ASX Lunch Wrap: ASX lifts; Star tumbles; Trump (and his volatile meme coin) firmly in focus

ASX climbs as Trump (and his official meme coin) grabs spotlight; miners surge on iron ore boost; Bitcoin dips and Star Entertainment drops.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX moves higher as Trump prepares to take centre stage

Miners rally as iron ore prices spike

Bitcoin drops, Star Entertainment tumbles

The Aussie market started the week with a modest bump, pushing the S&P/ASX 200 up 0.45% at around midday, Monday.

Investors were cautious yet curious about the possible market shake-ups as Donald Trump prepared to return to the White House. His inauguration is scheduled for Tuesday morning, AEDT.

As the world awaits his first moves, especially around trade tariffs and China relations, all eyes are on the potential effects on the stock market.

“US stocks are protected by Trump from downside,” strategist Michael Hartnett predicted in a note.

Historically, the market has done well after a new president’s inauguration, with the S&P 500 typically rising 3.7% in the three months following.

But Bitcoin, after rallying past US$106,000, couldn’t hold on, dropping back below US$100,000 a little earlier. It's just ticked back above that psychological level as this is typed.

Some strange things are afoot in the world of crypto at the moment, with the president elect officially launching a 'meme coin' on Friday – $TRUMP – built on the Solana network. By Sunday, the coin had surged to a ridonculous market cap above US$13 billion.

My NEW Official Trump Meme is HERE! It’s time to celebrate everything we stand for: WINNING! Join my very special Trump Community. GET YOUR $TRUMP NOW. Go to https://t.co/GX3ZxT5xyq — Have Fun! pic.twitter.com/flIKYyfBrC

— Donald J. Trump (@realDonaldTrump) January 18, 2025

The crypto world has so far had a mixed reaction to the emergence of this surprise new digital offering, with some lauding a new bullish era of crypto freedom in the US, while plenty of others have been questioning the ethics surrounding the incoming US president's involvement in launching a highly speculative crypto bearing his name, just days out from his inauguration.

According to the Trump meme coin website, a Trump-owned company called CIC Digital LLC owns 80% of the coin’s supply of 200m tokens. That supply is slated to increase to 1bn over three years.

$TRUMP has pulled back a fair bit today, but still boasts a sky-high market cap valuation near US$10bn at the time of writing.

News just in, erm, there's now a $MELANIA meme coin now, too. Officially endorsed by the new First Lady. All we really have time to add about this is… enter at own risk and absolutely buyer beware.

Back to perhaps slightly less volatile affairs, local investors have certainly been watching the ASX and global markets closely, with miners leading the charge on the local bourse this morning.

Iron ore prices spiked to US$104 a tonne, sending major miners like Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG) higher.

This came despite Tropical Cyclone Sean, with winds reaching 185 km/h, forcing the closure of key iron ore ports in the Pilbara, including Port Hedland, Australia’s largest iron ore export hub.

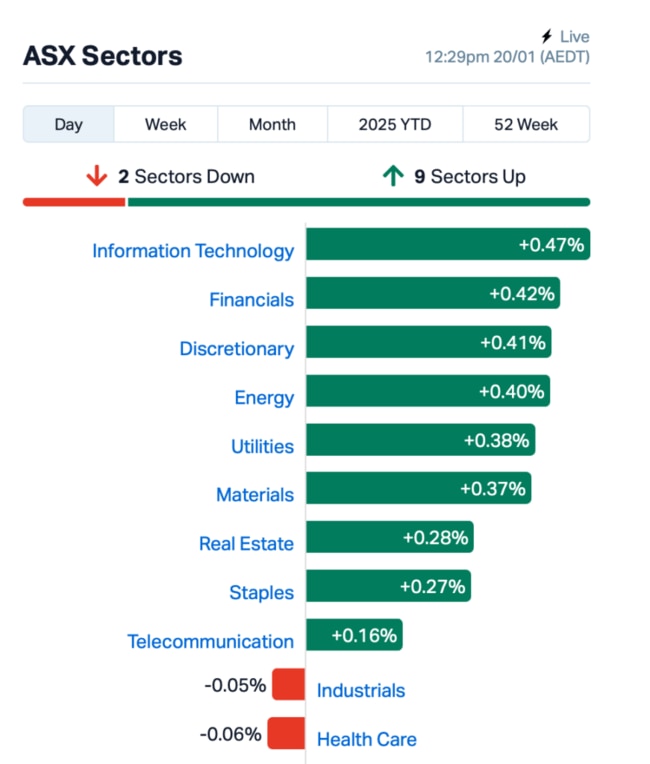

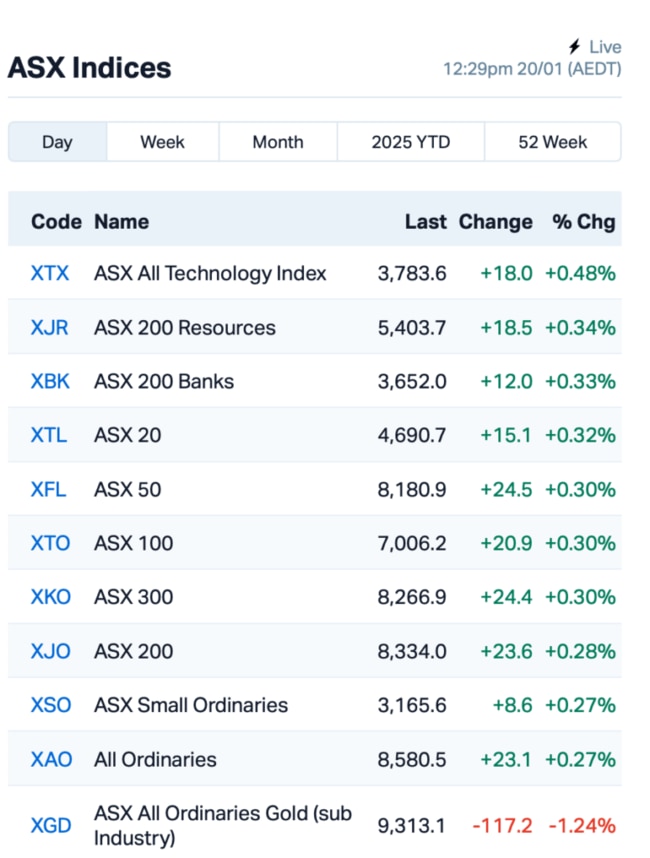

So this is where the ASX stood at around lunch time:

In the larger end of town, Star Entertainment Group (ASX:SGR) suffered another 7% dip after reminding investors of its financial distress in its quarterly report.

Financial data company Iress (ASX:IRE) made headlines with a 4.5% jump after announcing it’s selling its superannuation business to Apex for $40 million.

Meanwhile, fund manager Australian Ethical Investment (ASX:AEF) posted record assets under management, reaching $13.26 billion, but shares still fell 3%.

And, IGO (ASX:IGO) said it was bracing for a loss from its West Australian lithium plant. The Kwinana Lithium Hydroxide Refinery, owned 49% by IGO, is struggling amid falling prices. Shares, however, lifted 2%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 20 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| SP8 | Streamplay Studio | 0.011 | 38% | 12,926,756 | $9,204,990 |

| NIM | Nimyresourceslimited | 0.120 | 25% | 630,704 | $17,877,001 |

| MEL | Metgasco Ltd | 0.005 | 25% | 107,851 | $5,830,347 |

| MSG | Mcs Services Limited | 0.005 | 25% | 899,720 | $792,399 |

| TEM | Tempest Minerals | 0.005 | 25% | 1,342,447 | $2,538,119 |

| TSL | Titanium Sands Ltd | 0.005 | 25% | 2,176,658 | $8,846,989 |

| E25 | Element 25 Ltd | 0.335 | 24% | 2,003,988 | $59,376,348 |

| FND | Findi Limited | 4.630 | 23% | 276,661 | $184,620,591 |

| SUH | Southern Hem Min | 0.032 | 23% | 482,941 | $19,142,241 |

| PUA | Peak Minerals Ltd | 0.014 | 23% | 13,017,394 | $28,073,213 |

| VR8 | Vanadium Resources | 0.034 | 21% | 793,852 | $15,753,506 |

| 3DP | Pointerra Limited | 0.060 | 20% | 19,213,541 | $40,253,840 |

| ALM | Alma Metals Ltd | 0.006 | 20% | 83,333 | $7,931,727 |

| AOK | Australian Oil. | 0.003 | 20% | 450,000 | $2,504,457 |

| MRD | Mount Ridley Mines | 0.003 | 20% | 174,557 | $1,946,223 |

| TZL | TZ Limited | 0.048 | 20% | 65,000 | $10,611,231 |

| AVM | Advance Metals Ltd | 0.045 | 18% | 4,266,194 | $6,402,969 |

| CAY | Canyon Resources Ltd | 0.225 | 18% | 4,795,141 | $269,208,014 |

| TAL | Talius Group Limited | 0.010 | 18% | 4,755,465 | $24,339,635 |

| XRG | Xreality Group Ltd | 0.040 | 18% | 1,133,293 | $19,349,415 |

Element 25 (ASX:E25) rallied after securing a US$166 million grant from the U.S. Department of Energy to build a high-purity manganese facility in Louisiana. The project, set to kick off in April, will help boost domestic production of key battery materials. This funding adds to the US$115 million already committed by General Motors and Stellantis.

Findi (ASX:FND) has agreed to acquire BankIT Services for $30 million, marking a major step towards becoming a fully-fledged payments bank in India. BankIT, a digital financial products distributor, will help accelerate Findi’s growth with its extensive merchant network and tech solutions. The acquisition brings Findi closer to its goal of reaching 200,000 merchant locations by March.

The 3D geospatial data management and analytics company, Pointerra (ASX:3DP), said its Q2 growth stayed strong, with new customers signing up and existing ones expanding their licences. With the new photogrammetric tools and a partnership with Teledyne Geospatial, 3DP is said it’s gearing up for big moves in North America, especially in the aerial survey market.

Advance Metals (ASX:AVM) is kicking off on-ground work at its Yoquivo Silver Project in Mexico, after acquiring the site from Golden Minerals. The project hosts high-grade silver and gold systems, with drilling results showing hits like 5,260g/t silver and 34g/t gold.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 20 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.001 | -50% | 683,091 | $8,219,752 |

| MMR | Mec Resources | 0.003 | -40% | 5,365,750 | $9,159,035 |

| MOM | Moab Minerals Ltd | 0.002 | -33% | 11,623,655 | $4,700,998 |

| SFG | Seafarms Group Ltd | 0.001 | -33% | 5,497 | $7,254,899 |

| ERL | Empire Resources | 0.003 | -25% | 790,000 | $5,935,653 |

| OB1 | Orbminco Limited | 0.002 | -25% | 3,171,787 | $4,333,180 |

| FDV | Frontier Digital Ltd | 0.220 | -21% | 1,234,431 | $121,402,455 |

| AHN | Athena Resources | 0.004 | -20% | 265,000 | $10,016,007 |

| TMK | TMK Energy Limited | 0.002 | -20% | 29,380 | $23,313,913 |

| 1AE | Auroraenergymetals | 0.051 | -18% | 213,104 | $11,101,952 |

| ERA | Energy Resources | 0.003 | -17% | 107,373 | $1,216,188,722 |

| RGT | Argent Biopharma Ltd | 0.170 | -15% | 86,685 | $11,854,454 |

| DY6 | Dy6Metalsltd | 0.035 | -15% | 58,887 | $2,066,844 |

| DDT | DataDot Technology | 0.003 | -14% | 200,000 | $4,238,335 |

| EPM | Eclipse Metals | 0.006 | -14% | 1,000,000 | $16,014,989 |

| RMI | Resource Mining Corp | 0.006 | -14% | 971 | $4,566,435 |

| TAS | Tasman Resources Ltd | 0.006 | -14% | 432,000 | $5,636,747 |

| WNR | Wingara Ag Ltd | 0.006 | -14% | 150,000 | $1,228,798 |

| MQR | Marquee Resource Ltd | 0.013 | -13% | 402,934 | $6,245,766 |

| BPH | BPH Energy Ltd | 0.010 | -13% | 7,194,823 | $14,009,677 |

| PLC | Premier1 Lithium Ltd | 0.007 | -13% | 2,577,275 | $2,944,485 |

| AUA | Audeara | 0.036 | -12% | 55,533 | $7,180,851 |

IN CASE YOU MISSED IT

CuFe (ASX:CUF) has appointed David Palmer to its board as a non-executive director. Palmer is a geologist by trade and has nearly 40 years’ experience in the global exploration industry, having spent the majority of his career with Rio Tinto Exploration searching for copper, gold, base metals, industrial minerals, uranium, iron ore and diamonds.

Palmer’s work with Rio Tinto has taken him across Australia and the Asia/Pacific regions, including working in the management team that discovered the world-class Winu copper-gold deposit in the Pilbara.

Regenerative medicine company Orthocell (ASX:OCC) has received a $3.18m R&D tax incentive refund from the Australian Government. Following today’s rebate, Orthocell now holds roughly $33m cash in the bank, putting it in a favourable position to continue the commercialisation strategy of its Remplir product – designed to assist in peripheral nerve repair.

Orthocell is expecting US FDA clearance for sales of Remplir by late March or early April this year, allowing it to tap into a US$1.6bn market.

Explorer Belararox (ASX:BRX) has kicked off maiden drilling at its Toro-Malambo-Tambo project in Argentina’s San Juan province, testing a large porphyry copper-gold target identified by 3D modelling. The first hole is planned to burrow roughly 1,300m deep as part of a total 6,000m drill program expected to finish by the end of April this year.

The Belararox team say fieldworks at the Tambo South target have identified encouraging signs of porphyry-style veining within zoned hydrothermal alteration – coincident with “classic porphyry-style geochemical anomalies”.

At Stockhead, we tell it like it is. While CuFe, Orthocell and Belararox are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as ASX Lunch Wrap: ASX lifts; Star tumbles; Trump (and his volatile meme coin) firmly in focus