Lithium Universe enters final investment decision for Bécancour lithium refinery

Lithium Universe has made a final investment decision for its Bécancour lithium refinery in Quebec.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Lithium Universe makes FID for Bécancour refinery

The company believes the project highlights favourable economics

Discussions with banks and debt providers are taking place

Special Report: With a counter-cyclical strategy focused on developing projects during market downturns, Lithium Universe has revealed the results of its DFS for the Bécancour lithium carbonate refinery in Quebec, Canada.

Following the release of a pre-feasibility study in October last year, the definitive feasibility study reflects a cautious price forecast of US$1,170 per tonne (AUD$1,840) for spodumene concentrate and $20,970/t for battery-grade lithium carbonate equivalent.

At full production capacity, the project is expected to generate $383m in annual revenue with costs totalling ~$236m leading to an annual EBITDA of ~$148m and a gross margin of 39%.

The capital cost for the project, which boasts an annual capacity of up to 18,270t, is estimated at $549m and has risen by 11% driven by the inclusion of a zero liquid discharge system to enable the recycling and reuse of all process water on site.

A full-rate payback period of 3.9 years has also been estimated along with a post-tax NPV at an 8% discount of US$449m (AUD$706.9m), IRR of 21% and expected revenue of $383m.

Lithium Universe (ASX:LU7) said the project’s economics demonstrate the viability of a strong lithium conversion refinery, even within a below-average pricing environment that has seen a nearly 86% plunge in prices for the battery metal over the past two years from its peak in 2022.

Ongoing funding discussions

LU7 chairman Iggy Tan said the project is now proceeding to the funding stage with encouraging discussions taking place with various banks and debt providers.

“An equity and debt adviser will be engaged to lead the funding outreach program, aimed at securing strategic partners at the project level to support project financing,” he said.

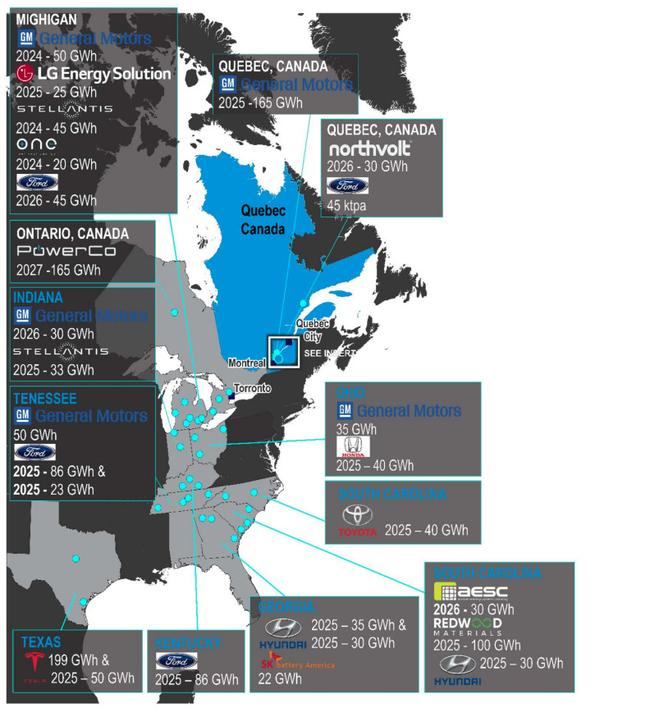

“The company will continue discussions with interested OEMs with spodumene offtake supply seeking conversion outside of China.

“We are confident that the Bécancour lithium refinery will emerge as a leader in producing green, battery-grade lithium carbonate,” he added.

Lithium price correction

Although lithium prices have experienced significant fluctuations due to the expanding EV market and increased demand for energy storage over the past four years, Tan believes the market is currently going through a rebalancing phase.

He sees lithium prices correcting faster than expected due to supply side pressures.

“This is driven by oversupply and strategic production curtailments by major producers who have either reduced output or temporarily halted operations,” he said.

“More recently, CATL’s Yichun mine and Arcadium’s Mt Cattlin operation have scaled back production and the Tianqi Kwinana lithium hydroxide plant has been placed under care and maintenance.

“These strategic adjustments highlight the industry’s efforts to balance supply with demand dynamics, potentially paving the way for a healthier market recovery in the future.”

This article was developed in collaboration with Lithium Universe, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lithium Universe enters final investment decision for Bécancour lithium refinery