Tivan’s Grant Wilson’s brutal take on sacked critical minerals rival ahead of write off

The boss of a Territory critical minerals start-up has delivered a passionate spray against the company he helped take over. Read what he said.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Territory critical minerals start-up Tivan has offloaded most of its Mount Peake assets in Central Australia ahead of an expected massive write off in coming weeks.

A board approved statement on Friday announced the company had surrendered its remaining Mount Peake mineral lease ML28341 and five ancillary exploration licenses “in order to reduce ongoing holding costs”.

The statement showed TNG, which held Mount Peake’s assets until a boardroom takeover replaced the previous board and saw the company rebranded Tivan, had spent $83m during project life, which its successor will have to carry.

The company “strategically” retained the exploration license covering the Mount Peake deposit “providing optionality for the company as circumstances dictate”.

The statement said Mount Peake played “a key facilitation role in the development” of Tivan’s project so far but that the Speewah vanadium titanomagnetite asset in Western Australia was “a superior development opportunity for the company, both as a superior resource and due to the significant commercial synergies”.

“As such, the Board has decided to progress with a single vanadium titanomagnetite resource.”

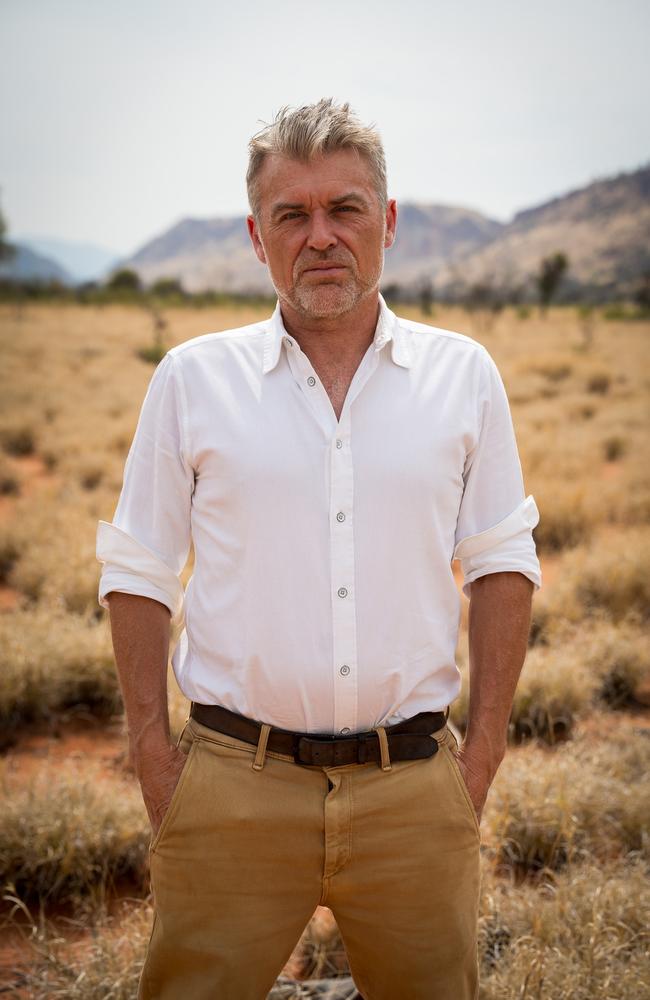

Tivan executive chairman Grant Wilson struck a positive note despite the anticipated write of.

“The Board notes that Mount Peake remains a sensitive topic for many longstanding shareholders of Tivan and for stakeholders in the Northern Territory,” he said.

“Our update today highlights the successful transition the company has made over the past 18 months. The transition has preserved shareholder capital and has opened multiple pathways to create shareholder value over different time horizons.

“The accumulated tax losses that Tivan is likely to carry forward will also serve to offset future income tax payable, thus bringing forward the date when free cash flow will be achieved.”

The ASX formalities mask what Grant Wilson really thinks about TNG, detailing this during a searing speech delivered at Tivan’s annual general meeting in Darwin last November.

The split was sparked in part by TNG’s 2021 decision to scrap a plan to build a Tivan processing plant at Middle Arm and develop instead a green hydrogen plant alongside the Mount Peake mine, about 300km northeast of Alice Springs.

Within weeks of Tivan’s January 2023 takeover, Mr Wilson announced the company would return to Middle Arm and replaced the Mount Peake asset with Speewah.

His attack on TNG provides an acute insight into the final acrimonious months of TNG before the takeover was finalised.

“What we found was a train wreck, an absolute train wreck,” he said. “I’ve worked all over the world in all sorts of industries and I’ve never seen a company so poorly managed ... so ineptly managed.

“There were only two things that management locked in (including) minimising the possibility of litigation against them. That was it. That was all they were doing.”

Tivan wants to use the Speewah resource to process vanadium redox flow batteries at the Territory government’s Middle Arm sustainable development precinct.