ASX Small Cap Lunch Wrap: Banks and Resources have pushed ASX 200 to another record high

Banks and Resources have pushed the ASX 200 to another record high on Tuesday.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Local markets opened higher on Tuesday morning, thanks to a decent lead-in from Wall Street overnight – and that saw the ASX 200 bolt to a record high almost as soon as the doors were open for the day’s session.

There’s been a run on Banks, InfoTech and Materials this morning, but Energy stocks have been hampered by renewed weakness in crude oil prices overnight.

That’s about it for the overview, so let’s dive in for the details.

TO MARKETS

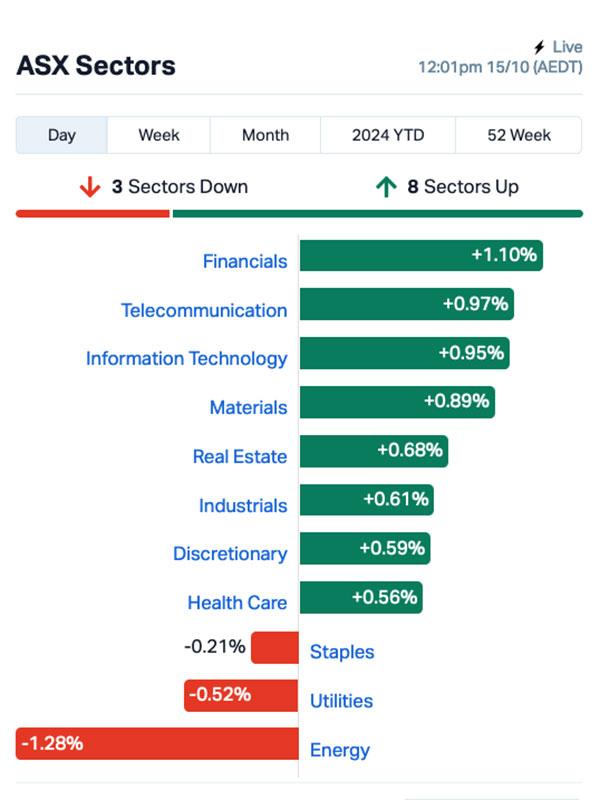

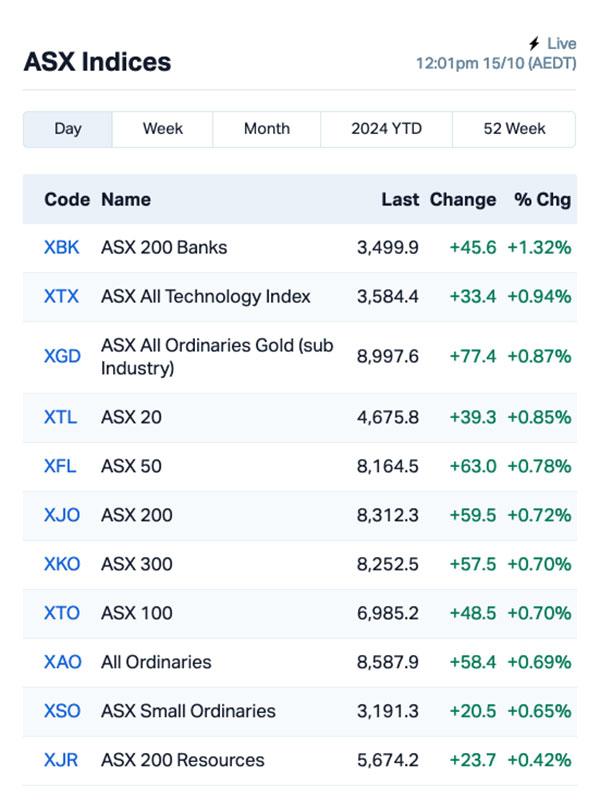

At lunchtime Tuesday, the ASX 200 benchmark was up around 0.7 per cent, thanks to a decent push among InfoTech and the Telcos throughout the morning, and some decent gains in the Resources department as well.

All three of those market sectors gained more than 1 per cent across the morning, and the ASX sector chart looked like this at midday:

Leading the way early at the heavy end of InfoTech was Life360 (ASX:360), with the family surveillance software company jumping more than 2 per cent on Tuesday morning in the absence of any real local news.

Meanwhile, weakening crude prices are taking their toll on oil-dependent stocks – so while it’s lovely that most of us are forking out a lot less at the bowsers than we have been in recent months, for investors it’s not so great.

Crude prices fell again yesterday, thanks in no small part to OPEC lowering its global oil demand 2024 and 2025 outlook, and China's oil imports have fallen – yes, again – for the fifth straight month.

That puts pressure on a few of the market heavyweights this morning, including Woodside (ASX:WDS) and Santos (ASX:STO), both of which were down more than 1.3 per cent before lunch.

Looking at the broader economic landscape, the forecasting on interest rates remains depressingly and stubbornly morose, as per Paul Bloxham, HSBC's chief economist for Australia and NZ, and his view of why everyone else is getting rate cuts while Aussies are being left behind.

“The RBA is in a different spot to most other central banks, with core inflation falling more slowly in Australia than in many other countries ... and it has underpinned our view that rate cuts are not likely until 2025," Bloxham says.

NOT THE ASX

Overnight, the S&P 500 notched fresh highs after rising by 0.77 per cent. The blue chips Dow Jones lifted by 0.47 per cent, and the tech-heavy Nasdaq climbed by 0.87 per cent.

In US stock news, Nvidia rose 2.5 per cent, nearing record highs after the company addressed investor concerns about product delays and its long-term growth prospects.

A report from Morgan Stanley suggested that analysts who met with Nvidia’s management found that Blackwell chip orders are booked out for 12 months ahead, suggesting the business remains strong with clear visibility moving forward. Nvidia is the second-best performer in the S&P 500 this year behind Vistra Corp.

Other semiconductor stocks also saw gains last night, including chip equipment manufacturer ASML, Arm Holdings, and Applied Materials. TMSC hit record highs.

Trump Media & Technology (DJT) soared 18 per cent as investors bet on former President Donald Trump’s improved chances of winning the November election. Also, DJT announced the launch of its Truth+ TV streaming service, now available on Android, with an iOS version coming soon.

Boeing fell 1.3 per cent as investors raised concerns about the ongoing job reductions and a strike entering its fifth week. On Friday, the company announced it would eliminate 17,000 positions – about 10 per cent of its workforce.

Crypto was in the headlines on Tuesday morning, because Bitcoin shot up more than 5 per cent to reach $US66,193, a peak we haven’t seen since September. Analysts reckon the jump was triggered by China’s underwhelming fiscal stimulus announcement.

“Markets are probably taking a disappointing China stimulus to be positive news for Bitcoin, as capital rotation from Bitcoin into Chinese equities was understood to be previously weighing on crypto prices,” said Caroline Mauron at Orbit Markets.

In Asian market news, Japan has come back from a national holiday with a +1.27 per cent surge on the Nikkei, while Chinese markets were still waking up at the time of writing.

ASX SMALL CAP WINNERS

Here are the best-performing ASX small cap stocks for October 15:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NVU | Nanoveu | 0.046 | 114.0 | 13,438,721 | $10,855,838 |

| A1G | African Gold | 0.098 | 108.5 | 66,031,144 | $16,871,097 |

| MTL | Mantle Minerals | 0.002 | 33.3 | 1,052,525 | $9,296,169 |

| SFG | Seafarms Group | 0.004 | 33.3 | 500,000 | $14,509,798 |

| BDG | Black Dragon Gold | 0.018 | 28.6 | 359,865 | $3,745,247 |

| ASQ | Australian Silica | 0.032 | 28.0 | 82,595 | $7,046,509 |

| IVX | Invion | 0.0025 | 25.0 | 2,457,895 | $13,533,183 |

| UBN | Urbanise.Com | 0.44 | 23.9 | 33,000 | $22,900,696 |

| FTL | Firetail Resources | 0.12 | 20.0 | 294,425 | $33,124,798 |

| BPP | Babylon Pump & Power | 0.006 | 20.0 | 3,140,000 | $12,497,745 |

| CUL | Cullen Resources | 0.006 | 20.0 | 18,530 | $3,467,009 |

| IBG | Ironbark Zinc | 0.003 | 20.0 | 596,274 | $4,584,120 |

| WML | Woomera Mining | 0.003 | 20.0 | 771,842 | $5,137,686 |

| EG1 | Evergreen Lithium | 0.06 | 17.6 | 71,010 | $2,867,730 |

| CDT | Castle Minerals | 0.0035 | 16.7 | 433,704 | $4,118,442 |

| DM1 | Desert Metals | 0.028 | 16.7 | 1,099,861 | $6,370,217 |

| EPM | Eclipse Metals | 0.007 | 16.7 | 441,668 | $13,505,133 |

| MOH | Moho Resources | 0.007 | 16.7 | 357,915 | $3,235,069 |

| ADO | Anteotech | 0.023 | 15.0 | 10,136,422 | $49,795,400 |

| BCB | Bowen Coal | 0.008 | 14.3 | 2,740,840 | $20,513,428 |

Nanoveu (ASX:NVU) came rocketing up the charts just before lunch on news that it is set to acquire 100 per cent of Embedded A.I. Systems, including the latter’s proprietary “System on a Chip” business and all associated IP for $5 million in shares, plus performance rights. The company released a comprehensive presentation about the acquisition on Tuesday morning, which is kinda complicated but well worth reading, as it looks genuinely exciting.

African Gold (ASX:A1G) was up by more than 100 per cent on Tuesday morning on news of drilling results, which included a “spectacular, wide, high-grade intercept” of 65.0m at 5.6 g/t of gold from 177m, along with shallow intercepts of 9.0m at 1.7 g/t of gold from 23m, and 28m at 1.1 g/t of gold from 77m. There have also been changes to the company’s board announced this morning, with Adam Oehlman stepping in as chief executive officer, and Phillip Gallagher set to step down as managing director.

Invion (ASX:IVX) was trading higher on news of a share consolidation, with the effective date pegged for October 18, with the number of securities falling from 6.76 billion to a far more manageable 6.76 million.

Eclipse Metals (ASX:EPM) was up on news of “promising preliminary findings from an extensive HyperXRF assessment of historical drill core”, which the company says shows evidence of “extensive rare earth resource potential” at its Grønnedal prospect within the Ivigtût project in southwestern Greenland.

AnteoTech (ASX:ADO) was rising on news that the company has received the first commercial order for its proprietary Ultranode battery anode technology containing 70 per cent silicon, from leading European EV manufacturer EV1, which is seeking step change in silicon content for their next generation EV batteries.

Earlier, eHealth tech plater Respiri (ASX:RSH) rose on news that it has secured a $1.6 million strategic placement at $0.045 per share representing a 4 per cent premium on the 10-day VWAP, via high-performing institutional investor Merchant Biotech Fund and other associated prominent investors including Hamma Capital.

And Lithium Australia (ASX:LIT) was up after releasing its quarterly report this morning, featuring news that recycling operations have generated revenue of ~ $2.5m and gross profit of ~ $1.7m, representing a record gross profit margin of 70 per cent, while also continuing to achieve operating cash profits.

ASX SMALL CAP LOSERS

Here are the worst-performing ASX small cap stocks for October 15:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MTB | Mount Burgess Mining | 0.001 | -50.0 | 182,857 | $2,596,294 |

| PRX | Prodigy Gold | 0.002 | -33.3 | 57,333 | $6,997,367 |

| ATH | Alterity Therapeutics | 0.003 | -25.0 | 1,324,463 | $21,281,344 |

| TX3 | Trinex Minerals | 0.0015 | -25.0 | 250,000 | $3,657,305 |

| FTZ | Fertoz | 0.022 | -21.4 | 108,083 | $8,300,895 |

| RMI | Resource Mining Corp | 0.012 | -20.0 | 617,640 | $9,785,217 |

| TMK | TMK Energy | 0.002 | -20.0 | 36,219 | $18,979,030 |

| VML | Vital Metals | 0.002 | -20.0 | 931,862 | $14,737,667 |

| RC1 | Redcastle Resources | 0.009 | -18.2 | 498,000 | $4,513,584 |

| BUY | Bounty Oil & Gas | 0.005 | -16.7 | 402,225 | $8,991,006 |

| PUR | Pursuit Minerals | 0.0025 | -16.7 | 510,682 | $10,906,200 |

| AJX | Alexium Int | 0.011 | -15.4 | 100,000 | $20,460,424 |

| TYR | Tyro Payments | 0.77 | -14.9 | 14,324,476 | $476,611,788 |

| HHR | Hartshead Resources | 0.006 | -14.3 | 2,703,650 | $19,660,775 |

| MRQ | MRG Metals | 0.003 | -14.3 | 100,000 | $9,490,315 |

| AUA | Audeara | 0.039 | -13.3 | 583,481 | $6,535,086 |

| AXN | Alliance Nickel | 0.039 | -13.3 | 185,261 | $32,662,783 |

| ILA | Island Pharma | 0.165 | -13.2 | 305,458 | $29,286,560 |

| JBY | James Bay Minerals | 0.305 | -12.9 | 685,869 | $11,704,875 |

| SMP | Smartpay Holdings | 0.7425 | -12.6 | 361,518 | $205,651,944 |

ICYMI – AM EDITION

Antipa Minerals (ASX:AZY) has started the Phase 2 exploration program at its wholly-owned Minyari Dome gold-copper project in WA’s Paterson project.

The program of 66 reverse circulation holes totalling 10,000m and four diamond holes for up to 1000m will seek to grow existing resources at the GEO-01 deposit and Minyari Southeast.

It will also pursue new gold discoveries within multiple high-priority areas such as GEO-01 South and North, the Minyari Southeast extension target and the Minyari Plunge target.

AZY expects to release an updated scoping study next week and complete the sale of its share of the Citadel joint venture project to Rio Tinto for $17m before the end of this month.

At Stockhead, we tell it like it is. While Antipa Minerals is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as ASX Small Cap Lunch Wrap: Banks and Resources have pushed ASX 200 to another record high