Closing Bell: ASX closes higher, but Trump’s hit on Canada and Mexico sparks market jitters

ASX pares gains after Trump’s tariffs threat sends nerves through the market. Meanwhile, Bitcoin slips as it awaits a bit more clarity from the new POTUS.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX reverses after Trump’s tariff threat sends jitters

Bitcoin drops as Trump’s policies remain unclear

Hub24 shines, Santos slumps after project delay

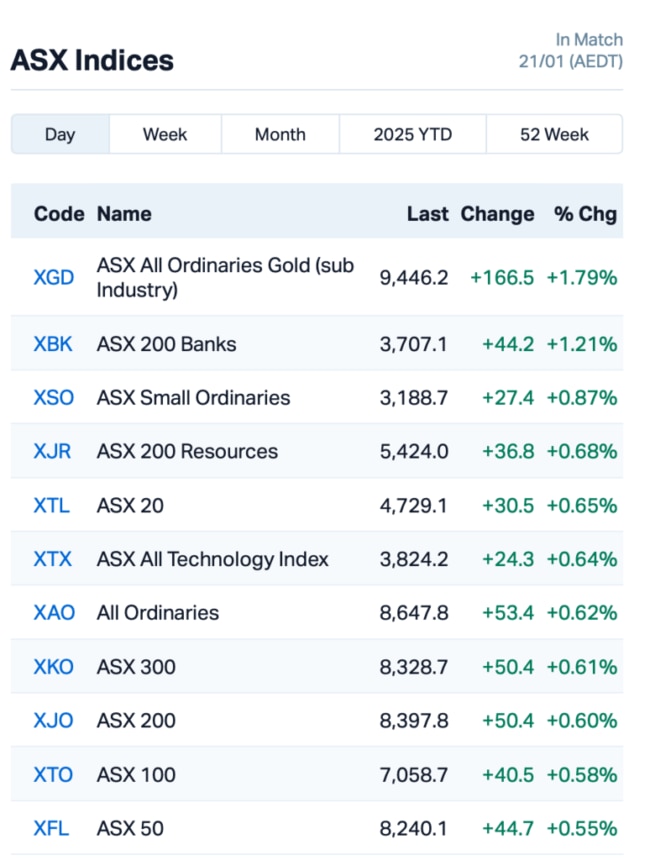

After an upbeat start to the day, the S&P/ASX 200 Index, which had surged as much as 1% in the morning, closed just 0.66% higher. Not terrible, mind.

In the last couple of hours, Trump sent shockwaves through the markets when he floated the idea of imposing 25% tariffs on Mexico and Canada as soon as February 1.

He didn’t mention China in the announcement, but the uncertainty surrounding his stance was enough to spook investors.

"I think we'll do it February 1," Trump said, signalling tariffs on the US neighbours for issues ranging from migration to trade imbalances.

Bitcoin, which had been riding high and even hit a record of more than US$109,000 before his inauguration, started to slip. As of this time of writing, it was trading around US$102,000.

Gold, however, edged higher, with traders flocking to the safe-haven assets; while oil prices faced pressure after Trump vowed to ramp up US oil and gas production.

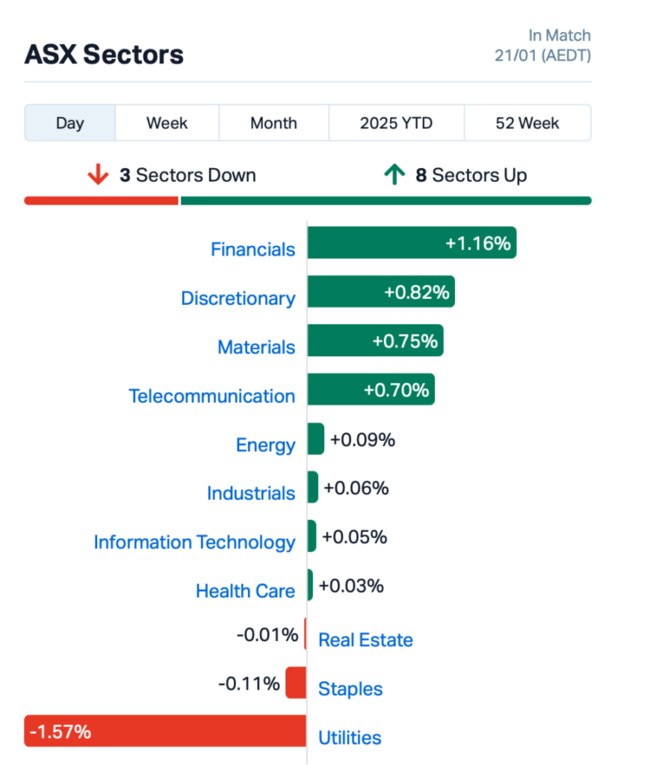

Back home, three out of the 11 ASX sectors finished in the red.

The utilities sector was dragged down by Origin Energy (ASX:ORG), and the mining giants weren’t spared either from the afternoon selloff.

BHP (ASX:BHP), which had initially been riding high on strong copper production reports, saw its gains pare back to just 0.8%.

This is how things looked leading up to today’s close:

In other large caps news, Hub24 (ASX:HUB), a wealth platform, had a great day, skyrocketing 12% after reporting record quarterly inflows of $5.5 billion.

Santos (ASX:STO) didn’t fare so well, with shares dipping 2% after it announced a delay to a major oil and gas project in WA. This news saw its partner, Carnarvon Energy (ASX:CVN) get absolutely hammered, down 25%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap 88E 88 Energy Ltd 0.002 100% 12,037,985 $28,933,812 SFG Seafarms Group Ltd 0.002 100% 287,959 $4,836,599 EPM Eclipse Metals 0.008 33% 1,156,517 $13,727,133 OB1 Orbminco Limited 0.002 33% 264,773 $3,249,885 TTI Traffic Technologies 0.004 33% 19,103,521 $3,461,200 NVQ Noviqtech Limited 0.105 28% 12,454,868 $18,881,917 RLF Rlfagtechltd 0.044 26% 607,880 $9,401,445 ECT Env Clean Tech Ltd. 0.003 25% 206,141 $6,343,621 RLT Renergen Limited 0.390 24% 8,756 $9,552,682 1CG One Click Group Ltd 0.011 22% 4,621,686 $10,600,919 AOK Australian Oil. 0.003 20% 2,004,456 $2,504,457 ASP Aspermont Limited 0.006 20% 203,272 $12,350,058 ASR Asra Minerals Ltd 0.003 20% 11,636 $5,781,575 CUL Cullen Resources 0.006 20% 84,970 $3,467,009 DUN Dundasminerals 0.039 18% 1,264,763 $3,538,205 3DP Pointerra Limited 0.087 18% 36,183,127 $59,575,683 KM1 Kalimetalslimited 0.135 17% 440,372 $8,835,177 AJL AJ Lucas Group 0.007 17% 993,391 $8,254,378 AVE Avecho Biotech Ltd 0.004 17% 31,529 $9,507,891 MMR Mec Resources 0.004 17% 4,709,081 $5,495,421

Dundas Minerals (ASX:DUN) has hit some impressive gold grades at its Rockland site, with multiple high-grade intercepts confirming a 1km gold-rich trend. Highlights include up to 14.9g/t gold in spots, and an estimated 1km stretch of mineralisation. This new gold zone sits between the historic Milford and Windanya North prospects.

Kali Metals (ASX:KM1) has ramped up gold digging at its Marble Bar project, expanding the gold-in-soil anomaly by 80% to a solid 9.5km stretch. So far, it’s only mapped a small part of it, but already it has found gold-bearing quartz veins at the Tiger and Sherman prospects, with surface grades up to 4.0g/t.

Traffic Technologies (ASX:TTI) has bagged a $3 million contract to supply smart, IoT-ready LED streetlights to the City of Sydney. The deal runs for five years, with an option to extend for up to nine, potentially bringing in $5 million. The lights will replace old ones and cover everything from roads to parks and laneways across Sydney’s CBD and surrounding suburbs.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap X2M X2M Connect Limited 0.020 -29% 295,974 10,554,339 1TT Thrive Tribe Tech 0.003 -25% 209,425,715 8,126,892 CRB Carbine Resources 0.003 -25% 200,000 2,206,951 CTN Catalina Resources 0.003 -25% 100,000 4,975,048 CVN Carnarvon Energy Ltd 0.118 -24% 21,169,195 277,308,467 FCT Firstwave Cloud Tech 0.020 -20% 565,280 42,837,967 ENV Enova Mining Limited 0.004 -20% 8,988,003 4,924,647 HPC Thehydration 0.016 -20% 245,624 6,098,261 LCL LCL Resources Ltd 0.008 -20% 2,983,624 11,948,127 MEL Metgasco Ltd 0.004 -20% 500,000 7,287,934 BCK Brockman Mining Ltd 0.013 -19% 321,308 148,483,714 SBW Shekel Brainweigh 0.018 -18% 24,170 5,017,347 SVY Stavely Minerals Ltd 0.018 -18% 2,463,468 11,968,926 TAR Taruga Minerals 0.009 -18% 1,000,000 7,766,295 AM7 Arcadia Minerals 0.020 -17% 90,158 2,817,202 AUK Aumake Limited 0.005 -17% 29,346 18,064,153 ERA Energy Resources 0.003 -17% 213,894 1,216,188,722 IS3 I Synergy Group Ltd 0.005 -17% 14,164 2,137,307 LNR Lanthanein Resources 0.003 -17% 647,088 7,330,908 TEM Tempest Minerals 0.005 -17% 2,059,000 3,807,179 ADN Andromeda Metals Ltd 0.006 -14% 1,397,512 24,001,094 HGO Hillgrove Res Ltd 0.048 -14% 20,984,821 117,351,112

Novonix’s (ASX:NVX) CEO Chris Burns announced he will step down this week after four years at the helm. The company, which focuses on battery materials, is entering a key growth phase and will now be searching for a new leader to steer it through the next stage.

IN CASE YOU MISSED IT

Nevada-based explorer Sun Silver (ASX:SS1) shared with the market today a series of impressive drill hits from its Maverick Springs project in the US – including a standout intercept of 132m at 887.2g/t AgEq.

The company says the drilling, taking place in the project’s north-west, is continuing to exceed average widths of Maverick Springs’ current mineral resource (195.7Mt at 40.25g/t silver and 0.32g/t gold for 253.3Moz of silver and 2Moz of gold).

Recce Pharmaceuticals (ASX:RCE) announced to the market today that all 30 patients taking part in its phase II clinical trial for its Recce 327 topical gel product have been dosed.

Recce is currently developing a new class of synthetic anti-infectives to fight antibiotic-resistant superbugs and viral pathogens. The Recce 327 topical gel is designed to treat acute bacterial skin and skin structure infections. Full analysis of the phase II results is expected this quarter.

At Stockhead, we tell it like it is. While Recce Pharmaceuticals and Sun Silver are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX closes higher, but Trump’s hit on Canada and Mexico sparks market jitters