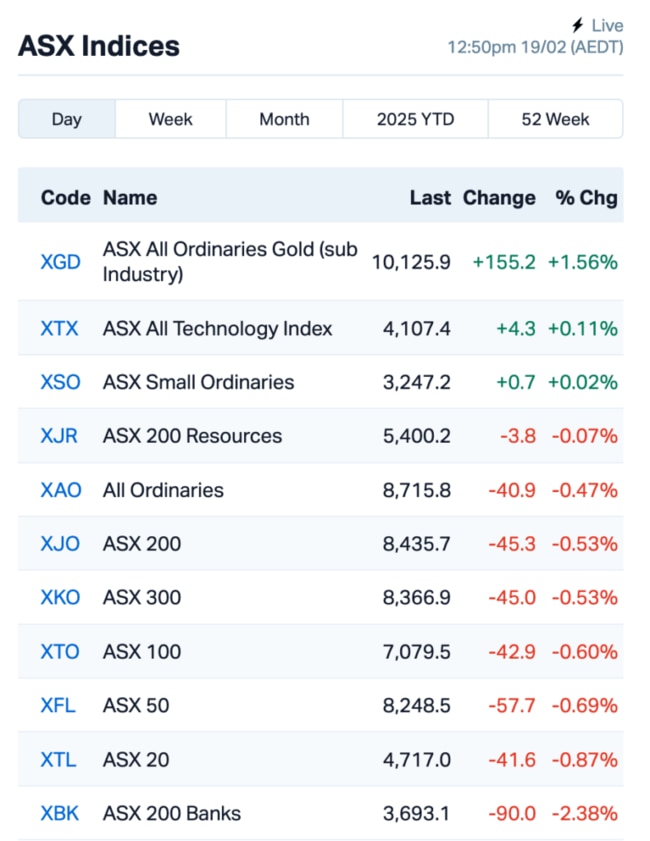

The ASX didn’t look too pretty on Wednesday as the market dipped by about 1% right after the bell rang, before paring losses to about 0.59% at lunch time.

Markets are feeling a bit uneasy as President Trump threatened new 25% tariffs on car, semiconductor and pharmaceutical imports to the US.

"It’ll be 25% and higher, and it’ll go very substantially higher over a course of a year,” Trump said.

Some experts reckon this might just be a bit of tough talk for negotiating purposes, but who knows?

Wall Street seemed to shrug it off. Both the S&P 500 and the Nasdaq 100 rose by 0.2% last night.

The gauge of US chipmakers also climbed 1.7%, boosted by Intel's 16% surge.

The spike followed rumours Intel might be split up, with Taiwan Semiconductor (TSMC) possibly taking over Intel’s US factories and Broadcom eyeing its chip-design business.

Elsewhere, oil prices managed to snap a three-day losing streak, bouncing back to about US$72 a barrel after OPEC+ hinted it might hold off on supply increases in April.

Gold is also holding strong at US$2,932 an ounce, just a smidge off its record high with the safe haven trade still firmly intact.

Now back to Aussie shores, because there’s plenty of action here, too.

National Australia Bank's (ASX:NAB) earnings miss set the tone for a rough morning session.

NAB's stock tanked 6% after its quarterly results. While revenue was up 3%, expenses climbed 2%, and cash earnings dropped 2%. Higher funding costs, competition, and credit impairment charges all weighed on profits, the bank said.

The negativity spread to other banks, too, with Commonwealth Bank (ASX:CBA) and Australia and New Zealand Banking Group (ASX:ANZ) taking a hit.

Still in large caps, oil and gas giant Santos (ASX:STO) saw a 14% drop in its full-year profit due to weaker prices for oil and gas, though it reassured the market that key production projects were still on track. Shares fell 2.7%.

The The Lottery Corporation (ASX:TLC)’s earnings took a hit due to lower jackpot volumes, though it still managed to hold its dividend steady. TLC's shares jumped almost 4%.

Property stock Vicinity Centres (ASX:VCX) posted a big jump in profits of 120%, thanks to higher valuations of its shopping centres, which got a nice bump after divesting a chunk of its malls. Shares climbed 1.3%.

And property goliath Goodman Group (ASX:GMG) has hit strong results for 1H25, with operating profit up 8% to $1.22 billion. GMG is also raising $4 billion through a placement to grow its data centre portfolio.

Oh, and news just in from our man in Freo today, Josh Chiat, who reports that Mineral Resources (ASX:MIN) "has again dumped its dividend as bloodcurdling lithium prices sent its half-year performance deep into the red, while guidance for its new Onslow Iron project has also been reduced for FY25 due to wet weather in the Pilbara.

"Shares tumbled by close to 12% in response, hitting levels not seen since November 2020."

Read more on this here.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 19 :

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| NRZ | Neurizer Ltd | 0.002 | 100% | 1,449,988 | $3,224,671 |

| VML | Vital Metals Limited | 0.002 | 100% | 8,814,342 | $5,895,067 |

| PFT | Pure Foods Tas Ltd | 0.032 | 45% | 492,567 | $2,979,364 |

| CSS | Clean Seas Ltd | 0.130 | 41% | 734,257 | $18,520,822 |

| ASR | Asra Minerals Ltd | 0.003 | 25% | 100,000 | $4,625,260 |

| WC1 | West Cobar Metals | 0.020 | 25% | 298,198 | $2,814,599 |

| EXL | Elixinol Wellness | 0.036 | 24% | 12,622 | $6,403,784 |

| RGT | Argent Biopharma Ltd | 0.170 | 21% | 59,656 | $8,298,118 |

| PEC | Perpetual Res Ltd | 0.018 | 20% | 6,303,851 | $12,395,218 |

| EPM | Eclipse Metals | 0.006 | 20% | 930,667 | $14,299,095 |

| ROG | Red Sky Energy. | 0.006 | 20% | 166,000 | $27,111,136 |

| NGI | Navigator Global Ltd | 1.950 | 19% | 1,463,285 | $806,180,659 |

| LMG | Latrobe Magnesium | 0.020 | 18% | 1,074,521 | $39,925,135 |

| C1X | Cosmosexploration | 0.100 | 18% | 1,076,672 | $8,794,661 |

| ION | Iondrive Limited | 0.027 | 17% | 3,423,891 | $20,503,654 |

| FTZ | Fertoz Ltd | 0.035 | 17% | 116,275 | $8,893,816 |

| BCB | Bowen Coal Limited | 0.007 | 17% | 3,905,788 | $64,653,841 |

| KGD | Kula Gold Limited | 0.007 | 17% | 272,000 | $4,257,922 |

| WGR | Westerngoldresources | 0.074 | 16% | 2,683,746 | $12,134,723 |

| NNL | Nordicresourcesltd | 0.070 | 15% | 36,893 | $8,990,415 |

| RFG | Retail Food Group | 2.110 | 15% | 367,215 | $114,642,652 |

| ADN | Andromeda Metals Ltd | 0.008 | 14% | 24,750 | $24,001,094 |

| SLZ | Sultan Resources Ltd | 0.008 | 14% | 230,000 | $1,620,289 |

| TM1 | Terra Metals Limited | 0.032 | 14% | 276,250 | $11,413,782 |

| GSN | Great Southern | 0.024 | 14% | 1,407,104 | $20,744,261 |

Clean Seas Seafood (ASX:CSS) revealed that it has received a non-binding proposal from Yumbah Aquaculture to merge by acquiring 100% of Clean Seas’ shares. Yumbah is offering $0.14 per share in cash, or a scrip alternative, which would allow Clean Seas shareholders to maintain exposure to the combined business. The offer is a 52.2% premium on Clean Seas’ current share price.

West Cobar Metals (ASX:WC1) said it has had success with leaching tests at its Bulla Park copper-antimony-silver project in NSW. After strong flotation results with up to 94% copper, 90% antimony, and 88% silver recovery, a leach test was done to extract antimony. The first test recovered 75% of the antimony, showing it can be separated from the copper and silver. This is a big step in optimising the process, it said, and further tests are now underway.

Perpetual Resources (ASX:PEC) has secured a landholding in Brazil's "Lithium Valley", just 3km from its existing Isabella lithium project. The new licenses expand its land by 3x and feature highly prospective ground with rock assays up to 7.6% Li2O. The project includes spodumene-rich pegmatites and numerous targets ready for drilling, with plans for a maiden drill program in mid-2025.

Iondrive (ASX:ION)'s Deep Eutectic Solvent (DES) battery recycling process has passed a big milestone, with independent economic modelling confirming its strong financial potential. The project shows a post-tax NPV of $249m and an IRR of 17.4%. The DES process is designed to process 21,000 tonnes of raw black mass annually, producing high-value battery minerals.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 19 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.001 | -50% | 465,264 | $8,219,762 |

| ADD | Adavale Resource Ltd | 0.002 | -33% | 2,061,682 | $6,819,838 |

| HLX | Helix Resources | 0.003 | -25% | 18,052,998 | $13,456,775 |

| SIT | Site Group Int Ltd | 0.002 | -25% | 199,999 | $6,514,980 |

| STP | Step One Limited | 1.100 | -23% | 1,888,800 | $264,109,915 |

| M2R | Miramar | 0.004 | -22% | 2,737,496 | $1,785,705 |

| MNC | Merino and Co | 0.135 | -21% | 115,808 | $9,023,017 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 5,485,362 | $15,392,639 |

| AU1 | The Agency Group Aus | 0.018 | -18% | 158,804 | $9,670,685 |

| PPG | Pro-Pac Packaging | 0.018 | -18% | 461,119 | $3,997,130 |

| PSL | Paterson Resources | 0.009 | -18% | 830,523 | $5,016,417 |

| AKN | Auking Mining Ltd | 0.005 | -17% | 435,638 | $3,448,673 |

| BNL | Blue Star Helium Ltd | 0.005 | -17% | 37,729 | $16,169,312 |

| CDT | Castle Minerals | 0.003 | -17% | 8,500,000 | $5,690,442 |

| ERA | Energy Resources | 0.003 | -17% | 1,730,756 | $1,216,188,722 |

| TYX | Tyranna Res Ltd | 0.005 | -17% | 404,225 | $19,727,552 |

| TGH | Terragen | 0.032 | -16% | 5,777 | $19,190,653 |

| AKM | Aspire Mining Ltd | 0.210 | -14% | 1,535,398 | $124,371,061 |

| IPB | IPB Petroleum Ltd | 0.006 | -14% | 87,484 | $4,944,821 |

| PVW | PVW Res Ltd | 0.012 | -14% | 236,476 | $2,784,667 |

| RNX | Renegade Exploration | 0.006 | -14% | 8,349,177 | $8,988,024 |

| SRN | Surefire Rescs NL | 0.003 | -14% | 180,191 | $8,457,077 |

| FGR | First Graphene Ltd | 0.055 | -14% | 328,492 | $44,799,328 |

| MEG | Megado Minerals Ltd | 0.013 | -13% | 117,901 | $6,295,249 |

IN CASE YOU MISSED IT

Vertex Minerals (ASX:VTX)has completed the commissioning of the ore sorting module at the Reward gold mine ahead of schedule, with gravity plant commissioning still ongoing. The sorter has significantly improved ore quality, and the company is addressing fine material buildup while preparing to commence underground mining.

At Stockhead, we tell it like it is. While Vertex Minerals is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX left scrambling again after Trump’s new threats; NAB misses earnings