ASX Lunch Wrap: ASX slips but tech soars, Fortescue hits record shipments and AusQuest’s Peru copper find

ASX slips despite Wall Street bounce, tech stocks shine after Netflix surge, Musk calls out Trump’s AI plan.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX falls but tech jumps after Netflix soars

Musk questions trump’s AI plan

Fortescue hits record, Myer merges with Premier’s clothing brands and AusQuest surges on Peru copper hit

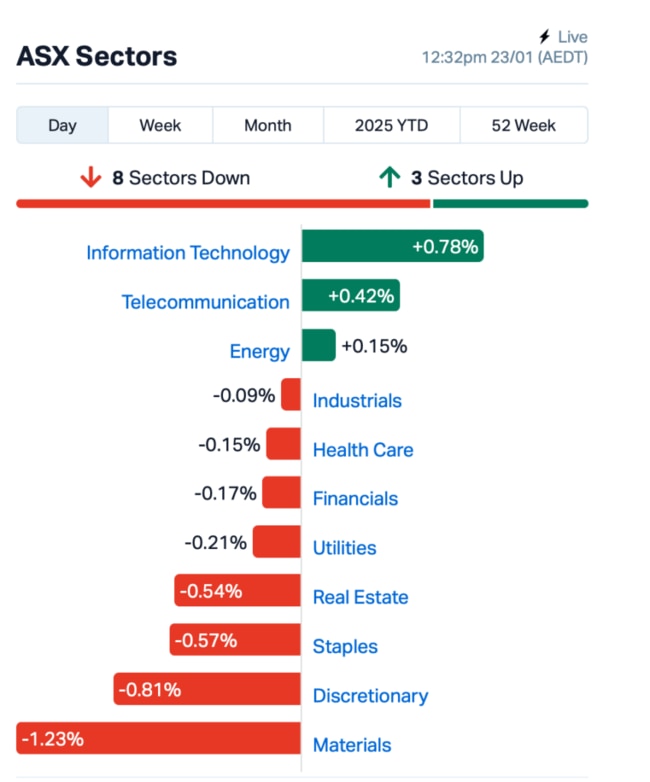

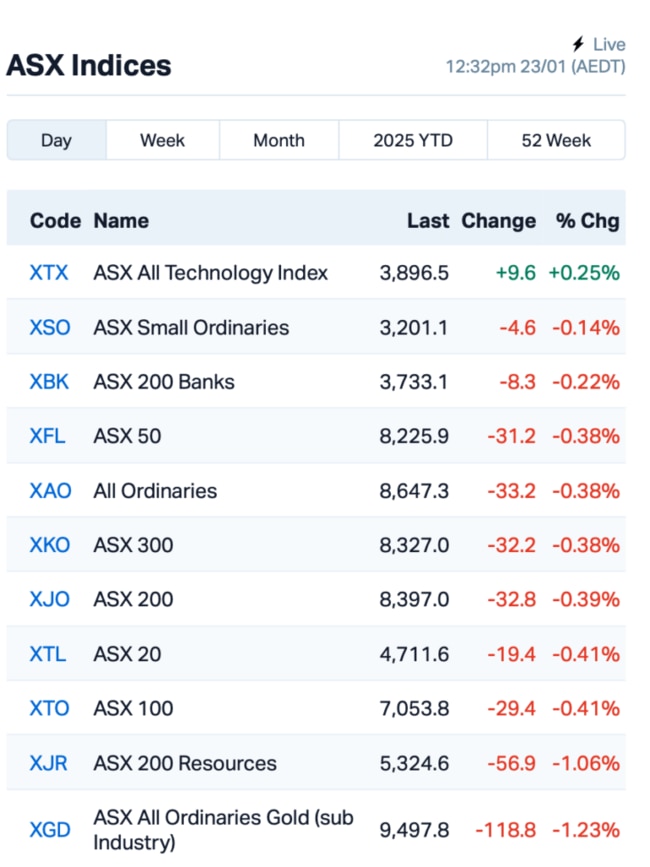

The ASX opened in the red on Thursday, down by 0.5% despite a solid performance from Wall Street overnight.

Weaker commodity prices dragged down mining stocks this morning, while tech stocks found themselves in the spotlight after Netflix posted a stellar earnings report.

The tech-heavy Nasdaq led the charge on Wall Street overnight after Netflix surged by 10%, sending the index closer to its record high.

Meanwhile, oil prices took a hit as US crude stockpiles saw their first rise since mid-November.

On a different note, Elon Musk is throwing shade on Trump’s $100b AI plan, claiming SoftBank, one of Trump’s partners, won’t have the cash to back it.

And... at 94, Warren Buffett said he wants to scale back on public appearances, saying no more interviews. “Father time always wins,” he said.

When asked about his successor, Buffett said he's all in on Greg Abel taking the reins at Berkshire Hathaway when the time comes.

Back to the ASX, this is where things stood at around lunch time:

In the large end of town, Fortescue (ASX:FMG) posted record iron ore shipments for the first half of FY25, despite challenges from wet weather in the Pilbara. The miner shipped 49.4 million tonnes of iron ore in the December quarter, contributing to 97.1 million tonnes for the half-year. Shares tumbled 2%.

"2Q cash generation was weaker than expected; however, this appears to have been impacted by a large working cap increase, which we expect will unwind in 2H. Given the strong shipment performance and better unit cost performance, we anticipate small consensus earnings/FCF FY25 upgrades, particularly given the AUD tailwind," RBC analyst Kaan Peker said.

Santos (ASX:STO) saw a 10% rise in its December quarter revenue, hitting US$1.4 billion, but the company’s full-year performance fell short of last year’s figures, with a 9% drop in revenue to US$5.4 billion.

Finally, a major shake-up is about to hit Australian retail. Myer (ASX:MYR)’s proposed merger with Solomon Lew’s Premier Investments (ASX:PMV)’ portfolio of clothing brands was overwhelmingly approved by shareholders.

The deal will create a retail giant with 783 stores and over 17,000 staff. Under the deal, Myer will acquire brands like Just Jeans and Jay Jays, and Premier shareholders will receive Myer shares.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 23 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| HYD | Hydrix Limited | 0.030 | 200% | 42,646,184 | $2,727,688 |

| AQD | Ausquest Limited | 0.022 | 175% | 62,090,409 | $9,039,478 |

| BP8 | Bph Global Ltd | 0.003 | 50% | 355,428 | $946,616 |

| IFG | Infocusgroup Hldltd | 0.021 | 31% | 13,871,476 | $2,627,389 |

| ICE | Icetana Limited | 0.019 | 27% | 4,244,488 | $3,969,427 |

| 1TT | Thrive Tribe Tech | 0.003 | 25% | 121,924 | $4,063,446 |

| ERA | Energy Resources | 0.003 | 25% | 1,171,000 | $810,792,482 |

| RKT | Rocketdna Ltd. | 0.013 | 24% | 6,810,620 | $9,289,917 |

| NIM | Nimyresourceslimited | 0.135 | 23% | 899,828 | $20,484,064 |

| AX8 | Accelerate Resources | 0.011 | 22% | 3,168,929 | $5,595,785 |

| ADG | Adelong Gold Limited | 0.006 | 20% | 2,258,945 | $5,589,945 |

| RDG | Res Dev Group Ltd | 0.019 | 19% | 213,094 | $47,213,730 |

| AU1 | The Agency Group Aus | 0.021 | 17% | 90,800 | $7,912,379 |

| AVE | Avecho Biotech Ltd | 0.004 | 17% | 138,960 | $9,507,891 |

| IXR | Ionic Rare Earths | 0.007 | 17% | 320,748 | $31,370,570 |

| WEC | White Energy Company | 0.036 | 16% | 1,500 | $6,168,513 |

| MEG | Megado Minerals Ltd | 0.015 | 15% | 82,427 | $5,455,882 |

| PTX | Prescient Ltd | 0.060 | 15% | 1,873,285 | $41,876,629 |

| T92 | Terrauraniumlimited | 0.046 | 15% | 11,272 | $3,478,838 |

| G88 | Golden Mile Res Ltd | 0.008 | 14% | 7,488,421 | $3,309,760 |

AusQuest (ASX:AQD) shares surged over 200% after announcing a major copper-gold discovery at its Cangallo project in Peru. The first drill results show broad zones of copper and gold, with thick porphyry intercepts including 348 metres at 0.26% copper and 0.06ppm gold. The mineralisation starts near surface and is open in all directions, suggesting the potential for a shallow copper oxide resource.

Hydrix (ASX:HYD), a provider of engineering solutions for the medical and tech sectors, has announced a $2.8m contract extension with European medical device company Paul Hartmann AG. Total revenue from the project will now be around $6.5m, following on from previous stages. Shares almost tripled on the news.

BPH Global (ASX:BP8) has wrapped up its Indonesian seaweed joint venture. The company has acquired assets from local partners in Indonesia and is now focused on expanding into Asian markets with raw seaweed sales and developing bio-stimulant products for India.

InFocus Group Holdings (ASX:IFG) has received $500k in cash from its digital gaming project, VigoBet, as it nears the end of the first phase. The full phase is expected to bring in $1.2 million, with the remaining balance due once completed this quarter. Positive feedback from GBO Assets suggests the project will move into the second phase soon.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 23 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ADD | Adavale Resource Ltd | 0.002 | -33% | 57,059 | $4,622,496 |

| VML | Vital Metals Limited | 0.002 | -33% | 504,688 | $17,685,201 |

| OB1 | Orbminco Limited | 0.002 | -25% | 1 | $4,333,180 |

| PRS | Prospech Limited | 0.021 | -22% | 148,549 | $8,878,299 |

| BNL | Blue Star Helium Ltd | 0.004 | -20% | 289,802 | $13,474,426 |

| EVR | Ev Resources Ltd | 0.002 | -20% | 48,000 | $4,531,258 |

| GMN | Gold Mountain Ltd | 0.002 | -20% | 20,693 | $11,448,058 |

| LNR | Lanthanein Resources | 0.002 | -20% | 50,000 | $6,109,090 |

| NHE | Nobleheliumlimited | 0.039 | -19% | 2,553,048 | $27,689,692 |

| EQR | Eq Resources Limited | 0.031 | -18% | 12,215,638 | $88,731,233 |

| CPO | Culpeominerals | 0.017 | -15% | 33,724 | $4,399,244 |

| BUY | Bounty Oil & Gas NL | 0.003 | -14% | 103,258 | $5,244,753 |

| OLY | Olympio Metals Ltd | 0.030 | -14% | 7,043 | $3,044,176 |

| PSL | Paterson Resources | 0.012 | -14% | 121,832 | $6,384,530 |

| SKK | Stakk Limited | 0.006 | -14% | 2,320,423 | $14,525,558 |

| OCT | Octava Minerals | 0.113 | -13% | 272,502 | $7,931,210 |

| BCB | Bowen Coal Limited | 0.007 | -13% | 1,630,100 | $86,204,221 |

| CAV | Carnavale Resources | 0.004 | -13% | 6,506,750 | $16,360,874 |

| GSM | Golden State Mining | 0.007 | -13% | 2,222 | $2,234,965 |

| GTR | Gti Energy Ltd | 0.004 | -13% | 347,905 | $11,851,799 |

| CVR | Cavalierresources | 0.105 | -13% | 3,334 | $6,941,066 |

| MRR | Minrex Resources Ltd | 0.008 | -11% | 191,559 | $9,763,808 |

IN CASE YOU MISSED IT

Firetail Resources (ASX:FTL) has offloaded rights at one of its non-core assets to Spartan Resources (ASX:SPR) so it can inject more cash into exploring the Skyline copper project in Canada.

Firetail will receive $275,000 from Spartan for the lithium rights at its Yalgoo, Egerton and Dalgaranga projects in Western Australia. The Canadian-focused explorer is also open to leveraging its ownership at the Paterson copper-gold-uranium project and Mt Slopeway nickel-cobalt project to further bolster its position at Skyline.

At Stockhead, we tell it like it is. While Firetail Resources and Spartan Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as ASX Lunch Wrap: ASX slips but tech soars, Fortescue hits record shipments and AusQuest’s Peru copper find