ASX Lunch Wrap: Chinese startup triggers meltdown in Nvidia and ASX’s AI-related stocks

Nasdaq and ASX tech stocks dive as debut of bargain Chinese AI model DeepSeek causes US$590bn Nvidia wipeout.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Chinese AI disruptor tanks Nasdaq and ASX tech stocks

Nvidia drops 17pc as DeepSeek's AI disrupts

Nuix, DigiCo and NextDC face sharp losses

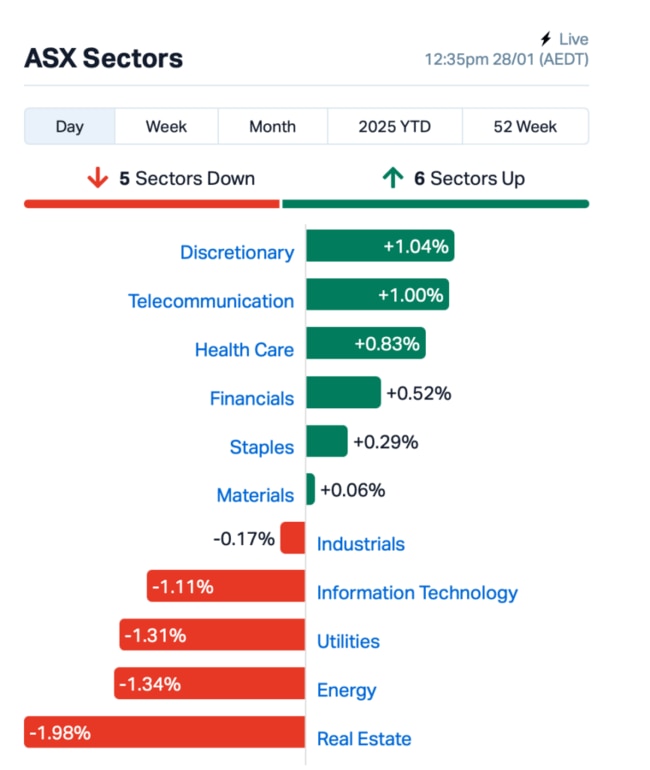

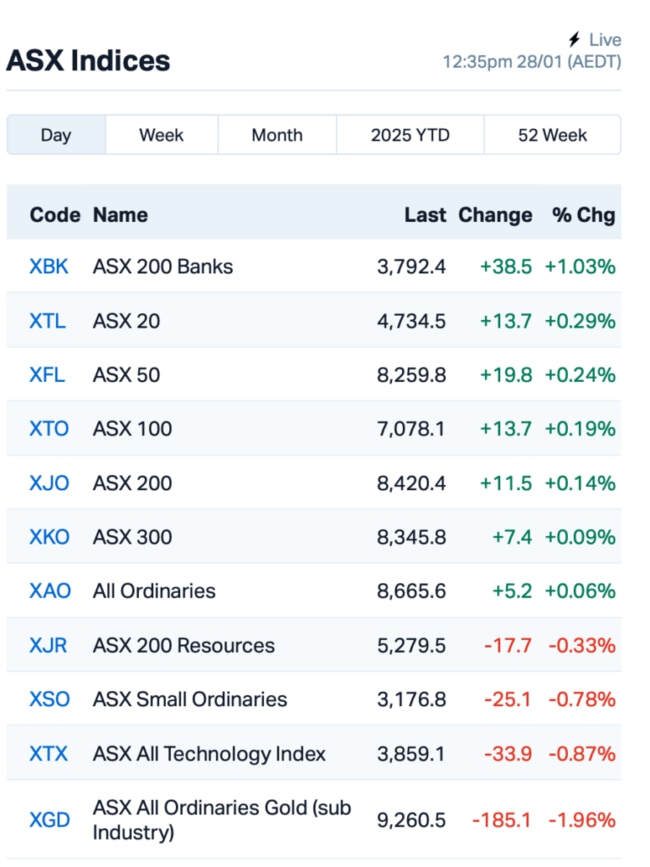

Aussie shares inched higher after the long weekend break, with the S&P/ASX 200 benchmark rising by 0.1% at around lunch time.

But the big action was in tech, as fears over China’s new AI model, DeepSeek, sparked a global tech sell-off.

On Wall Street overnight, the Nasdaq index plummeted by 3%, and Nvidia wiped out hundreds of billions in market cap after crashing 17%.

“This the biggest-ever plunge for a single stock, due to China’s DeepSeek demonstrating to the world it can produce inexpensive, powerful AI models that require less energy,” said moomoo’s Jessica Amir.

DeepSeek, a Chinese AI upstart competitor, has just introduced a new model that experts believe could disrupt the playing field.

The model offers similar capabilities to those of OpenAI but at a much lower cost. It has raised concerns that China is catching up to the US in AI.

DeepSeek’s AI model reportedly cost just US$5.6 million to train, a fraction of the capital spent to develop OpenAI’s GPT.

“So naturally, every man, woman, and their dog are questioning and reassessing everything – from expecting chip demand to slow, to expecting lower energy and uranium requirements to power future data centres," added Amir.

Bring on the trade war: Elon Musk has already accused DeepSeek of lying about how many Nvidia chips it’s managed to stockpile, adding more fuel to the fire in the AI race.

Elon Musk on DeepSeek:

He says, DeepSeek “obviously†has ~50,000 Nvidia H100 chips that they can’t talk about due to US export controls.

Interesting. pic.twitter.com/Og7urnZIi6

— The Kobeissi Letter (@KobeissiLetter) January 27, 2025

Back on the ASX, stocks related to AI were expectedly hit hard this morning, with stocks like NextDC (ASX:NXT) falling 6.5%.

DigiCo Infrastructure REIT (ASX:DGT), a real estate investment trust with a focus on data centres, also dropped 10%.

Meanwhile, Bellevue Gold (ASX:BGL) said it was on track to meet its production guidance of 90,000 ounces for the six months to June 2025. Shares were down 4%.

Fellow gold miner Gold Road Resources (ASX:GOR) saw its shares fall 4.3% after releasing is guidance for the Gruyere mine for 2025, with it and 50-50 JV partner Gold Fields to produce 325,000 – 355,000 ounces at anAISC of between A$2400 and A$2600 an ounce.

Production will range from 335,000 to 375,000ozpa over the next three years, putting it on track to hit its 2Moz produced milestone next year. $15m of drilling is planned this year as Gold Fields and Gold Road seek data to extend the mine's life beyond 2032 via a theoretical underground development.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 28 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| LNU | Linius Tech Limited | 0.002 | 100% | 33,534 | $6,151,216 |

| EVR | Ev Resources Ltd | 0.004 | 75% | 23,394,934 | $3,625,007 |

| YAR | Yari Minerals Ltd | 0.005 | 67% | 12,797,955 | $1,447,073 |

| AJL | AJ Lucas Group | 0.015 | 67% | 4,435,544 | $12,381,567 |

| ASO | Aston Minerals Ltd | 0.015 | 50% | 14,557,682 | $12,950,643 |

| 1TT | Thrive Tribe Tech | 0.003 | 50% | 425,347 | $4,063,446 |

| AYM | Australia United Min | 0.003 | 50% | 357,868 | $3,685,155 |

| CZN | Corazon Ltd | 0.003 | 50% | 170,000 | $2,369,145 |

| RHK | Red Hawk Mining Ltd | 1.195 | 46% | 515,210 | $163,845,413 |

| CTO | Citigold Corp Ltd | 0.004 | 33% | 1,011,021 | $9,000,000 |

| PKO | Peako Limited | 0.004 | 33% | 125,000 | $3,285,425 |

| PRX | Prodigy Gold NL | 0.002 | 33% | 101,000 | $4,762,583 |

| TTI | Traffic Technologies | 0.004 | 33% | 129,490 | $3,461,200 |

| VPR | Voltgroupltd | 0.002 | 33% | 119,014 | $16,074,312 |

| DSE | Dropsuite Ltd | 5.720 | 30% | 2,191,626 | $309,141,329 |

| AQD | Ausquest Limited | 0.044 | 29% | 44,485,328 | $38,417,780 |

| PPL | Pureprofile Ltd | 0.041 | 28% | 4,137,265 | $37,099,989 |

| TRI | Trivarx Ltd | 0.021 | 24% | 2,544,425 | $7,930,468 |

| TOR | Torque Met | 0.070 | 21% | 5,297,194 | $14,480,508 |

| RCL | Readcloud | 0.090 | 20% | 324,183 | $11,072,481 |

EV Resources (ASX:EVR) has secured a deal to acquire 70% of the Los Lirios antimony mine in Oaxaca, Mexico. The mine covers 1652 hectares, and grab samples have shown impressive antimony grades of up to 62.99%. With antimony prices soaring above US$40,000 per tonne, EVR sees this as a rare opportunity in a market with few new low-cost supplies.

Fortescue (ASX:FMG) has made a cash takeover offer for Red Hawk Mining (ASX:RHK) at $1.05 per share, a 28% premium on its last closing price. If FMG secures 75% of Red Hawk shares in the first 7 days, the offer increases to $1.20 per share, a 46% premium. Red Hawk's two largest shareholders control over 80% of the explorer. The Red Hawk board recommends shareholders accept the offer, as it’s deemed fair and reasonable by an independent expert.

Aston Minerals (ASX:ASO) and Torque Metals (ASX:TOR) have announced a merger, creating a combined entity with 1.75 million ounces of gold resources across two top-tier projects. The merger gives both Torque and Aston shareholders 50% ownership each. The Paris Gold Project in WA holds 250,000oz at 3.1g/t, while the Edleston Gold Project in Ontario holds 1.5Moz at 1.0g/t. The deal includes a $1 million investment from key figures Tolga Kumova and Evan Cranston.

In other merger news, tech stock Dropsuite (ASX:DSE) has agreed to an all-cash takeover offer from NinjaOne for $5.90 per share, valuing the company at around $420 million. This offer represents a 34% premium to its last closing price. The Dropsuite board fully backs the deal.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 28 :

Nuix's (ASX:NXL) shares also took a big hit, down 15%, after the company warned of lower earnings in the first half of FY25.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| OB1 | Orbminco Limited | 0.001 | -50% | 314 | $4,333,180 |

| NIM | Nimyresourceslimited | 0.096 | -34% | 2,131,071 | $27,001,721 |

| AOK | Australian Oil. | 0.002 | -33% | 500,000 | $3,005,349 |

| BP8 | Bph Global Ltd | 0.002 | -33% | 20,000 | $1,449,924 |

| VML | Vital Metals Limited | 0.002 | -33% | 41,133 | $17,685,201 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 1,435,876 | $57,867,624 |

| BDM | Burgundy D Mines Ltd | 0.056 | -20% | 4,528,285 | $99,493,259 |

| ALM | Alma Metals Ltd | 0.004 | -20% | 100,006 | $7,931,727 |

| ENV | Enova Mining Limited | 0.004 | -20% | 2,595,000 | $4,924,647 |

| FFF | Forbidden Foods | 0.008 | -20% | 6,170,789 | $5,722,235 |

| GGE | Grand Gulf Energy | 0.002 | -20% | 1,040,000 | $6,125,968 |

| LNR | Lanthanein Resources | 0.002 | -20% | 318,994 | $6,109,090 |

| LOT | Lotus Resources Ltd | 0.205 | -20% | 16,556,522 | $602,476,245 |

| BMN | Bannerman Energy Ltd | 2.600 | -18% | 1,455,366 | $568,534,697 |

| NXL | Nuix Limited | 4.430 | -18% | 1,945,120 | $1,785,959,987 |

| 1AE | Auroraenergymetals | 0.050 | -18% | 480,091 | $10,922,888 |

| ADG | Adelong Gold Limited | 0.005 | -17% | 20,719 | $6,707,934 |

| C7A | Clara Resources | 0.005 | -17% | 50,769 | $2,860,496 |

| DYL | Deep Yellow Limited | 1.215 | -16% | 4,984,271 | $1,414,967,258 |

| AQN | Aquirianlimited | 0.250 | -15% | 233,320 | $23,822,421 |

| C29 | C29Metalslimited | 0.034 | -15% | 510,615 | $6,967,529 |

| I88 | Infini Resources Ltd | 0.600 | -15% | 158,022 | $32,216,680 |

IN CASE YOU MISSED IT

New South Wales explorer Australian Mines (ASX:AUZ) is gearing up to drill at its high-grade scandium Flemington project, which currently holds a 6.3Mt resource at 466ppm scandium.

AUZ will drill out the project for roughly 50 aircore holes with the majority of the campaign focused on infill drilling and to test potential lateral extensions to the resource. The remainder of the drilling will be for exploration and testing the Owendale Intrusive Complex which, outside of AUZ’s tenements, hosts Rio Tinto’s Burra scandium project 4km to the east.

In a bid to boost its manufacturing scale and capabilities, EBR Systems (ASX:EBR) has signed an 11-year commercial lease agreement for a 4751sqm facility.

EBR – which touts itself as the developer of the world’s only wireless cardiac pacing device for heart failure – expects to complete its move into the new Santa Clara facility during H1 2026.

At Stockhead, we tell it like it is. While Australian Mines and EBR Systems are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as ASX Lunch Wrap: Chinese startup triggers meltdown in Nvidia and ASX’s AI-related stocks