ASX Lunch Wrap: ASX jumps as banks, BHP and Trump spark investor optimism

ASX lifts with banks, BHP; Trump boosts markets, Liontown triples output and Northern Star is on track.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX opens higher with banks and BHP leading

Trump’s trade stance lifts market

Liontown triples output, Northern Star on track

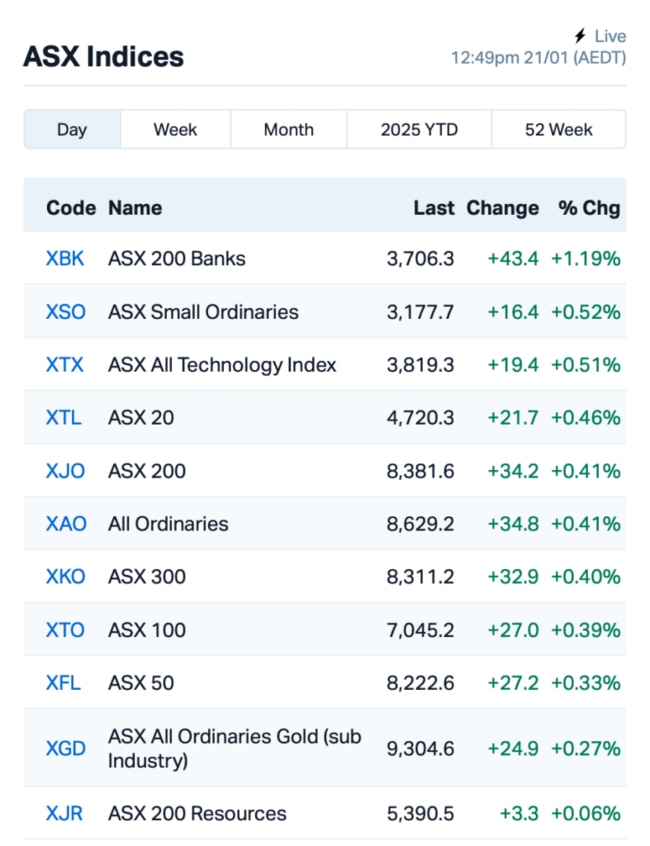

The ASX opened higher on Tuesday, with the S&P/ASX 200 index climbing 0.5% by around lunch time AEDT, with banks the standout performers.

The market was given a boost by a wave of relief after US President Donald Trump’s first day in office.

There were fears he'd hit the US’s key trading partners with tariffs right away, but instead, he opted to hold off and asked for a review of trade policies with China, Canada and Mexico.

“Trump is pretty mercurial and it all could change in a Twitter post, but for now, it’s filling investors with confidence that the worst of the trade war may not materialise,” said Kyle Rodda at Capital.com.

This lifted markets globally, with the Australian dollar also gaining, reaching US62.40 cents at the time of writing.

Wall Street was closed last night for Martin Luther King Jr. Day, but with a more 'risk-on' mood taking hold, investors are expected to pile back into stocks.

Oil prices, however, came under pressure after Trump vowed to boost domestic oil and gas production, saying "Drill, baby, drill" in his inauguration speech, while also promising to pull the US out of the Paris climate agreement.

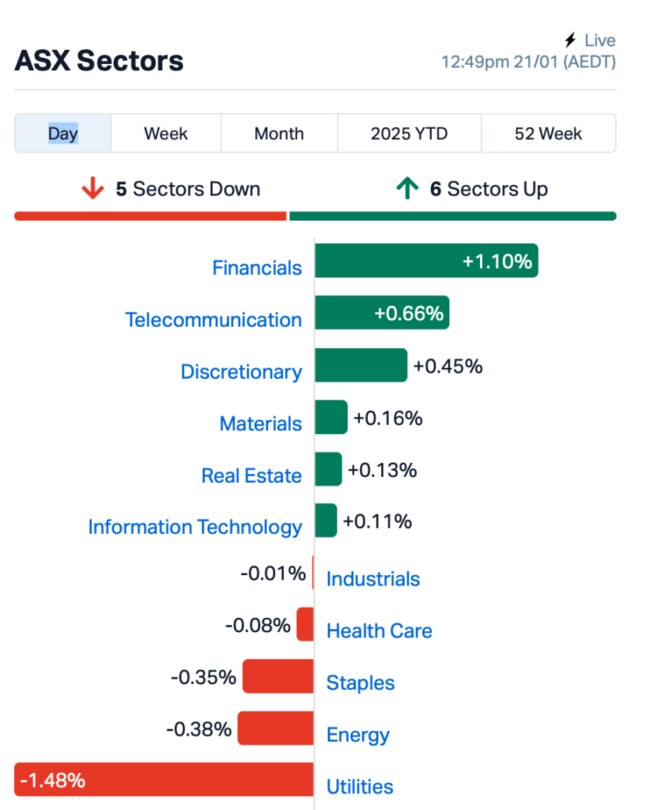

Back home, this is how things looked on the ASX close to 1pm AEDT:

BHP (ASX:BHP) grabbed attention with its production numbers, posting a 10% increase in copper output, largely thanks to a record performance at its Escondida mine. While coal and nickel production slipped, the copper surge helped keep BHP on the front foot today.

Northern Star Resources (ASX:NST) kept things steady with its gold production. The company said it sold over 400,000 ounces of gold in the December quarter at an all-in-sustaining cost of $2,128 per ounce. It also said it was on track to hit annual targets.

Still in large caps, Liontown Resources' (ASX:LTR) production tripled in the December quarter as the company looks to “become an established world-class producer in the lithium sector”.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 21 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.002 | 100% | 3,198,468 | $28,933,812 |

| SFG | Seafarms Group Ltd | 0.002 | 100% | 287,959 | $4,836,599 |

| TTI | Traffic Technologies | 0.005 | 67% | 12,069,302 | $3,461,200 |

| OB1 | Orbminco Limited | 0.002 | 33% | 264,773 | $3,249,885 |

| RLF | Rlfagtechltd | 0.044 | 26% | 607,880 | $9,401,445 |

| 3DP | Pointerra Limited | 0.093 | 26% | 20,524,818 | $59,575,683 |

| ECT | Env Clean Tech Ltd. | 0.003 | 25% | 206,141 | $6,343,621 |

| VML | Vital Metals Limited | 0.003 | 25% | 403,186 | $11,790,134 |

| 1CG | One Click Group Ltd | 0.011 | 22% | 1,457,702 | $10,600,919 |

| NVQ | Noviqtech Limited | 0.100 | 22% | 9,578,769 | $18,881,917 |

| AOK | Australian Oil. | 0.003 | 20% | 2,004,456 | $2,504,457 |

| ASP | Aspermont Limited | 0.006 | 20% | 203,272 | $12,350,058 |

| ASR | Asra Minerals Ltd | 0.003 | 20% | 11,636 | $5,781,575 |

| CUL | Cullen Resources | 0.006 | 20% | 83,334 | $3,467,009 |

| RAU | Resouro Strategic | 0.190 | 19% | 152,535 | $6,930,182 |

| AJL | AJ Lucas Group | 0.007 | 17% | 893,391 | $8,254,378 |

| AVE | Avecho Biotech Ltd | 0.004 | 17% | 31,529 | $9,507,891 |

| EPM | Eclipse Metals | 0.007 | 17% | 1,086,517 | $13,727,133 |

| IXR | Ionic Rare Earths | 0.007 | 17% | 1,570,134 | $31,370,570 |

| PXX | Polarx Limited | 0.007 | 17% | 1,869,885 | $14,253,006 |

Traffic Technologies (ASX:TTI) has bagged a $3 million contract to supply smart, IoT-ready LED streetlights to the City of Sydney. The deal runs for five years, with an option to extend for up to nine, potentially bringing in $5 million. The lights will replace old ones and cover everything from roads to parks and laneways across Sydney’s CBD and surrounding suburbs.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 21 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ENV | Enova Mining Limited | 0.003 | -40% | 7,284,381 | $4,924,647 |

| 1TT | Thrive Tribe Tech | 0.003 | -25% | 206,721,206 | $8,126,892 |

| CRB | Carbine Resources | 0.003 | -25% | 200,000 | $2,206,951 |

| CTN | Catalina Resources | 0.003 | -25% | 100,000 | $4,975,048 |

| M2R | Miramar | 0.003 | -25% | 339,544 | $1,587,293 |

| CVN | Carnarvon Energy Ltd | 0.120 | -23% | 14,206,246 | $277,308,467 |

| MEL | Metgasco Ltd | 0.004 | -20% | 500,000 | $7,287,934 |

| AUK | Aumake Limited | 0.005 | -17% | 29,346 | $18,064,153 |

| ERA | Energy Resources | 0.003 | -17% | 64,277 | $1,216,188,722 |

| TEM | Tempest Minerals | 0.005 | -17% | 2,059,000 | $3,807,179 |

| CLG | Close Loop | 0.200 | -15% | 2,495,200 | $124,984,719 |

| ADN | Andromeda Metals Ltd | 0.006 | -14% | 1,397,512 | $24,001,094 |

| HGO | Hillgrove Res Ltd | 0.048 | -14% | 14,886,057 | $117,351,112 |

| MHC | Manhattan Corp Ltd | 0.024 | -14% | 59,557 | $6,577,169 |

| RGL | Riversgold | 0.003 | -14% | 300,000 | $5,892,994 |

| CBY | Canterbury Resources | 0.020 | -13% | 30,925 | $4,541,141 |

| 8CO | 8Common Limited | 0.028 | -13% | 26,567 | $7,171,037 |

| BCB | Bowen Coal Limited | 0.007 | -13% | 12,921,452 | $86,204,221 |

| SKK | Stakk Limited | 0.007 | -13% | 149,500 | $16,600,637 |

| TYX | Tyranna Res Ltd | 0.004 | -13% | 28,367 | $13,151,701 |

| W2V | Way2Vatltd | 0.007 | -13% | 957,141 | $7,461,324 |

| WOA | Wide Open Agricultur | 0.007 | -13% | 2,141,450 | $4,269,493 |

Novonix's (ASX:NVX) CEO Chris Burns announced he will step down this week after four years at the helm. The company, which focuses on battery materials, is entering a key growth phase and will now be searching for a new leader to steer it through the next stage.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as ASX Lunch Wrap: ASX jumps as banks, BHP and Trump spark investor optimism