ASX Lunch Wrap: Tech stocks rally after Trump unveils $500bn AI deal

ASX lifts, tech stocks fly high on Trump’s US$500bn AI promise, while miners drop as tariff talk heats up.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX up, tech stocks soar on Trump’s US$500b AI pledge

Miners drop as Trump threatens China tariffs

Woodside, Iluka down, while Paladin and Beach rise

The ASX kicked off Wednesday morning on a high note, up by 0.4% and continuing positive momentum from Tuesday.

The tech sector jumped out of the gates after Trump unveiled a massive US$500 billion AI deal over the next few years to back what’s dubbed the Stargate project.

Exact details surrounding it are still sketchy, but SoftBank's Masayoshi Son has called it the start of America's "golden age" in tech. Other big names such as Larry Ellison and Sam Altman are apparently into it, too.

Tech stocks on Wall Street including Nvida, Dell, Oracle, and Arm all rallied after the announcement.

Despite the optimism, markets are still keeping a close eye on Trump’s next moves, particularly around the debt ceiling and potential further tariff threats.

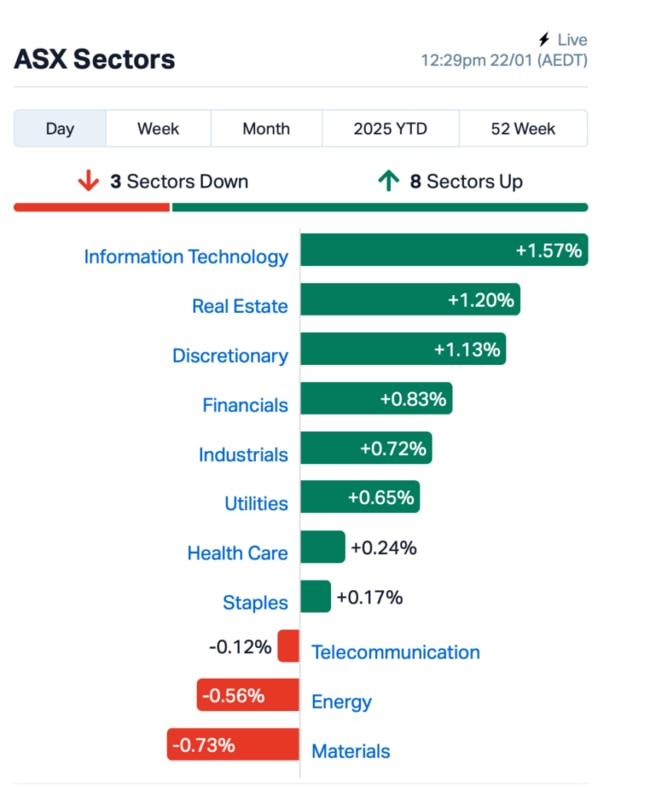

Back to the ASX, eight out of the 11 sectors were in the green this morning, reflecting the "risk-on" mood.

But miners took a hit after Trump floated the idea of imposing a 10% tariff on China, claiming it’s due to China’s role in allegedly sending fentanyl to Mexico and Canada.

That news sent some of our biggest iron ore players like BHP (ASX:BHP) and Fortescue (ASX:FMG) tumbling over 1%.

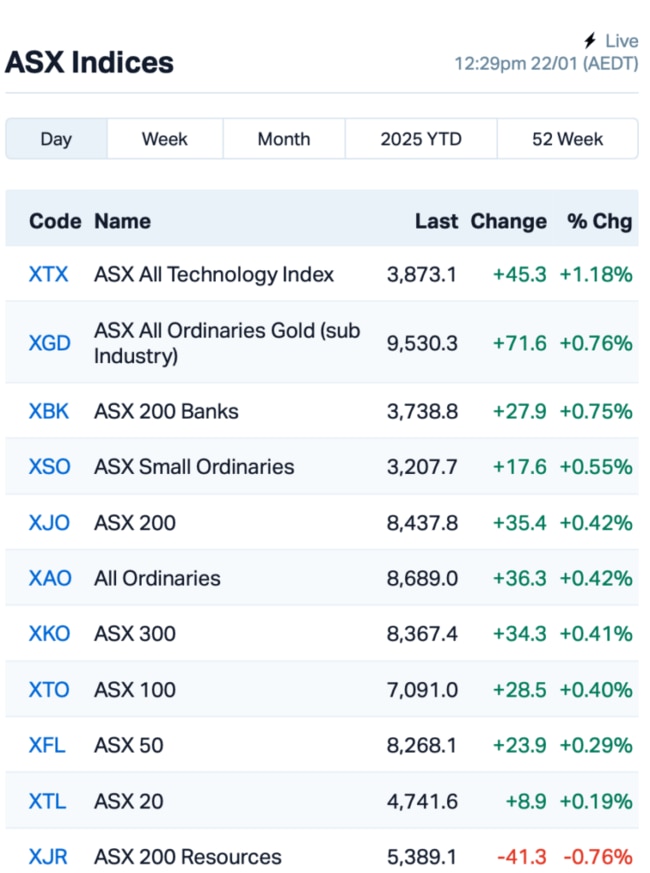

Here’s where things stood at around lunch time AEDT:

In other large caps news, Woodside Energy Group (ASX:WDS) was down 2%, which weighed down the entire energy sector. WDS reported record output for 2024, but its most recent quarter showed a 3% dip in production.

Iluka Resources (ASX:ILU) has crumbled by 9% hit after some mixed results in Q4. While production was solid, exceeding full-year targets, zircon sand sales were down. Prices for Q1 2025 sales are expected to be about 5% lower, the company said.

Uranium player Paladin Energy (ASX:PDN), meanwhile, rose 9% despite a slight dip in production at its Langer Heinrich Mine in Namibia. The production slip was expected, and it didn't stop investors from jumping in.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 22 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| 5GG | Pentanet | 0.055 | 83% | 24,094,141 | $12,995,150 |

| 1TT | Thrive Tribe Tech | 0.003 | 50% | 13,613,978 | $4,063,446 |

| PL3 | Patagonia Lithium | 0.120 | 43% | 2,525,471 | $5,493,663 |

| AUH | Austchina Holdings | 0.002 | 33% | 2,500,000 | $3,600,575 |

| CRB | Carbine Resources | 0.004 | 33% | 212,500 | $1,655,213 |

| GTR | Gti Energy Ltd | 0.004 | 33% | 272,229 | $8,888,849 |

| HLX | Helix Resources | 0.004 | 33% | 3,454,519 | $10,092,581 |

| CMD | Cassius Mining Ltd | 0.019 | 27% | 479,814 | $9,630,667 |

| ADD | Adavale Resource Ltd | 0.003 | 25% | 5,675,599 | $3,081,664 |

| EVR | Ev Resources Ltd | 0.003 | 25% | 301,963 | $3,625,007 |

| MOM | Moab Minerals Ltd | 0.003 | 25% | 193,800 | $3,133,999 |

| BUB | Bubs Aust Ltd | 0.120 | 22% | 22,276,316 | $87,526,744 |

| CR3 | Core Energy Minerals | 0.022 | 22% | 270,463 | $3,012,608 |

| EPM | Eclipse Metals | 0.009 | 21% | 7,604,280 | $16,014,989 |

| TG1 | Techgen Metals Ltd | 0.040 | 21% | 4,364,941 | $5,235,968 |

| EE1 | Earths Energy Ltd | 0.012 | 20% | 3,504,792 | $5,299,642 |

| MRD | Mount Ridley Mines | 0.003 | 20% | 710,940 | $1,946,223 |

| CRI | Criticalim | 0.019 | 19% | 2,409,672 | $43,015,178 |

| EMD | Emyria Limited | 0.038 | 19% | 32,479 | $14,738,861 |

| PXX | Polarx Limited | 0.007 | 17% | 4,682,655 | $14,253,006 |

Pentanet (ASX:5GG), the telco and tech company, flipped from a small loss to a positive EBITDA of $0.6m in Q2. Revenue's up 7% year-on-year, and gaming's booming with a 31% rise in gaming revenue. The 5G side’s picking up steam, too, and the cloud gaming service is smashing it, with ARPU (Average Revenue Per User) up 23%.

Patagonia Lithium (ASX:PL3) dropped a big first resource estimate for its Formentera lithium project in Argentina – 3.8 million tonnes of lithium carbonate equivalent (LCE). The project’s got a 15-year mine life, and further drilling at Cilon is expected to bump up those numbers, said PL3.

Bubs Australia (ASX:BUB) has reported a turnaround in Q2 FY25, from a $6.8m loss last year to a $2.9m positive EBITDA. Revenue’s up 42% to $32.9m, and gross margins improved to 48%. Cash is flowing, with $3.9m in inflows and $17.2m in the bank. On the US front, the FDA trial’s progressing well, with approval expected by October. Bubs also said it’s still on track to hit the $102m revenue forecast this year.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 22 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CNJ | Conico Ltd | 0.008 | -20% | 602,871 | $2,374,873 |

| ECT | Env Clean Tech Ltd. | 0.002 | -20% | 4,938,642 | $7,929,526 |

| M24 | Mamba Exploration | 0.014 | -18% | 45,000 | $3,994,274 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 1,500,071 | $9,518,072 |

| CRR | Critical Resources | 0.005 | -17% | 666,666 | $14,591,779 |

| CUL | Cullen Resources | 0.005 | -17% | 1,265,000 | $4,160,411 |

| ERA | Energy Resources | 0.003 | -17% | 623,141 | $1,216,188,722 |

| RDG | Res Dev Group Ltd | 0.016 | -16% | 42,360 | $56,066,304 |

| DUN | Dundasminerals | 0.033 | -15% | 510,749 | $4,181,515 |

| GNM | Great Northern | 0.013 | -13% | 136,363 | $2,319,436 |

| CRS | Caprice Resources | 0.020 | -13% | 623,559 | $10,189,846 |

| SER | Strategic Energy | 0.007 | -13% | 130,750 | $5,368,267 |

| WBE | Whitebark Energy | 0.007 | -13% | 100,600 | $2,018,668 |

| POS | Poseidon Nick Ltd | 0.004 | -11% | 480,503 | $18,917,512 |

| BRU | Buru Energy | 0.050 | -11% | 222,654 | $43,646,938 |

| SLM | Solismineralsltd | 0.067 | -11% | 86,330 | $5,792,088 |

| CST | Castile Resources | 0.063 | -10% | 120,256 | $20,998,555 |

| ENR | Encounter Resources | 0.270 | -10% | 1,102,647 | $149,637,696 |

| AYT | Austin Metals Ltd | 0.005 | -10% | 200,000 | $6,620,957 |

| HTG | Harvest Tech Grp Ltd | 0.018 | -10% | 1,050,118 | $17,720,979 |

| SPX | Spenda Limited | 0.009 | -10% | 461,703 | $46,152,155 |

| ELS | Elsight Ltd | 0.320 | -10% | 20,140 | $64,269,630 |

IN CASE YOU MISSED IT

North American white hydrogen explorer HyTerra Limited (ASX:HYT) has advised the market it expects to drill at its Nemaha project following Kansas’ winter period which typically runs from December to February.

HyTerra has contracted Murfin Drilling Company – one of the leading drillers in the US’ Midwest region – for a fully funded exploration phase at Nemaha as part of a multi-well campaign targeting key prospects. Fortescue Future Industries Technologies acquired nearly 40% in HyTerra in December for more than $20m.

VHM (ASX:VHM) has officially received endorsement from the Victorian Minister for Planning Sonya Kilkenny for its Environment Effects Statement at the Goschen rare earths and mineral sands project.

The company is now working on mining licence approval, work plan submissions and engineering plans with the expectation of starting construction late this year. First production would then occur in the second half of next year with plans for an initial 1.5Mtpa output before ramping up to 5Mtpa over a three-year period.

At Stockhead, we tell it like it is. While HyTerra and VHM are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as ASX Lunch Wrap: Tech stocks rally after Trump unveils $500bn AI deal