Endeavour Group has posted weaker profits and cut its dividend

The owner of Dan Murphy’s, BWS and a network of hotels is wearing the bruises of supply chain disruptions caused by the Woolworths strike last year.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

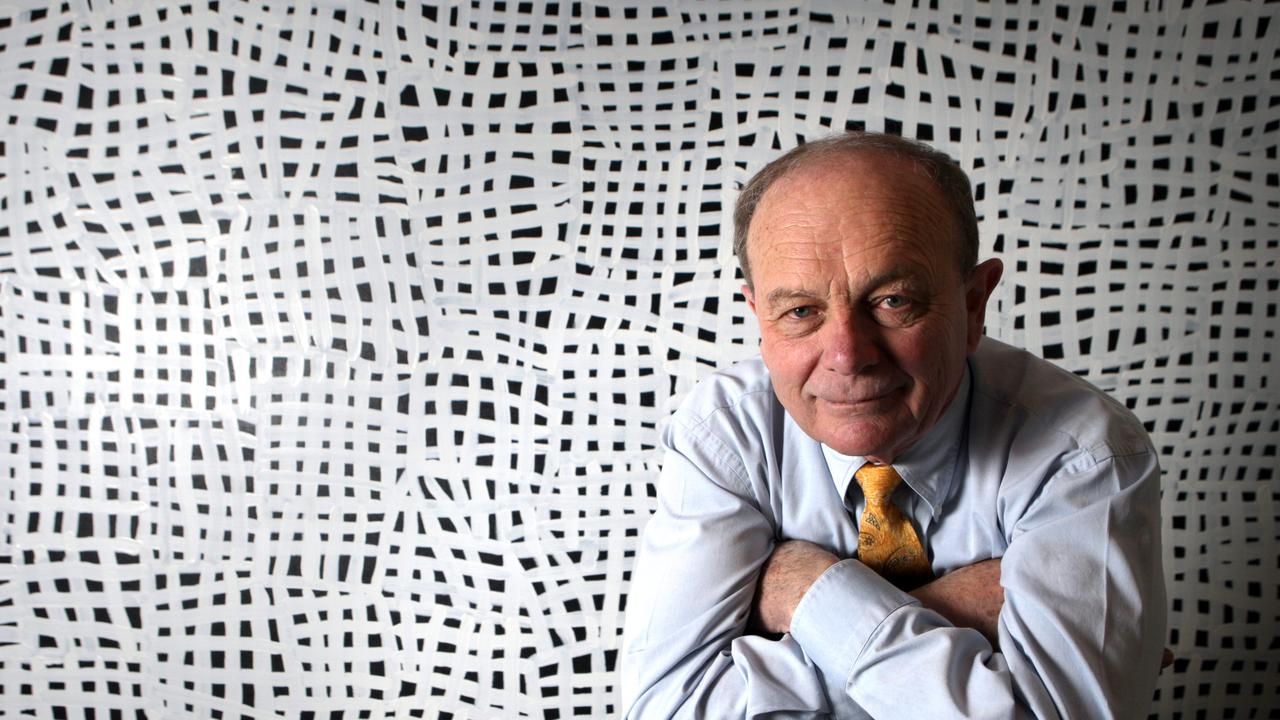

Endeavour Group has disappointed investors as its earnings undershot expectations, while some analysts were frustrated that newly anointed executive chair Ari Mervis did not turn up to a briefing to answer key questions, given he will be running the company from next month.

The company, owner of Dan Murphy’s, BWS and the nation’s largest network of pubs, also said it had not found a replacement for its outgoing CEO Steve Donohue. It has tapped chair Mr Mervis to take on the more powerful and hands-on role as executive chairman upon Mr Donohue’s departure on March 17.

The move comes as Endeavour faces several challenges, with those threats to its business laid bare on Friday when it posted a 0.7 per cent fall in interim revenue to $6.62bn as profit slipped 15.1 per cent to $298m.

Its shares closed 7.1 per cent lower at $4.17, after hitting $4.11 earlier in the day and almost touching its lowest point since listing in 2021 of $4.08.

Earnings and net profit were slightly below consensus forecasts, as was the earnings from its network of pubs, and the trading update for the start of the second half revealed weaker than hoped sales at its bottleshops, although hotel sales were better.

The company also cut its dividend to 12.5c a share, down from 14.3c and payable on April 10.

Analysts had questions for Mr Mervis, but he was not at the briefing, sparking displeasure from investors and analysts. Citi analyst Sam Teeger wrote in a note to clients that many analysts had wanted to question Mr Mervis “given that this morning it was announced that he is taking over from outgoing CEO Steve Donohue from the middle of next month until a replacement is able to commence”, adding: “Given Endeavour’s share register composition, analysts want to ensure that Mr Mervis will be representing all shareholders equally.”

This is a reference to the Mathieson family that remains Endeavour’s largest shareholder and has a representative on the board, with the pubs family also having engaged in a protracted and public battle with Mr Donohue about his running of the company.

Bank of America analyst David Errington said he was surprised Mr Mervis didn’t turn up and wanted the company to ensure Endeavour would be run on behalf of all shareholders and in line with good corporate governance. Mr Errington asked for Mr Mervis to conduct another call with analysts and investors to answer these questions.

Mr Donohue, delivering his last financial results, pointed to supply chain disruptions at Woolworths that kept some of its own shelves empty, as well as tough economic conditions for flat sales, retreating profits and a large cut to its interim dividend.

Although this weakness was countered by a stronger performance at its pubs, led by more money spent on gaming machines and more meals at the dining rooms, the drinks and pubs giant is sporting the bruises of a dour economy and supply chain problems, with its bottle shop sales still struggling into January and February.

Retail sales from its bottle shops led by big-box retailer Dan Murphy’s and other beverage retail businesses fell 1.5 per cent to $5.5bn, reflecting subdued consumer spending in the first quarter and an estimated $40m-$50m in lost sales due to the Victorian supply chain disruption (triggered by the strike at Woolworths warehouses) that reduced stock availability in stores during the peak end-of-year trading period.

Endeavour shares some warehouse and supply chain functions with its former parent Woolworths, and the protracted strike at Victorian warehouses in the lead-up to Christmas created its own headaches for the drinks giant.

Retail earnings fell 15.1 per cent to $370m, Endeavour said. Gross profit margin improved by 11 basis points to 24.7 per cent. The company said following a lift in industry-wide discounting in the first quarter, promotional intensity moderated in the second quarter.

Mr Donohue said the retailer had performed strongly in the face of challenging economic conditions and the supply chain disruptions with customer satisfaction at its bottleshops improving despite stock issues.

“I couldn’t be more prouder of the efforts of the team under the circumstances if you allow for that material supply chain disruption,” he told The Australian.

“They had everything running against them.”

He said the retailer was “back on track” in terms of shelf availability but it was still an issue for his BWS stores attached to Woolworths supermarkets.

During the half its drinks producer Pinnacle Drinks reported growing sales momentum, notably in the premium wine category, supported by 170 new product releases including K by Krondorf, which was the best performing new product in the red wine category.

Hotel sales rose by 3.3 per cent to $1.1bn, with sales momentum increasing throughout the half. Higher sales results were achieved across all four key business drivers – food, bars, gaming and accommodation.

Hotel earnings rose 0.8 per cent to $262m.

Tough conditions for the retailer and pubs owner have continued and been a weight on sales. It said sales growth for the first seven weeks of the second half was down 0.8 per cent for its retail arm and up 4.7 per cent for hotels. Endeavour said retail sales in the first seven weeks had been affected by ongoing effects of supply chain disruption.

Mr Donohue said that, despite cost-of-living pressures, there was “buoyancy” at its hotels arm as going to the pub for a beer and a meal was seen as a permissible treat and people were visiting pubs more often, but visitation rates at bottleshops were more challenged.

Originally published as Endeavour Group has posted weaker profits and cut its dividend