NAB customers lose up to $80,000 to text message scam

Dozens of customers have fallen victim to the same scam losing up to $80,000 in hard-earned savings, with the knock-on effect leaving a trail of devastation.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

More than a dozen National Australia Bank customers have fallen victim to the same scam in the past few months, losing anywhere between $4000 and $80,000 each, and leaving them distressed after being fleeced of money they had spent years saving.

Eve* and her husband Josh* are one couple who fell for the scam, losing almost $20,000 – money they had saved running their largely tourist-based business in Far North Queensland, which was badly hit by the pandemic.

“This was the first year things are going right and we tried to save as much money as we could and we were working seven days a week without a day off, 12 hours a day, without a break since Easter and then this happens,” Eve told news.com.au.

A Facebook group created by one of the people scammed discovered multiple NAB customers across Australia scammed in November and December alone – with at least 14 other victims coming forward.

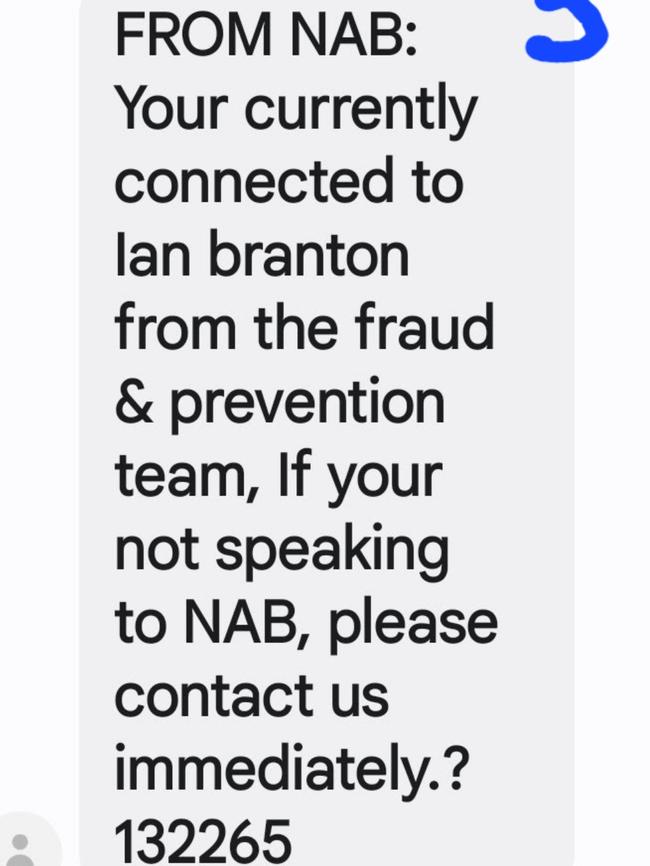

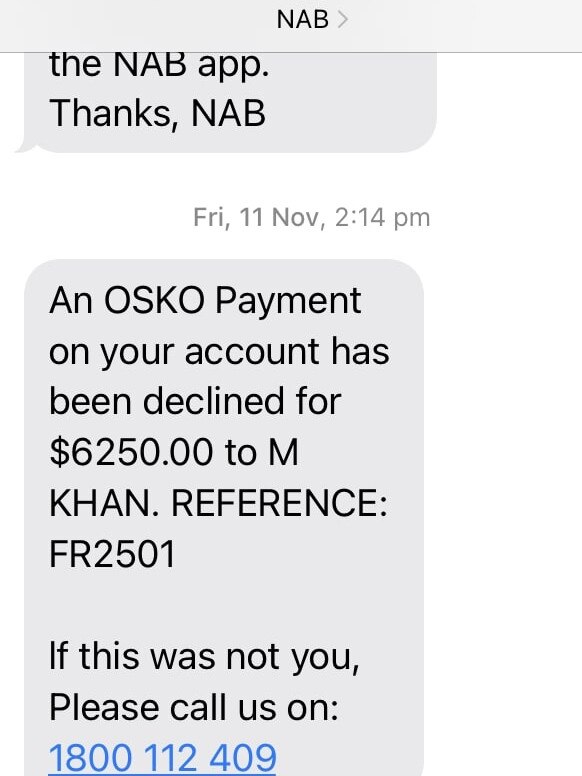

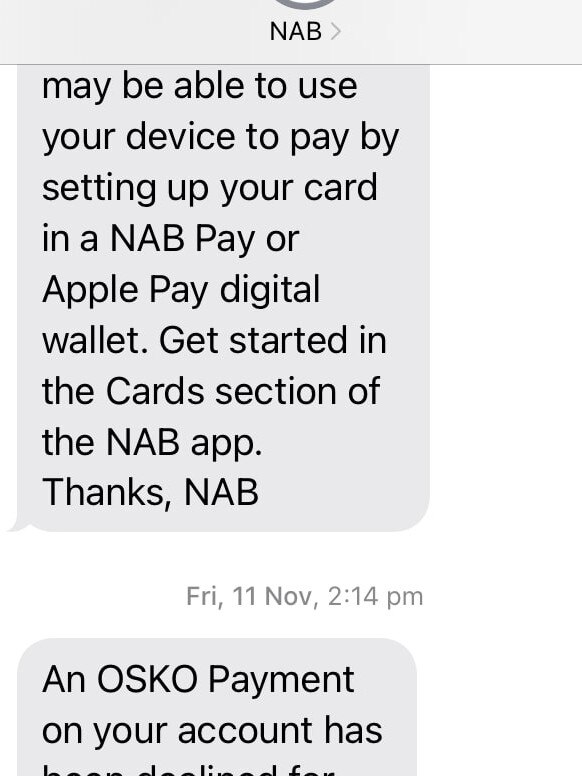

Most of the victims’ experiences started with a text message that appeared to be from NAB, which said there had been fraudulent activity on their account and asked them to call the number back immediately.

Others received a text message that a payment had been declined and urged them to contact the bank if they had not made the transaction.

All the texts appeared in the same thread as other correspondence from the bank, which led the customers to believe the message was genuine and lulled them into a false sense of security.

But unfortunately it’s an increasingly common scam using a tactic called ‘spoofing’. This is where scammers overstamp the legitimate number that they are calling or texting, making it appear as if customers are receiving communication from the legitimate number.

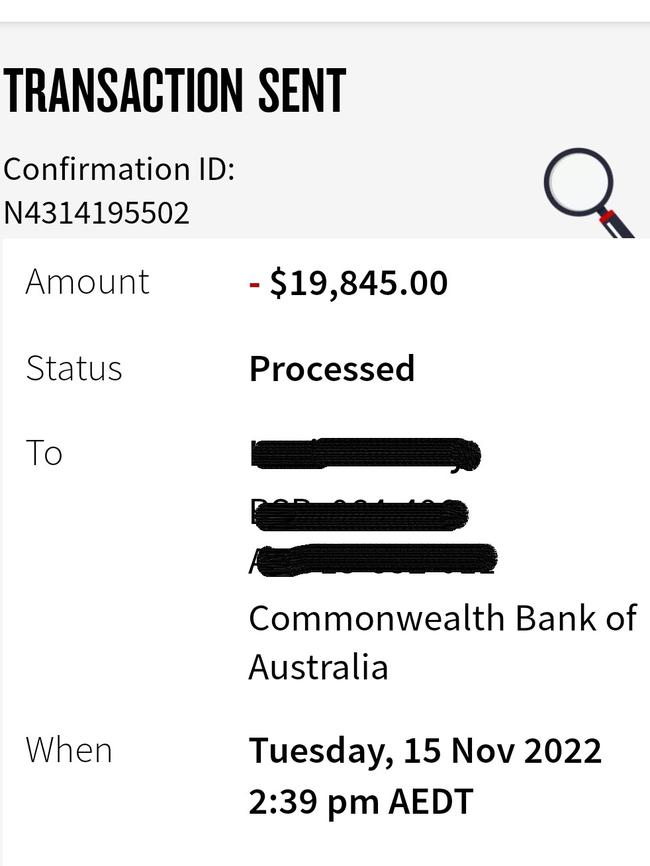

Josh was the one who fell for the SMS message about fraudulent activity on November 15, and believing they were in “big trouble” he called the number before transferring the couple’s hard earned savings into a “safe account”.

It was Eve who then realised something was wrong and contacted the bank an hour and 20 minutes after the transfer was made into what they discovered was a Commonwealth Bank account.

Meanwhile, her husband was still on the phone to the scammer, who was trying to extract even more money, before hanging up when Josh confronted him.

Have a similar story? Continue the conversation | sarah.sharples@news.com.au

The experience left Eve unable to eat or sleep, she said, and mentally drained.

“I had to go to the doctors to help me calm down during the day as I have to work 12 hours a day serving customers on my feet and being happy so she gave me some anti-anxiety tablets to take. I haven’t slept all this time,” she said.

“But the worst thing is [my business] works on seasons; we can’t depend on locals so when there are no tourists it’s dead. I have three girls almost part-time and I did promise that even when it’s quiet we would keep them on.

“But at the moment I am too worried I might not have the money to keep them on as we have to pay rent, electricity, BAS next month and I hadn’t put money aside as it was just in one account. It has affected us so much.”

The couple, in their sixties, had been told by NAB there is no chance of seeing their money again and that the transfer was their fault.

“There was no warnings. The day after we called the fraud department when we tried to log in and reinstated our internet banking at the top was a scam warning but before that there were never any warnings anywhere,” she said.

“We work so long, we don’t listen to the news, we don’t go to websites to see what is happening and you can’t say my husband is naive. There wasn’t any warning anywhere.

“We get nothing from NAB and their opinion is we willingly transferred the money, like I wanted willingly to lose $20,000 out of my pocket just like that.”

Eve added that the loss had placed their plans to retire soon in jeopardy and she “can’t see that happening any time soon”, while the couple have been too scared to reveal the financial devastation caused by the scam to their two adult children.

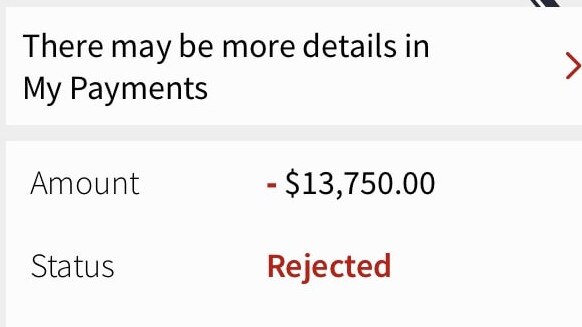

Manpreet Singh has also been working 12-hour days to save and lost $14,550 to the same scam.

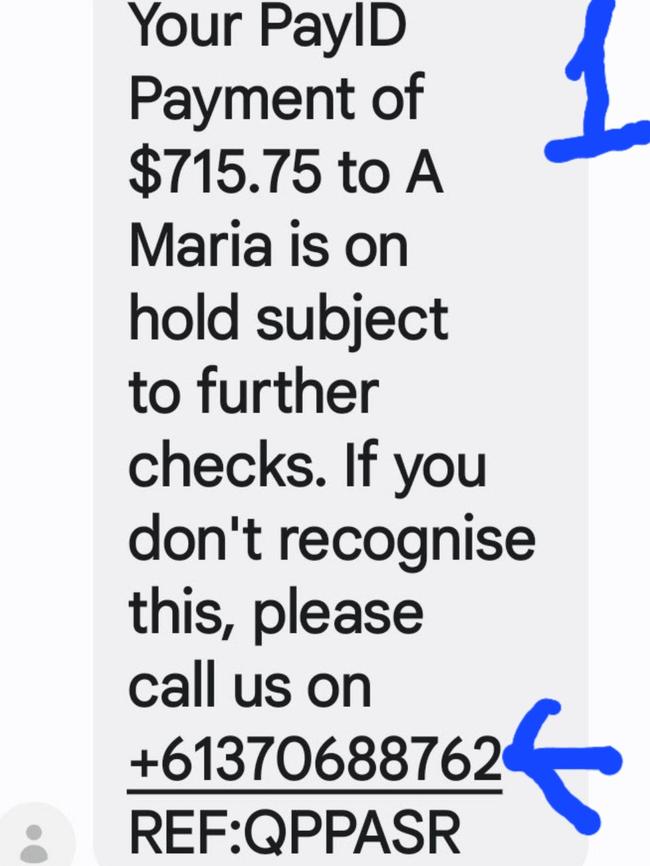

The Brisbane man received a text message in his NAB thread that someone had tried to transfer out more than $6000 from his account but it said it had been declined and to call the number if it wasn’t him.

He “panicked” and called the number resulting in him transferring out almost $28,000 from his mortgage offset account – however he was lucky that only $14,550 went through in the end.

Around five minutes later, he received a call from NAB and was told the original SMS and phone call were not legitimate and the money had landed in a Commonwealth Bank account.

The truck driver said he had been amassing the savings as a safety net against rising interest rates and is now fearful about losing the family home that he shares with his wife and two-year-old.

“It’s a horrible feeling, especially in these bad times,” he said.

The 37-year-old said he became so distressed on the phone to the bank that the police were sent to check on him and he has sunk into depression.

“It broke my heart. I just don’t trust in the system,” he said. “I feel like there is no justice and if something happens no one takes responsibility. We are on our own.”

Mr Singh said NAB had offered to give him $1000 after the experience, but he said he wanted them to step up and take responsibility for the scam and refund him the full amount.

NAB executive for group investigations and fraud Chris Sheehan would not comment on individual cases but said there had been a “significant” increase in scams with a 38 per rise in scams reported to the bank in 2022.

“It’s upsetting to see the devastating effects these can have, which are both financial and emotional,” he said.

“Each month, we take around 100,000 calls from customers in relation to scam and fraud matters. To help us counter this rising global problem, we invest tens of millions each year into our systems and processes. In the last six months we’ve added 140 more people to our scams and fraud team, taking us to more than 400 people working in this area to help respond and provide support to customers.”

Mr Sheehan added when a customer receives a text message or call impersonating NAB or another brand, the criminal has ‘spoofed’ the number and is impersonating that company. “NAB’s systems have not been breached in any way,” he said.

“To help address this, we are working with telecommunications providers to try and prevent these criminals from spoofing NAB numbers. This really needs to be a team effort

as we can’t stop this on our own.

“If someone is ever unsure if the person contacting them is from NAB, they should hang up, and call NAB on the number found on the back of their card.

“NAB will never ask a customer to confirm, update or disclose personal or banking information via a link in a text message or email.

“People need to know that their bank will never ask you to transfer money to another account to keep it safe – it’s safe where it is.”

Every attempt to prevent these scams and recover funds is made, but once the funds have left a victim’s account, it can often be difficult to recover them due to the sophistication of these criminals and the speed with which they move stolen funds, he noted.

“NAB considers a range of factors when resolving a customer complaint. We will pay compensation when the bank is at fault,” he said.

“Each case is assessed individually, and in some instances, we may offer a customer a goodwill payment, which can be for reasons such as assisting a customer with immediate support to help with their circumstances.”

In 2022, NAB ran 70 free education sessions, all available to the public, and during Cyber Security Awareness Month it sent alerts to more than two million customers with information on how they can stay safe.

“We have a dedicated online security hub that provides regular scam updates, and we use our mobile app and internet banking to alert customers directly,” Mr Sheehan said.

“Unfortunately, there is no easy fix. We must all remain vigilant.”

Australians may have lost up to $4 billion to scams in 2022, the ACCC revealed.

*Names have been changed for privacy

Originally published as NAB customers lose up to $80,000 to text message scam