ASX Lunch Wrap: ASX and gold reset record highs; but Origin cuts its LNG forecast

ASX hits record high, gold as well, Apple misses iPhone target, Mesoblast rises and Origin trims LNG forecast.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX hits record high as miners lead gains

On Wall Street, Apple reports a slight miss on iPhone sales

Mesoblast rises, Origin cuts LNG forecast

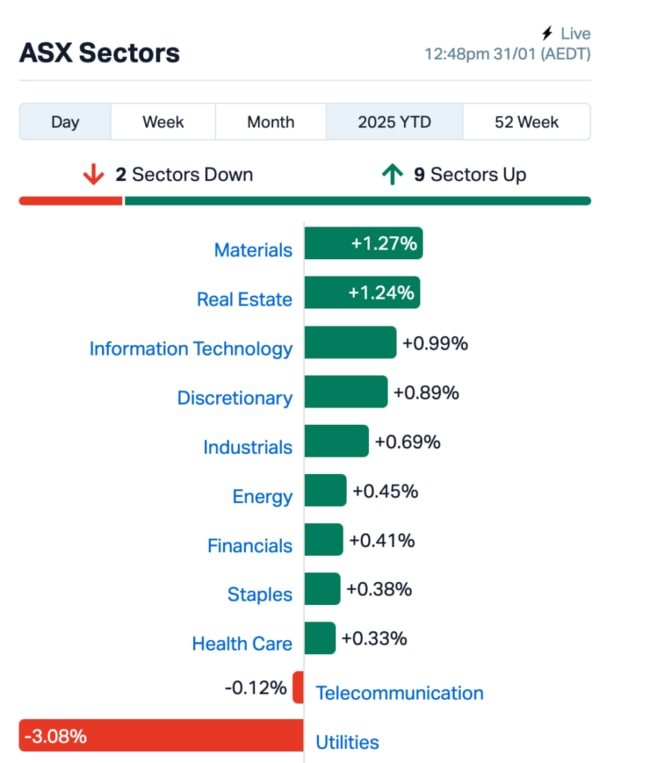

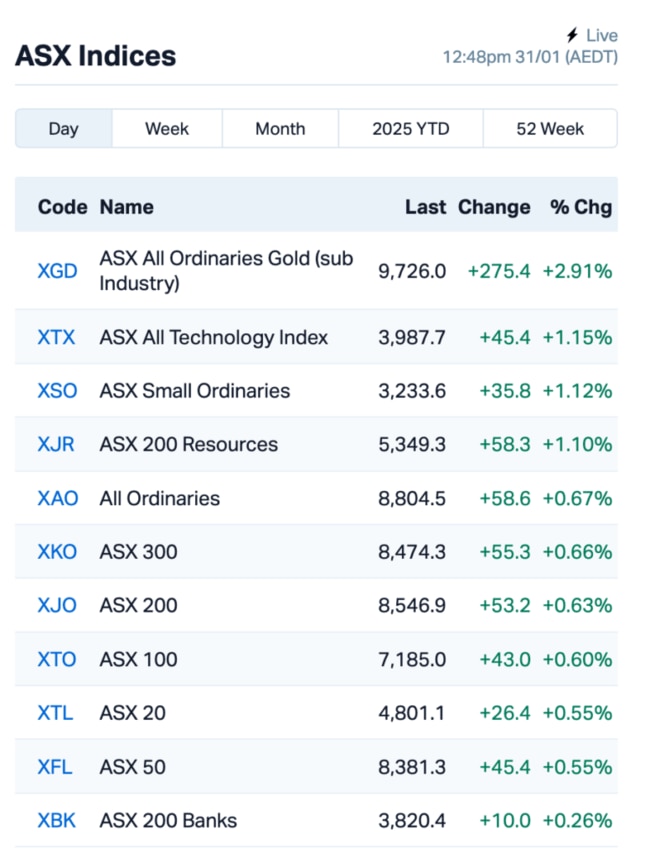

The ASX 200 benchmark touched an all-time record of 8566 points before pulling back slightly. At around lunch time Friday, the index was up 0.55% to trade at 8540.

The surge was driven by a lift from the mining sector and a broad rally in the US markets overnight.

On Wall Street, the S&P 500 index closed 0.5% higher, but things got a little rocky in late trading after President Trump threatened once again to slap 25% tariffs on imports from Mexico and Canada... as early as tomorrow.

The news sent the markets into a brief tailspin, though stocks managed to recover.

Apple rose 3% post-market after reporting a slight miss on iPhone sales, but still beat earnings expectations with strong performances from iPads and Macs.

Aussie tech firm Atlassian was a big winner, jumping 20% after announcing impressive cloud revenue growth of 30%, beating its own forecast.

Meanwhile, gold prices are going through the roof, hitting a new all-time high of almost US$2,800/oz. The surge comes after disappointing data on the US economy, where growth in the last quarter of 2024 was slower than expected.

On the ASX this morning, miners, including goldies, were the stars, while real estate stocks also enjoyed a good session.

In the the large caps space, healthcare giant Ramsay Health Care (ASX:RHC) dipped 0.7% after its Aussie CEO, Carmel Monaghan, revealed she’ll retire mid-year after 27 years at the helm.

Over at Tabcorp Holdings (ASX:TAH), ex-AFL CEO Gillon McLachlan is now officially taking the reins after the company’s leadership reshuffle. Shares were up 1%.

Mesoblast (ASX:MSB) rose 2% on the launch of its FDA-approved Ryoncil (remestemcel-L) for treating steroid-refractory acute graft-versus-host disease (SR-aGvHD) in kids. After securing US$160 million in financing, Mesoblast said it now has US$200 million cash in hand, giving it the muscle to meet demand.

Meanwhile, Origin Energy (ASX:ORG) has lowered its LNG output forecast for FY25 after facing operational setbacks. Despite this, the company saw a 3% increase in revenue for the December quarter due to higher LNG prices. ORG’s shares slipped 4.5%, dragging down the utilities sector.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 31 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| SIO | Simonds Grp Ltd | 0.200 | 33% | 83,349 | $53,985,968 |

| SHN | Sunshine Metals Ltd | 0.009 | 29% | 15,884,232 | $11,113,514 |

| MVP | Medical Developments | 0.558 | 27% | 578,038 | $49,569,663 |

| GDM | Greatdivideminingltd | 0.410 | 26% | 83,583 | $9,135,208 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 1,691,569 | $12,000,000 |

| GES | Genesis Resources | 0.005 | 25% | 117,400 | $3,131,365 |

| MEL | Metgasco Ltd | 0.005 | 25% | 171,243 | $5,830,347 |

| RLG | Roolife Group Ltd | 0.005 | 25% | 100,000 | $4,784,125 |

| 14D | 1414 Degrees Limited | 0.027 | 23% | 72,777 | $6,270,027 |

| MTB | Mount Burgess Mining | 0.006 | 20% | 206,018 | $1,697,687 |

| SPQ | Superior Resources | 0.006 | 20% | 150,000 | $10,849,319 |

| MAG | Magmatic Resrce Ltd | 0.050 | 19% | 308,803 | $17,516,130 |

| PUA | Peak Minerals Ltd | 0.013 | 18% | 1,364,925 | $28,073,213 |

| 1AI | Algorae Pharma | 0.007 | 17% | 1,089,299 | $10,124,368 |

| FHS | Freehill Mining Ltd. | 0.004 | 17% | 1,662 | $9,235,583 |

| MEM | Memphasys Ltd | 0.007 | 17% | 367,134 | $10,626,089 |

| KAI | Kairos Minerals Ltd | 0.015 | 15% | 7,325,490 | $34,201,858 |

| SFM | Santa Fe Minerals | 0.039 | 15% | 20,000 | $2,475,839 |

| BLU | Blue Energy Limited | 0.008 | 14% | 350,000 | $12,956,815 |

| HHR | Hartshead Resources | 0.008 | 14% | 21,762,201 | $19,660,775 |

Homebuilding group, Simonds (ASX:SIO), is set to acquire Dennis Family Homes (DFH) for $10 million. DFH, which builds and sells residential homes in Victoria and NSW, aligns perfectly with Simonds’ strategy to expand affordable homes across Australia, Simonds said. The deal will more than double Simonds' product range and increase its market presence.

Deterra Royalties (ASX:DRR), the spin-off from Iluka Resources (ASX:ILU), reported an 11.7% rise in revenue from September to December, reaching $59.3 million on the back of record iron ore volumes. During the quarter, the company also made good traction with its Thacker Pass lithium project in Nevada, securing a US$2.3 billion loan from the US Department of Energy and a $625 million joint venture with GM to fund and run the site.

Sunshine Metals (ASX:SHN) said it’s drilling deep into its top projects in Queensland, with the Ravenswood Consolidated Project leading the charge. The project just saw a 57% jump in gold resources and positive results from recent drilling at the Gap Zone, with gold recoveries hitting 97.4% and copper at 95.2%. During the quarter, Sunshine also wrapped up the sale of its Triumph Gold Project for $2 million.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 31 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.002 | -33% | 940,692 | $6,095,169 |

| ERA | Energy Resources | 0.002 | -33% | 912,497 | $1,216,188,722 |

| ATH | Alterity Therap Ltd | 0.013 | -31% | 62,880,140 | $95,767,764 |

| BDT | Birddog | 0.041 | -27% | 3,202,242 | $9,043,217 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 575,323 | $57,867,624 |

| AKN | Auking Mining Ltd | 0.003 | -25% | 150,000 | $2,059,115 |

| EEL | Enrg Elements Ltd | 0.002 | -25% | 21,487 | $6,507,557 |

| ERL | Empire Resources | 0.003 | -25% | 43,720 | $5,935,653 |

| DAF | Discovery Alaska Ltd | 0.015 | -25% | 624,594 | $4,684,694 |

| JAT | Jatcorp Limited | 0.375 | -24% | 283,044 | $41,216,997 |

| DUB | Dubber Corp Ltd | 0.041 | -24% | 15,100,329 | $140,375,749 |

| ADR | Adherium Ltd | 0.012 | -20% | 342,051 | $11,378,699 |

| ADD | Adavale Resource Ltd | 0.002 | -20% | 420,032 | $5,683,198 |

| ASR | Asra Minerals Ltd | 0.003 | -17% | 200,000 | $6,937,890 |

| AUG | Augustus Minerals | 0.040 | -17% | 1,208,847 | $5,721,189 |

| LML | Lincoln Minerals | 0.005 | -17% | 5,385,554 | $12,337,557 |

| TAS | Tasman Resources Ltd | 0.005 | -17% | 2,160,982 | $4,831,498 |

| 1AE | Auroraenergymetals | 0.048 | -16% | 122,365 | $10,206,633 |

| PBH | Pointsbet Holdings | 0.830 | -15% | 3,294,907 | $325,090,767 |

| PEN | Peninsula Energy Ltd | 1.115 | -15% | 2,536,396 | $209,921,596 |

| OCT | Octava Minerals | 0.080 | -15% | 211,918 | $5,734,875 |

| DTR | Dateline Resources | 0.003 | -14% | 284,630 | $8,806,912 |

IN CASE YOU MISSED IT

Everest Metals (ASX:EMC) is issuing $720,000 in Junior Minerals Exploration Incentive (JMEI) exploration credits to eligible shareholders who participated in the company's $2.4 million capital raising in the last quarter of 2023. Through the JMEI scheme, explorers can convert a portion of their tax losses into credits, which are then passed on to investors as a tax benefit.

Clinical-stage biopharma developer Neurotech International (ASX:NTI) has received a $2.44 million R&D tax incentive refund relating to activities in FY24. The refund strengthens NTI’s cash position as it works to complete the required animal toxicology and human pharmacokinetic studies in preparation for regulatory submissions to the Australian Therapeutic Goods Administration and the US Food and Drug Administration in FY25.

At Stockhead, we tell it like it is. While Everest Metals Corporation and Neurotech International are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as ASX Lunch Wrap: ASX and gold reset record highs; but Origin cuts its LNG forecast