ASX Small Caps Weekly Wrap: ASX up on a modest win while a fire put coal on the radar once more

A big week for Energy, goldies and some handsome Small Cap wins.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

It’s been a week of ups and downs for the ASX, as the nation came to grips with the looming spectre of Yet Another Rate Hike after last week’s inflation rate disaster came home to roost.

- Local markets can thank a wonderful Thursday for this week’s meagre gain

- An underground coal mine fire put the cat among the pigeons in Energy

- Who won the Small Caps race? Read on to find out…

To be fair, the week’s saving grace happened on Thursday, after the ASX got off to a less-than-stellar start to the week and looked like it would dawdle through to the weekend in a glum, desultory manner.

But, a sudden spike in iron ore prices lit a fire under the nation’s miners on Thursday, sending the market skyward and putting some vim and verve back in investors’ steps.

It didn’t last – Friday was quiet, there weren’t many huge announcements worth getting excited about, and the week ended with more of a whimper than a bang.

There was one other fire, though, which is worth a mention here – and that’s a fire that is burning underground at Anglo American’s Grosvenor coal mine in Queensland.

Locally, the effect that the fire is likely to have is a very unpleasant one. About 1,400 jobs are basically in limbo, while the company figures out what the future holds for the site.

And at the moment, that future is looking bleak, with the mine likely to be shuttered for months (at a minimum), while the whole mess gets brought under control.

The worst case scenario is, of course, the fire burning itself out – but that could potentially take years, if the lesson learned from the mother of all underground coal fires is to be relied upon.

The underground coal mine in Centralia, in the US state of Pennsylvania, caught fire in 1962 (I think… I should look that up) – and when authorities there realised that there was no chance of ever bringing it under control, they simply walked away from it.

The true impact of the blaze wasn't revealed until 1979, due to a noxious blend of incompetence and passing the buck.

Centralia is still on fire, the township above it all but abandoned (save for a handful of weirdos who are refusing to leave) – and the current estimate there is that it’s likely to burn for another 250 years.

But what was bad news for Anglo, was good news for other ASX-listed coal miners, which – for the most part – saw hefty gains as investors realised that a major contributor to Queensland’s coal output was suddenly out of the game.

And in Europe this week, there has been some interesting action, because voters went to the polls there yesterday, and by all accounts, the Tories have been comprehensively spanked… and not in the way they’re rumoured to rather enjoy.

Labour has already claimed a massive majority in the House of Commons, with voting set to continue for a few more hours yet – but the last time I looked, Labour had picked up 187 seats to deliver a known majority of 376 seats, well past the 326 required to claim victory on their own right.

Exit polling available showed that the vote has been split somewhat in either direction away from the ruling Conservative Party, which has been in power for 14 years, and seen 5 different Prime Ministers moving into 10 Downing St – although it could be argued that at least one of them doesn’t really count.

Liz Truss was PM for just 50 gruelling days, was famously out-lasted by a head of lettuce, and is the only Prime Minister I’ve ever seen leaving Downing Street limping with both legs at the same time.

Her replacement, Rishi Sunak, will be widely remembered as a disaster as well, earning the rare distinction of being one of the few people who made Britain yearn for the return of Boris Johnson – the former PM who will forever serve as the poster child for the word “oaf”.

And so, it looks as if a fella called Sir Keir Starmer will step in as the new British PM – off the back of recent opinion polls that were… unflattering, to say the least.

48% of voters polled said Starmer was performing “badly” as Opposition Leader, 41% described Starmer’s Labour Party as “incompetent” and 42% said it “was not ready” to govern.

So it should come as no surprise that the vote in the UK has seen Conservative voters – unable to bring themselves to put Sunak back into Downing St – flocking to Nigel Farage’s UK Reform party.

Farage – the perennial numpty who drove the UK Brexit campaign – has finally landed himself a seat in the UK House of Commons, so we can expect to see him doing his best “I’m a ferret that’s been stuffed into a tiny glass jar” impersonation on the telly over the coming months.

Interestingly, former Labour leader Jeremy Corbyn, who was dumped from the party by incoming PM Keir Starmer, has toppled the local Labour candidate and been elected as an Independent – so it’ll be ‘pension cheques at 20 paces’ between him and the PM as well.

For what it’s worth, UK markets were up ahead of the expected pantsing for Ravi Shankar or whatever his name was. I’ve already forgotten… but I daresay he’s leaving Downing Street with a very firm sense of “Good Riddance” from the UK voting public.

Here’s what happened on Aussie markets this week...

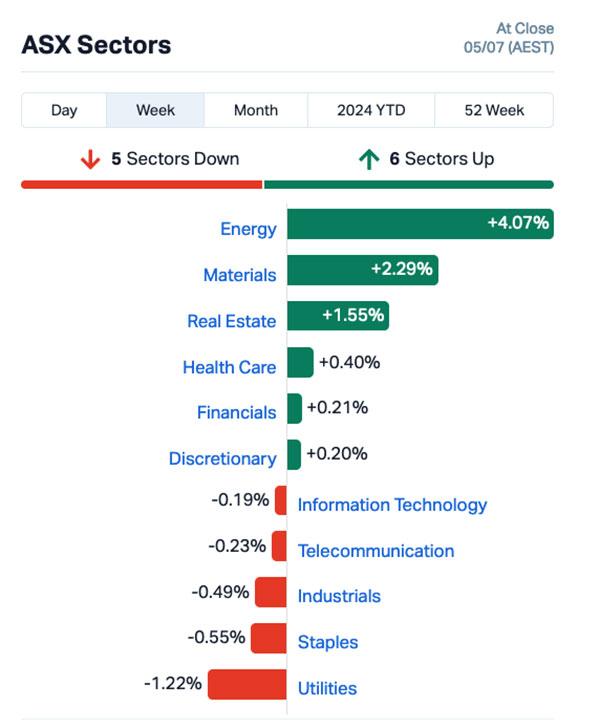

The sectors overall looked like this:

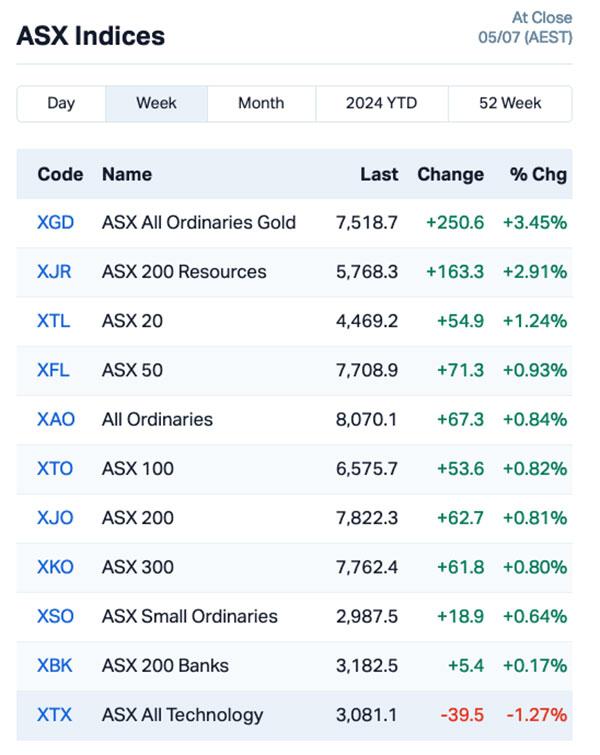

And the ASX indices looked like this:

And I have run out of time to explain to you why I've run out of time to explain what that means.

SMALL CAP WINNERS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| I88 | Infini Resources Ltd | 0.44 | 184% | $13,673,997 |

| WTM | Waratah Minerals Ltd | 0.305 | 177% | $51,118,882 |

| AL3 | AML3D | 0.215 | 150% | $64,106,835 |

| WLD | Wellard Limited | 0.039 | 129% | $21,781,263 |

| JTL | Jayex Technology Ltd | 0.002 | 100% | $562,557 |

| M2M | Mt Malcolm Mines NL | 0.044 | 100% | $6,447,897 |

| RIL | Redivium Limited | 0.004 | 100% | $10,923,419 |

| VML | Vital Metals Limited | 0.004 | 100% | $17,685,201 |

| OLY | Olympio Metals Ltd | 0.055 | 96% | $4,188,347 |

| PPK | PPK Group Limited | 0.73 | 87% | $62,074,124 |

| TTT | Titomic Limited | 0.135 | 85% | $96,010,406 |

| NNL | Nordic Nickel | 0.099 | 77% | $12,468,849 |

| AI1 | Adisyn Ltd | 0.035 | 75% | $5,924,224 |

| SGC | Sacgasco Ltd | 0.005 | 67% | $4,483,201 |

| SHO | Sportshero Ltd | 0.005 | 67% | $3,089,164 |

| AHK | Ark Mines Limited | 0.255 | 65% | $14,138,835 |

| 1CG | One Click Group Ltd | 0.016 | 60% | $11,250,861 |

| E33 | East 33 Limited. | 0.016 | 60% | $12,402,943 |

| FCT | Firstwave Cloud Tech | 0.019 | 58% | $30,780,349 |

| PHL | Propell Holdings Ltd | 0.011 | 57% | $3,061,719 |

| IMI | Infinity Mining | 0.02 | 54% | $2,493,821 |

| AMN | Agrimin Ltd | 0.25 | 52% | $87,679,655 |

| HVY | Heavy Minerals | 0.08 | 51% | $5,037,279 |

| BEO | Beonic Ltd | 0.03 | 50% | $14,645,075 |

| BFC | Beston Global Ltd | 0.003 | 50% | $5,991,141 |

| LSR | Lodestar Minerals | 0.0015 | 50% | $3,035,096 |

| MOH | Moho Resources | 0.006 | 50% | $3,774,247 |

| NGS | NGS Ltd | 0.003 | 50% | $1,004,910 |

| PRX | Prodigy Gold NL | 0.003 | 50% | $5,294,436 |

| RDS | Redstone Resources | 0.006 | 50% | $5,552,271 |

| SFG | Seafarms Group Ltd | 0.003 | 50% | $14,509,798 |

| TD1 | Tali Digital Limited | 0.0015 | 50% | $4,942,733 |

| TX3 | Trinex Minerals Ltd | 0.003 | 50% | $5,485,957 |

| ABE | Australian Bond Exchange | 0.022 | 47% | $2,478,699 |

| BAS | Bass Oil Ltd | 0.088 | 47% | $23,524,956 |

| SOM | SomnoMed Limited | 0.36 | 44% | $75,637,889 |

| ZLD | Zelira Therapeutics | 0.46 | 44% | $4,084,976 |

| M2R | Miramar | 0.01 | 43% | $1,973,898 |

| RCL | Readcloud | 0.115 | 42% | $14,620,451 |

| ICL | Iceni Gold | 0.085 | 42% | $19,366,035 |

| RCR | Rincon | 0.1475 | 40% | $38,921,267 |

| ZMM | Zimi Ltd | 0.014 | 40% | $1,773,306 |

| NOV | Novatti Group Ltd | 0.053 | 39% | $18,499,023 |

| MMM | Marley Spoon Se | 0.025 | 39% | $3,884,905 |

| PTR | Petratherm Ltd | 0.025 | 39% | $4,300,077 |

| SRI | Sipa Resources Ltd | 0.018 | 38% | $3,878,688 |

| ACW | Actinogen Medical | 0.0635 | 38% | $174,398,205 |

| PNT | Panthermetalsltd | 0.033 | 38% | $2,789,317 |

| PVT | Pivotal Metals Ltd | 0.022 | 38% | $16,898,839 |

| SPQ | Superior Resources | 0.011 | 38% | $18,010,984 |

Up the top of the ladder this week was Infini Resources (ASX:I88) , after maiden field sampling results at Infini’s Portland Creek uranium project in Newfoundland, Canada, have exceeded lab testing limitations in 17 samples – meaning they are above 1.18% (11,792ppm) U3O8 – therefore sent for additional testing using higher grade tech.

Those are some seriously high numbers, which the company says are “nothing short of outstanding” and some of the highest returned grades of yellowcake in the world.

The company says another 52% of the samples tested have come back with readings above 1000ppm U3O8, which is impressive in itself.

Gold explorer Waratah Minerals (ASX:WTM) was next best, having sprung the market with more high-grade results from ongoing drilling at its Spur project, with up to 9.33g/t gold.

The explorer is betting there’s a sizeable gold deposit on its tenure since the tenements are just 5km from Newmont’s +50Moz gold Cadia Valley and near the multi-million ounce Cowal and Boda deposits in NSW’s prolific Lachlan Ford Belt.

And AML3D (ASX:AL3) came in third this week, on news from the top of this period of a juicy defence contract, worth $1.1 million, courtesy of the US Navy.

SMALL CAP LAGGARDS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| GCR | Golden Cross | 0.001 | -50% | $1,097,256 |

| FMR | FMR Resources Ltd | 0.21 | -48% | $4,082,129 |

| 1MCDA | Morella Corporation | 0.045 | -40% | $18,536,398 |

| RNX | Renegade Exploration | 0.009 | -40% | $12,800,534 |

| IS3 | I Synergy Group Ltd | 0.005 | -38% | $1,770,402 |

| CUS | Copper Search | 0.058 | -38% | $6,287,983 |

| HTG | Harvest Tech Grp Ltd | 0.014 | -33% | $12,177,868 |

| MSG | MCS Services Limited | 0.002 | -33% | $396,199 |

| AX8 | Accelerate Resources | 0.026 | -28% | $16,760,356 |

| OVT | Ovanti Limited | 0.0115 | -28% | $13,641,160 |

| APL | Associate Global | 0.1 | -26% | $5,649,243 |

| 1TT | Thrive Tribe Tech | 0.003 | -25% | $1,411,865 |

| AAU | Antilles Gold Ltd | 0.003 | -25% | $3,986,140 |

| CLZ | Classic Minerals | 0.0015 | -25% | $808,365 |

| MTB | Mount Burgess Mining | 0.0015 | -25% | $1,947,220 |

| PKO | Peako Limited | 0.003 | -25% | $1,581,254 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| ASQ | Australian Silica | 0.024 | -23% | $6,764,649 |

| GRV | Greenvale Energy Ltd | 0.03 | -23% | $14,220,595 |

| CAQ | CAQ Holdings Ltd | 0.021 | -22% | $15,073,512 |

| SUM | Summit Minerals | 0.295 | -22% | $19,287,561 |

| AUA | Audeara | 0.031 | -21% | $4,501,948 |

| GMN | Gold Mountain Ltd | 0.002 | -20% | $7,944,359 |

| IVX | Invion Ltd | 0.004 | -20% | $26,418,129 |

| ODA | Orcoda Limited | 0.14 | -20% | $21,990,419 |

| SI6 | SI6 Metals Limited | 0.002 | -20% | $4,737,719 |

| SIH | Sihayo Gold Limited | 0.002 | -20% | $24,408,512 |

| PSC | Prospect Resources | 0.13 | -19% | $64,621,784 |

| ILT | Iltani Resources Lim | 0.25 | -19% | $8,332,574 |

| HAR | Haranga resources | 0.07 | -18% | $6,804,233 |

| DTZ | Dotz Nano Ltd | 0.115 | -18% | $65,470,264 |

| RC1 | Redcastle Resources | 0.018 | -18% | $5,909,115 |

| 1AG | Alterra Limited | 0.005 | -17% | $4,310,732 |

| APS | Allup Silica Ltd | 0.035 | -17% | $3,268,443 |

| CCZ | Castillo Copper Ltd | 0.005 | -17% | $6,497,527 |

| ESK | Etherstack PLC | 0.175 | -17% | $23,704,899 |

| EVR | Ev Resources Ltd | 0.005 | -17% | $7,927,629 |

| HLX | Helix Resources | 0.0025 | -17% | $8,160,484 |

| JNO | Juno | 0.03 | -17% | $5,458,358 |

| ME1 | Melodiol Global Health | 0.0025 | -17% | $691,387 |

| T3D | 333D Limited | 0.005 | -17% | $597,225 |

| TZL | TZ Limited | 0.02 | -17% | $5,131,662 |

| RCE | Recce Pharmaceutical | 0.4725 | -17% | $95,874,005 |

| RMI | Resource Mining Corp | 0.019 | -17% | $12,394,608 |

| NMR | Native Mineral Res | 0.021 | -16% | $4,406,861 |

| NVQ | Noviqtech Limited | 0.031 | -16% | $4,666,885 |

| OCN | Oceana lithiumlimited | 0.036 | -16% | $2,969,928 |

| IR1 | Iris Metals | 0.2675 | -16% | $36,459,445 |

| FRB | Firebird Metals | 0.14 | -15% | $21,354,210 |

| FML | Focus Minerals Ltd | 0.14 | -15% | $44,416,590 |

HOW THE WEEK SHOOK OUT

Monday 01 July, 2024

Infini Resources (ASX:I88) announced its maiden field sampling assay results at its 100% owned Portland Creek Uranium Project in Newfoundland, Canada, where the company says the results have exceeded laboratory testing limitations in 17 samples – meaning they are above 1.18% (11,792ppm) U3O8 – and have been sent for additional testing, with other high range samples close to the upper limit for testing of this type.

The company says that 52% of the samples tested have come back with readings above 1,000ppm U3O8, which sets the project up to be a potential record breaker.

Wellard (ASX:WLD) was surging early on news that the company has signed paperwork to offload one of its oldest livestock ships, the M/V Ocean Ute, for $12 million, the majority of which is set to be returned directly to shareholders in a manner that is yet to be determined by the company.

Lindian Resources (ASX:LIN) released news that its feasibility study for the company’s Kangankunde rare earths project has confirmed it as a “technically low risk and economically robust project”, boasting a Stage 1 post-tax Net Present Value of US$555M (A$831M), an IRR of 80% and an average annual EBITDA of US$84M1 (A$124.5M).

Antilles Gold (ASX:AAU) has advised that on 28 June, 2024, shareholders of the Cuban joint venture mining company, Minera La Victoria SA, formally adopted previously agreed modifications to the existing Joint Venture Agreement, paving the way for the companies to pursue a strategy to progressively evolve as a substantial mining company, with “minimal future contributions required from Antilles Gold”.

Tuesday 02 July, 2024

TMK Energy (ASX:TMK) was up on news that the company has put a broom through the boardroom and managerial roster, to “align individuals’ competencies and experience with the immediate and future direction of the company”.

The shakeup comes as TMK preps for a big push forward on the delivery of its Gurvantes XXXV Project in Mongolia and says the changes will provide additional support to management to progress the significant growth opportunity that lies ahead.

Tesoro Gold (ASX:TSO) was pleased to report significant assay results from first-pass drilling of the Ternera East target, which has intercepted a newly identified, thick (+200m), well-mineralised El Zorro Tonalite (EZT) intrusive, approximately 300m east of the 1.3Moz Ternera Gold Deposit within Tesoro’s broader El Zorro Gold Project in Chile.

Ark Mines (ASX:AHK) revealed that an extensive reconnaissance drilling programme has been conducted, allowing the company to assess an exploration target range for the Sandy Mitchell rare earths tenement.

Ark says in the release that the target is estimated at 1.3 billion tonnes to 1.5 billion tonnes @ 1250 to 1490ppm monazite equivalent – but does also note that “the potential quantity and grade of the Exploration Target is conceptual in nature; there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in estimation of a Mineral Resource.”

Earlier in the day, Critical Resources (ASX:CRR) was climbing on Tuesday morning after it announced that its summer field program has reinforced the company’s recently announced Exploration Target of 18-29Mt at 0.8-1.2% Li2O at its Mavis Lake prospect, with new assays confirming “exceptionally high grades” at surface with lithium assays of up to 5.12% Li2O along the extensions of pegmatites 7 and 24.

Redflow (ASX:RFX) was moving sharply on news that it has signed an MoU with the Queensland government-owned Energy producer Stanwell, setting out out Redflow’s and Stanwell’s intention to collaborate on the development and deployment of Redflow’s X10 battery for use in a 400 MWh large-scale project, which will serve as a potential anchor order for Redflow’s planned manufacturing facility in Queensland.

Cygnus Metals (ASX:CY5) announced some pleasant news from its lithium prospect, after a ground gravity survey suggested the Pegasus spodumene pegmatite trend extends for at least 1.7km and remains open in all directions. The survey was centred around a find the company reported in February this year, which included a fabulous intersection of 43.7m @ 1.15% Li2O below 10m of glacial cover.

And Pioneer Lithium (ASX:PLN) jumped nicely on news that its 300m exploratory auger drilling campaign at its 100% owned Verde Valor Rare Earth tenements in Bahia state in Brazil has been completed, with the samples all packed carefully and sent off to the lab to be processed.

Wednesday 03 July, 20244

Waratah Minerals (ASX:WTM) was out in front on Wednesday morning, thanks to a fresh set of results from a further six drill holes from the on-going RC drill program at the company’s Spur gold-copper project, with the highlight result coming in at 89m at 1.73g/t Au, 0.08% Cu from 115m inc. 57m at 2.50g/t Au, 0.11% Cu from 115m.

Melodiol Global Health (ASX:ME1) was up earlier on Wednesday after issuing a trading update, showing that Q2 2024 unaudited revenues have come in at a total of $4.8 million, which represents a 9% increase on Q1 2024 revenue of $4.4 million. The uptick brings the company’s H1 2024 unaudited revenues to $9.2 million, a 31% increase on H1 2023 of $7.0 million.

The Calmer Co (ASX:CCO) has also issued some updated sales results, showing that its eCommerce sales have increased by $2,500, to over $18,500 per day in June, showing month on month growth over the full financial year of FY24.

The company says that sales via eCommerce channels grew at an average of 17% monthly over the full FY24 year, with an aggregate annual growth rate of 540%

And Prodigy Gold (ASX:PRX) has released an updated Mineral Resource Estimate for its Tregony gold deposit, which now sits at 0.46Mt at 1.6g/t Au for 23,000oz indicated, 1.10Mt at 1.2g/t Au for 41,000oz inferred for a total MRE of 1.56Mt at 1.3g/t Au for 64,000oz.

Thursday 04 July, 20244

Askari Metals (ASX:AS2) announced that is has defined a significant JORC (2012) Exploration Target at the 100%-owned Burracoppin Gold Project in WA, measuring in at 8.212Mt to 11.121Mt at an average grade of between 0.67g/t Au and 0.91g/t Au for 176,000oz Au to 323,000oz Au, using a cut-off grade of 0.3g/t Au.

Ecofibre (ASX:EOF) announced the appointment of Ulrich (Uli) Tombuelt as Managing Director and CEO of Ecofibre and President of Ecofibre Advanced Technologies, effective by 05 August, 2024.

Hexagon Energy Materials (ASX:HXG) saw a boost on Thursday after delivering an investor briefing on its low emissions ammonia project, highlighting the current push by the Japanese government to invest in the technology.

Rincon Resources (ASX:RCR) continued to perform well off the back of Wednesday’s news that the company has obtained heritage clearance for drilling at its Avalon, Sheoak, K1, and K2 targets, within the West Arunta Project in Western Australia.

AML3D (ASX:AL3) was also up on old news – the company announced a juicy defence contract on Tuesday, worth $1.1 million, courtesy of the US Navy.

Waratah Minerals (ASX:WTM) was still performing well today on yesterday’s news about fresh results from a further six drill holes from the on-going RC drill program at the company’s Spur gold-copper project, with the highlight result coming in at 89m at 1.73g/t Au, 0.08% Cu from 115m inc. 57m at 2.50g/t Au, 0.11% Cu from 115m.

Avenira (ASX:AEV) was rising this morning, but the only recent news of note was the resignation of two directors, Mr Kevin Dundo and Ms Winnie Lai Hadad, who stepped down from the Board of Directors on 2 July 2024.

Similarly, Marley Spoon’s (ASX:MMM) news today was the result of a resignation as well, after CEO and Management Board Chairman Fabian Siegel departed on 26 June – by mutual agreement – after 10 years at the helm of the company.

Friday 05 July, 2024

There was a lot of interest in Titomic (ASX:TTT) on Friday, but the latest news from the company is already four days old – but, for what it’s worth, it was pretty good news. The company sold one of its custom high-pressure cold spray systems to the Oregon Manufacturing Innovation Centre, for a cool $1.2 million.

The system, once installed, will allow the Oregon centre to get into the additive manufacture of multi-metal parts, large-scale titanium parts, and the manufacture of multi-metal coatings, Titomic says.

Classic Minerals (ASX:CLZ) climbed on Friday in the wake of an announcement that LDA Capital had subscribed for 49,850,800 shares of the 51,000,000 on offer, for a total of $47,500.00 at a price per Subscription Share of $0.00095. CLZ submitted the capital Call Notice under the terms of its strategic $15 million Put Option Agreement with the US-based financier announced in December 2022.

Peak Minerals (ASX:PUA) was rising on Friday morning on news that the company has executed binding agreements for the acquisition of 80% of the highly prospective Kitongo and Lolo Uranium Projects and the Minta Rutile Project in Cameroon, West Africa.

The acquisition includes six exploration permits under valid application covering an area of ~2,400km2, including the areas previously held by Mega Uranium Ltd (TSX:MGA) and actively explored until 2011.

iTech Minerals (ASX:ITM) was celebrating rock chip sampling results from Reynolds Range, which have come back with samples as high as 182g/t Au, with totals for copper, silver, base metals and lithium still pending, but they are expected to arrive in the coming weeks.

And Zelira Therapeutics (ASX:ZLD) was performing well after recieving a shot in the arm – and a show of confidence – from the company chairman Mr Osagie Imasogie, who has provided the company with a $1.4 million unsecured loan.

The loan was announced several days ago, and Zelira has informed the market that the money has arrived, and will be used to support the advancement of the HOPE SPV clinical trial, as well as general working capital purposes.

IPOs that didn’t happen yet

Piche Resources (ASX:PR2)

Proposed Listing: June-ish, 2024

IPO: $10 million at $0.10 per share

Blinklab describes itself as a mineral exploration company with multiple, drill ready uranium projects with the potential to host tier 1 mineral deposits.

The IPO, as listed, will be managed by Euroz Hartleys (Lead Manager).

Pengana Global Credit Private Trust (ASX:PCX)

Proposed Listing: June-ish, 2024

IPO: $250,000 at $2.00 per share

Pengana Global Credit Private Trust is a listed Investment Trust investing in global private debt.

The IPO, as listed, will be managed by Taylor Collison Limited, Morgans Financial Limited, Shaw and Partners Limited. (Joint Lead Managers).

Originally published as ASX Small Caps Weekly Wrap: ASX up on a modest win while a fire put coal on the radar once more