Inside new Westpac CEO Anthony Miller’s plan to rebuild the bank

Taking the reins of Westpac on Monday, one of Anthony Miller’s first tasks will be to visit call centre staff – who are the eyes and ears of the banking giant and hear exactly how customers feel.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Anthony Miller will spend the morning of his first day as chief executive of Australia’s second-biggest bank working out of Westpac’s offices in Sydney’s Parramatta.

His first session is meeting the bank’s call centre staffers. These people are increasingly the front line of the bank, taking millions of calls a year, sorting out issues as well as dealing with complaints and customers doing it tough. They also hear about what’s broken before the more sanitised message filters up to management.

Then it’s on to visiting branches across the western suburbs, before holding a full meeting of his leadership team later Monday.

The shift outside Sydney’s CBD speaks volumes about where the newest boss sees the future of Westpac. And that’s about being closer to his customers in middle Australia, as well as being the go-to choice among small to mid-sized businesses.

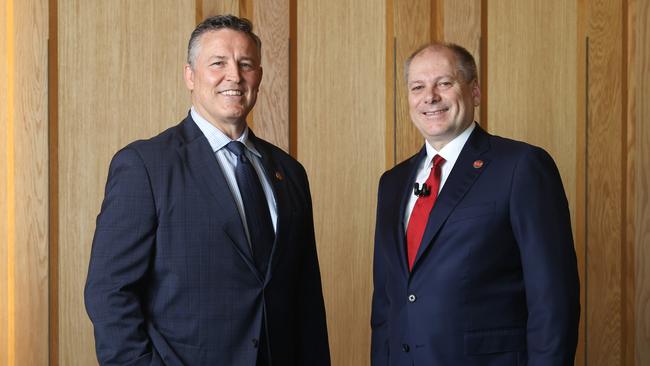

It’s part of the understated style of Miller, the 54-year-old who was named to the top job in September. He had been running Westpac’s all-important business bank for small and mid-sized customers for the past year after heading the institutional arm that looks after corporate clients.

With a new chief executive in the corner office (whether in Sydney or Parramatta), don’t expect any major shifts for now. Miller will continue to drive the massive internal renovation that has been under way for almost four years. It’s designed to finally shake off the “underperforming” tag the bank hasn’t been able to drop.

Miller’s approach will be all about “consistent, steady improvement,” he tells The Australian in an interview.

Miller is the sixth Westpac chief since the bank’s near-death experience in the early 1990s, when it was financially crippled by soured commercial and corporate loans. It took then chief executive Bob Joss to put the bank back on track while instilling a deeply conservative approach to running the lender – although “low risk” eventually morphed into worrying complacency.

Westpac is only just emerging from another scandal that shook it to the core. This one was about culture – even if it did come with a financial sting – when the bank looked the other way and missed numerous red flags about money laundering.

Westpac’s multi-decade run of sidestepped scandals all came to an end during 2019’s Austrac legal action, that resulted in a record $1.3bn fine. This has forced it to be internally focused since then, as it overhauled culture and risk settings. But the Austrac claims exposed just how poorly successive managements approached Westpac’s technology.

Much of the rebuild and the hardest work had been taking place under now-retired boss Peter King, all while regulators kept Westpac under a tight leash.

With so much internal focus on culture and compliance, there was limited capacity to chase growth options.

Although significant progress has been made on the renovation work, Miller says there’s more to be done. The proof of this is that the bank still operates with a $500m capital “penalty” from bank regulator APRA. The final leg of its remediation program is expected to be delivered through the coming year. If it wins a clean bill of health, Westpac gets to play on a more even field with its rivals.

Miller says Westpac is a “safer and more sustainable bank” today, given the rebuilding efforts to date, and has a strong platform to compete. And with many of the Austrac programs rolling off, Miller too can start plotting a longer-term strategy for Westpac.

One word you can expect to hear a lot from the new boss in coming years is “simplify”. Like outgoing boss King, Miller wants to tackle Westpac’s complexity. The biggest task is to finish once and for all the integration of St George bank, acquired for nearly $19bn heading into the Global Financial Crisis.

“This is about saying let’s simplify the way we do things and find one way to do it,” Miller says.

As St George shows, integration programs for a string of acquisitions over the years at Westpac have been kicked down the road. This has meant system after system piling up, making it harder to even begin. Today, Westpac runs dozens of processing systems and more than 180 tech platforms – which is simply too many.

Each process is making the bank harder to deal with and means Westpac runs at an operating cost much higher than rivals Commonwealth Bank and National Australia Bank.

King late last year committed billions of dollars to untangling the bank under the banner of “Unite” and Miller is determined to see this program through – even if the full benefit could be years away, and he may not even see the end result as CEO.

Unite has a good start given the past five years has involved extensive clean-up work on the structure of Westpac under King. This involved selling off a range of businesses, such as car leasing and an auto dealer loan book.

At the same time it has been pulling back from Asian operations, including China. Miller says he’s happy with the mix of businesses Westpac has, which suggest the on-again, off-again sale of the BT wealth platform stays off the agenda.

Now it comes down to the grind of untangling the business.

“If we do it one way, one process, on one technology system it’s going to be easier to run the company; it’s going to be a little bit more cost-efficient to run the company and it’s going to be easier to add value and potentially innovate,” Miller says.

The second big area of focus is Westpac’s overall customer proposition. This will involve investment in the front line, including training and an uplift of skill. This might seem out of fashion when everyone is rushing towards digitisation, immediacy and artificial intelligence.

Miller says the onset of this technology will make relationships with customers even more important.

“We just can’t assume because much of what people want to do today is digital, that means everything we do and must be done is in a digitised way,” he says. “There’s no escaping that there’s many things that people still want that ability to speak to someone about. They still want to connect with a human.”

He quickly adds this is not about downgrading the bank’s digital channels. “We obviously want to continue to grow digital mortgages, but for people in that significant moment or they might be buying their first house, is it realistic to expect for everyone to do it all digitally?”

The same is true for branch banking, which he is committed to.

“Clearly the No.1 rule is listen to what the customers and what the community wants,” he says.

Miller represents a smooth internal succession, the second internal handover among the big four banks this year – NAB being the other. ANZ has gone outside for its replacement to outgoing boss Shayne Elliott.

As a relative newcomer to the bank, Miller is a clean skin without any of the baggage linked to Austrac or management missteps.

Miller was the first external executive-level hiring after King took charge. He was appointed to head the bank’s flagship institutional business in late 2020, delivering a significant confidence boost when morale had hit rock bottom.

At the time it showed that despite the scandals, Westpac was still able to attract the talent needed to rebuild. Miller had been poached from Deutsche Bank where he had been running the Australian business and was co-head of investment banking for Asia-Pacific from 2017. Before then he was with Goldman Sachs for almost 15 years working in investment banking where he was named a partner, based in Hong Kong. Much of his working life has been with Wall Street banks, but Miller grew up around small business. His parents operated takeaway food shops in and around Canberra.

He got a first-hand view of the work business owners put in and the almost constant challenge of getting and keeping the right staff, paying surging energy and insurance costs and riding the swings of the local economy – the same conversations and challenges that came to him while running Westpac’s business bank in the past two years.

Miller’s immediate challenge in the job is to keep stability among his executive team. This includes keeping onside ambitious banker Jason Yetton, who is running Westpac’s vast retail business and had put his hand up for the CEO job. Miller can ill afford more disruption across Westpac’s senior team.

Elsewhere, Miller will come under pressure from investors for quicker wins in cutting costs as profits have flatlined at around $7bn. King has already ripped billions of dollars in costs from the bank, but the inflation bubble undermined some of this. A slowing lending environment will result in demands for more.

Miller’s other challenge is, after such a long period of introspection, to give the bank strong ambition to grow. This includes defining its differences from its key rivals, the bigger CBA on retail and then NAB on business lending. Westpac lags both banks in terms of returns and efficiency ratios. Here Miller will push the need to fix the root cause of the higher costs.

Miller, too, is agnostic about Westpac’s many brands. In recent years it has collected retail brands like no other with operations like Bank SA, Bank of Melbourne and St George. It recently pulled the plug on the RAMS mortgage broking and savings business.

It comes back to the delivering the best proposition to the customers as efficiently as possible.

“Let’s pick the one way to do it, the best way to do it and simplify everything around doing it that way,” Miller says.

eric.johnston@news.com.au

Originally published as Inside new Westpac CEO Anthony Miller’s plan to rebuild the bank