BCCC banking watchdog sanctions Westpac for Tennant Creek branch closure

“High risk of harm”: Australia’s banking watchdog has sanctioned Westpac for the sudden closure of a remote Northern Territory branch, which left people unable to access their money.

Australia’s banking watchdog has sanctioned Westpac for the sudden closure of its Tennant Creek branch, which left many people unable to access their money.

The Banking Code Compliance Committee (BCCC) found Westpac Bank committed serious and systemic breaches of the national banking code of practice after it failed to provide adequate support to customers following the closure of the remote branch in September 2022.

The Tennant Creek bank was a key service hub for almost 3400 people in the Barkly region, many of whom relied on face-to-face banking due to limited internet access or language barriers.

CatholicCare NT reported up to 30 customers a day seeking help to access Westpac services immediately after the branch closure.

BCCC found the bank did not adequately consider the unique context of the Tennant Creek community and potential assistance its customers may need to transition to different ways of banking.

It said the breaches posed “a high risk of harm” to vulnerable customers, and its response to community concerns was “inadequate and slow”.

“In this case, Westpac has fallen short of their promise to customers,” committee chair Ian Govey AM said.

“Their actions have had a significant and detrimental impact on many people within the Tennant Creek community.

“Westpac’s failure to respond promptly to community concerns and provide adequate support was troubling and appears to have disproportionately impacted on vulnerable customers.”

Westpac said it was forced to shut the branch due to ongoing safety and security threats “in order to protect our people”.

“These circumstances were specific to the Tennant Creek branch and included damage to our branch and ATM,” a spokesman said.

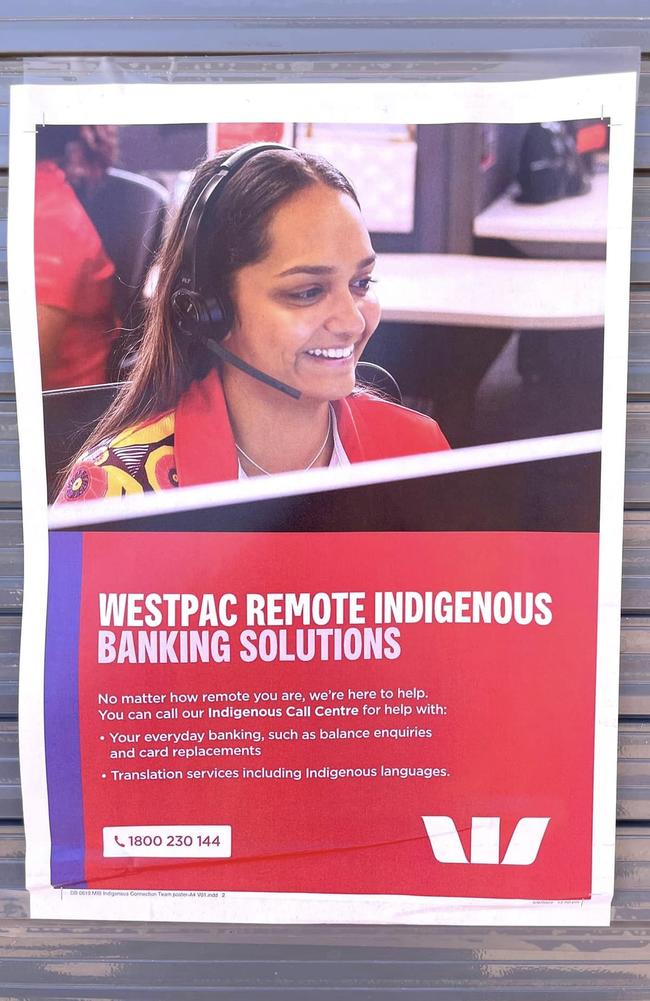

“Customers were notified of the closure and alternative banking options via SMS ahead of closure, as well as posters in the branch.

“We recognise more could’ve been done to fully support our customers during the closure. As a result, we have reviewed and strengthened our branch closure protocols.”

Earlier this year Westpac announced it would make no further branch closures in regional areas until at least 2027, extending its existing moratorium to four years.

The sanction, which does not include any financial penalty, is the most serious disciplinary action BCCC can take in response to serious and systemic breaches of the code.

Mr Govey said the decision sent a clear message to the banking industry that noncompliance with the code’s standards would not be tolerated.

“Banks must carefully consider the needs of its customers and provide the right support to adapt to new ways of banking,” Mr Govey said.