‘It’s a train wreck’: Millions of Aussies doomed by the latest rate hike, now spending more than they earn

Millions of Australians are now spending more than they earn thanks to the RBA’s rapid run of rate hikes, and some areas are especially struggling.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The latest rate hike by the Reserve Bank means more than two million Australian households are spending more than they make each month, shocking new analysis reveals.

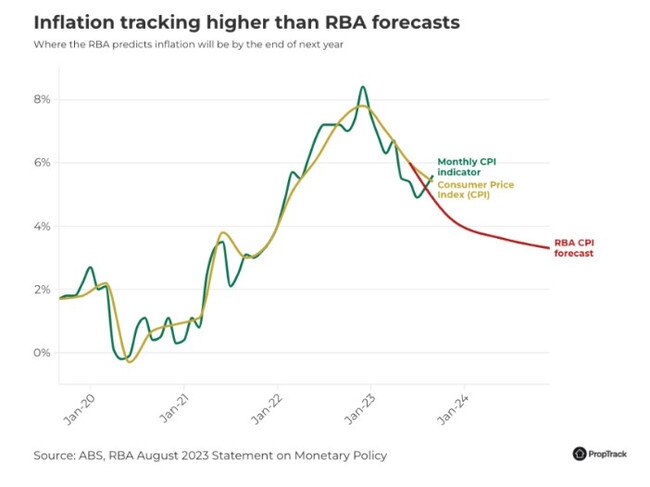

The RBA board met yesterday and decided to lift the official cash rate by 25 basis points to 4.35 per cent – its highest level in 12 years – citing persistently high inflation.

Analysis of the impact of that hike, conducted by Kos Samaras, director of research firm RedBridge Group Australia, using data from Digital Financial Analytics, paints a grim picture of the disastrous financial positions of people in a number of regions.

Shockingly, the data indicates 100 per cent mortgage holders are now in the red, spending more than they make, in the Pyrenees Shire in Victoria’s west, both Narrandera and Carrathool in the Riverina in New South Wales, and Bogan in Orana in NSW.

A staggering 99 per cent of borrowers in the Campbeltown region in Sydney’s west are in negative cash flow, as are 96 per cent of homeowners in Weddin Shire in the state’s central-west.

Rates of negative cashflow in Baw Baw in Melbourne’s outer southern suburbs are 95 per cent, in Singleton in regional NSW they are 94 per cent, and in Moonee Valley in the Victorian capital’s inner-north it’s 92 per cent.

Other notable results are Blacktown in western Sydney (87 per cent), Newcastle in NSW (86.1 per cent), Ballarat in Victoria (85 per cent), and Yass Valley (83 per cent).

Half of all mortgaged households in New South Wales have negative cashflows, with the so-called ‘mortgage belt’ in Sydney’s west being hit particularly hard.

The DFA data indicates another 200,000 households across the country were plunged into the red yesterday as a result of the RBA’s decision.

“How are they managing? They’re eating into savings, living off credit, cutting down on other essentials, ignoring bills that do not result in the loss of basic utilities, and relying on food banks,” Mr Samaras said.

He described the unfolding situation as a “trainwreck”.

“They’re unable to keep up with repayments, including bills, with income alone,” Mr Samaras said. “It’s hard to see how these Australians are contributing to inflation.”

Instead, he said it’s “people like me” who are driving inflation – the economic measure the RBA relies on heavily to determine if rates go up.

“Fifty plus spending is up, savings are up and higher interest rates equal higher earned interest on savings. It’s also super profits and other international drivers.”

The analysis reveals the top five Local Government Areas for mortgage stress nationally are Brisbane in southeast Queensland, Blacktown in western Sydney, Casey in southeast Melbourne, Wanneroo in Perth’s north and Canberra in the ACT.

It’s worth pointing out the RBA’s estimates of the number of households potentially in the red are much more conservative, at up to 15 per cent of mortgage holders.

Many people are battling cost-of-living pressures, but they are more acute for some, according to Associate Professor Ben Phillips from the Centre for Social Research and Methods at Australian National University.

“Homeowners with a mortgage turn out to have experienced a very large cost increase over the past two years of 17.5 per cent,” Mr Phillips wrote for The Conversation.

That figure is much higher than renters, who have seen an average cost increase of 10.8 per cent.

“First homebuyers who bought within the past three years faced the biggest living cost increase, of 20.5 per cent.”

Mortgage stress booming

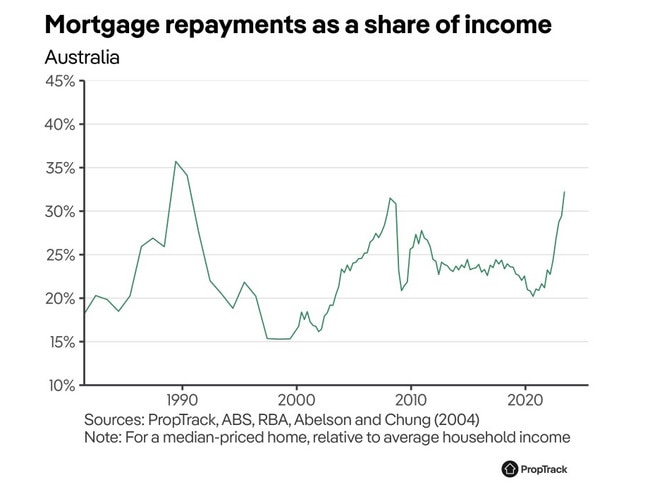

The number of Aussies experiencing mortgage stress – which is paying more than 30 per cent of their incomes on repayments – is surging.

According to modelling by the Australian National University, more than 48 per cent of borrowers will be in a stressed financial state by the end of the year.

Michele Levine is the chief executive of research firm Roy Morgan and said its data shows another 1.5 million mortgage holders are now considered at risk of falling into stress.

“This represents a substantial increase of 766,000 mortgage holders since the RBA began a record-breaking series of interest rate increases nearly 18 months ago,” Ms Levine said.

“Of even more concern is the rise in mortgage holders considered ‘extremely at risk’, now estimated at 1,043,000 in September 2023. This figure has more than doubled since the RBA began raising rates, representing an increase of over 560,000 mortgage holders.”

It seems a growing number of households are turning to unstable means to make budgetary ends meet.

Data from credit reporting agency Equifax shows the number of applications for credit cards was 6.9 per cent higher year-on-year in the June quarter. Applications for personal loans rose 8.2 per cent in the same period.

Many are already running into strife.

Equifax data shows late credit card payment rates are the highest they’ve been in two years, with a 19 per cent increase year-on-year in August in the number of customers 90 days or more behind.

RBA acknowledges ‘painful squeeze’

In April 2022, the average variable interest rate sat at about 2.86 per cent when the official cash rate was just 0.1 per cent.

Back then, based on what the Australian Bureau of Statistics reports is the average home loan balance right now – $593,000 – the typical homeowner was paying about $2456 per month in repayments.

Since the RBA began hiking rates in May last year, the cash rate has risen by 4.25 per cent and the majority of lenders have passed on each of those increases in full.

So, the average Aussie borrower is now forking out $3990 per month, or $1534 more than they were. That equates to an extra $18,400 per year.

In cities with higher average home loan sizes, such as Sydney, the situation is even more horrifying.

In a statement yesterday, RBA governor Michelle Bullock acknowledged the “painful squeeze” on household finances as a result of the latest rate hike.

Data from the big banks suggests one-in-20 homeowners are now paying more for their essential expenses and housing costs than they earn.

For those with particularly hefty mortgages, it’s one-in-four.

Analysis by the RBA is much more pessimistic, with indications that one-in-seven typical borrowers are forking out more than they bring in.

And more than 40 per cent of mortgage holders only have enough savings squirrelled away to get by for three months should they become unemployed, the RBA found.

Albo faces a ‘political dragon’

Veteran political journalist Michelle Grattan believes images of Prime Minister Anthony Albanese hobnobbing abroad with US President Joe Biden and China’s leader Xi Jinping in the past fortnight will be galling to many here at home.

“The timing is not great for Albanese,” Ms Grattan, now a professional fellow at the University of Canberra, wrote in analysis for The Conversation.

“[The government] mightn’t be responsible for the trouble but it rode to power promising to relieve cost-of-living pressures. Since then, those pressures have become a great deal worse.

“So far, the public haven’t turned their wrath onto the government. The cost-of-living dragon has wreaked its havoc on families. If it starts to consume the government’s support, it could eat a lot of political capital very quickly.”

The Opposition is squaring blame firmly at the feet of the government, with its finance spokesperson Jane Hume saying Mr Albanese is “gambling with Australians’ money and with our economy”.

“This rate rise is the consequence of a government that has spent the past 17 months with the wrong priorities, without a plan to tackle inflation and without a plan to lower the cost of living,” Ms Hume said.

“While the RBA has its foot heavily on the brake trying to cool the economy, Labor has added $188 billion of new spending, which is only going to keep inflation higher for longer.”

The latest Newspoll indicates growing frustration among voters, with Labor’s two-party preferred standing at 52 per cent compared to the Coalition’s 48 per cent – the government’s worst position since winning the election.

Mr Albanese’s disapproval rating jumped six points to 52 per cent and his net approval rating is now minus 10.

Home price growth could slow

Despite skyrocketing interest rates, home prices have continued to surge throughout the year, defying almost all expectations.

CoreLogic reports national dwelling values have leapt by 7.6 per cent so far in 2023. They rose by 0.9 per cent last month alone and later this month are expected to reach an all-time high.

In the previous quarter to October, home values in Sydney rose by 2.5 per cent, while in Melbourne they lifted 1.2 per cent and surged by 3.8 per cent in Brisbane.

But Tim Lawless, executive research director at data firm CoreLogic, believes the latest rate hike will contribute to a “drag” on housing markets.

“The lift in rates combined with ongoing cost of living pressures and alarming geopolitical environment is likely to weigh on consumer sentiment, which is already in deeply pessimistic territory,” Mr Lawless said.

“Lower confidence could act as a drag on housing market activity, denting buyer demand at a time when advertised stock levels are rising across most regions.

“A rebalancing between buyer demand and advertised stock levels is likely to take some heat out of the housing upswing, which has already been losing some momentum, at least at a macro level, since the monthly rate of value growth peaked in May.”

But those banking on a sharp fall in home prices in order to crack the market will likely be disappointed in the mid-term.

The latest market forecasts from economists at the big four banks point to continued levels of growth throughout 2024.

CBA is tipping five per cent growth nationally across the year and expects prices in Melbourne to surge five per cent and to rise four per cent in Sydney.

At NAB, economists forecast national home price growth of five per cent, with prices rising five per cent in Sydney and 5.5 per cent in Melbourne.

The ANZ expects a national growth rate of between three and four per cent, with Sydney prices rising four per cent and Melbourne’s nudging three per cent higher. Westpac tips a four per cent increase nationally, with a six per cent lift in Sydney and a three per cent rise in Melbourne.

Originally published as ‘It’s a train wreck’: Millions of Aussies doomed by the latest rate hike, now spending more than they earn