ASX Lunch Wrap: Bargain hunters swoop in; Does CPI make RBA rate cut a lock?

ASX rebounds, Aussie CPI drops to 2.4%, and wine exports jump 34% thanks to China.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

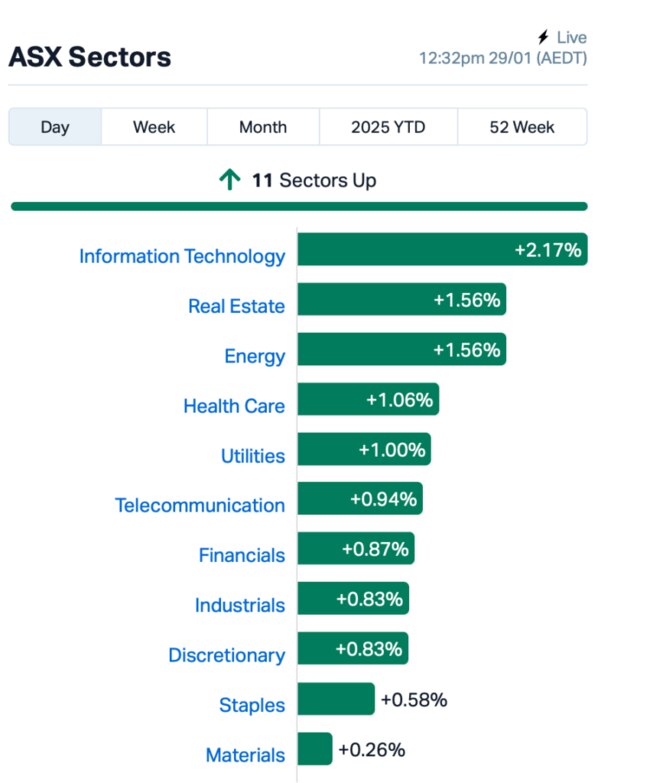

ASX rebounds as tech stocks lead the way

Aussie CPI drops to 2.4pc, rate cut hopes rise

Aussie wine exports surge 34pc, thanks to China

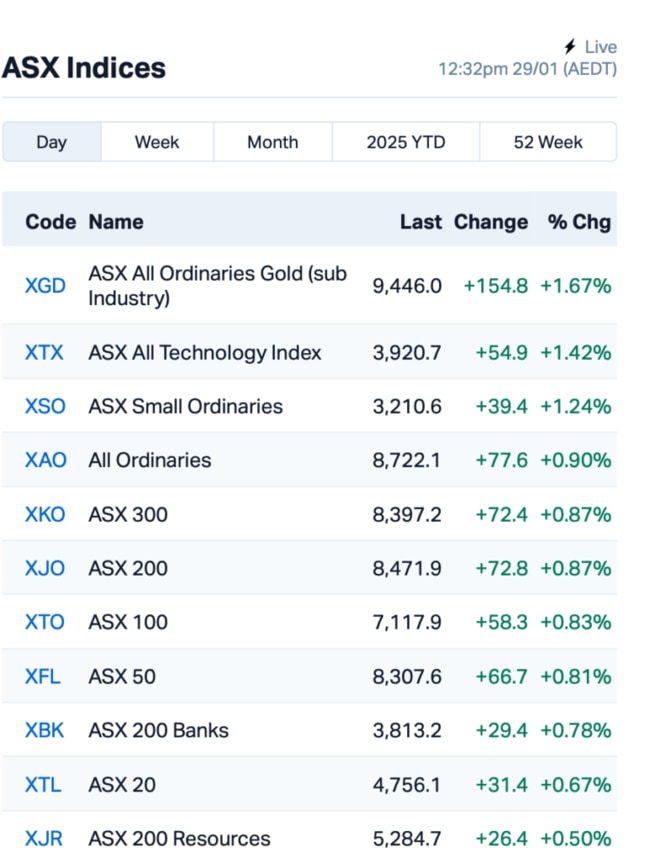

The ASX got off to a strong start on Wednesday, with the S&P/ASX 200 benchmark up by 0.85% at around lunch time.

It was a nice reversal after Tuesday’s sell-off, which hit Aussie tech, utilities, and some real estate stocks.

Overnight, dip buyers scooped up bargains, lifting US tech stocks after a sell-off triggered by worries over DeepSeek AI’s cheaper model.

Nvidia was the big winner, bouncing back by 9% after a 17% crash the day before.

Meanwhile, ABS data this morning shows that the Aussie consumer price index (CPI) eased in the December quarter, coming in at 2.4% year-on-year, down from 2.8% in the previous quarter. It was also lower than the 2.5% economists were expecting.

Analysts say this could play into the RBA’s decision-making, with bond traders now betting big on a rate cut in February.

But some are still not convinced.

"For the RBA to have absolute confidence that core inflationary pressures are under control, we believe there is an outside chance that they may wait to see at least another consecutive CPI trimmed mean quarterly annualised print below 3% (due in April) before making a move," said Cameron McCormack at VanEck.

Elsewhere, there’s some good news for Aussie wine. Exports soared 34% to $2.55 billion in 2024, driven by China lifting its tariffs, with sales to China alone rising by $898 million.

Back to the ASX, and tech was the star this morning as it lifted the market with big names like WiseTech Global (ASX:WTC) jumping 3.5%.

The mining sector, however, didn't too well as Trump’s ongoing tough talk on trade weighed on market sentiment.

This is how things looked this morning:

In the large caps space, Pilbara Minerals (ASX:PLS)’s output dipped in the December quarter, falling to 188,200 tonnes of spodumene concentrate, down from 220,100 tonnes. Shares were nevertheless up by 3% as production and pricing beat consensus estimates.

Boss Energy (ASX:BOE) is riding high, up by 12% after announcing it's on track to meet its production guidance of 850,000lb U3O8 drummed for the year.

And big news from Star Entertainment Group (ASX:SGR): It’s selling off several Sydney assets, including the Star Sydney Event Centre, for $60 million as it undergoes a liquidity crunch. Shares jumped 6%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 29 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| LNU | Linius Tech Limited | 0.002 | 100% | 33,534 | $6,151,216 |

| EVR | Ev Resources Ltd | 0.004 | 75% | 23,394,934 | $3,625,007 |

| YAR | Yari Minerals Ltd | 0.005 | 67% | 12,797,955 | $1,447,073 |

| AJL | AJ Lucas Group | 0.015 | 67% | 4,435,544 | $12,381,567 |

| ASO | Aston Minerals Ltd | 0.015 | 50% | 14,557,682 | $12,950,643 |

| 1TT | Thrive Tribe Tech | 0.003 | 50% | 425,347 | $4,063,446 |

| AYM | Australia United Min | 0.003 | 50% | 357,868 | $3,685,155 |

| CZN | Corazon Ltd | 0.003 | 50% | 170,000 | $2,369,145 |

| RHK | Red Hawk Mining Ltd | 1.195 | 46% | 515,210 | $163,845,413 |

| CTO | Citigold Corp Ltd | 0.004 | 33% | 1,011,021 | $9,000,000 |

| PKO | Peako Limited | 0.004 | 33% | 125,000 | $3,285,425 |

| PRX | Prodigy Gold NL | 0.002 | 33% | 101,000 | $4,762,583 |

| TTI | Traffic Technologies | 0.004 | 33% | 129,490 | $3,461,200 |

| VPR | Voltgroupltd | 0.002 | 33% | 119,014 | $16,074,312 |

| DSE | Dropsuite Ltd | 5.720 | 30% | 2,191,626 | $309,141,329 |

| AQD | Ausquest Limited | 0.044 | 29% | 44,485,328 | $38,417,780 |

| PPL | Pureprofile Ltd | 0.041 | 28% | 4,137,265 | $37,099,989 |

| TRI | Trivarx Ltd | 0.021 | 24% | 2,544,425 | $7,930,468 |

| TOR | Torque Met | 0.070 | 21% | 5,297,194 | $14,480,508 |

| RCL | Readcloud | 0.090 | 20% | 324,183 | $11,072,481 |

Bio-Gene Technology (ASX:BGT)’s shares popped after scoring two grants from the US Department of Defense worth a total of $3 million. The first grant, $1.6m, will help develop a wearable device using Bio-Gene's Flavocide to control mosquitoes and other disease-carrying insects. The second, $1.4m, will fund a sprayable version of Qcide to tackle flies and bed bugs. These grants are part of the US military’s effort to protect troops from insect-borne diseases.

Hamelin Gold (ASX:HMG) ’s recent soil sampling at its Anderson project in WA has uncovered strong gold signals, pointing to a potential bedrock gold source. The company’s use of the Ultrafine (UFF) tech has identified new gold zones, alongside historical anomalies, and the results are promising. The company is now expanding its field trials, with more sampling underway and a new tenement application to the east.

PVW Resources (ASX:PVW) has appointed Lucas Stanfield as its new CEO, starting 3rd February. Stanfield brings heaps of experience in rare earth projects, having previously developed the Ngualla Rare Earth Project in Tanzania and led a deposit from discovery to production at WA1. The Board said they’re excited to have him on board as PVW focuses on advancing its Brazilian rare earth projects.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 29 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| OB1 | Orbminco Limited | 0.001 | -50% | 314 | $4,333,180 |

| NIM | Nimyresourceslimited | 0.096 | -34% | 2,131,071 | $27,001,721 |

| AOK | Australian Oil. | 0.002 | -33% | 500,000 | $3,005,349 |

| BP8 | Bph Global Ltd | 0.002 | -33% | 20,000 | $1,449,924 |

| VML | Vital Metals Limited | 0.002 | -33% | 41,133 | $17,685,201 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 1,435,876 | $57,867,624 |

| BDM | Burgundy D Mines Ltd | 0.056 | -20% | 4,528,285 | $99,493,259 |

| ALM | Alma Metals Ltd | 0.004 | -20% | 100,006 | $7,931,727 |

| ENV | Enova Mining Limited | 0.004 | -20% | 2,595,000 | $4,924,647 |

| FFF | Forbidden Foods | 0.008 | -20% | 6,170,789 | $5,722,235 |

| GGE | Grand Gulf Energy | 0.002 | -20% | 1,040,000 | $6,125,968 |

| LNR | Lanthanein Resources | 0.002 | -20% | 318,994 | $6,109,090 |

| LOT | Lotus Resources Ltd | 0.205 | -20% | 16,556,522 | $602,476,245 |

| BMN | Bannerman Energy Ltd | 2.600 | -18% | 1,455,366 | $568,534,697 |

| NXL | Nuix Limited | 4.430 | -18% | 1,945,120 | $1,785,959,987 |

| 1AE | Auroraenergymetals | 0.050 | -18% | 480,091 | $10,922,888 |

| ADG | Adelong Gold Limited | 0.005 | -17% | 20,719 | $6,707,934 |

| C7A | Clara Resources | 0.005 | -17% | 50,769 | $2,860,496 |

| DYL | Deep Yellow Limited | 1.215 | -16% | 4,984,271 | $1,414,967,258 |

| AQN | Aquirianlimited | 0.250 | -15% | 233,320 | $23,822,421 |

| C29 | C29Metalslimited | 0.034 | -15% | 510,615 | $6,967,529 |

| I88 | Infini Resources Ltd | 0.600 | -15% | 158,022 | $32,216,680 |

IN CASE YOU MISSED IT

Explorer White Cliff Minerals (ASX:WCN) has received all remaining permits and approvals to kick off drilling at its Rae copper project in Canada’s Nunavut region.

This maiden drilling campaign follows on from the discovery of high-priority targets generated from a field program, where WCN uncovered impressive rock chips assaying beyond 60%. Drilling is expected to begin in March, initially focusing on the Hulk Sedimentary prospect and the Danvers project area.

At Stockhead, we tell it like it is. While White Cliff Minerals is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as ASX Lunch Wrap: Bargain hunters swoop in; Does CPI make RBA rate cut a lock?