Closing Bell: ASX shakes off morning malaise; Xero jumps on profit and revenue gains

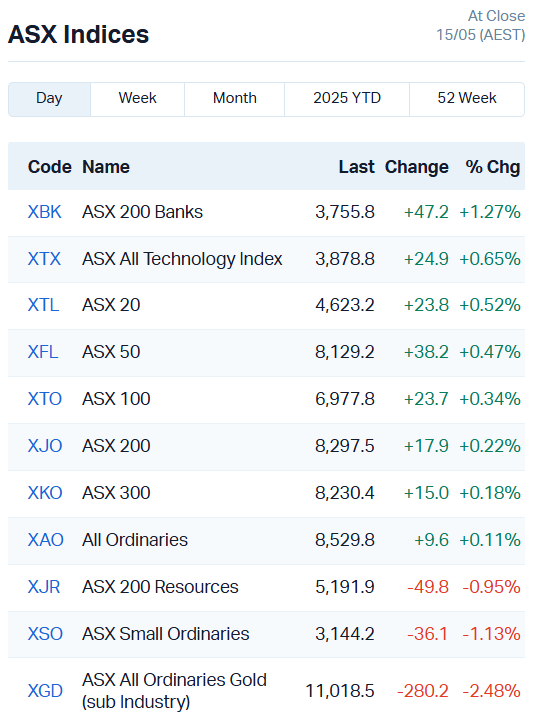

The ASX recovered from an early morning dip, lifted by strong movements in tech and banking stocks to rise 0.22pc.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX posts 0.22pc gains, recovering from dip earlier in the day

Xero brings big profit and revenue gains in quarterly report, lifting stock 4.7pc

Insurance Australia surges 5.7pc on Royal Automobile Club of Western Australia deal

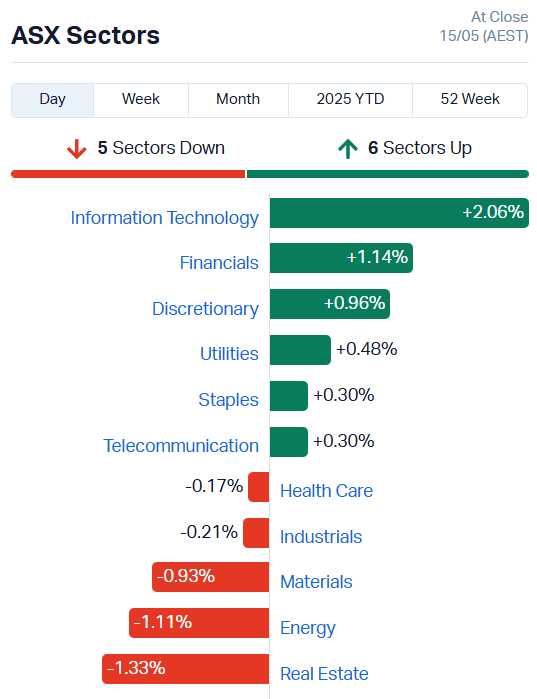

It was looking like a day for the bears in the first hour of trading today, but the ASX has once again shown its resilience, climbing back into the green to add 0.22%.

That marks the Aussie market’s seventh day of gains, and the second time we’ve hit that seven-day mark in the space of about three weeks.

While we’re still sitting 3.69% off our 52-week average, the ASX has been trucking along, adding 1.29% over the past five trading days.

In a now familiar story, it was our tech stocks that provided much of those gains, although the Discretionary and Financials sector also made some solid progress.

Xero brings the dosh

Xero (ASX:XRO) is the hero of today’s story, finishing the day up 4.71% after hitting it out of the park with its latest quarterly report.

The accounting software company is a household name, used by large and small businesses alike.

Although the stock missed its net profit after tax target, Xero achieved double-digit jumps to its full-year revenue and profit, raking in NZ$227.82 million ($209.10 million in AUD).

Net profit was up 30%, revenue jumped 23% and overall earnings lifted 28%, delighting investors.

The banks also had an upbeat day, adding more than 1.2% to the ASX 200 Banks index.

Commonwealth (ASX:CBA), Westpac, (ASX:WBC), NAB (ASX:NAB), ANZ (ASX:ANZ) and Macquarie (ASX:MGQ) posted gains of between 0.83% and 1.65%, while Insurance Australia (ASX:IAG)outperformed with a 5.7% surge.

IAG announced a strategic alliance with the Royal Automobile Club of Western Australia today, locking-in its purchase of the RAC Insurance business and a 20-year exclusive distribution agreement for RAC branded insurance products.

Insurance Australia will gain direct access to RAC’s 1.3 million members, and better footing in the WA insurance market to boot.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PEK | Peak Rare Earths Ltd | 0.325 | 171% | 10721125 | $42,253,993 |

| CHM | Chimeric Therapeutic | 0.008 | 60% | 1.02E+08 | $9,253,431 |

| EDE | Eden Inv Ltd | 0.0015 | 50% | 151332 | $4,109,881 |

| AJL | AJ Lucas Group | 0.008 | 33% | 3724695 | $8,254,378 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 2250489 | $7,254,899 |

| ATX | Amplia Therapeutics | 0.07 | 27% | 56028459 | $21,337,397 |

| EDU | EDU Holdings Limited | 0.165 | 27% | 17701847 | $19,571,943 |

| HCF | Hghighconviction | 0.033 | 27% | 160676 | $504,568 |

| MSI | Multistack Internat. | 0.005 | 25% | 65445 | $545,216 |

| SHP | South Harz Potash | 0.005 | 25% | 2694073 | $4,410,915 |

| TEM | Tempest Minerals | 0.005 | 25% | 194123 | $2,938,119 |

| 8CO | 8Common Limited | 0.017 | 21% | 4661234 | $3,137,329 |

| LOC | Locatetechnologies | 0.06 | 20% | 20326 | $10,059,692 |

| EPM | Eclipse Metals | 0.006 | 20% | 6783059 | $14,329,095 |

| IPT | Impact Minerals | 0.006 | 20% | 880965 | $19,247,483 |

| MBK | Metal Bank Ltd | 0.012 | 20% | 152455 | $4,974,590 |

| MEM | Memphasys Ltd | 0.006 | 20% | 3406116 | $9,917,991 |

| SKK | Stakk Limited | 0.006 | 20% | 158653 | $10,375,398 |

| FRM | Farm Pride Foods | 0.285 | 19% | 42911 | $55,389,901 |

| FZR | Fitzroy River Corp | 0.16 | 19% | 145 | $14,574,364 |

| LMG | Latrobe Magnesium | 0.013 | 18% | 3320460 | $28,870,710 |

| PCL | Pancontinental Energ | 0.013 | 18% | 2887886 | $89,502,444 |

| RMI | Resource Mining Corp | 0.013 | 18% | 15526735 | $7,319,463 |

| BCA | Black Canyon Limited | 0.059 | 18% | 12500 | $6,482,535 |

| E79 | E79Goldmineslimited | 0.027 | 17% | 539768 | $3,643,491 |

Making news…

Peak Rare Earths (ASX:PEK) came flying out of a trading halt, jumping by over 150% after locking in a takeover deal with its biggest backer, Chinese rare earths giant Shenghe.

Through its arm Chenguang, Shenghe’s offering around $150.5 million, plus the proceeds of a $7.5 million cap raise, to buy out the rest of Peak it doesn’t already own.

That values Peak at roughly 36 cents a share, a massive 199% premium to where it last traded. For investors, it’s a big payday if the deal lands, but there are still a few hoops to clear.

Amplia (ASX:ATX) announced a key milestone in its pancreatic cancer trial, with 15 confirmed tumour responses now locked in, enough to show its drug, narmafotinib, works better when paired with chemo than chemo alone.

The trial is testing the company’s narmafotinib combined with standard treatments gemcitabine and Abraxane. Top-line results are due mid-Q3.

Read more on this from Tim Boreham: Amplia shares surge on pancreatic cancer trial results; Immutep offers hope

Staying on the biotech theme, Chimeric Therapeutics (ASX:CHM) has also made very promising clinical progress with its ADVENT-AML trial, achieving complete responses (remission) in two of three patients with Acute Myeloid Leukemia.

The third patient also stabilised, meaning their disease hadn’t decreased or increased in severity during the treatment period.

Importantly, the trial observed no safety concerns.

“This is great news for newly diagnosed AML patients who may benefit from our CORE-NK cells as their initial AML therapy,” said Dr Rebecca McQualter, CEO of Chimeric Therapeutics.

“We are excited to be pioneers in the cell therapy sector, with the first frontline cell therapy study in AML lead by MD Anderson Cancer Center.”

E79 Gold Mines (ASX:E79) is set to drill new gold targets at the Laverton South gold project in WA. The company drummed up the new targets after reviewing its data sets for the project, identifying several areas of interest close to known gold deposits.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LNR | Lanthanein Resources | 0.001 | -50% | 62793668 | $4,887,272 |

| EAT | Entertainment | 0.004 | -33% | 78006 | $7,852,716 |

| ERA | Energy Resources | 0.001 | -33% | 17999965 | $608,094,361 |

| NES | Nelson Resources. | 0.002 | -33% | 7840 | $6,515,783 |

| T3D | 333D Limited | 0.005 | -29% | 114519 | $1,233,284 |

| ZMM | Zimi Ltd | 0.008 | -27% | 51646 | $4,702,982 |

| EEL | Enrg Elements Ltd | 0.0015 | -25% | 1252678 | $6,507,557 |

| JAY | Jayride Group | 0.0015 | -25% | 6009801 | $2,855,778 |

| MRQ | Mrg Metals Limited | 0.003 | -25% | 32780 | $10,906,075 |

| OSL | Oncosil Medical | 0.003 | -25% | 997500 | $18,426,329 |

| ECS | ECS Botanics Holding | 0.009 | -25% | 11054322 | $15,552,595 |

| RMY | RMA Global | 0.026 | -21% | 2189843 | $21,922,944 |

| HTA | Hutchison | 0.02 | -20% | 658233 | $339,312,714 |

| DTM | Dart Mining NL | 0.004 | -20% | 1812126 | $5,990,278 |

| QXR | Qx Resources Limited | 0.004 | -20% | 45496 | $6,551,644 |

| RDN | Raiden Resources Ltd | 0.004 | -20% | 1595407 | $17,254,457 |

| VML | Vital Metals Limited | 0.002 | -20% | 4599904 | $14,737,667 |

| 8IH | 8I Holdings Ltd | 0.009 | -18% | 24000 | $3,829,769 |

| NPM | Newpeak Metals | 0.009 | -18% | 2 | $3,542,789 |

| ORD | Ordell Minerals Ltd | 0.41 | -18% | 344891 | $17,993,835 |

| EVR | Ev Resources Ltd | 0.005 | -17% | 834932 | $11,915,020 |

| IFG | Infocusgroup Hldltd | 0.005 | -17% | 131116 | $1,574,561 |

| KPO | Kalina Power Limited | 0.005 | -17% | 10608551 | $17,597,818 |

| NWM | Norwest Minerals | 0.01 | -17% | 839344 | $5,821,434 |

| ROG | Red Sky Energy. | 0.005 | -17% | 27224449 | $32,533,363 |

IN CASE YOU MISSED IT

Anson Resources (ASX:ASN) is preparing to re-enter the Mt Fuel-Skyline Geyser after securing the necessary approvals, with the goal of defining a mineral resource for the Green River lithium brine project. ASN will be drilling deeper into limestone layers in this re-entry, looking to increase the size of the lithium-rich reservoir. Read more about it here.

Blue Star Helium’s (ASX:BNL) Jackson-2 well continues to demonstrate strong flow testing, with optimised rates achieved as well as promising reports of helium concentrations. Watch StockTake for more.

Lanthanein Resources (ASX:LNR) has announced encouraging diamond drilling results from its Lady Grey project at Mt Holland in Western Australia’s Yilgarn region. Watch StockTake for more.

MTM Critical Metals (ASX:MTM) has agreed to leasing terms for a first Flash Joule Heating metal recovery demonstration plant in the United States. Watch StockTake for more.

Trading Halts

Alvo Minerals (ASX:ALV) - proposed acquisition of Lavra Velha Project

Aspen Group (ASX:APZ) - cap raise

Australian Bond Exchange (ASX:ABE) - cap raise

Chimeric Therapeutics (ASX:CHM) - new data on ADVENT-AML Phase 1B clinical trial

Codrus Minerals (ASX:CDR) - cap raise

Emu (ASX:EMU) - results of a general meeting

GreenX Metals (ASX:GRX) - cap raise

Hastings Technology Metals (ASX:HAS) - Yangibana joint venture with Wyloo

HeraMED (ASX:HMD) - customer update and its go-to-market strategy in the US

Medallion Metals (ASX:MM8) - cap raise

Uvre (ASX:UVA) - cap raise

White Cliff Minerals (ASX:WCN) - cap raise

At Stockhead, we tell it like it is. While Anson Resources, Blue Star Helium, Lanthanein Resources and MTM Critical Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX shakes off morning malaise; Xero jumps on profit and revenue gains