The answer to Donald Trump’s 3am question about the US dollar

DONALD Trump has been roundly mocked for the question he asked his national security adviser in the middle of the night. It was actually a good one.

Australian Dollar

Don't miss out on the headlines from Australian Dollar. Followed categories will be added to My News.

IT IS one of the best leaks to come out of the White House so far.

Donald Trump’s 3am phone call to his national security adviser, retired Lt Gen Mike Flynn, was reported by the Huffington Post. Was there an emergency? Nope. Trump just wanted to find out about the US dollar: Was a high dollar good for the economy, or was a low dollar good?

Flynn said he had no idea, and why didn’t the President ask an economist. Good answer, sir.

The leak has been a gift to America’s comedians, who were already making great sport of the President. They love it, and why not? It is a terrific anecdote. But here’s the thing — the question is actually a rich and delicious one.

Mock the president for thinking the national security guy would know, sure. And mock him for thinking there is a simple answer. But don’t mock him for wondering about it. Do we want a high dollar or a low dollar? This is a question for the ages.

Even just thinking about it will stretch your mind and lift your understanding of how wonderful the economy is. And a few moments pondering it will make you realise how over simplified and silly some people can become when they open their mouth about economic policy.

DOLLAR UP: FILL YOUR CUP

In 2013, Australia’s dollar was around US$1.05. I took a holiday in Aspen, Colorado and I remember thinking it wasn’t as expensive as I had expected. That was because our currency was so strong.

Things that would have cost $A100 with the dollar around $US0.50 were now only costing $A50. It was probably a once in a lifetime opportunity to live like a king.

This is the strength of a high dollar. It makes your citizens rich and powerful. They can buy foreign stuff cheaply and travel easily all over the world.

It is also very handy for any company that has to buy imported things to do business — whether your company buys circular saws, delivery vans, printers, computers, or giant precision tooling machines, they are probably made overseas. A high dollar makes the cost of doing business lower.

When the dollar is high, tourists don’t want to come here so much, but foreigners are very keen to come and work here because our salaries look great when they are translated into foreign currency.

DOLLAR DOWN: STAY IN TOWN

When the Aussie dollar fell against the US dollar, I never went back to Aspen. I spent more money in Australia instead.

This is the power of a low dollar. Citizens stop buying foreign stuff, and spend more money on local goods and services. Even better — foreign citizens also find your stuff cheaper. Instead of Aussies going to America, these days Americans are coming to Australia and buying things.

A low dollar is exciting for business — it helps sales. Businesses should be able to sell more to locals who are trying to avoid expensive imports, but also to foreigners. In supermarkets from Madrid to Mongolia they are suddenly finding goods and services that say Made in Australia are cheaper than ever.

A low dollar makes Australia a less attractive place to come and work — our salaries look less competitive. But it is great for getting tourists to come and spend a long time here.

ON THE BREEZE … FLOATING

The Australian dollar goes up some days, down on other days. All goes back to Paul Keating. The then Treasurer cut our dollar loose in 1983 — he “floated” it.

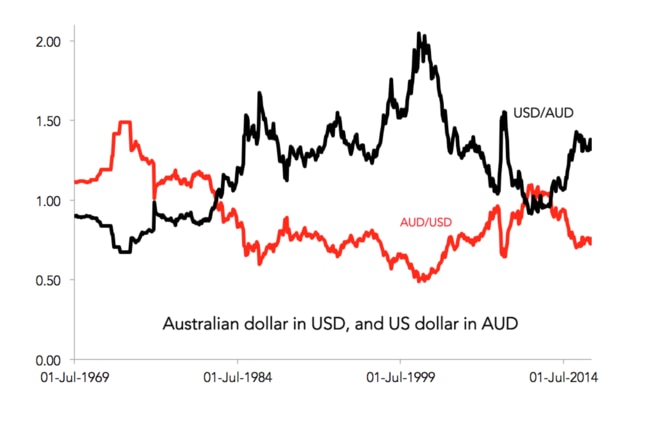

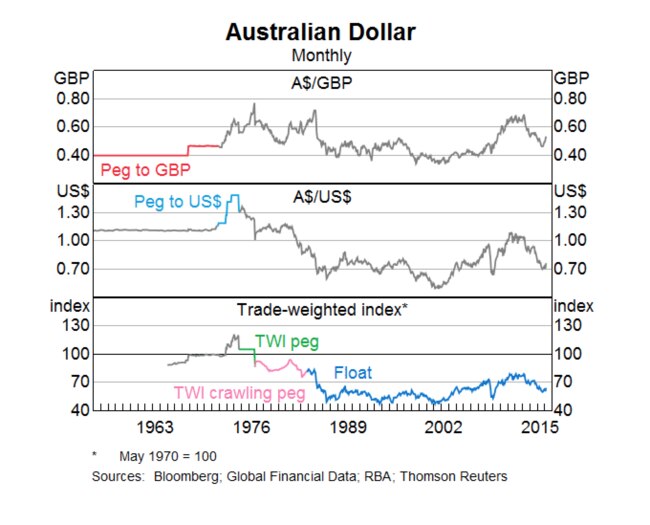

Australia’s dollar was ‘pegged’ to the British pound, then the US dollar and then a combined bundle of currencies called the trade weighted index. But now it floats along, rising and falling with the waves of the global economy, as you can see in this next chart.

A floating currency is really clever. It works like a shock absorber. And it works naturally, just by the changing patterns of who is buying and selling the Australian dollar.

When our economy is strong, lots of foreigners want to buy Australian things. They buy our exports, they want to buy shares in our companies, and they want to lend money to Australians.

To do that they have to have Aussie dollars. So they try to buy AUD on the currency markets. Lots of people trying to buy AUD makes the price go up. The price of Australian dollar is measured in US Dollars. So we see the Aussie dollar rise by a few US cents.

When our economy is weak, the reverse happens. People don’t want Australian dollars any more and they try to sell them, and the price of an Aussie dollar falls. We see the Aussie dollar go down.

The shock absorber works like this: When our economy is a bit weaker, the dollar falls, which makes it easier for businesses to sell things overseas. That reduces the weakness in the economy! When our economy gets stronger, the dollar rises a bit. Suddenly imports are a bit cheaper and the economy avoids the risk of inflation.

CURRENCY WARS

A floating dollar is a good idea normally. But it can also leave you vulnerable.

The last few years, you might have seen headlines about a currency war. America and Japan were both doing something called quantitative easing, and that was making their currencies go down.

Both their economies were a pigsty of terrible unemployment and low growth, both countries decided to tip the scales a little bit, and keep their currencies low. It worked well for America. It got lots of exports (including my trip to Colorado!) and the economy grew.

But of course, that made life harder for some other countries. When one country’s currency goes down, another one must go up.

This is the risk of a floating currency. If every other country is trying to keep their currency down, your currency can get higher than it should be, and that can be tough. This is one of the complaints Americans have about China. Some say China keeps its currency artificially low so it can export to America more easily.

ADMIT WHEN YOU DON’T KNOW

To be honest, the fact Donald Trump is unsure whether a high dollar is good or bad seems to me like a good sign. I’m encouraged that he is not too proud to ask for advice. I’m also pleased to hear the national security adviser didn’t just make up an answer to keep his boss happy!

I just hope Mr Trump eventually got onto someone who had the guts to tell him the strength of the dollar is a complex thing that has good and bad sides.

Jason Murphy is an economist. He publishes the blog Thomas The Thinkengine. Follow Jason on Twitter @Jasemurphy

Originally published as The answer to Donald Trump’s 3am question about the US dollar