South Australian man devastated after losing $307,000 fortune in elaborate investment scam

A simple decision four years ago has left this family reeling. They are still facing financial devastation now.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

An Australian man is feeling the aftermath of a scam more than four years after cyber criminals parted him from his fortune.

For the past few years Cooper* has been forking out thousands of dollars every month to his bank, including $1200 every month on interest alone, to pay off the massive debt he was left with.

The South Australian dad fell for a “cunning” scam in 2018 which saw his family fortune of $307,000 wiped out in an instant.

The 50-year-old thought he was putting his money into a legitimate investment opportunity but later learned it was all fake.

Although he had paid off his mortgage, he decided to redraw the loan and pull out another $280,000 to invest in the scheme, as well as using some of his existing savings.

He then lost a further $3600 on a scam recovery service, later discovering they were in league with the original group of scammers.

“The sad thing was, we were in a reasonably good position (before the scam),” Cooper told news.com.au. “We’d paid off the land for a home we’d bought and we’d paid off the house.

“I’m starting to get shaky talking about it,” Cooper added, saying he felt “like a fool”.

Want to stream your news? Flash lets you stream 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer available for a limited time only >

Cooper blamed falling for the fraudulent scheme on the fact he is an “innocent country boy” and also the great lengths the cyber criminals went to to appear legitimate.

For Cooper, it started in September 2018 when he was scrolling on social media and he saw an ad pop up for a company called FXleader.com.

Clicking the link, he registered his interest and soon received a phone call from them.

“Within about a minute and a half, I had a guy call me just like myself,” Cooper recalled. “He knew all about general things, he just started chatting. He was a genuine Aussie.

“He said you’d be making money every day on the side.”

With the power of hindsight, Cooper remarked: “There’s some Aussie guy out there who has no shame.”

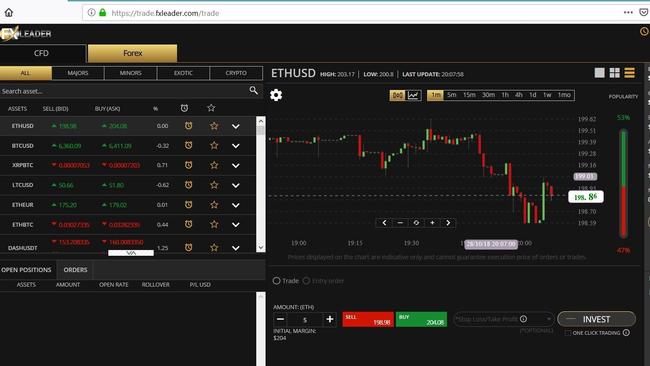

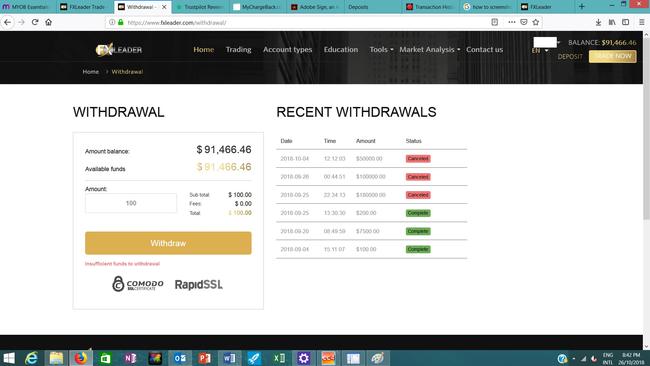

From there Cooper started trading on fxleader.com — which is not to be confused with FX Leaders, a legitimate trading platform.

Cooper didn’t hear from the Australian man again and was instead passed onto another scammer who called himself John Jordan, with a European accent.

It worked like a normal stocks portfolio, with employees giving him market updates that matched with real world events, such as investing in Apple because a new phone was coming out.

He was given a password for a login portal, had to verify his identity and the stocks dashboard changed in real time.

“They strung me along for four weeks, in four weeks I put $307,000 in there,” Cooper said.

At its height, his stocks portfolio swelled to US$386,00. “My money had risen quite well”.

Have a similar story? Get in touch | alex.turner-cohen@news.com.au

He was also able to withdraw his money, taking US$10,500 out of the account. However, later he realised this was simply because the scammers had reversed one of his payments to seem like he could withdraw whenever he liked.

The cyber criminals also encouraged Cooper to download a malware app and were able to see the balance of his bank account.

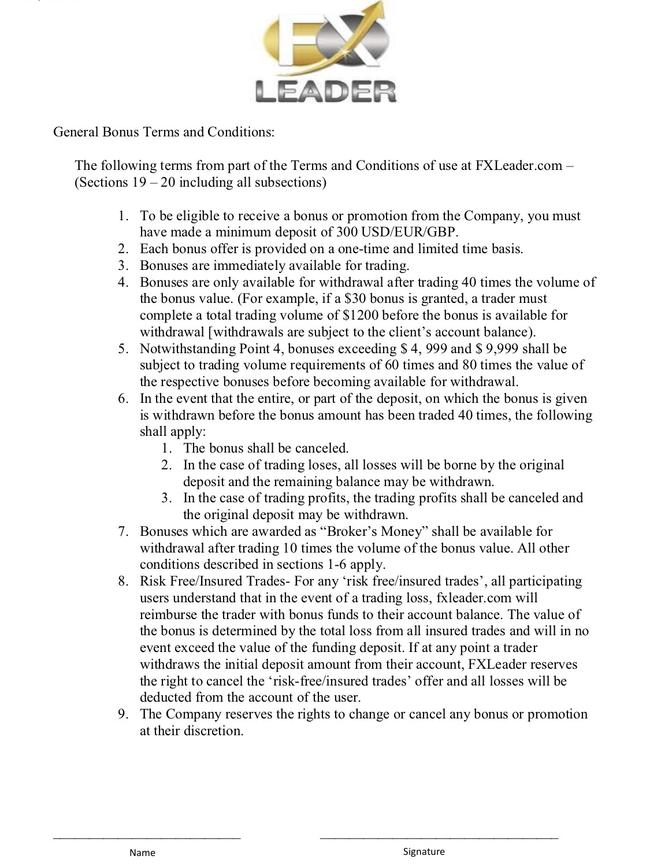

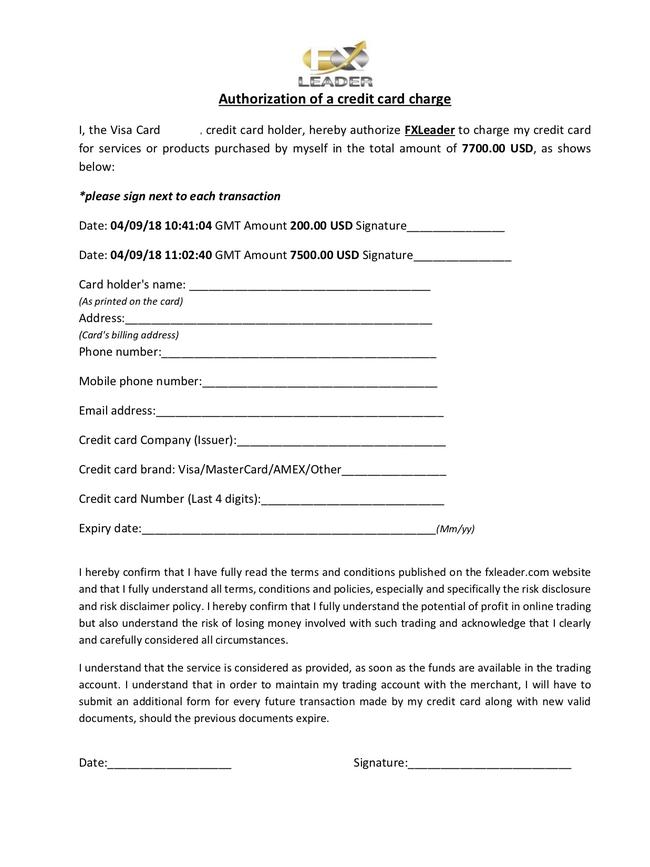

They also made him sign a paper digitally “to allow me to access my Visa”.

But Cooper’s family were convinced it was a scam.

“At one stage my daughter and wife were crying as I sent $50,000.”

Finally heeding his family’s advice, Cooper travelled for several hours to Adelaide. There, he met with a staff member from international trading firm Morgan Stanley to get their opinion.

At first, even the Morgan Stanley worker was convinced the scam was real.

“He said ‘this looks sort of real, maybe there’s a chance’,” Cooper recalled.

However, when Cooper informed them he was unable to withdraw funds, they grew suspicious and looked more closely at the trading website.

Then the expert warned Cooper that his stocks were “delayed”.

“Oil would go up 7c, and then mine would go up 7c,” Cooper explained. “There was a programmer programming every stock share.”

The Morgan Stanley employee warned the dad: “Your money is already gone.”

Cooper tried harder to withdraw his cash and in recorded conversations, the scammers had a long stream of excuses about why this couldn’t happen.

In the end, they even offered him US$75,000 if he wouldn’t go to the media to expose the website for being a fraud, but he knew it was another empty promise.

As the realisation finally dawned on him, Cooper was now determined to get his money back to salvage his fortune and came across a scam recovery expert.

Forking out US$2500, the man claimed he recognised the voice from Cooper’s recordings and that he would be able to get his money back in full.

“He was just too good,” Cooper said.

This man disappeared and the promised funds never eventuated.

Cooper has now been left to pick up the pieces of his life, and his family’s.

“I’m still paying off $280,000 of debt,” he said. “The home loans were all paid off before we started this, but the loans were open.”

As a tradie, he sold a lot of machinery and his car to make a dent in the debt.

Cooper is also building a property that he planned to retire into – but the entire thing will be sold to pay off the loan.

He pointed out that as someone self-employed, that machinery and property is essentially his superannuation – something he no longer heads as retirement edges closer.

He is speaking out in the hopes that others don’t make the same mistake he did.

alex.turner-cohen@news.com.au

Originally published as South Australian man devastated after losing $307,000 fortune in elaborate investment scam