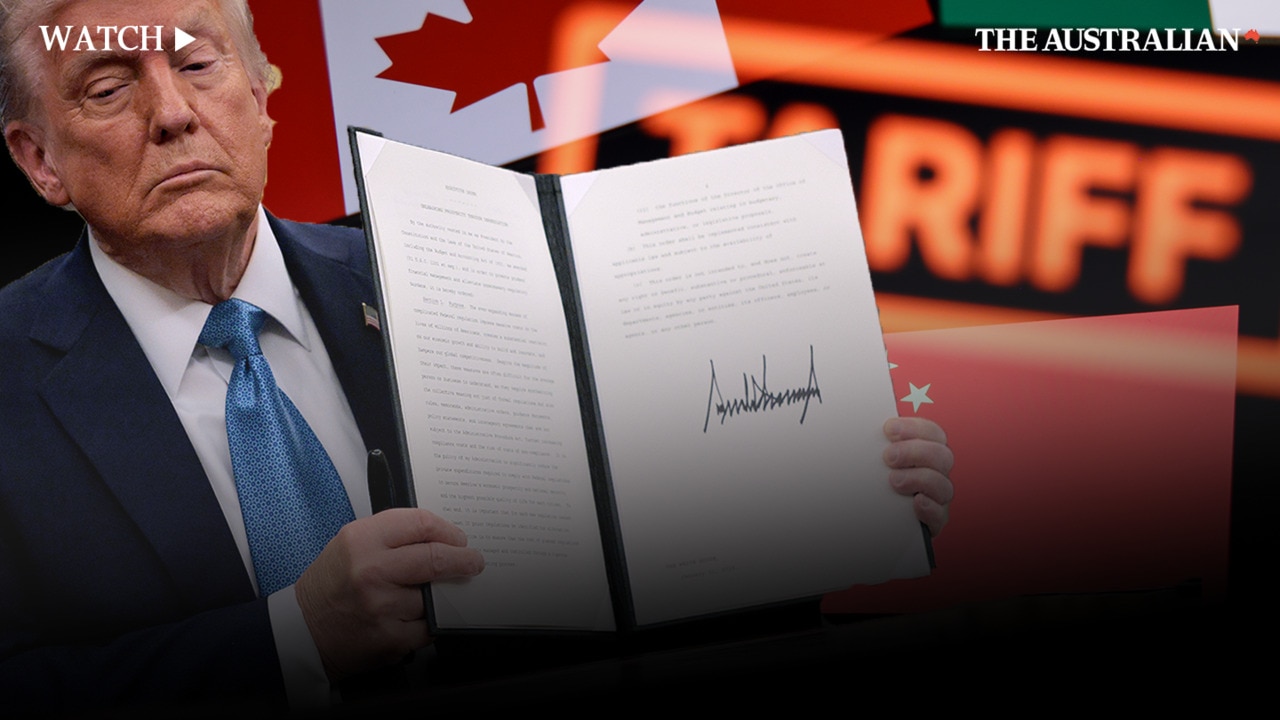

Global financial markets roiled by reality of looming trade war

Financial markets were roiled by the opening salvo in what may soon be a global trade war sparked by US tariffs, with explosive moves in currencies, stocks and commodities.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

It was a long time in the making but the brutal reality of a tit-for-tat trade war proved too much for global financial markets after a build-up of risk taking in recent years.

The Australian dollar fell as much as 2.1 per cent to a five-year low of US60.88c after US President Donald Trump confirmed tariffs of 25 per cent on Mexico and Canada – with a 10 per cent carve out for Canadian oil – and a 10 per cent tariff on China from Tuesday, sparking a surge in the US dollar.

The Greenback roared 2.1 per cent against the euro, 1.7 per cent against the Canadian dollar and 3 per cent against the Mexican peso, extending gains that have matched the revival of Mr Trump.

While not directly in the firing line of tariffs at this point, the Aussie dollar has fallen about 12 per cent since September owing to the fact that China is Australia’s biggest trading partner.

It was a similar story for Australia’s stockmarket as the S&P/ASX 200 share index dived 2.1 per cent before closing down 1.8 per cent at 8379.4 points. The ASX 200 hit a record high last week as lower than expected inflation data fuelled expectations of interest rate cuts.

It was the biggest one-day fall in Australia’s stockmarket in the past six months.

And in a reaction that won’t go unnoticed by the Trump Administration if it is sustained this week, S&P 500 futures dived 2 per cent in Asia-Pacific trading, signalling a rough night ahead for Wall Street.

In the wake of Canada’s threat to put 100 per cent tariffs on Tesla, Pepperstone’s 24-hour CFD pricing indicated that Tesla shares were set to fall about 5 per cent on Monday.

Nvidia CFDs were also down about 5 per cent. Nvidia was hit last week by jitters about the competitive threat posed to US AI chip makers by China’s DeepSeek.

“Markets had been complacent about the tariff threat and will now have to price it in,” said Khoon Goh, head of Asia research for ANZ.

He saw a “slim possibility” that the tariffs could be suspended at the last minute because they were tied to the affected countries addressing US concerns over illegal immigration and the flow of fentanyl. But even so he saw a “constant threat of tariffs hanging over US major trading partners”.

According to the Wall Street Journal, Beijing was readying an opening bid to try to head off greater tariff increases and technology restrictions from the Trump administration - a sign that China is eager to get trade talks going.

However, what it is prepared to offer, according to people in both capitals familiar with Beijing’s thinking - chiefly focused on going back to a previous trade deal that didn’t work out - is likely to intensify debates in Washington over how to negotiate with China.

Even though the White House hit China with 10 per cent tariffs for its failure to crack down on chemicals used to make fentanyl, neither side appears ready to launch a full-on trade war.

China, in particular, is in weak economic shape, and Chinese leader Xi Jinping has signalled his interest in engaging in negotiations with Mr Trump, who has also suggested he is open to dialogue by deferring most of his promised tariffs on China.

RBC Capital markets said the tariffs announced over the weekend were the most significant trade shock since the Smoot-Hawley tariffs of the 1930s, which are widely blamed for exacerbating and prolonging the Great Depression.

“This shock far surpasses the 2018 tariffs in magnitude, diminishing the value of that period as a helpful guide for the economic impact ahead,” RBC chief economist Frances Donald said.

In 2018, the US average import tariff rose from 1.5 per cent to roughly 3 per cent. Under the new policy, the US average tariff rises to nearly 11 per cent, the highest average ratio since the 1940s.

The risk aversion in stocks and currencies also spilled into commodities with Comex copper futures down about 2 per cent and spot gold down almost 1 per cent after hitting a record high of $US2817.18 last week.

WTI crude oil futures rose about 1.8 per cent however.

Even high flying cryptocurrencies weren’t spared. Bitcoin fell as much as 6 per cent to a three-week low of $US91,304.56, dipping below its 100-day moving average for the first time since October.

Ethereum dived 27 per cent intraday. Dogecoin fell 25 per cent.

“This isn’t just a crypto selloff,” Stephen Inness at SPI Asset Management said.

“It’s a liquidity scramble as traders shed speculative assets ahead of what could be a tidal wave of margin calls and stop losses across multiple assets.”

He said the crypto wipe-out cast a long shadow over global equities, suggesting retail traders were offloading profitable positions before they got “steamrolled” in FX or stocks.

A similar “panic dynamic” hit the gold market, with its usual safe-haven demand overridden by “cash-raising urgency”, however temporarily. US Treasury bonds found support however, with the yield on the 10-year Treasury yield falling 3 basis points to 4.51 per cent.

“Global central banks may be forced to cut rates, but the Fed is looking at a raging inflation beast that just got a fresh dose of adrenaline,” Mr Innes said.

“If these tariffs stick, expect the inflation dragon to roar back to life, forcing the Fed to keep the screws tight while other central banks scramble to ease.”

Betashares chief economist David Bassanese said the risk of a damaging correction in stocks has escalated amid an “onslaught of challenges” capped off by tariff announcements over the weekend.

“First came sticky US inflation and news that the Fed is in no hurry to cut rates further. Then came the DeepSeek shock, which raised question marks over US tech valuations again,” he said.

“Then on Friday came what markets have long dreaded: significant new tariffs on key trading partners and the start of Trump Trade Wars 2.0.

“Countering these negatives are the resilience of US economic growth and corporate earnings, and reasonable hopes - prior to the new tariffs - that US inflation would likely fall further.

“The near-term outlook is messy and the risk of deeper correction in equity markets has escalated.”

More Coverage

Originally published as Global financial markets roiled by reality of looming trade war